| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

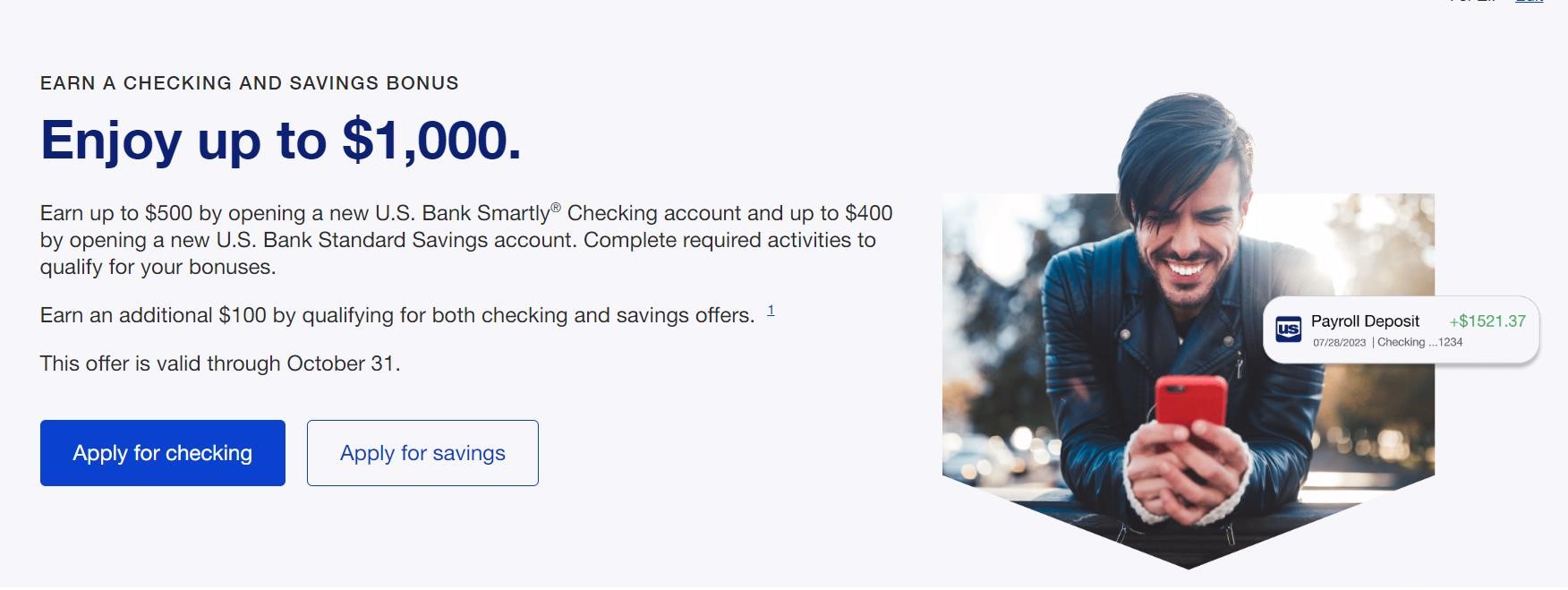

US Bank has another promotion for new Bank Smartly checking accounts and Standard Savings accounts that offers up to a $1000 bonus with fairly simple requirements. This deal is available in states within US Bank’s footprint and is split into two parts.

The $500 checking account bonus requires signing up for online banking and making two direct deposits within the first 90 days. The total of the direct deposits will determine the bonus amount. In order to get the full $500, your direct deposits must total $10,000 or more within 90 days of opening the account.

The savings account bonus requires you to park $25,000-$50,000 in the account for four months and, given the earnings involved, probably won’t be appealing to many folks. The savings account promo is $400 if done without the checking account but, if you do both, there’s an additional $100 thrown in for up to a $1,000 total bonus.

US Bank does allow credit card funding of Bank Smartly accounts, but only up to a maximum of $250. DP’s indicate that Amex, Chase and Capital One work and do not code as a cash advance.

The Deal

Checking Account Promo

- US Bank is offering a bonus of up to $500 when you open new Bank Smartly checking account using promo code 2023SEP and complete the following requirements within 90 days:

- Enroll in online banking or the U.S. Bank Mobile App.

- Complete two or more direct deposits within the first 90 days

- Your bonus is determined by the total amount of your direct deposits

- Earn $300 when your total direct deposits total $3,000 to $9,999.99.

- Earn $500 when your total direct deposits total $10,000 or more.

- $6.95 monthly fee (waived if you have a US Bank Credit Card or maintain a $1,500 monthly balance or have monthly direct deposits totaling $1000+)

Savings Account Promo

- US Bank is also offering a bonus of up to $400 when you open new Standard Savings account using promo code 2023SEP within an opening deposit of at least $25 by October 31st, 2023 and make at least $25,000 in deposits:

- Your bonus is determined by the total amount of your deposits:

- Earn $200 when you deposit at least $25,000 in new money by November 30, 2023 and maintain a minimum total account balance of $25,000 to $49,999.99 until March 31, 2024.

- Earn $400 when you deposit at least $50,000 in new money by November 30, 2023 and maintain a minimum total account balance of $50,000+ until March 31, 2024.

- $4 monthly fee (Waived if you maintain a $300 minimum daily balance, keep a $1,000 average monthly collected balance or hold the account jointly with a youth)

- Complete both promos and earn an additional $100 bonus.

- Expires 10/31/23

- Check US Bank locations here

- See Doctor of Credit’s list of what counts as direct deposits with US Bank (it’s a lot)

Terms and Conditions

Quick Thoughts

The checking account portion, which is easily the most appealing of the two, is a good bank bonus opportunity that comes around regularly. We covered the $400 version last year.

The requirements for the bonus are fairly simple: make at least two “direct deposits” within ninety days of account opening and sign-up for mobile or online banking. US Bank is known as one of the easier banks in terms of what’s considered a direct deposit and ACH transfers work from many common banks (you can see the full DOC list here). While the direct deposit totals are relatively high, there’s no requirement that the money stay in the account, so you should be able to transfer the money back out right after it goes in.

If you don’t have a US Bank credit card, the simplest way to avoid fees is to keep a $1500 average monthly balance or push monthly “direct deposits” totaling $1000+. If you have a US Bank credit card, the monthly fee is waived. Members of the US Military also get the fee waived.

The savings account combo might be appealing if have the free cash lying around and are looking for a short-term, interest-earning option. You’d want to deposit the money as close to November 30th as possible and then withdraw it soon after March 31st, 2024. Even though the time is short, it only corresponds to an interest rate of ~3-3.5% depending on how much you deposit. I imagine most folks can find better than that on a high-yield checking account so, personally, I’d consider this a pass.

These bonuses are limited to those states that have a US Bank branch (which is a wide net…see locations here). That said, if you happen to live in one of the states that doesn’t have a branch, you can get around this requirement by opening a US Bank brokerage account first and then opening the checking/savings account afterwards. There’s no need to have any activity on the brokerage account.

US Bank is fairly strict on its churning rules so I wouldn’t mess with it if you’ve had an account or received a US Bank bonus within the past two years.

(h/t: DOC)

[…] $1000 bonus offer for new US Bank savings and checking accounts […]

I’m going to betray my ignorance here but with CD’s paying up to around 5%, why go for this? How much extra are you earning versus parking $50,000 in a CD?

You are going to earn less.

Many bank accounts are paying over 5%.

Seems like it was mentioned in the post (the savings account is probably not worth it), but it does feel a little click baity to say “$1000 bonus!” then in the article “don’t waste your time with half of it, it’s a bad deal.”

Sorry, I’m tired of seeing people complain about click bait so why am I doing it? The post is fine Tim.

I just wish the stupid edit button didn’t always tell me “slow down…”