There’s an oft-repeated joke in travel circles that goes something like this: “Want to know what United is planning for next year? Look at what Delta did last year.”

Today, United MileagePlus announced significant changes to how its members would earn and redeem miles, starting April 2nd (studiously avoiding April Fools Day). Essentially, it is following Delta’s lead in using award discounts to encourage customers to hold a United credit card, then going a step further by also giving improved earning rates on paid travel to cardholders.

Come Summer, if you want to engage with United MileagePlus in any significant way, you’ll need a credit card.

Changes Coming to United MileagePlus

Cardholders will earn more miles; everyone else earns much less

The biggest change to the United MileagePlus program will be how miles are earned on paid flights. Starting April 2nd, all United elite members who are not cardholders will see their earnings slashed by 2 miles per dollar. Cardholders, on the other hand, will see their earnings increased by 1 mile per dollar.

Here is a summary of the changes:

| Elite level | Current | Post-April 2, non-cardholder | Post-April 2, cardholder |

|---|---|---|---|

| Member | 5 miles/dollar | 3 miles/dollar | 6 miles/dollar |

| Silver | 7 miles/dollar | 5 miles/dollar | 8 miles/dollar |

| Gold | 8 miles/dollar | 6 miles/dollar | 9 miles/dollar |

| Platinum | 9 miles/dollar | 7 miles/dollar | 10 miles/dollar |

| Premier 1K |

11 miles/dollar | 9 miles/dollar | 12 miles/dollar |

Non-cardholders are really taking a hit here, and it’s not just the absolute numbers, but also the difference between the two: across the board, cardholders will earn 3 more miles per dollar on paid flights than non-cardholders.

Note that this makes a much bigger difference the lower someone’s status is. A Premier 1K member will see a 33% increase in earnings by getting a United card; a run-of-the-mill regular member will have their earnings doubled. This is undoubtedly intentional, as United and Chase know that most elite members (especially high-level ones) probably already have a United credit card. The ones who need the most encouragement are the masses on the bottom rungs of the ladder.

This change will make United by far the least-rewarding major domestic airline for non-cardholders, as both Delta and American have nearly identical earning rates to United’s current rates.

Non-cardholders will earn nothing when flying basic economy

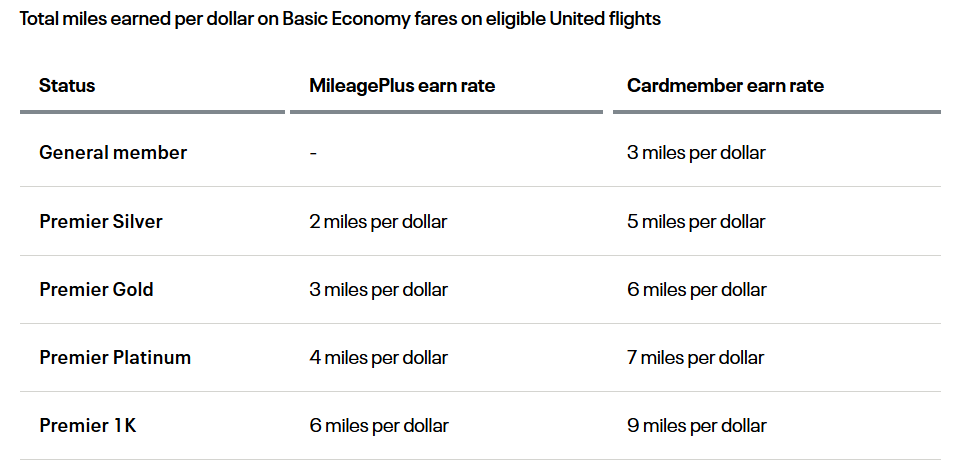

Exacerbating the earning rates themselves, United will also require you to hold a credit card to earn miles when flying basic economy. Elite members and cardholders will earn reduced rates, with both categories taking a 3-mile per dollar hit from non-basic tickets, as shown in the table below:

Cardholders will get discounts on awards and better availability

United will also give cardholders at least 10% off all award flights, similar to the 15% discount Delta offers its cardholders now. United cardholders who are also elite members will get a 15% discount. United will also be following Delta’s lead by showing its discounted prices to everyone, regardless of whether or not they’re a cardholder, as a means to juice credit card customer acquisition.

Not only will there be an award discount, but United will also increase the proportion of Polaris business-class saver awards it reserves for elite members and cardholders. From what I understand, that’s currently at ~33% of all saver awards. I wasn’t able to find anything specifying what that will increase to. Regardless, it means that non-cardholders will be fighting over fewer seats.

Quick Thoughts

This is about as surprising as a sunrise. Just six weeks ago, in our points and miles forecasts for 2026, I predicted that at least one more domestic carrier would “Delta-rize” its credit card portfolio by giving award discounts to cardholders. United didn’t make me wait long, and I’ll be interested to see if American follows suit once the transition of Barclays cardholders to Citi is settled.

These days, the major domestic carriers are essentially rewards programs that happen to fly airplanes, and their credit cards are a massive revenue driver; the yearly dollars spent on Delta’s portfolio of credit cards are staggering. It only makes sense that United would try to wrangle every last customer and dollar of spend into its suite of cards.

What I find really interesting here is that United has become the first airline that I can think of to take two additional steps. First, it’s taking Delta’s card-acquisition strategy and going a step further by using cardholder status as the single biggest factor in setting earning rates on paid flights. Starting in April, a non-elite cardholder will earn more miles per dollar on United flights than someone with Silver status and no credit card, and that same pattern holds as you go up the elite ladder.

Second, instead of simply adding incentives to get a credit card, it’s actually punishing those who don’t by cutting their earning rates. It’s not just that cardholders will earn more from April on; non-cardholders will also earn less. I’m a little surprised by that from a PR standpoint, but it creates a wider gap in benefits between those with a United credit card and those without one than what any other carrier has had the hutzpah to implement. If it works, the other carriers will undoubtedly follow suit.

With today’s announcement, United is making clear that it cares far more about whether you have one of its credit cards than it does about whether you fly its airline. That’s a pretty dramatic statement.

Wonder if UA quest cardholder’s 10k anniversary award mile rebate will be stacked with 10% or 15% award discount ? Also, will be interesting if UA can refund miles back after April 2 for previous award booking?

Tim, do you know if the united gateway cc offers the same 10-15% discount and increased saver award availability as the United Explorer cc? I’m trying to cut down on cc fees and I don’t see myself really utilizing the Explorer benefits.

Only if you spend 10k per year on it

Hidden here, I think, is that this probably devalues points from Air Canada and Avianca. If they are saving more Polaris seats for United cardholders I assume that will reduce J award availability for Star Alliance partner programs. For me that’s the headline as I rely on foreign programs to book star alliance awards.

Polaris hasn’t been widely available for a year on partner airlines so nothing new on that front

This is UA’s way of telling non US resident MileagePlus members to get lost (and sign up for Aeroplan)

United offers cards in a surprising number of countries, but not Canada or Europe

I’ve had an Explorer card for many years (occasionally taking advantage of a product change and then back again). United genuinely nerfed the program years ago, so I use any accumulated points for random Saver Awards. To second Thomas, this really won’t change anything for most people – the free bags by holding a United credit card would be worth far more than any incremental points gained here.

I know there have been lots of Reddit comments and rightfully so. But for the average price-conscious consumer, they don’t really window-shop between mileage earn rates between airlines. Most people I know that aren’t into the hobby won’t fly on a single airline enough to earn more than an economy ticket every year or so. I would argue that only the frequent flier community really cares about this change and those who frequently fly already would mostly likely have a United credit card already. For those that don’t fly often, this wouldn’t be a big loss for them, regardless. Losing 1,000 United miles every year is really not that big of a deal, with the current value of United miles.

On the otherhand, increase mileage earn rates for credit card holders is a pretty smart move in my opinion. I’m someone who holds a United Explorer card so this is a huge buff to this card for me. The base earning rate with a credit card is now higher than their competition. Making the United Club card earn 5x is also competitive on paper with Amex Platinum card, assuming each point is the same (which I don’t).

All in all, I think the changes are very good to me, and I believe most loyal United fans too.