| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

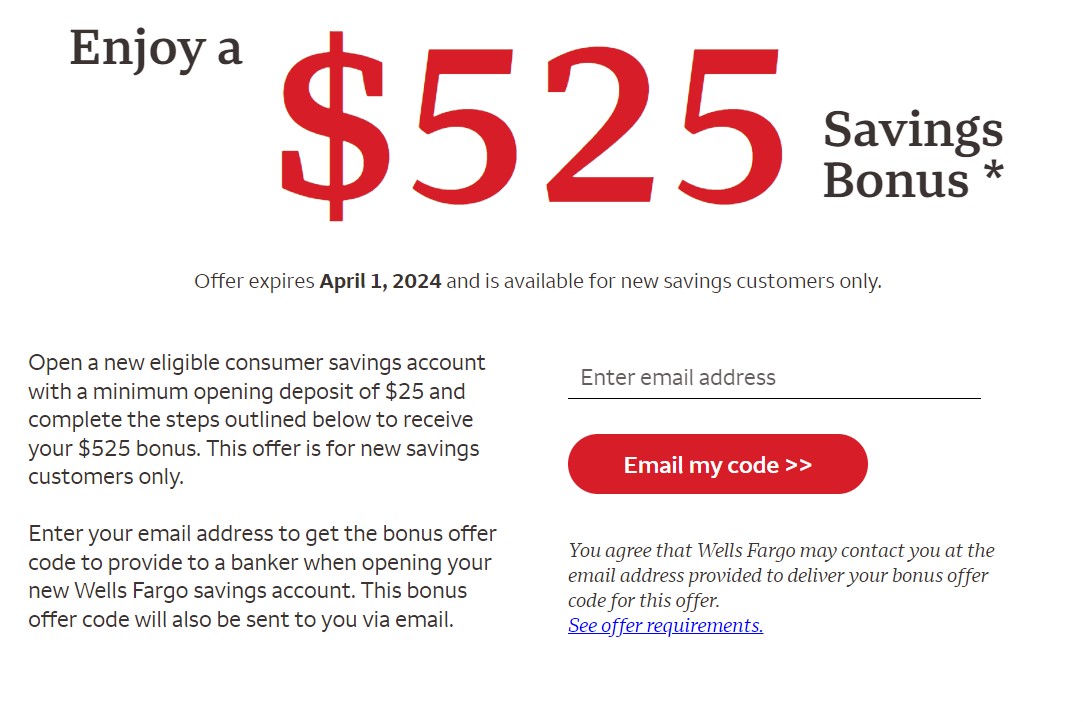

Wells Fargo is back with a good promotion for new savings account customers. This offer is available in-branch only and gives a $525 bonus when depositing $25,000 and then maintaining that balance for 61 days. This is obviously a significant deposit requirement for many and there is some loss of interest on those funds while they are deposited in the savings account (more details below). That said, it could be an appealing option for those who can swing it.

The Deal

- Wells Fargo is offering a $525 bonus when opening a new savings account, depositing $25,000 and maintaining that balance for a minimum of 61 days.

In order to receive the bonus you must:

- Go to this link and enter an e-mail address to receive a promo code.

- Open a new Way2Save savings account with a minimum balance of $25 in-branch using the promo code by 4/1/24.

- Deposit at least $25,000 by day 30 after account opening and maintain that balance until 90 days after account opening.

Terms and Conditions

- This offer is for new savings customers only. All Wells Fargo consumer savings accounts are eligible for this offer with the exception of Time Accounts (CDs) and savings accounts offered by Wells Fargo Private Bank.

- You must use your bonus offer code at account opening when you apply for a new eligible Wells Fargo savings account

- You are not eligible for this offer if:

- You are a current owner of a Wells Fargo consumer savings account

- You have received any other consumer savings offer bonus or promotional rate that required a bonus offer code within the past 12 months.

- You are a Wells Fargo employee

- To receive the bonus, you must:

- Open a new Wells Fargo consumer savings account with a minimum opening deposit of $25 in a Wells Fargo branch by April 1, 2024. All account applications are subject to approval.

- Bring $25,000 or more in new money to your new savings account by Day 30 and maintain at least a $25,000 balance through Day 90 after account opening.

- New money is money that is new to the customer or new to Wells Fargo (deposited into the customer’s new savings account directly from outside of Wells Fargo and Company and all affiliates, or from a Wells Fargo account not owned by the customer).

- The Wells Fargo Way2Save® Savings account monthly service fee is $5. Minimum opening deposit is $25. The monthly service fee can be avoided with one of the following each fee period:

- $300 minimum daily balance

- 1 automatic transfer each fee period of $25 or more from a linked Wells Fargo checking account

- 1 automatic transfer each business day within the fee period of $1 or more from a linked Wells Fargo checking account

- 1 or more Save As You Go® transfers from a linked Wells Fargo checking account. A qualifying Save As You Go transfer is an automatic transfer of $1 from your linked Wells Fargo checking account to your Way2Save Savings account each time you (or any authorized signer or joint owner) use your debit card for a one-time purchase or complete a Bill Pay transaction through online banking, and the one-time debit card purchase or Bill Pay transaction posts to the account. We reserve the right to determine through our sole discretion if a particular transaction is a qualifying transaction.

- Primary account owner is 24 years old or under. (When the primary account owner reaches the age of 25, age can no longer be used to avoid the monthly service fee.) Customers 12 and under must have an adult co-owner.

Quick Thoughts

Based on how I read the terms, you only have to leave the $25K in the bank for ~61 days to get the bonus. This is because you have to deposit $25 initially and then add the remainder of the $25,000 by 30 days from account opening. Then, you only have to maintain that balance for 90 days after account opening.

It’s important to note that the net upside is much lower than $525. There are plenty of ways to get ~5% interest right now with savings accounts, CDs and T-bills. These savings accounts offer a paltry 0.01 – 0.15%, so you’re effectively losing 61 days of interest on $25,000. Given that, the opportunity cost is ~$200 in interest, making the incremental gain closer to $325 than $525.

That said, this bonus corresponds to a ~12% annual interest rate, a very good return. At the same time, there’s minimum time commitment and more flexibility with your money.

We would normally jump at this kind of return were it not for the largesse of the last couple of years, as well as current interest rates. While it doesn’t seem quite as earth-shattering now, I’d probably still take the plunge on this if my cash flow allowed, simply because it’s fairly easy and the funds are tied up for a relatively short amount of time when compared to many other bank bonuses or CD’s.

Does anyone know if I have screwed myself. Due to WeBull’s strict deposit and withdrawal rules. I had to withdraw my funds to the same account that provided the deposit(WF Checking). Meaning, the $25K I pulled from WeBull for the WF Savings Bonus went to my WF Checking account first and then I immediately transferred it to my new WF Savings account. I am coming up on the end of my 30 day window(2/18) after completing the 90 day requirement and still no bonus. Have I shot my self in the foot?

Woof. I hate to be the bearer of bad news, but you probably did. The bonus requires the money be “new money” to WF, meaning money from another person’s Wells account or from outside of Wells Fargo. In order to hold to the terms, you’d need to transfer the money from WF Checking to some account outside of WF, then back to the savings account. I’m not 100% sure that you won’t get the bonus, but it’s not likely.

Still holding out hope that by 2/18 a magical $525 bonus will appear. Though, chatted with a WF Banker today and she was quite certain I shot myself in the foot, but felt she could get it all overridden if I in fact did all that was asked with the funds minus the deposit directly to my savings and not by way of my checking.

Appreciate your reply – Will keep ya updated!

[…] Wells Fargo $525 Bonus for New Savings Account: This bonus does not require a direct deposit, but you do have to park $25k for 61 days. See this post on Frequent Miler. […]

[…] 【2024.1 更新】$525 开户奖励回归,这次仅限新用户。HT: FM。要求是开户30天内存入$25k,并保持此余额至少到开户起第90天。也就是说如果赶在第29天存入,最少存61天就够,当然最好不要卡的这么紧张否则万一到账晚一天就不好了。Wells Fargo savings 年利率是羞辱性的 0.01%;但是考虑到这笔钱只要存在里面至少2个月最多3个月即可转走,算bonus的年化利率其实蛮高的,大概有 8.4%~12%,所以比目前正常的存款利率还是要高一些的。 […]

Wells also has an offer for a savings account with 4.6% interest. For a full year guaranteed. $10k minimum. I’d do that over an extra $15k locked up for two months.

Assuming you have no accounts with Wells Fargo, it seems like the smart move would be to deposit $300 initially, to avoid a potential monthly fee, and then deposit the remaining $24,700 on day 29. To me, the big downside is having to visit the actual branch at least twice (once to open the account, once to close it). IME, opening an account in-branch takes at least 30 minutes, and closing it sometimes leads to a sales pitch about why you should keep it. Even if P2 and I did this together, each opening an account at the same time, I’m having a hard time justifying our time and hassle for a net $650.

Yeah, the in-branch requirement definitely increases the “hassle” factor.

The in-branch only requirement is a killer for me. All of the branches that were near me closed within the last few years.

Thank you. Quick note, under “The Deal” it says 61 days, while the offer page states 90 days.

Yeah, this one is awkwardly worded. They’re measuring the amount of time that the money has to be in the account from account opening, not from deposit. You have 30 days to deposit the cash after you open the account, then you have to leave it for 90 days after you opened the account, not after you deposited the money. So, if you deposited the money on day 29 and then left it for 61 days, you’d hit the 90 day time requirement.

(the first paragraph in the “Quick Thoughts” section describes this as well)