US Credit Card Guide has spotted something concerning on the American Express website when applying for a new card. They noticed that welcome offers displayed on this page now sometimes show wording that you’ll earn “up to” a certain number of bonus points

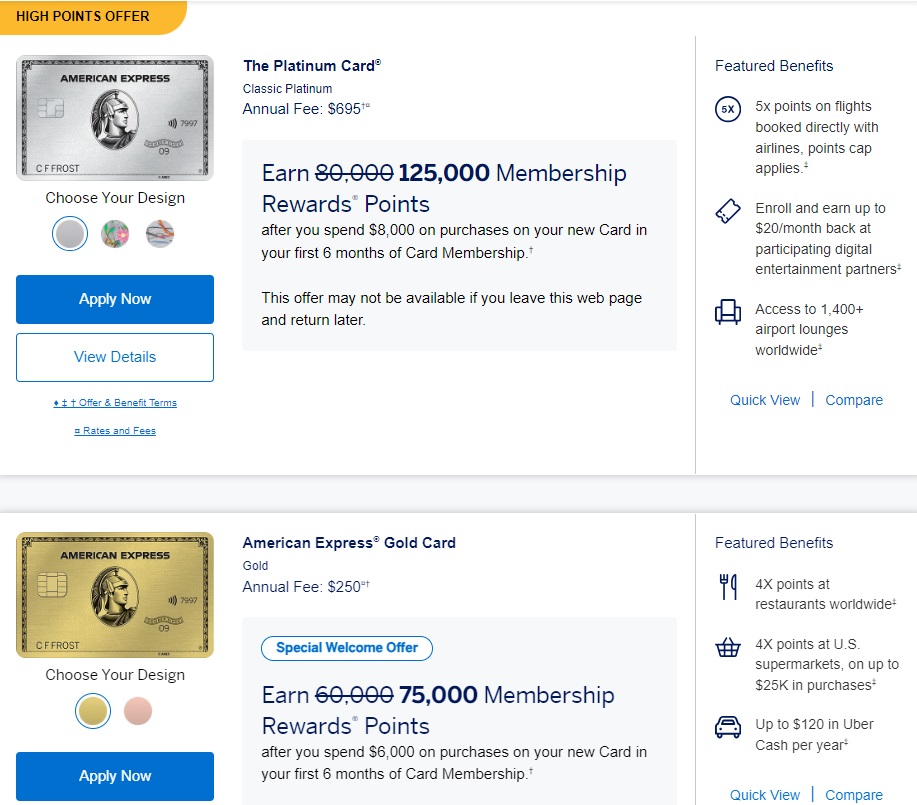

That’s not all though. That type of offer is sometimes randomly shown, but other times you might see wording stating that you’ll earn “more than” a certain number of bonus points.

Move over C F Frost because Pat Sajak* is on the scene. It’s time to play the Wheel of Amex Fortune.

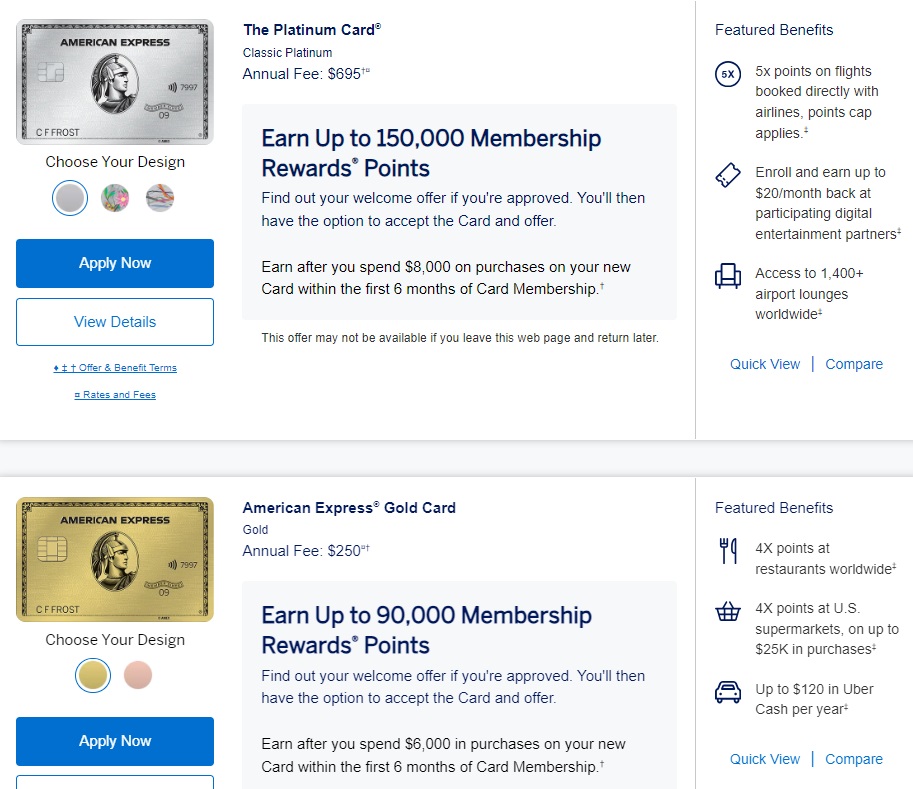

What you see on that offer page will be completely random and can completely change from visit to visit. When checking it out in a fresh browser window yesterday when I first read that US Credit Card Guide post, I saw that same “up to 150,000 Membership Rewards points” offer on the personal Platinum card and “up to 90,000 Membership Rewards points” on the personal Gold card (both my bolding).

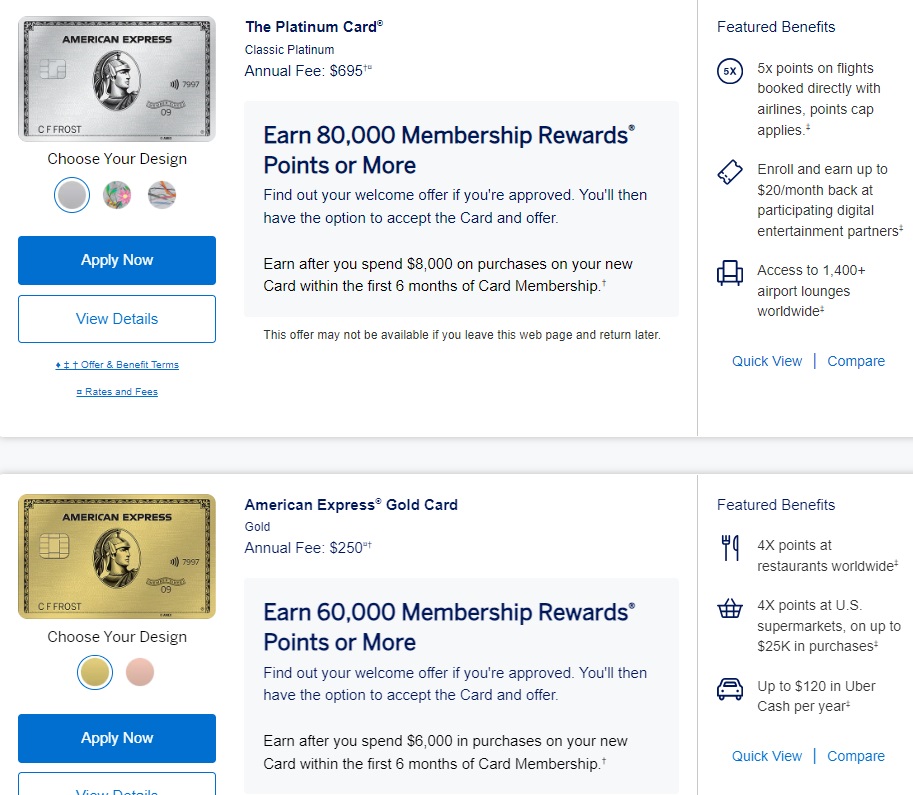

After closing that incognito window and opening that page again, this time it showed me “regular” offers with no weird wording.

Other times I saw wording stating that I’d earn “80,000 Membership Rewards points or more” on the personal Platinum and “60,000 Membership Rewards points or more” on the personal Gold (both my bolding).

What does this mean? If you’re savvy, this hopefully won’t change things very much. That’s because on our Best Offers page we always link to the very best publicly available offer for all credit cards, including American Express. Most of the Amex links on that page are either affiliate links or referral links of Frequent Miler team members or readers, all of which should be unaffected by this change.

The biggest issue will therefore be when going directly to the American Express website and looking for the card, or when searching for the card on a search engine and clicking through to the card application page. In those instances, it seems as though in at least some circumstances you’ll see offers giving “up to” or “more than” a certain number of points. If that’s the case, it’s up to you as to whether or not you want to spin the Wheel of Amex Fortune or close that browser window and try again in a “clean” window.

Here’s the dilemma though. In all the times I checked that page, the highest possible offers were the “up to” offers. If that’s the case for you too, that means you’ll have to choose between applying for a lower guaranteed welcome offer or applying for the higher “up to” offer, risking that Amex decides that they’re not willing to extend the highest possible bonus to you and ending up with a far inferior bonus.

Ultimately though, in actuality it isn’t much of a risk. That’s because the application terms state the following:

After you submit your application and before you accept the Card (if you are approved), we will tell you the exact amount of Membership Rewards Points which you are eligible to earn, which will be an amount up to xx,000 points. To qualify for such points, you must spend $x,xxx (the “Threshold Amount”) or more in eligible purchases on your xx Card from American Express within the first x months of xx Card from American Express Card Membership starting from the date that your account is opened.

That’s similar to how Amex will sometimes give you a popup which warns that you’re not eligible for a welcome offer for one reason or another (e.g. you’ve had the card before), giving you the chance to cancel your application. With these nebulous welcome offers, you’ll be able to do the same thing. Find (hopefully) the highest possible welcome offer, then apply for it even if it has “up to” wording. If you get offered that higher amount, great – you can accept the offer. If not, you can cancel your application unless the difference is something negligible (e.g. 145k instead of 150k).

* I know Ryan Seacrest is the new presenter of Wheel of Fortune, but in a world where I have to choose between two disappointing choices, I’d have to begrudgingly pick Pat Sajak. He’s the “up to” in this situation 😉

[…] messing with our plans since they recently introduced new “up to” sign up offers. Frequent Miler wrote a great post about the various sign up bonuses for these 2 […]

Making it even more curious, all of the offers that I’m seeing are “X points OR MORE” as opposed to “UP TO”. Hmmm.

This new SUB scheme lets them target offers based on info in the application. In particular, it makes more sense for them to give higher welcome offers to:

A) higher income applicants, who would presumably spend more and care less about the 1x multiplier;

B) applicants with a history of carrying a balance; and

C) applicants with fewer cards, who are less likely to be gamers.

[…] FM noticed sometimes the reverse where an offer will say “80,000 points or […]

My theory is that this is a perfect way for AMEX to get an idea of what the demographics is like when applying for cards at different SUB values. Since they already require your information, they can collect that, look to see which ones pass, and which ones bite, at different levels. They can also possibly provide a tiered amount based on the data points or lower the SUB amount to the most cost effective, instead of blindly offering 150K when many others may take less.

At the end of the day, they aren’t doing this just for fun. They have a purpose for this. We can only attempt to decipher/interpret what that is.