US Bank’s Real-Time Mobile Rewards offer a way to book travel outside of US Bank’s limited travel portal and still get 1.5 cents per point value from your points. Unfortunately, the details about what works where are sketchy. For example, the terms state that real time mobile rewards work only with US merchants, but there are examples of airlines that it works with that includes several foreign airlines.

Note that the US Bank Altitude is currently unavailable to new applicants.

FAQ – US Bank Real Time Mobile Rewards

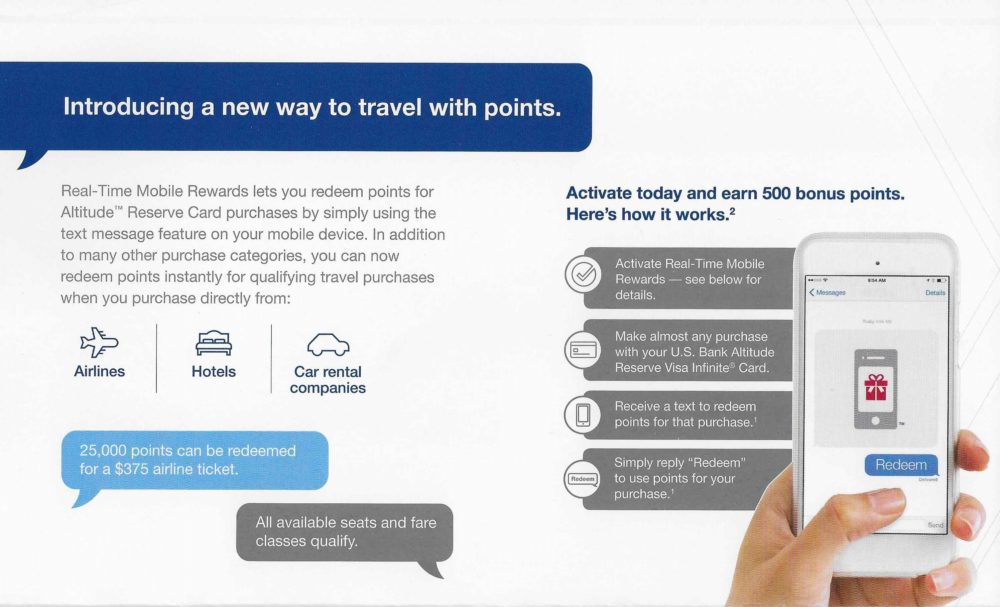

- Q: Which credit cards do Real-Time Mobile Rewards work with and offer 1.5 cents value towards travel?

A: US Bank Altitude Reserve card. - Q: How do I activate Real-Time Mobile Rewards?

A: After logging into your US Bank account, browse here: rewards.usbank.com/altmidprem/en_us/home/card-benefits.html - Q: What happens if I redeem rewards for a purchase and the purchase is later canceled or the actual charges end up being lower than the amount redeemed for?

A: You will receive a statement credit. For example, if you redeem 20,000 points for a $300 flight via Real-Time Mobile Rewards, and you cancel that flight purchase, the $300 will be applied to your account balance. You will not get the 20,000 points back. - Q: Which types of travel purchases are officially supported by Real-Time Mobile Rewards?

A: US Bank lets users enable purchases withing the following categories, and offers examples, as follows:- Lodging: Four Seasons, Hyatt, Starwood, Hilton, Disney Resorts, Best Western, Westin, Wyndham, etc.

- Airline: American Airlines, Sun Country Airlines, Southwest Airlines, Delta Air Lines, JetBlue Airways, United Airlines, Frontier Airlines, etc.

- Car Rental: Hertz, Budget, Alamo, Avis, National, Enterprise.

- Other Travel: Norwegian Cruise Line Holdings Ltd., Amtrak, Lyft, Inc., Royal Caribbean International, Uber Technologies Inc., etc.

- Q: What are the minimum purchase amounts necessary to trigger Real-Time Mobile Rewards?

A: With most categories, the minimum is set by the user’s preferences to as low as $10. The Hotels category has a fixed minimum of $150 and the Car Rental category has a fixed minimum of $150. - Q: Do you have to have enough points for an entire charge in order to redeem?A: Yes, you need to have enough points to cover the total amount of a purchase in order to redeem points towards for it. Partial redemptions are not allowed.

- Q: What does US Bank mean by “Other Travel”?

A: We don’t know. We hope that this post will help figure that out. - Q: What else do I need to know?

- A: You can only respond to the most recent Real-time Mobile Rewards text, so if you’re booking more than one travel component at a time, be sure to redeem before making your next purchase. Once you have a new real-time mobile rewards text, it is impossible to go back and redeem against an earlier purchase for 1.5c per point.

US Bank Real-Time Mobile Rewards. What works where?

Please comment below with your findings and we’ll update this chart with any meaningful new data. Thanks!

Airline Charges

- Aegean: FAIL

- AeroMexico booked via Expedia: SUCCESS

- Aer Lingus seat assignment: FAIL

- Aeroplan award ticket fees: FAIL

- Aeroplan lap infant fee: FAIL

- Air Europa ticket: FAIL

- Air Europa purchased through Orbitz: SUCCESS

- Air Premia: FAIL

- Air France ticket purchased on AirFrance.us website (flights within Europe only – MAD-CDG-OTP): SUCCESS

- Air France award fees for Delta flight (US to Canada): SUCCESS

- Air New Zealand ticket: FAIL, but see also SUCCESS via Expedia

- Air Tahiti Nui: SUCCESS

- Alaska Airlines: SUCCESS

- Alaska Airlines ticket for multiple passengers: PARTIAL SUCCESS (Each passenger charge separate, only works for one)

- Alaska Award ticket taxes/fees: SUCCESS

- Alaska Airlines buy miles: FAIL

- Alitalia ticket purchased through alitalia.com: SUCCESS

- Allegiant Air: SUCCESS

- American Airlines purchase at airport: FAIL

- American Airlines online purchase of upgrade while in Dominican Republic: FAIL

- American Airlines online purchase of upgrade while on Delta flight: FAIL

- American Airlines $50 e-gift card: SUCCESS

- American Airlines $149 e-gift card: SUCCESS

- American Airlines award fee: SUCCESS

- American Airlines award fees via phone: SUCCESS

- ANA: FAIL

- Asiana award fees: SUCCESS

- Asiana ticket: SUCCESS

- Avelo: FAIL

- Avianca Lifemiles award fees: SUCCESS

- Avianca Lifemiles buy miles: SUCCESS

- Avianca ticket purchase: SUCCESS

- British Airways award fees: SUCCESS

- British Airways ticket booked with ExploreTrip: FAIL

- Booking.com for Lufthansa ticket within Europe: FAIL

- Cathay Pacific award fees booked with Asia miles via phone: FAIL

- Cathay Pacific award fees booked with Asia miles online: SUCCESS

- Cathay Airways Award Taxes booked in HKD: FAIL

- Cathay Pacific extra bag fee: FAIL

- China Airlines: FAIL

- Delta e-gift card purchased via desktop browser: SUCCESS (and again), but more recent FAIL

- Delta ticket purchased through Expedia: SUCCESS

- Delta ticket purchased directly: SUCCESS

- Delta award fee ($11.20): SUCCESS

- Delta fare difference Korea to US flight: SUCCESS

- Delta flight from Brazil to US (the currency displayed in BRL): FAIL

- Delta ticket from China to US purchased at delta.com: FAIL

- Easyjet: FAIL

- Emirates online seat selection fee: SUCCESS

- EVA Airways seat selection fee: SUCCESS

- Etihad award fees: SUCCESS

- Flair Airlines: FAIL

- Finnair (via Expedia): SUCCESS

- French Bee: Flight from US to Europe SUCCESS

- Gotogate.com for flight in Europe: FAIL

- Iberia award fees from US to Spain: SUCCESS

- Iceland Air checked bag fees: FAIL

- ITA Airways within Europe: FAIL

- JetAir: FAIL

- JetBlue Award Fee: SUCCESS

- JetBlue Vacations: FAIL

- KLM round-trip from US: SUCCESS

- Korean Air award fees: SUCCESS

- LATAM booked direct: SUCCESS

- LATAM via trip.com: FAIL

- Level Airlines at flylevel.com: FAIL

- LOT Airlines: FAIL

- Lufthansa flights within Europe: FAIL

- Lufthansa change fee processed in NY: SUCCESS

- Hawaiian Airlines inter-island flight tickets: SUCCESS

- Maya Air tickets purchased directly: SUCCESS

- Norwegian Air: SUCCESS

- Primera Air ticket purchased directly: FAIL

- Porter Airlines (Canada to US): SUCCESS

- Qatar Airways cancellation fees: SUCCESS, but see also an award fee FAIL

- SAS Airlines ticket purchased directly: SUCCESS

- Southwest Airlines ticket purchase: SUCCESS

- Southwest Airlines gift card: SUCCESS

- Southwest Airlines award fees: SUCCESS

- Spirit Airlines ticket and $9 fare club: SUCCESS

- TAP Portugal booked via Orbitz: SUCCESS

- Turkish Airlines award taxes & fees: SUCCESS

- United award fees: SUCCESS

- United Award Europe to US: FAIL

- United baggage fees (via United app): SUCCESS

- United flight booked through Orbitz: SUCCESS

- United flight booked at United.com: SUCCESS

- United award fees: SUCCESS

- United TravelBank: SUCCESS

- Uzbekistan Airways ticket: FAIL

- Vietnam Airlines ticket: FAIL

- Virgin Atlantic seat upgrade: SUCCESS

- Virgin Atlantic Award Fee (flight originating in US): SUCCESS

- Virgin Atlantic ticket for flight departing from UK: FAIL

- Vueling ticket purchased directly: FAIL

- Vueling ticket purchased through Orbitz: FAIL

- Wizzair: FAIL

- Yeti Airlines (Nepal): FAIL

- ZIPAIR: SUCCESS

Hotel & Lodging

- Airbnb: FAIL

- Agoda $150.37 hotel transaction: FAIL

- Airbnb: FAIL, FAIL, FAIL

- AVANI hotel in Africa. FAIL

- Best Western property in France (booked at Best Western site & prepaid): FAIL

- Booking.com: SUCCESS for a UAE hotel, but see also this more recent FAIL for a US hotel and FAIL for a hotel in Tokyo.

- Campgrounds and RV Parks: FAIL

- Gosplitty.com SUCCESS

- Great Wolf Lodge deposit: SUCCESS

- Extra Holidays (booking engine for Wyndham vacation rentals): SUCCESS

- EZ-Pass (Virginia): FAIL

- Fairmont hotel in Canada: FAIL

- Hotel booked through Hotels.com: FAIL

- Hyatt in Jordan: FAIL

- Loews reservation deposit: SUCCESS

- Sheraton in US: SUCCESS with initial hold charge

- St Regis Spa Charge: SUCCESS

- Vdara Las Vegas: FAIL

- VRBO: FAIL, but then a more recent SUCCESS

- West Virginia State Parks: SUCCESS

Car Rental

- Avis pay-now rental in France booked on U.S. website: SUCCESS

- Enterprise: SUCCESS

- Hertz in Bonaire: FAIL

- Hertz in Canada: FAIL

- Hertz in US: SUCCESS

- Turo: FAIL

- Vipcars.com: FAIL

Car Services

- Autoslash “Pay now with Autoslash”: SUCCESS (note that we’ve had this work abroad)

- Lyft: SUCCESS

- Lyft Cash loaded in app: SUCCESS

- Taxi: SUCCESS

- Uber (within US): SUCCESS

- Uber (in Canada): FAIL

- Uber (in Canada): FAIL

- Uber (in Europe): FAIL

- Uber Cash purchased in Uber app: SUCCESS

Cruises

- Carnival Cruise: SUCCESS

- Carnival Cruise gift card bought from Carnival: SUCCESS

- Celebrity Cruises online payment: SUCCESS

- Disney Cruise Line online payment: SUCCESS

- Holland America over the phone: SUCCESS

- Holland America gratuities / onboard purchases: SUCCESS

- Holland America pre-sailing charges (Wi-Fi package, distilled water, laundry package booked pre-cruise added on to existing booking): SUCCESS

- MSC Cruise: SUCCESS

- Norwegian Cruise: SUCCESS (see also SUCCESS for gratuities / on-board purchases)

- Princess for gratuities/on-board purchases: SUCCESS

- Royal Caribbean, both over the phone and onboard: SUCCESS

- Virgin Voyages for onboard purchases: SUCCESS

Other Travel

- Amtrak: SUCCESS

- Catalina Express (ferry): FAIL

- Daily Getaways: FAIL

- Deutsche Bahn train ticket (Germany): FAIL

- Eurostar train tickets: FAIL

- FasTrak: FAIL

- Flixbus: FAIL

- Iryo train ticket in Spain: FAIL

- Klook for Colosseum tickets in Rome: FAIL

- London Northwestern Railway: FAIL

- New Jersey Transit Purchases ticket purchase: FAIL (only received 1 cent per point)

- OBB train ticket (Austria): FAIL

- Toronto Public Transit: FAIL

- Wine Train in Napa Valley FAIL

- Reserve America: FAIL

- Swiss Travel Pass (train tickets): FAIL

- Trailways (bus network): FAIL

- Trenitalia (Italian train line, booked direct): FAIL

- Viator: FAIL

- Washington DC Metro: FAIL

Other

- Buy retail gift card via United MileageX App: FAIL

- Uber Eats: FAIL (it used to work. workaround is to pay for Uber Cash in the Uber app)

- Uber Gift Card via Fluz: SUCCESS

- Tour payment for G Adventures: FAIL

- TripAdvisor activity: FAIL

Real-Time Mobile Rewards Terms & Conditions

The following terms were found here (must be logged in to access): https://rtr.myrewardsaccess.com/Offers/OfferSummary. Click “Terms and Conditions” then click “Program Rules” near the bottom of the Terms & Conditions page.

Real-Time Rewards

With Real-Time Rewards, you may instantly redeem Points for your credit card Purchases via text messaging. The Points redemption comes in the form of a credit to your monthly billing statement. Points will be deducted from your Points balance and a credit for the Purchase amount will be applied to your Account billing statement when you request redemption. For transactions which include a gratuity, fees, or estimated taxes, the statement credit may not equal your final Purchase amount. Auto bill pay transactions will be part of Real-Time Rewards text messages if the Purchase falls within your preference selections. Real-Time Rewards text messages are available only for transactions with U.S. merchants. You may sign up for Real-Time Rewards using your 10-digit U.S. mobile number. Only one mobile number may be used per credit card account. After you complete a brief enrollment profile, you need to confirm your enrollment within 24 hours by replying ‘YES’ to a confirmation message that Real-Time Rewards will send you. If any changes are made to your Account that will affect the card number, account ownership or your rewards program, you will need to re-enroll in Real-Time Rewards. Message and data rates may apply. The short code REDEEM (733336) is used by Real-Time Rewards to send redemption requests. Message frequency is based upon the preferences you select and the Purchases you make on your Account. Text ‘HELP’ to REDEEM (733336) for Help. Text ‘STOP’ to REDEEM (733336) to cancel your participation in Real-Time Rewards. All cancellations completed via text message will remove that mobile number from all accounts registered for Real-Time Rewards. Please visit rtr.myrewardsaccess.com for a full listing of the Mobile Terms and Conditions. For inquiries, to sign up to receive text alerts, to update your preferences or to cancel your enrollment, please visit the Rewards Center online or call the Rewards Center.

You will not receive Real-Time Rewards text messages until you confirm your enrollment and preferences. You will receive a Real-Time Rewards request text message if your credit card Purchase falls within the criteria you have set up in your Real-Time Rewards preferences. Merchants who accept Visa cards are assigned a merchant code based on the kinds of products and services they sell. U.S. Bank does not control how Purchases are processed by merchants or the merchant codes they use; therefore, U.S. Bank cannot guarantee that a specific transaction will qualify. Your Account must remain in good standing in order to redeem. You may redeem by replying ‘REDEEM’ within 24 hours of when the message was sent. You may only redeem the most recent Real-Time Rewards text message. Upon confirmation of a redemption request, Points will be deducted from your Points balance immediately, and a credit to your statement will be processed within three business days and will appear on your next billing statement. The Account statement credit for a Real-Time Rewards redemption will reduce the Account balance, but will not count toward the minimum payment due. All redemptions are final. If you return the item or service that you redeemed Points for to the merchant, the Points will not be reinstated, but you may receive a monetary credit to your credit card account (in accordance with the merchant’s return policy).

I bought miles today on United’s website because they’re running a sale. The RTR redemption was at 1.0, not 1.5% (it’s not 12/15 yet). I’m so pissed!!!

PSA: I wasn’t get texts prob bec mine was a Google Voice number. So I changed it to a “real” number and finally got RTR texts.

I just did a Delta RTR redemption on Friday and immediately got the RTR text. Points redeemed and posted in less than 24 hours.

I can confirm two recent purchases with UA, each in $25-$50 range, triggered 1.5 cpp RTR text.

All points redeemed. RIP USBAR

I recently tried charges with Delta, Southwest and United. None triggered a text even though I have enough points to completely cover the charges at 1.5x but not enough to cover them at 1x. I’ve used RTR in the past at 1.5x successfully but it seems like they might have changed multiplier early.

I just did Delta on Friday and it worked. I immediately got the RTR text and was able to redeem.

I just got off the phone with USB trying to RTR my AltRes points (53k). I made a $1.2k purchase for a refundable AA ticket directly thru the airlines. No text received. USB told me if you do not have enough to cover the entire ticket, you will not receive a text asking if you want to use the RTR.

Unless someone can confirm otherwise, I will have to try to plan out multiple refundable flights to cash out my AltRes pts.

That’s correct. You’ll find that information spelled out in the FAQ section right at the top of this post:

Q: Do you have to have enough points for an entire charge in order to redeem?

A: Yes, you need to have enough points to cover the total amount of a purchase in order to redeem points towards for it. Partial redemptions are not allowed.

Thanks Nick. The USB rep also said the points are 1.25x redemption rate, not 1.5x for RTR. Was the rep wrong?

Any recent data points if 1.5x RTR redemption for Travel is still working?

Can’t even get the text anymore with United or Delta or American

May I ask what were the amounts charged to the card? This will be horrific if they stopped the redemption way before 12/14

Marriott points + cash booking ($200+) failed

American airlines

United airlines,

lyft cash

All failed for me, triggering only 0.67c redemptiion

I thought at least 1:1 for UAR? 0.67c is scamming for them to do!

My recent delta airlines charge of $438 triggerred 29213 points. Is this the correct math? 29213*1.5

I am confused.. you spent $438 and you can redeem using 29200 points, and I don’t see a problem here. 0.67c redemption would be 65373 points to redeem this purchase..

I see, I guess my math was wrong then

Royal Caribean – Success- However- I booked two rooms and had to pay a deposit and they did two separate charges for each room back to back and the real time rewards texts came back to back and I was unable to redeem the first charge. Just an FYI.

Flair Airlines – fail, didn’t trigger it

Autoslash -SUCCESS- Pay now with Autoslash received text immediately after booking

EVA award booking fee and YQ – SUCCESS – charged in USD

EVA infant ticket – FAILED – charged in TWD

Hyatt Moab (US) – SUCCESS – direct reservation, paid for room at checkin (I thought it was incidentals deposit, but it matched the room rate), and got the RT rewards text.

NYC Taxi Cab – SUCCESS – processed through Curb, although I paid using the in-cab terminal

Hilton (US) as double tree deposit- Success

Bolt ride share in France -Success