Update 12/4/25: The nerfing of the US Bank Altitude Reserve commences on December 15th, so only ten more days to get those 1.5-cent-per-point redemptions in. Also, the $325 travel and dining credit will change to a credit for travel booked through US Bank Travel Center only. Happy Holidays.

~~~

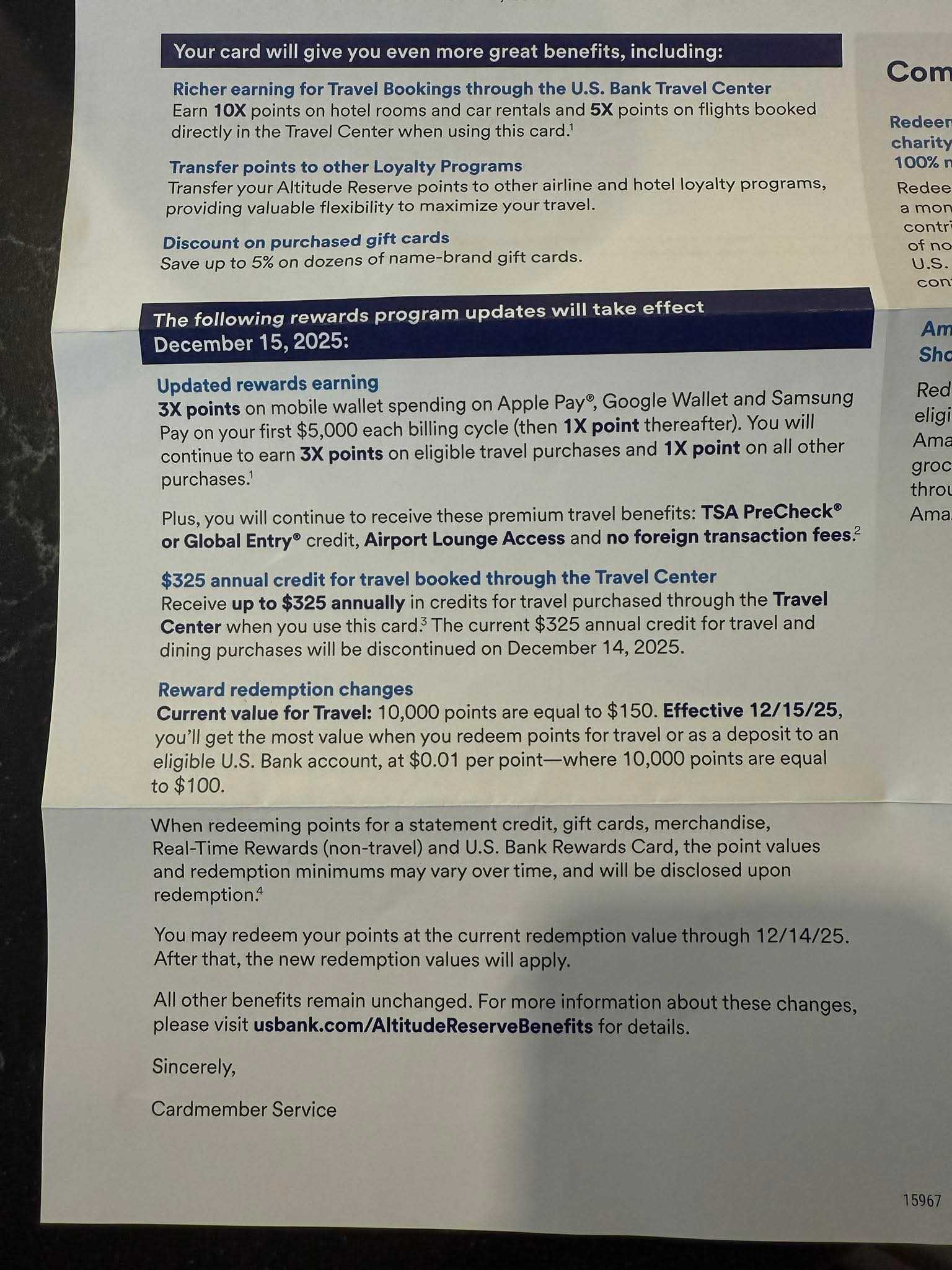

Doctor of Credit has reported on an image we have also seen in our Facebook group of a letter that has apparently been sent to U.S. Bank Altitude Reserve cardholders, indicating major changes coming to the card in December 2025. To my knowledge, none of the members of the Frequent Miler team have received this letter (several of us have the card), but assuming it is legitimate, it looks like the Altitude Reserve will see a slew of major changes coming in December.

Update 8/1/25: All of the changes discussed below have been confirmed and are now displayed by US Bank online. We still haven’t heard any further details about the coming transfer partners, so there’s reason to hold off final judgment. However, taken alone, the changes to redemption values and the travel credit are brutal.

U.S. Bank Altitude Reserve December 2025 changes at a high level

Here’s a high-level summary of the most important changes listed, which are all scheduled to take effect on December 15, 2025, according to the letter:

- 3x Mobile Wallet purchases capped at $5,000 per month (then 1x). This is a change from uncapped 3x mobile wallet earnings (when paying via mobile payment methods like Apple Pay, Google Pay, or Samsung Pay)

- $325 travel and dining credit changed to $325 credit for travel booked through US Bank Travel Center

- Redemption value dropped to $0.01 per point for travel or deposit to a US Bank checking account (or less for other redemptions). That’s a 33% devaluation from the current value of 1.5c per point for travel redemptions through US Bank Travel Center or Real-time mobile rewards.

- Transfer points to other airline and hotel loyalty programs. No details are given as to which programs or transfer ratios

- Earn 10x on hotels and car rentals & 5x on flights booked through US Bank Travel Center

Again, note that the above changes are all slated to take effect on December 15, 2025, according to the letter being circulated.

Quick Take

My immediate reaction to these changes is very mixed. I expect that many cardholders will have a knee-jerk reaction to a set of major changes to a widely beloved card, and I don’t disagree with feelings of disappointment overall. It’s certainly a bummer to see a cap on mobile wallet earnings, and the 33% devaluation on redemptions is a massive hit that may prove to be a nail in the coffin for many cardholders. That said….

- I think the $5K/mo cap on mobile wallet will be reasonable for most folks. I know there are people who have been exceptions to this, but I bet a lot of cardholders were already under this cap. I could still see this being the perfect card for my wife now that I have finally gotten her used to using tap to pay. Whether she’s picking up groceries at a wholesale club, paying for a car repair at the shop, getting a massage, or even paying at an actual supermarket or restaurant, she’d still be effectively getting 3x on all of her purchases without having to juggle multiple cards. If we maxed out our mobile wallet at 15,000 points per month, that’s 180,000 points per year — not a bad haul (though we probably won’t). And if we took a cruise or paid for a large hotel bill, we’d just have to remember to insert the card in the payment terminal to earn 3x on all travel still (without that cap).

- Transfer partners could be huge! I’m particularly excited about this and interested to see which transfer partners U.S. Bank might offer. If they offered 1:1 transfers to popular transfer partners, I’d still be pretty happen with 3x mobile wallet spend! The loss of 1.5cpp redemptions will sting, but it’ll sting less if we can get 3 transferable points per dollar spent on a wide range of purchases. But will they transfer 1:1, or will U.S. Bank make this wildly complicated? Will U.S. Bank bring Korean Skypass back into the fold for a transferable currency for the first time since Chase Ultimate Rewards ended its partnership with Skypass in 2018? Could U.S. Bank pull out a complete wild card partner like Amtrak? Probably not on the latter, but I’ll be excited to see what comes of the transfer partners.

- Redemption value decrease to $0.01 per point is devastating. The best thing about U.S. Bank’s program has been the ability to use Real-time Mobile Rewards to erase travel purchases at a value of 1.5c per point. That has made it possible to pay for travel directly with travel providers, repeating the full benefit of that, but redeem at 1.5c per point. The drop to 1c per point is a massive, massive loss. The flip side of this is that the system has been buggy. We’ve kept a resource of what works, but over the past couple of months, I’ve had multiple purchases that clearly should have been eligible (like Marriott properties in the US) that have failed to trigger any text message, leaving me to pay the full cash rate when I wanted to use my points (that stung on one prepaid rate I booked specifically because I thought I’d erase with points). If you had given me a choice to keep Real-time mobile rewards or get a really good set of transfer partners, it might have been a toss-up for me. But I’m sure that many folks would have gladly kept 1.5c per point via Real-time mobile rewards. There’s no doubt that this hurts.

- The change in automatic travel & dining credit to a US Bank Travel Center credit stinks. I never even thought about using this card’s annual $325 travel and dining credit. I just used this card to pay for stuff as I usually would, and I’ve earned the travel credit within weeks each time. Having to make the effort to book $325 in travel through the US Bank Travel Center will be really annoying. Given that I most often travel with a family of four, it probably won’t be hard for us to use this booking a single flight somewhere, but I hate that it won’t be automatic and will instead require effort. That said, I did recently book some JetBlue flights through the US Bank Travel Center, and I’m glad to report that the process was easy. The flights showed up in my JetBlue ap,p and I was even able to make changes via JetBlue without issue. I’m still not thrilled with the change, though.

In short, I don’t think these changes are the end for the Altitude Reserve card. In fact, I’m sure I’ll still keep the card if these changes come to pass, but I’ll shed a tear or two along with everyone else who will miss the simplicity of an uncapped 3x on mobile wallet combined with the chance to get 1.5c per point for travel redemptions. There’s no doubt that this card will be far less of a no-brainer for many than it has been for years. Here’s hoping that U.S. Bank surprises us with a terrific set of transfer partners.

My annual fee posted right after the changes. I made a one-night booking at an airport Crowne Plaza on the USBank Travel Portal and it was $50 more than booking direct!

I am definitely going to downgrade and hoping to get the annual fee back

Hey Nick – have you reached out to US Bank to find out what the heck is going on with the promised transfer partners?

I don’t have any contacts at US Bank. I see the same “coming soon” message as everyone else, unfortunately. I’m not holding my breath.

Spoke to live chat just now and this is what their response was

At this time we have limited information. More information will become available on 12/15/25. Please visit usbank.com/AltitudeReserveBenefits on 12/15/25.

Can’t wait for the announcement for transfers to Best Western and Spirit at 2:1 (2 AR points to 1 travel company point.)

It’s coming down to the wire. Assuming there are no amazing transfer partners announced soon, I’ll call to ask for a retention offer, then most likely cancel the card if there’s no offer. They are going to get so many of these calls in the last few days, I hope they are prepared.

I’d bet you that they create a wall between the current cards and some new transferable points card. With the current cards being cash-back only and no movement of points to the transferable bucket. It’s just the way US Bank operates.

To be fair, the USBAR changes announcement from USB described it as “transfer your Altitude Reserve points to other airline and hotel loyalty programs”, so we can hope they haven’t changed their minds. OTOH, here we are one week out…

To answer the title’s query: yes, it is the end.

Does anyone still trust US Bank?

Very disappointing that USB still hasn’t announced any transfer partners. Starting to feel like they announced the change months ago without anything sorted out. If they had good news about partners they should have announced it right away because clearly people are canceling in light of the news. Since my annual fee hit a few months ago I’m keeping the card until the summer of next year since I’m able to fully use up the travel/dining credit before 12/15. 3x points on mobile wallet is still quite valuable for me even with the monthly cap, since worst case scenario that is still 3% everywhere, but with the shift from an easy to use credit to something that can only be used in the travel portal, I need to see good transfer partners if I’m going to keep the card. The need to at least have transfer partners comparable to Wells Fargo for me to even consider keeping the card. That’s the minimum. Any less and it means there’s really no intention to make this card valuable. If they have more compelling partners, or a small selection of uniquely valuable partners (e.g. Korean), I might keep it.

Same. USB AR was my first premium card so I have a soft spot for it, and US Bank made customer friendly changes to the credit during COVID by adding dining as an option so I’ve generally been pleased with it. But with such an overhaul there needs to be a compelling reason to use it going forward. I’ll keep it until renewal time to maybe get a chance to double dip credits if they allow it as AMEX has, but otherwise it’s likely to go in the sock drawer without a good list of transfer partners.

To your point, Wells Fargo Autograph Journey seems like a more compelling card for most travel expenses if the transfer list will be similar. Comes in at a much lower annual fee with an easier to use credit.

I wasn’t really comparing the Wells Fargo card to USB AR so much as saying that WF has basically the most basic list of transfer partners compared to Amex/Chase/Citi/CO/Bilt so that’s the minimum threshold to clear. I don’t love only having Avios, Avianca, and Flying Blue with no transfer bonuses, but at least that’s 3 distinct alliances and the programs can be useful. If they just have things like Jetblue, AeroMexico, and Virgin I’ll be canceling. I need at least a reliable program in each alliance.

US Bank isn’t a serious bank. No news on transfer partners, devals everywhere. This was an easy cancel for me; it was great while it lasted.

Any news on transfer partners? Was expecting something by now

Yeah, that is the make or break issue if I keep this card. I’m dumping it unless good transfer partners.

With the change to the $325 travel credit, is there any chance that they’re treating it as a discontinuation of one benefit and a an initiation of a different benefit, such that we can double dip if we already used our $325 credit for this annual cycle?

Now they just need to let us combine points between U.S. Bank cards, especially if they get transfer partners.

I was wondering the same..

I just got the bonus on both the altitude connect biz and leverage biz. Might hold out to wait and see since now I have 170k+ “points” on those cards.

US Bank losing Altitude recently

One thing I haven’t seen this.past year was typical $75~100 in points/statement credits every year for using card on certain categories – this always completely offset the AF (PP visits or not) but I do wonder if the will relaunch the USB AR and if it will have a hugher AF – the old SUB was pretty decent if you could meet MSR at Costco or with 3X then it was worth ±62K/$930 in RTR.

Not lots of ways to earn lots of Pts.with USB AR moving forward.

The biggest variable will be Transfer partners and if the PP “lounge access ” is 8 * $28 F&B PP experinces or just watered down PP select.

BTH the PP Experiences at PDX post C19 have been devalued at Capers market (select to go items from a list – used to be everything) and Capers Café (I haven’t seen it since the remodel (but its listed). Now that PDX has the PP Escape lounge and we have access to Delta Sky club/United club 4X – the 8x * $28 are less important and valuable.

I am a huge fan of the Giant’s Clubhouse at SFO but we just haven’t been transiting SFO for domestic flights much the past three years (but we have have mostly had access to Polaris for Int’l) but Amex CL is now.closed for 18-24 months remodel.

Anecdotally I’ve still gotten a few of the 1000 or 1500 point offers for spending on utilities, internet, etc but no more than $50 worth. The double cash back on card linked offers has occasionally worked out well.

A downgrade to PP select would be a huge blow – that’s one of the few differentiators for this card anymore.

This is really unfortunate. I got this card last year and have really put it to good use. I did call the number on the back of the card, talked to a representative, and told them I was unhappy with these changes and I would appreciate them emailing their manager to let them know. My hope is that if enough people did the same thing we might be able to influence them not to make these changes.

Denial. Anger. Acceptance.

Accept US Bank for what it is as demonstrated by its actions over the past couple years.

And, move on.