NOTICE: This post references card features that have changed, expired, or are not currently available

In the post “The game we play” I broke down the miles & points “game” into two key components:

- Acquire points & miles very cheaply

- Use points & miles for maximum value

The easiest way to acquire points & miles cheaply is through credit card signup bonuses. And, the best way to maximize value from your points is to focus on transferable points. These are points that can be transferred to a variety of airline and hotel programs. Transferable points make it easier to maximize value because they can often be transferred to whichever loyalty programs best meet your needs for your travel plans. An overview of transferable points programs can be found here: A quick guide to transferable points programs.

In previous posts, I introduced unbiased rankings of hotel card signup offers, and unbiased rankings of airline card signup offers. Today, I’m introducing unbiased rankings of transferable point signup offers.

I ranked all of the best transferable point signup offers by “first year value”. First year values are calculated as: estimated first year value minus estimated first year costs. First year value includes signup bonus points and statement credits. First year costs include the first year annual fee and the opportunity cost of meeting minimum spend requirements. Full details of how first year value is calculated can be found here: Credit card signup bonus estimation details. It’s important to understand that these rankings are not intended to identify which cards are best to keep long term and/or to use for everyday spend. The rankings are specifically tied to to each card’s current signup offer. The question that the rankings try to answer is: which cards offer the most value from their signup bonuses?

Over time, as signup bonuses and related factors change, the rankings will change as well. For now, though, we see the following top 5:

- Chase Sapphire Preferred

- Citi ThankYou Premier

- Chase Ink Plus

- Starwood Preferred Guest

- Starwood Preferred Guest Business

Coincidentally, that is not only a good list of signup offers, but in my opinion it happens to be a list of great credit cards overall.

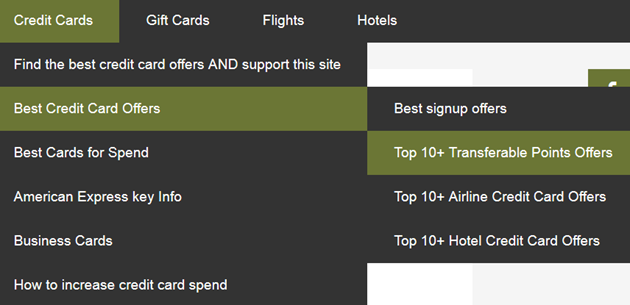

The full ranked list can be found here: Top 10+ Transferable Points Program Credit Card Offers.

You can always find the best offer rankings in the Credit Cards menu on this site. Currently, the offer rankings can be found under the sub-heading “Best Credit Card Offers”.

[…] Unbiased signup offer rankings: Transferable points – A formula based approach to ranking offers on credit cards that earn transferable points. […]

I would like to see an article on when one should cancel credit cards and how long the cycle is before getting the same card and benefit again.

Also, a yearly chart, by month, that shows when all these cards have the better benefit, ie, some cards increase their awards bonus for some period and then go back to the standard level.

Thanks

None of these look that exciting when compared to the “Vulture” sign up bonuses that have occurred over the last couple of years………the Cit AA cards for 100k with multiple cards approved……..the AMEX 100k offers more surgically approved………with those experiences it makes me want to way back and save the application for a raptor moment………….

LOL, I love the term “raptor moment”.

I’ve only recently begun in this hobby and I currently have all my spending going through my 2 discover it cards. I cannot possible max them out but, I don’t see a better return on my money than 22-23%. So why chase a sign up offer UNLESS it is a “raptor moment”. For the remaining 7 ish months on my discover double offer. I intend to use them as much as possible, through either the discover shopping portal or apple wallet. The lowest possible return is 3%

So in my scaredy cat newb way, I agree with you.

And I’ll use this time to chase checking account deals.

How can someone who earns a living selling credit cards claim to be unbiased?

The rankings are all based on calculations that I’ve documented. I don’t claim to be unbiased (but I try very hard to be). My claim is that the rankings are unbiased. They’re all data driven.

Remember that the new page is specifically designed to identify the cards that offer the best signup bonuses, not those that are best for spend. To find cards best for spend, please see my series of posts titled “Best credit card combos…” such as this one: https://frequentmiler.com/2015/05/26/best-credit-card-combos-mixed-rewards/

Geez, guys. He specifically said this is a post about the sign up bonus (and related costs for that). NOT about spend or use. (And, John, most of us in this game do exactly that–sign up, get points, cancel. Repeat. That’s what the hobby is all about.)

IF it were about spend and use, I’d say Ink and Amex Everyday Preferred, along with one of the cards with 3x for airfare (Amex Gold, Citi Prestige) are the hands down winners.

Thanks mbh, you said pretty much what I was going to!

lol ok my bad, where’s the spend thread so I can cut and paste my earlier comment 😛

I personally value INK much more than the CSP for the fact it acts like a x5 everywhere card for me. Utilizing office supply stores, ebay, gyft, cardcash etc.. there is nothing I can’t purchase that won’t cover my daily spending.

For the average person I’m sure the CSP might work better, but given this site tailors to a lot of savvy people, I’d say the INK is leaps and bounds ahead if you know what you’re doing.

CSP may have good transfer partners , but earning point is only thru spending money on travel which is not we do in this hobby.

Thank you premier is the best since it gets you points + we can do MS on that by buying gift cards from gas stations and earn 3x points and have a free travel. International RT ticket costs atleast 1000$ . Then this is the personal card available to all.

Chase ink plus can be second best which has more potential earning and good transfer partners than thank you premier , but available only to business customers.

If this topic is about more card with valuable points then csp or spg may be good, but we have to see the earning potential also by which Thank you premier is the best

I would like to see these really evaluated over 2 years as I think that is more realistic. Unless you recommend getting a card, getting its benefit, then cancelling the card.