At Frequent Miler, we keep a database of point valuations called “Reasonable Redemption Values.” These are estimates of the “worth” of airline miles, hotel points, transferable points, and more. The idea is that we try to identify the point at which it is “reasonable” to get that much value or more from your points.

This information is critical for making informed decisions. In fact, it’s a key component of the First Year Value information shown on our Best Credit Card Offers page, and it’s similarly used to show which cards offer the best value for everyday spend and which offer the best category bonuses.

Hilton Honors has a weird hybrid approach to free night awards. Like IHG, they no longer publicly assign hotels to categories and can therefore dynamically price award nights. Behind the scenes, they maintain a categorization and assign standard room award prices to each property (or to each category… or something). They seem to also maintain an internal peak/off-peak type of approach in that some properties have different standard award prices at different times of year. Due to category-ish award pricing, it’s possible to get outsized value from Hilton points when cash prices are high compared to their relatively fixed award costs. That’s the good news.

The bad news is that it’s not likely to happen by chance. In most cases, Hilton points are worth less than half a cent each.

When we first started looking at the value of hotel points, we used a laborious process that involved manually comparing the cash and award prices of hundreds of stays each year, then using those results to create RRV estimates. However, we now have a much better way of pinning down the value of Hilton points.

Gondola is a terrific free hotel search tool that shows prices of properties both in cash and in points, and it keeps data of both for searches done via its platform.

The kind folks over at Gondola have made this data available to us for the purpose of identifying hotel program point values. Thanks to them, we now have access to the results of around 3.3 million domestic and international Hilton award searches at over 7,000 different properties, and each one notes both the cash and award prices for the same room. Using this data, we can provide a far better estimate of the “Reasonable Redemption Value” of Hilton points than we were ever able to obtain by using manual calculations.

Outside of the manner in which we’re collecting data, the biggest change between this analysis and last year’s is our decision to include Small Luxury Hotels of the World (SLH) properties. SLH is a loosely organized group of boutique properties that used to partner with World of Hyatt before jumping ship to Hilton in 2024. Initially, the value that could be had at the upper end of the SLH spectrum was incredible, much like with Hilton’s own portfolio.

However, over the last year, Hilton has almost doubled the maximum amount of points that it will charge for a standard room, going from 120,000 points per night to an eye-watering 200,000 points. Although many SLH properties are still technically “good value” at that level, it’s put a substantial ding in the potential upside.

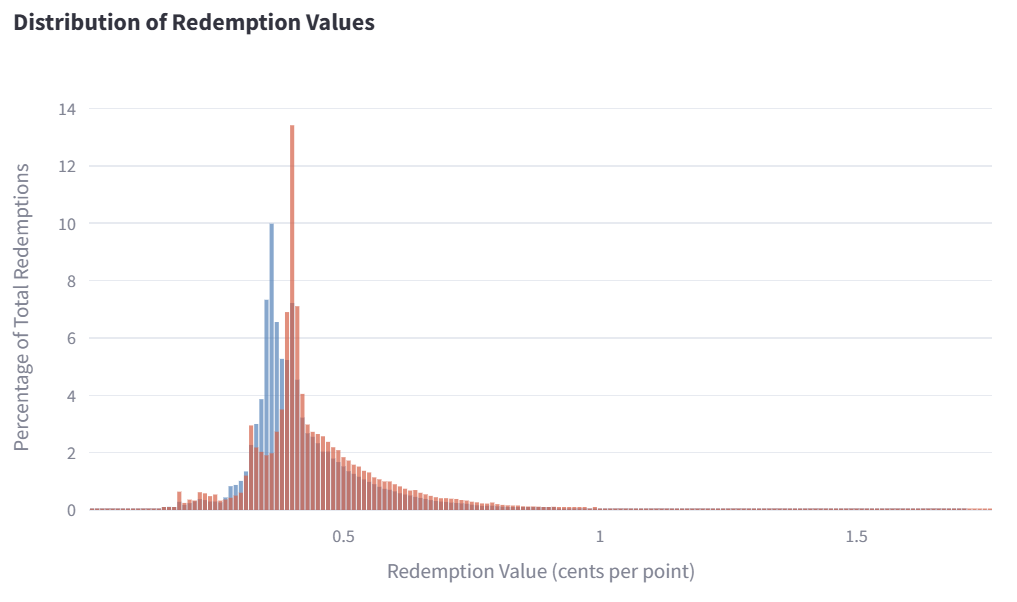

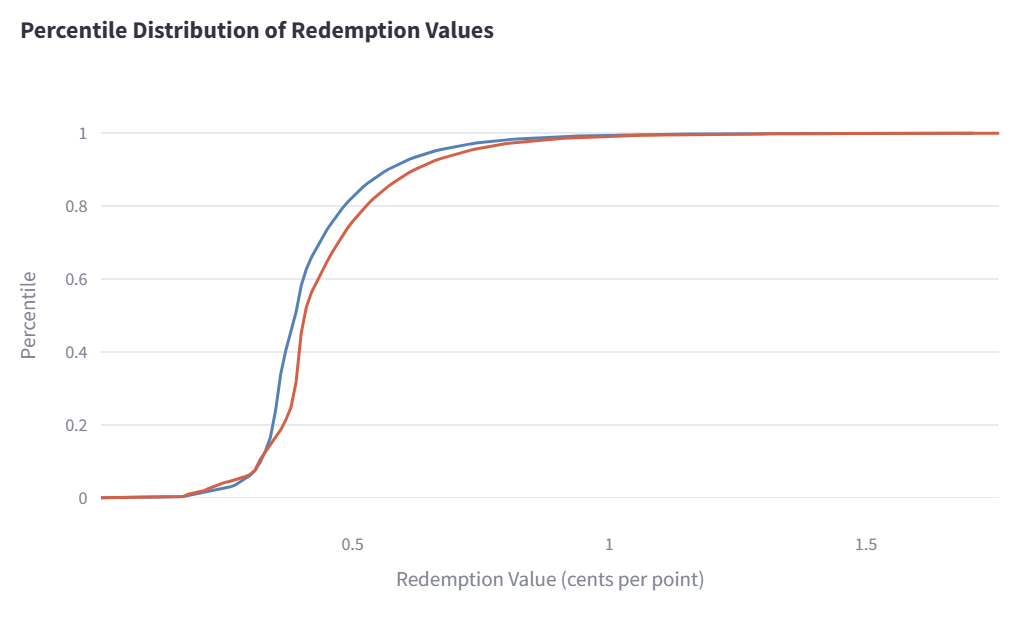

Based on Gondola’s data, even with SLH properties included, the Reasonable Redemption Value (RRV) for Hilton Honors Points has gone noticeably down, to 0.41 cents per point, from the previous level of 0.48 cents per point.

Background

When collecting points and miles, it’s always a good idea to have a general idea of what points are worth. Let’s say, for example, that you have the opportunity to either earn 1,000 Hyatt points or 2,000 Hilton points. Which should you go for? If you don’t know what the points are worth, you’d likely go for the Hilton points. But, in our analyses, we’ve found Hyatt points to be worth over four times as much as Hilton points. Therefore, on average, 1,000 Hyatt points are worth considerably more than 2,000 Hilton points. In this post, you’ll find our best current estimate of the value of Hilton points.

Methodology

In order to determine the value of Hilton Honors points, we looked at Gondola’s collected, real-world cash and point prices for over 7,000 Hilton properties. Since Hilton award bookings are fully refundable, we excluded data from all cash rates that were non-refundable in order to make it a complete apples-to-apples comparison. We also used the Total Cash Rate, which includes taxes and any local fees.

Hotel Programs that Waive Resort Fees on Award Stays

Hilton, Hyatt, and Wyndham waive resort fees when you book stays using points or free night certificates. For these chains, the resort fee does not have to be considered separately from the Total Cash Rate (which includes the resort fee). So, the RRV calculation is as follows:

RRV = Total Cash Rate ÷ Point Price

Hotel Programs that Charge Resort Fees on Award Stays

IHG, Marriott, and many other hotel programs impose resort fees on award stays. For these chains, the resort fee must be specifically taken into account in the calculation. We do that by having Gondola subtract it from the Total Cash Rate. The RRV calculation is as follows:

RRV = [Total Cash Rate – Resort Fee] ÷ Point Price

Gondola Data

For our hotel RRV values, we use the median value we see based on the data from Gondola. If the median is 1 cent per point, meaning that half of all searches produced a value of less than 1 cent per point, and the other half above 1 cent per point.

- Gondola Median Observed Value for Hilton redemptions: 0.41 cents per point

(based on data as of August 8th, 2025) - Range: 0.19 to 1.27 cents per point

Brand Comparison

Another cool feature of the data set that Gondola provides for us is that we can actually see how point values vary across a program’s different brands. Amazingly, even with Hilton’s massive coterie of brands, there was almost no variance; almost all of them had a median redemption value of 0.39-0.43. There were three exemptions:

| Brand: | RRV | Difference |

|---|---|---|

| LXR | 0.65 | +54.7% |

| SLH | 0.51 | +21.4% |

| Hilton Grand Vacations | 0.25 | -39.1% |

Perhaps the most interesting part of the Hilton data, in comparison to most other hotel chains, is the consistency of the median value. There are 20-25 distinct brands contained within Hilton Honors, and all but three of them were clustered between 0.39 and 0.43 cents per point (in contrast to other chains, which had numerous brands where the variance was ~10%+). That seems to indicate that Hilton is making a concerted attempt to price its standard awards at ~0.4 cents per point, which is a notable decrease from the ~0.5 cents per point that has been standard for years.

The only two notable places for consistent, outsized value were the luxury brand LXR and Small Luxury Hotels of the World…both which would appear to reinforce that Hilton’s “value” is primarily at the high end. That’s been true for some time, but the combination of higher maximum prices and a seemingly lower mid-range has made it even more striking with this year’s analysis.

Hilton’s vacation rental arm, Hilton Grand Vacations, is the one terrible value. That’s been true for as long as I’ve been engaged with the program, and most vacation rental properties have absurd points prices when compared to the cash rates.

Results

Point Value

| Analysis Date: | 8/8/25 | 7/16/24 | 12/7/22 |

|---|---|---|---|

| Point Value (Median) | 0.41 cents | 0.48 cents | 0.48 cents |

| Minimum Point Value | 0.19 | 0.9 | 1.3 |

| Maximum Point Value | 1.27 | 3.6 | 4.9 |

* Analyses starting 8/8/25 include international properties, as well as Small Luxury Hotels of the World.

The median observed point value for Hilton points was 0.41 cents per point. This means that half of the observed results offered equal or better point value, and half offered equal or worse value. Another way to think about it is that, without trying to cherry-pick good awards, you have a 50/50 chance of getting 0.41 cents or better value from your Hilton points when booking free night awards.

Compared to our last analysis, and despite including SLH properties, the median value of Hilton points has gone down by ~15%.

Pick your own point value

| Analysis Date: | 8/8/25 | 7/16/24 | 12/7/22 |

|---|---|---|---|

| 50th Percentile (Median) | 0.41 | 0.48 | 0.48 |

| 75th Percentile | 0.50 | 0.57 | 0.56 |

| 90th Percentile | 0.63 | 0.69 | 0.65 |

* Analyses starting 6/9/25 include international properties, as well as Small Luxury Hotels of the World.

When we publish Reasonable Redemption Values of points (RRVs), we conservatively pick the middle value, or the 50th percentile. The idea is that just by randomly picking hotels to use your points, you have a 50/50 chance of getting this value or better.

But what if you “cherry-pick” awards? Many people prefer to hold onto their points until they find uses that represent good value. If that’s you, then you may want to use the table above to pick your own point value. For example, if you think that you’ll hold out for the best 10% value awards, then pick the 90th percentile. If you cherry-pick a bit, but not that much, you might want to use the 75th percentile (for example). We’re guessing that most cherry-pickers will land around the 75th percentile: 0.5 cents per point.

This analysis shows that those who cherry-pick good value awards can count on getting around 0.50 cents per point in value or better.

Reasonable Redemption Value for Hilton points: 0.41 CPP

Our Reasonable Redemption Value (RRV) for Hilton points was previously set to 0.48 cents per point, but we’ve now lowered it to 0.41. RRVs are intended to be the point at which it is reasonable to get that much value or better for your points. Therefore, we believe the median observed value is a good choice for our RRV.

- Reasonable Redemption Value for Hilton: 0.41 cents per point

- Targeted Redemption Value for those who cherry-pick awards: 0.50 cents per point

Points are worth less for elite members

With most hotel programs, elite members earn more points per dollar on paid stays than do non-elite members. As a result, the relative value of an award stay compared to a paid stay decreases. Similarly, when Hilton offers double-point promotions, the value of using points decreases compared to using cash. The following table shows the median point values with various levels of elite status and with and without a double-point promo.

| Elite Level | Point Bonus on Paid Stays | Median Cents Per Point | Double Point Promo Median Cents Per Point |

|---|---|---|---|

| None | None | 0.41 | 0.41 |

| Silver | 20% | 0.41 | 0.40 |

| Gold | 80% | 0.40 | 0.39 |

| Diamond | 100% | 0.40 | 0.39 |

As you can see above, points are worth a bit less for elite members and during double-point promotions, but these factors don’t make a huge difference.

Should I buy Hilton points for half a cent each?

Hilton puts their points on sale for half a cent each so often that it would be crazy to buy points for more than that. If there isn’t a sale going on when you need the points, wait a minute or two to see if one pops up. But even then, is it a good deal?

If you have a specific award in mind where points are worth more than half a cent each, then it makes sense to buy points for that award. The question that we want to address here was whether it makes sense to buy Hilton points prospectively just to have enough around for whatever you need.

For point-buyers, the good news with the latest analysis is that you’re unlikely to lose much by buying points prospectively. The bad news is that you’re unlikely to stumble upon huge savings either. Even by cherry-picking awards at the 90th percentile, you can only expect to get around 0.63 cents per point value or better. That’s a savings of around 20%. Personally, we wouldn’t prospectively buy Hilton points with the hope of saving only 20% if we very selectively cherry-picked.

Buying points isn’t a terrible deal, but on average, it’s not a great deal either. Do it only if you have a specific high-value award in mind.

Overvaluing vs. Undervaluing Points

There is no perfect way to estimate the value of points. Decisions we made here in some ways overvalue points and in some ways undervalue points. The hope is that these things roughly offset each other…

Factors that cause us to undervalue points

- With hotel programs that offer 4th Night Free Awards (IHG, with some credit cards), or 5th Night Free Awards (Hilton & Marriott), or award discounts (Wyndham), we do not consider the point savings in our analyses.

- With hotel programs that offer free parking on award stays to top-tier elites (Hyatt), we do not factor this in.

Factors that cause us to overvalue points

- We do not use discount rates (other than member rates) in our analyses. In real life, many people book hotels cheaper (and sometimes far cheaper) by using AAA rates, government & military rates, senior rates, etc.

- We do not use hotel promotional rates. Often, individual hotels have deals such as “Stay 2 Nights, Get 1 Night Free,” which can greatly reduce the cost of a stay.

- We do not use prepaid rates in our analyses. Sometimes these rates are significantly lower than refundable rates.

- We do not factor in rebates, which can be earned from booking hotels through shopping portals.

- We do not factor in extra points earned on paid stays for those with elite status.

- We do not factor in rewards earned from credit card spend at hotels.

- We do not factor in hotel loyalty program promotions: Most promotions, but not all, only offer incentives for paid stays. We often see promos offering bonus points, double or triple points, free night awards, etc.

- With hotel programs that waive resort fees for top-tier elites on paid stays (e.g., Hyatt), we do not factor this in.

Conclusion

Based on the latest analysis, our Hilton RRV drops to 0.41 cents per point.

The idea behind using the median for our RRVs is that you have a 50/50 chance of getting that much value or more from your award stays, and so it is reasonable to expect to get that much value or better. For those more advanced, this post’s percentile results show that it’s reasonable to expect to get 0.5 cents per point or better if you cherry-pick good-value awards.

This is a disheartening set of data for Hilton. I (Tim) have noticed over the past several months that it’s been increasingly difficult to find “normal” Hilton properties whose awards are priced at ~0.5 cents per point – what I previously took to be the the program’s baseline. Evidently, that’s not just me.

I tend to be looking to redeem points and free night certificates at the top end of the spectrum, and indeed that’s where the best value still seems to be located. However, as the dust from the SLH acquisition has settled, Hilton points appear to have become less valuable overall, not more, something that none of us expected after the rollout last year.

Update of RRV after significant deval in September?

Great methodology, but in multiple recent searches in many different locations I’m not seeing the calculated RRV supported. I’m thinking under the radar devaluations since last August. Time for an update of Hilton RRV.

Hampton Inns used to be my go-to place for road trips and business travel. That was before the devaluation when I could regularly find them for 20,000 pts/night. Not any more. 34,000 seems to be the norm now. Sorry Hilton. You lost my business with that move. I just need a bed, a shower, and a TV for the night. I’m not giving up that many points for a 12 hour stay. Choice has my business now.

I can appreciate that. For years, I used to think of Hilton, IHG, and Choice points as all being relatively equivalent in value. Now, both Choice and IHG are, on average. 50%+ more valuable.

Crazy world.

[…] What are Hilton points worth? by FM. […]

Hilton value is in the FNCs (and I guess the breakfast?). If they Bonvoy that, the party will be over.

Glad to see you come off of the fever dream high of Transferring MR to Hilton. Peak of points navel gazing

There has also been a large trend in many Hilton markets to add parking fees. In SoCal it is hard to find a Hilton hotel even in the suburbs that is not charging for parking these days. I have read the hotels do not have to share parking revenue with corporate and with it not being waived on award stays it has further diminished the value of points. In the US I have not found “good” value for Hilton points other than higher end properties the past year.

The thing to keep in mind is that some hotels are absolute bargains on points due to fifth night free deals and the absence of 15 percent or higher sales taxes. I’m paying 240,000 points for a 5 night stay that would otherwise cost $2100, so I can’t quibble. It all depends on your particular plans,

Why would anyone spend $2,100 when they can just spend $1,200 to buy 240k points?

And they would also get all the fancy perks of 5th night “free” and waived fees.

Will be interesting to see what you value the Hilton FNC’s are now that the maximum cap is 200K (but are most people actually redeeming at the cap or even 85% of that at 170K?)

This makes me feel better like I’m not going crazy. We do mostly family travel looking for Hampton Inns and the like. We almost never find 0.5 cpp value at the ones we’re looking at and usually go with other chains.

One un-calculatable value for Hilton is with all the potential AMEX hilton hotel credits + the daily status F&B credits, there is several hundred dollars of additional value available (albeit in the form of $25 burgers & $150 massages). These are available for paid stays as well, but for those looking for “free” travel, it makes Hilton points go further from a total travel expense perspective.

I think we all have known for the past year that Hilton has bonvoyed the value of its points; even when accounting for SLH.

Right now it is a race to the bottom and Hilton is leading on the Hotels side and Delta on the airline side.

But hey Amex is still printing money so the devaluations will continue until we tell them otherwise.

I tried booking ~1 month out for a hotel in Chicago, and points were worth just $0.02 – $0.03 per night. I checked multiple hotels and they were nearly the same. Very very disappointing.

That is excellent value! 4-6X what this article values points at.

I don’t have a good way of earning Hilton points directly. Same for Marriott points.

Most of my MRs seem to go to Delta economy flights.

At what minimum conversion rate of Amex MRs —> Hilton Points would you speculatively transfer ?

If you’re OK with transferring MR to Delta, you’re getting ~1.3 cpp.

With a Hilton CPP ~0.5, you would get >1.3 CPP (better value than your Delta redemption) transferring Amex MR to Hilton if they are offering a 30% bonus (1 MR: 2.6 Hilton)

If you are utilizing Hilton’s 5th night free, even transferring 1:2 without a bonus might be worthwhile for you.

Thanks for the chart, I dont quite get the Points are worth less for elite memberschart as Elite, say diamond earn 100% more base points so at a loss why more points are worth less.

I get why that’s confusing! It’s probably easier to explain by saying not that the points are worth less, but that the paid stay is worth more (because you’ll earn more points on a paid stay). To determine the value of points, we compare booking an award stay to booking a paid stay. When you book an award stay, you don’t earn points for the stay, so we take that into account. For example, if comparing a stay that costs either 40,000 points or $500, let’s say that you would earn 10,000 points on the paid stay. In that case, we compare 50,000 points to $500 because the award stay costs you 40,000 points plus the loss of 10,000 points that you would have earned on a paid stay. Now, let’s say that a Diamond member would earn 20,000 points for that stay. Now we compare 60,000 points to $500. That comparison makes it look like points are worth less, but that’s only because the paid stay is worth more.

Ahhh thanks Greg, now I get it . Its a bit of an opportunity cost especially when your higher status getting the 100% bonus you “miss out” on more points via an award booking vs cash.