I’ve never been one to chase airline elite status, but with yesterday’s Delta Medallion Massacre, I can’t help but see the real winner: American Airlines AAdvantage. While I can concede that the on-board experience when flying American Airlines is clearly inferior to that when flying Delta, I think that there’s no denying the, erm, advantages of the way that American redesigned their program. I had mostly fallen asleep on the American Airlines Loyalty Games, but Hyatt’s new fast track and woken me up a bit and I can’t help but marvel at how much easier it is to earn meaningful elite status with American Airlines.

Delta adds ways to earn loyalty credit, but American Airlines AAdvantage offers far more

As Greg predicted, Delta scrapped multiple metrics and have gone to a single measurement of consumer loyalty: Medallion Qualifying Dollars. Along with that, they added new ways to earn MQDs — namely by booking vacation packages, hotels, and rental cars through Delta. That’s great for those situations where a vacation package makes sense, but unless you’re spending thousands of dollars on vacations that can be booked through Delta, it’s not going to move the needle much. You cad read more about the changes in these posts: Delta’s 2024 elite program: it ain’t pretty and Delta announces big Delta Sky Club® access changes for 2024 and beyond.

By contrast, American Airlines offers a multitude of ways to earn Loyalty Points. You can earn Loyalty Points by flying on American Airlines and by booking vacation packages and all of the things that Delta will begin counting next year, but there are a couple of remarkable differences: Rather than earning 1 MQD per $20 spent on the Delta Platinum SkyMiles cards or 1 MQD per $10 spent on the Delta Reserve SkyMiles cards, you can earn 1 American Airlines Loyalty Point per dollar spent on any of their US credit cards. That’s even true on the no-annual-fee MileUp card!

But where American really stands out is through the ability to earn Loyalty Points through the AAdvantage eShopping portal. We’ve long written about many ways to earn easy American Airlines elite status without flying at all.

Easy American Airlines elite status

When American Airlines launched their new Loyalty Points metric for earning elite status, Greg, Tim, and I turned the chase for AA elite status into a bit of a game. That was in part because there had been numerous shopping portal opportunities to earn easy / cheap American Airlines Loyalty Points. We tracked those opportunities pretty closely for a while.

Over time, many of the offers became less generous, some didn’t pan out as expected, and others just disappeared from portals altogether for a while. However, there are a number of easy opportunities for low-hanging fruit that still exist in the here-and-now.

In my case, I intend to pick some low-hanging fruit, but I’m going to try to be strategic about how I do it. Thankfully, the strategy will be far easier for earning or maintaining American Airlines elite status than it will be for Delta loyalists.

I currently have American Airlines Platinum status thanks to the Loyalty Games when the new program launched. I haven’t earned many Loyalty Points at all this year. However, I earned Hyatt Globalist status this year due to the temporary (and no-longer-available) Bilt fast track. Thanks to that status, I recently received an American Airlines fast track offer. Tim wrote about this opportunity yesterday: American Airlines back with instant status pass for Hyatt Elite Members (targeted).

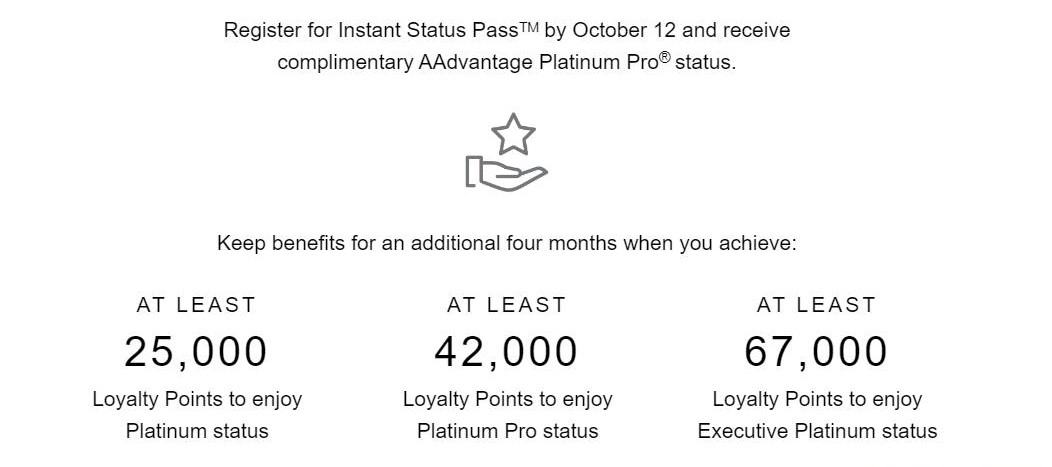

The short story is that while I currently have American Airlines Platinum status, I have until October 12th to register for an “Instant Status Pass” that will give me American Airlines Platinum Pro status for four months. If I earn at least 25,000 Loyalty Points during those four months, I will keep Platinum status for four months thereafter. If I earn 42,000 Loyalty Points during that time, I will get Platinum Pro. Executive Platinum comes in at 67,000 Loyalty Points in four months.

If I meet one of those thresholds, I will receive that status for four more months, during which time I would need to re-qualify with the same thresholds over the following four months. All this does is divide the typical American Airlines elite status Loyalty Points requirements and split them into thirds to encourage me to maintain the appropriate level of activity for my desired status.

I’ll wait until October 11th to register for this in order to play it as strategically as I can. Because of the way American’s elite year now operates, my current AAdvantage Platinum status is valid through March 31, 2024. I don’t have any plans to travel with AA or oneworld partners in the near-term, so I will wait until the last minute to register for this fast track promotion to stretch my four months of instant Platinum Pro status as far into next year as possible (February 11, 2024). If I can earn 42,000 Loyalty Points between registration on October 11th and February 11th of next year, I would presumably keep my new Platinum Pro status until June 11, 2024 — which gives me a couple extra months with status and I will likely have several opportunities to make use of first class lounges between when I register and next June.

I anticipate qualification to be very easy the first time around. Keep in mind that payouts can change at any time and I intend to hold off about a month before registering, but here are the American Airlines AAdvantage eShopping offers I anticipate using to earn the 42,000 Loyalty Points required in the first four months:

- GiftCards.com (3 miles per dollar): While GiftCards.com had disappeared from shopping portals for quite a while, I am glad to see it back again. We have historically been able to earn rewards on up to $2,000 in purchases per month. Assuming the payout sticks at 3x, my hope is to place an order for $2,000 in gift cards during each of the four months of the challenge. That should earn me 6,000 Loyalty Points per month for a total of 24,000 Loyalty Points during the challenge period, which almost hits the threshold to keep Platinum status. I have a monthly bill that costs around $1500 and can be paid online using virtual Visa or Mastercard gift cards, so I anticipate that it will be easy to overpay that bill by a little bit to get rid of the cards quickly. The activation fee runs just under $6 per card, but we often see promotions during the fall that discount the cards enough to make them slightly profitable. However, even if I manage to miss all promotions, I’ll pay $24 each month in activation fees for a total of $96. Running total: 24,000 Loyalty Points after 4 months.

- Consumer Cellular (3,700 miles w/ first paid month). Consumer Cellular has plans that start from $20 per month. If you bring your own phone (you’ll need to enter an IMEI to show that your phone is unlocked), you would only need to pay for cellular service. There is a 5% discount for AARP members, which drops the price to $19. Note that you don’t get charged initially but rather after your first month, so I’ll probably jump on this by the middle of my 4-month window at the latest to be sure I get charged and earn the miles in time. Running total: 27,700 Loyalty Points.

- Millionacres: 6,200 miles with $99 subscription. This real estate investment advice is not a terribly good deal at an effective cost of about 1.6c per mile / Loyalty Point. That said, I tend to redeem American Airlines miles at 1.6cpm or better, so I’ll deal with the high cost to knock out what is effectively almost 1/4 of the requirement for Platinum or a nice boost toward Platinum Pro. I’ll send the emails to an address I don’t use. Running total: 33,900 Loyalty Points

- Verizon Business Markets: 10,900 miles for new customers. I did this deal once before, but terms indicate that it is valid for up to 3 lines per loyalty account, so I assume I can repeat it. You need to keep service for 45 days to get the miles, which means paying the monthly fee twice. The cheapest cell plan is $70/mo plus tax ($5 less with auto pay). There is a current Amex Offer out that’s good for $50 back on $100, so I’ll assume that this will cost about a net $100 and then I’ll cancel service. Running total: 44,800 Loyalty points

With that, I’ll keep Platinum Pro status until next June. It will cost me around $315 (or less if I catch GiftCards.com sales), but I’ll also end up with 44,800 redeemable miles. That is definitely not the cheapest path to miles and Loyalty points, but given the very low effort involved, I find that attractive enough. Notice that if you started with 0 Loyalty points and no fast track offer but you just did the 4 offers above, you would earn more than enough Loyalty Points for American Airlines Gold status (with no further requirements at all).

Moving forward, if the portal continues to pay out 3x on GiftCards.com, that would be an easy 24,000 Loyalty Points every 4 months, which means that if I want to continue to requalify for Platinum Pro status, I only need to find a way to get another 18,000 Loyalty Points during each 4 month period so long as I keep up GiftCards.com orders (and they stay on the portals). I might consider getting an American Airlines credit card to let card spend handle some of the heavy lifting. Other deals I’ll be keeping my eye on include:

- UShip (3000 miles on each of first 5 shipments). This is a website where you can list shipments for large items (like vehicles and household supplies) for bid from all types of transporters. In my reselling days, I resold stoves, grills, some kayaks, and a motorcycle that I shipped with UShip and my experiences with it were very good. We have a car that we’ve been talking about selling and if I see any large resale opportunities I’ll keep this one in mind.

- DoorDash Driver (1200 miles after first completed delivery). This one won’t really cost much of anything since it just involves completing a single DoorDash delivery. That said, the incentive is weak — a couple of years ago, my wife and I each earned $250 for completing a single Uber Eats delivery. Rakuten is currently offering $50 / 5,000 points, so I’ll hope to see an increase on this one.

- Barron’s (1,000 miles). I never did this one during the Loyalty games, but you can still sign up for like $1 or $2 every 4 weeks and cancel after 45 days. This used to hit 1500 miles, but it hasn’t been higher than 1200 in the past 15 months.

- MarketWatch (1,000 miles). Same story as above – I never did this one during the Loyalty Games the first time around, so this could be easy miles.

- Blue Apron (5,000 miles). We have occasionally signed up for meal delivery kits and/or sent them to people are gifts. It’s been quite a while since we last did Blue Apron, so I imagine I could qualify as a new customer again.

- Hello Fresh (3,500 miles). Same story as with Blue Apron above.

- Splash Wines (2,200 miles). This doesn’t look like a good deal right now since it’s about $108, though you do get 18 bottles of wine (I assume they aren’t very good). I wouldn’t do this deal as-is, but I’ll keep an eye out for a Black Friday or Cyber Monday deal or something like that.

There are also a couple of other wine delivery deals that I didn’t do last year and might consider if the rewards or package value increased.

All in all, I expect to earn / maintain American Airlines elite status without very much effort and certainly without spending hundreds of thousands of dollars on a credit card.

Why chase American Airlines elite status?

The obvious answer to this question would be “because I fly American Airlines often). For me, that’s not actually true. I’ll admit that a large part of the reason that I’ll chase easy American Airlines elite status is because it is so easy. I enjoy playing games like this and I think it is especially relevant now that many people are likely to find themselves disenchanted with Delta. The contrast in the ease of earning here is just so significant.

Practically speaking, I don’t fly American often. However, there are a few elite benefits that may matter to me when I do. For starters, elites can receiving complimentary upgrades (now even on award tickets). There is also additional checked luggage allowance, which often comes in handy for my family (and as I’m in the midst of planning a trip to Europe next year, the prospect of a free checked bag even on cheap intra-European flights can be very helpful). Main Cabin Extra seating at the time of booking on American Airlines is nice and access to oneworld first class lounges when traveling outside of the United States may come in handy a few times over the next 6 or 8 months.

I won’t get as much value as some will get from airline elite status, but hopefully there is value in demonstrating how easy it is to get, particularly for those who can’t possibly imagine qualifying for high-level Delta status in the future.

And if I’m lucky, perhaps I’ll be able to pull off a status match before my Platinum Pro runs out so that I can leverage that Platinum Pro status to pick up meaningful elite status with another airline program.

Bottom line

Delta dropped a massive devaluation of its loyalty program yesterday. If that’s got you down, it might be a great time to consider how much simpler the American Airlines AAdvantage program can be. Given the multitude of ways to earn American Airlines Loyalty Points and Hyatt’s targeted Instant Status Pass offer, I can’t help but marvel at just how different the world looks if you are aiming for Delta elite status versus American Airlines elite status. Sure, there are lots of reasons one might want to be loyalty to Delta (such as being located at one of their hubs or for their superior on-board experience), but I can’t ignore American’s advantages, particularly as compared against the high bar Delta has set.

Going through the list of offers listed in the post, a lot of them seem to have dropped in miles/LP payout. Most prominently of course giftcards.com, But a lot of others, too. Did the merchants/AA realize that the high value offers currently aren’t needed to promote sales due to the instant status offer?

Not there now but Motley Fool had a 6900 for a $79 membership. Hope it comes back. Then i will ensure I NEVER renew and turn off all marking emails. Their “best tips” are always on the level one up from what you bought.

Bummer… giftcards.com back down to 1 point per dollar on AAdvantage shopping portal

Did you do Consumer Wireless – it wasn’t a hard pull was it?

also there is a $20 chase offer

Thanks Nick – I’m going to try for hopefully Platinum Pro and maybe even Exec Platinum for this one! Wondering – are you guys thinking about merging these tips/trick into i.e. updating your previous “cheat sheet”? I think it would be awesome to have a more comprehensive list of current worthwhile AA Shopping deals and their effective CPPs, as I (and I assume others) would save a lot of time having that as a reference for the next 4-12 months!! https://frequentmiler.com/how-to-earn-american-airlines-loyalty-points-without-flying-cheat-sheet-to-play-the-elite-status-game/

Giftcards.com recently return to the AA portal has different terms. It is only limiting to 2k per ORDER, not per month. When sale happened at the same time I was able to snag a several orders before the coupon code ran out, grand total way over 2k.

The old guide for playing the game is a little out of date. Most (or all) Citi merchant offer + simply miles double stacks aren’t working anymore. You’ll only get one or the other, things will disappear if you activate on both, etc. Citi merchant offers are also recently only working on the last card you activate them on if you have multiple Citi cards.

Re: “… disappear if you activate on both ….”

I saved the Blue Apron offer in Simply Miles.

Then I saved the Blue Apron merchant offer on a Custom Cash card not linked to Simply Miles.

Then I linked the Custom Cash card to Simply Miles.

Just re-checked at both offers are showing, i.e., at Simply Miles and on the Custom Cash card. Are you saying that one will fall off at some point? Or that only one will pay out? Or might this saving-both-before-linking be a way around the problem?

I haven’t seen any DPs on linking the card after adding it, so definitely report back if it works! What I’ve personally experienced and seen several other DPs on since May is (assuming cards are already linked in Simply Miles) each of these scenarios, no consistent pattern. SM = Simply Miles, CMO = Citi Merchant Offers

1/ If you add the offer on SM first, you can see it in CMO but it won’t activate.

2/ If you add the offer on CMO first, it will disappear in SM. I even will still get emails about it saying “activate this offer!” but the links don’t work.

3/ If you do manage to activate them in both, usually one will disappear and either way you won’t get both to pay out.

On a related note, there’s also several recent (i.e., last couple of weeks with the return of giftcards.com in AA portal) DPs that CMO will show an offer on multiple cards but will only actually pay out on the last card where it was activated. Meaning if you activate an offer on Citi card A, then activate the same offer on citi card B, and finally make two separate orders with both cards (even on different days) you will only get the card link offer on B to pay out.

Your both WRONG. Citi Merchant Offers and Simply Miles WILL NOT STACK after the fact. Even IF they are both showing “active”. Trust me. Lost on on over 4000 LP’s in January of 2023 because of this. I had activated the Citi offer for 6.5% back on Johnston & Murphy before a wardrobe refresh and missed on on 2.5X LP’s/Miles. Took it all the way to AA Corp too. All of these offers are basically run through Mastercard now, they are the “agent” buying the Miles from AA and then each branch doles them out. Mastercard has gotten smart and stingy after the Blogger Debacle on Simply Miles with the 40X on Wildlife Donations.

How can one pay $24 in fees for $2k worth of V/MC cards each month? Shouldn’t it be $48?

Came here to ask same question (seeing $250 as maximum value for virtual card).

I used to earn a good number of LPs via the AA shopping portal by doing grocery pick up via Safeway.com. Safeway family stores have all disappeared from shopping portals for several weeks now – any idea if they’ll be back?

You get 3x loyalty points from giftcards.com? I thought bonus miles did not count as loyalty points. So wouldn’t that equate to 2000 LP per $2000 vs 6000 LP?

Bonus earn in AA cards and special portal bonuses (like the spend $200 via the portal and get 500 bonus miles) don’t count as LPs, but the store-specific multipliers in the portal DO count as LPs. So 3x at giftcards.com would earn 6,000 LPs on $2,000 spend (so long as it’s eligible spend).

Whitney is of course spot on here. You don’t get LPs for a bonus category on the card — like the MileUp card only earns 1 LP everywhere. It earns 2x redeemable miles at grocery stores, but still only 1 LP per dollar spent. But the portal works exactly as she says.

@ Nick — I would rather save the earth. AA really needs to bring that promotion back. 🙂 🙂

Wouldnt you be better off taking this deal for 4 months, Oct 10 to Feb 10 2024. Then banging out 75k of LP starting March 1 and then getting AA Plat till the end of 2025? Seems a waste as u already have Plat till next year!

While I agree with your statement off AA elite is easier to earned than Delta now, but I definitely would say you probably want to add some notes to the statement below:

Rather than earning 1 MQD per $20 spenton the Delta Platinum SkyMiles cards or 1 MQD per $10 spent on the Delta Reserve SkyMiles cards, you can earn 1 American Airlines Loyalty Point per dollar spent on any of their US credit cards.

In my opinion, based on the elite qualifying matrix for new Delta system and AA system, ~6 Loyalty Points equates to roughly 1 MQD (For example, Delta Silver requires 6000 MQD while AA Gold requires 40000 LP, etc. Ranging from 5.714 to 6.944 ratio). But yeah, even with the conversion rate, spending on any AA credit cards is still way much better than spending on Delta Reserve for merely 0.1 MQD per dollar spent. Also AA SimplyMiles earns a ton too.

Greg made the same point in discussion with me and I recognized the difference and don’t refute your point, but the bottom line for me is that Loyalty Points are in general so easy to come by that the distinction there hardly seemed worth emphasizing (but I guess if I was going to emphasize the difference in elite earnings, it would have made sense to make mention of proportions).

But all of that is relatively small potatoes: anyone willing to spend ~$315 could follow the four deals in this post and get AA Gold status (or maybe spend only $215 if you catch those GiftCards dot com sales). Credit card spend then comes down to bridging relatively small gaps. Heck, even if you did those four deals and spent $160,000 on an American Airlines credit card, the path to top tier status is just so much short than if you spent $315 on a Delta flight or Delta Vacation and you had to spend your way to the rest of the MQDs.

And all of that ignores the fact that earning American Airlines redeemable miles is generally a far better value proposition.

Boarding Area selfie king likes his own face so much he will photoshop it onto a blog post.

It’s not that he likes his face so much. It’s because photos with faces have better SEO

I believe you can also earn Loyalty Points through AAdvantage Dining!

It’s true! I stacked a deal at a restaurant that earned me Simply Miles, AA Dining, a Chase cashback offer and a Dosh cashback offer. (Dickie’s BBQ Pit, if that’s a place you have in your area.)