At Frequent Miler, we keep a database of point valuations called “Reasonable Redemption Values.” These are estimates of the “worth” of airline miles, hotel points, transferable points, and more. The idea is that we try to identify the point at which it is “reasonable” to get that much value or more from your points.

This information is critical for making informed decisions. In fact, it’s a key component of the First Year Value information shown on our Best Credit Card Offers page, and it’s similarly used to show which cards offer the best value for everyday spend and which offer the best category bonuses.

When we first started looking at the value of hotel points, we used a laborious process that involved manually comparing the cash and award prices of hundreds of stays each year, then using those results to create RRV estimates. However, we now have a much better way of pinning down the value of Marriott points.

Gondola is a terrific free hotel search tool that shows prices of properties both in cash and in points, and it keeps data of both for searches done via its platform.

The kind folks over at Gondola have made this data available to us for the purpose of identifying hotel program point values. Thanks to them, we now have access to the results of around 3 million domestic and international Marriott searches at over 8,300 different properties, and each one notes both the cash and award prices for the same room. Using this data, we can provide a far better estimate of the “Reasonable Redemption Value” of Marriott points than we were ever able to obtain by using manual calculations.

Marriott caused quite a stir in the points and miles world earlier this year when it raised the award prices of many of its most aspirational properties into the stratosphere, with the cost of some properties almost doubling overnight.

At the same time, it appeared that Marriott had also raised the cap on each tier of its “secret award chart,” meaning that the maximum points that it charges for each award level had gone up by ~5-10%. Because of that, we did an analysis in February and found that the overall value of Marriott points had actually gone up slightly. However, now that we have a much more robust data set, we wanted to take another look, both to check our earlier numbers and to see if there was any further “devaluation creep” that had happened over the last few months.

Based on Gondola’s data, there hasn’t been, and the Reasonable Redemption Value (RRV) has been remarkably steady. It remains 0.76 cents per point, the exact same value that we arrived at with our more limited searches several months ago.

Background

When collecting points and miles, it’s always good to have a general idea of what points are worth. Let’s say, for example, that you have the opportunity to either earn 1,000 Hyatt points or 2,000 Marriott points. Which should you go for?

If you don’t know what the points are worth, you’d likely go for the Marriott points. But, in our analyses, we’ve found Hyatt points to be worth more than twice as much as Marriott points. Therefore, on average, 1,000 Hyatt points are worth more than 2,000 Marriott points. In this post, you’ll find my best current estimate of the redemption value of Marriott points.

Methodology

In order to determine the value of Marriott points, we looked at Gondola’s collected, real-world cash and point prices for over 8,300 Marriott properties. Since Marriott award bookings are fully refundable, we excluded data from all cash rates that were non-refundable in order to make it a complete apples-to-apples comparison. We also used the Total Cash Rate, which includes taxes and any local fees.

Hotel Programs that Waive Resort Fees on Award Stays

Hilton, Hyatt, and Wyndham waive resort fees when you book stays using points or free night certificates. For these chains, the resort fee does not have to be considered separately from the Total Cash Rate (which includes the resort fee). So, the RRV calculation is as follows:

RRV = Total Cash Rate ÷ Point Price

Hotel Programs that Charge Resort Fees on Award Stays

IHG, Marriott, and many other hotel programs impose resort fees on award stays. For these chains, the resort fee must be specifically taken into account in the calculation. We do that by having Gondola subtract it from the Total Cash Rate. The RRV calculation is as follows:

RRV = [Total Cash Rate – Resort Fee] ÷ Point Price

Gondola Data

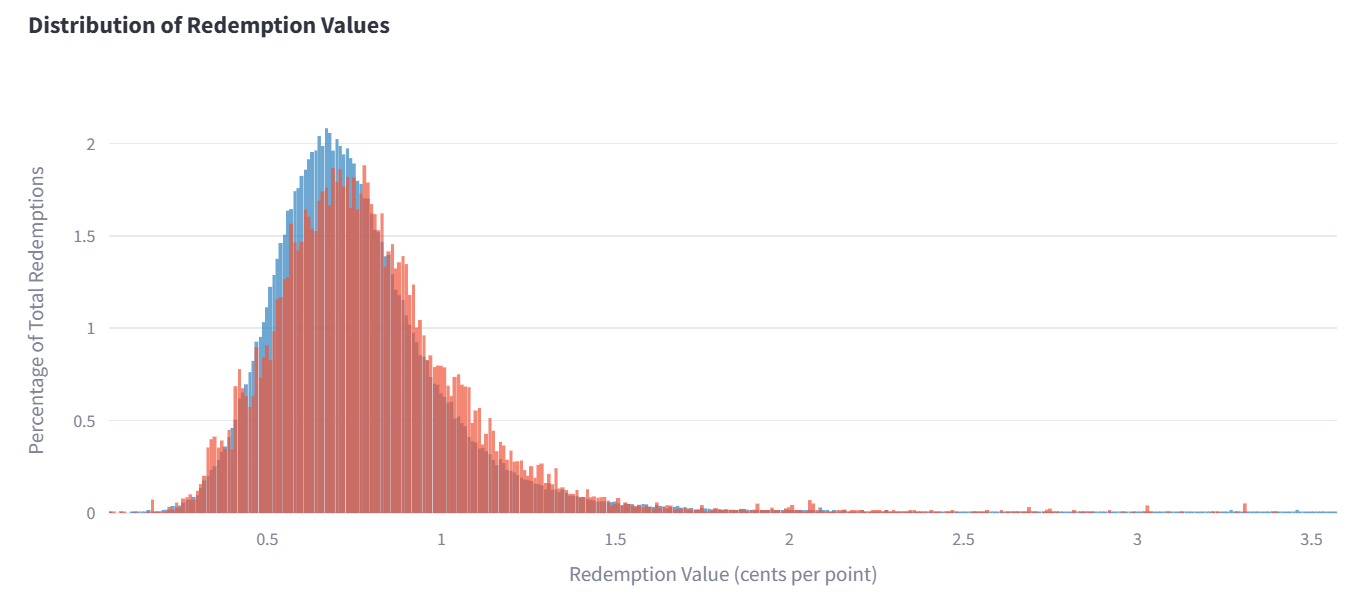

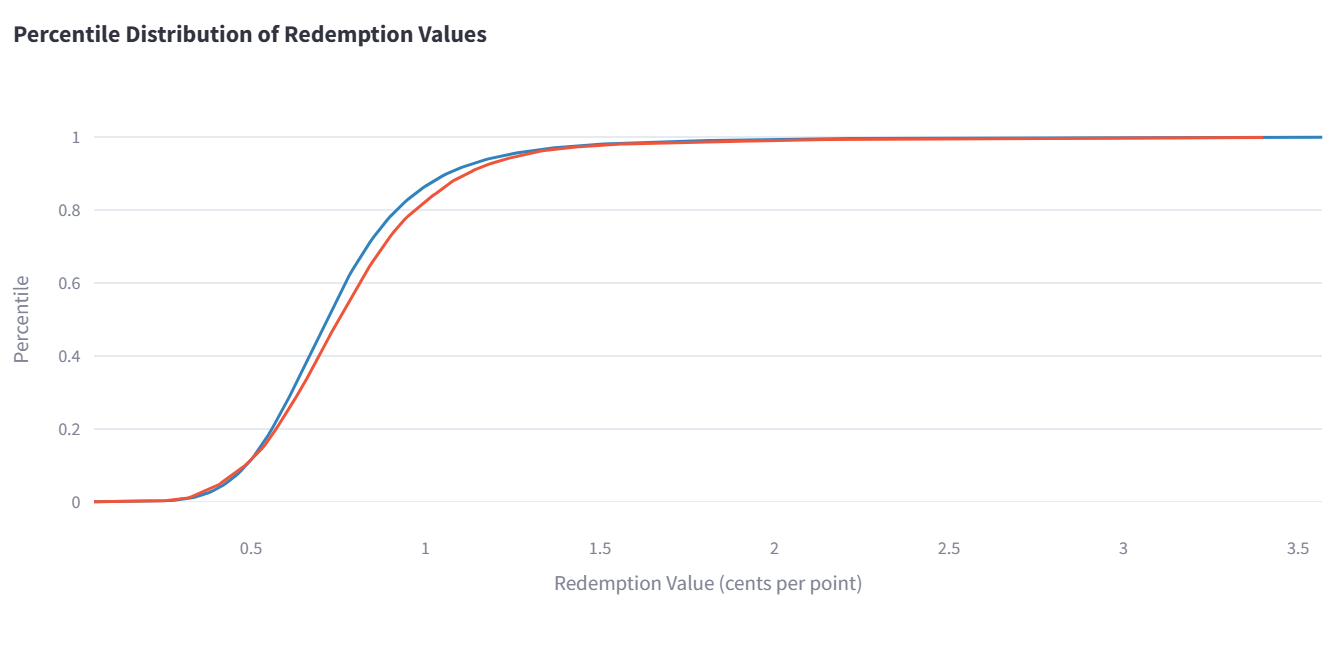

For our hotel RRV values, we use the median value we see based on the data from Gondola. If the median is 1 cent per point, that means that half of all searches produced a value of less than 1 cent per point, and the other half above 1 cent per point.

- Gondola Median Observed Value for Marriott redemptions: 0.76 cents per point

(based on data as of June 5th, 2025) - Range: .17 to 3.46 cents per point

Brand Comparison

Another cool feature of the data set that Gondola provides for us is that we can actually see how point values vary across a program’s different brands. Most brands stayed fairly close to Marriott’s overall value of 0.76 cents per point. However, there were a handful of outliers, and we’ve listed the four biggest positive and negative examples below:

| Brand: | RRV | Difference |

|---|---|---|

| City Express | 0.92 | +21% |

| Ritz Carlton | 0.88 | +15.7% |

| St Regis | 0.86 | +13.1% |

| Towneplace Suites | 0.83 | +9.2% |

| Delta Hotels | 0.66 | -13.2% |

| Tribute Portfolio | 0.63 | -17% |

| Design Hotels | 0.62 | -18.4% |

| MGM | 0.60 | -21% |

The standout brands are interesting. I’m not surprised to see that Ritz-Carlton and St Regis, two of Marriott’s most significant luxury brands, end up tracking higher than the rest. They’re more expensive, especially on the very top-end, so even if the points price is astronomical, it often can represent 1 cent per point or better value.

It’s also not a shock to see MGM and Design Hotels bringing up the rear. Neither is owned by Marriott, but are independent properties that participate in the Bonvoy Program. My experience in looking at both of them is that they tend to offer sub-optimal value, and I’ve never found any reason to choose either of them in a given city or area.

Interestingly, by far the best “brand performer” is Marriott’s new budget entry, City Express. There are only around 150 of them right now, but they seem to be providing excellent value when compared to the rest of Marriott’s brands…perhaps simply because it’s a new brand, so pricing hasn’t stabilized yet.

Results

Point Value

| Analysis Date: | 6/5/25 | 2/2/25 | 6/21/24 | 4/7/23 |

|---|---|---|---|---|

| Point Value (Median) | 0.76 | 0.76 | 0.70 | 0.76 |

| Minimum Point Value | 0.17 | 0.48 | 0.49 | 0.38 |

| Maximum Point Value | 3.46 | 1.81 | 1.3 | 1.65 |

The median observed point value for the latest analysis was 0.76 cents per point. This means that half of the observed results offered equal or better point value, and half offered equal or worse value. Another way to think about it is that, without trying to cherry-pick good awards, you have a 50/50 chance of getting 0.76 cents or better value from your Marriott points when booking free night awards.

In our last data collection in February 2025, the median cents per point value was 0.76. We reached the exact same result using Gondola’s data, so the Reasonable Redemption Value for Bonvoy points is unchanged.

Pick your own point value

| Analysis Date: | 6/5/25 | 2/2/25 | 6/21/24 | 4/7/23 |

|---|---|---|---|---|

| 50th Percentile (Median) | 0.76 | 0.76 | 0.70 | 0.76 |

| 75th Percentile | 0.92 | 0.89 | 0.83 | 0.92 |

| 90th Percentile | 1.12 | 1.01 | 0.94 | 1.15 |

When we publish Reasonable Redemption Values of points (RRVs), we conservatively pick the middle value, or the 50th percentile. The idea is that just by randomly picking hotels to use your points, you have a 50/50 chance of getting this value or better. But what if you cherry-pick awards? Many people prefer to hold onto their points until they find good value uses for them. If that’s you, then you may want to use the table above to pick your own point value. For example, if you think that you’ll hold out for the best 10% value awards, then pick the 90th percentile. If you cherry-pick a bit, but not that much, you might want to use the 70th percentile (for example).

We’re guessing that most cherry-pickers will land around the 75th percentile: 0.92 cents per point. Another way of saying it is that those folks who cherry-pick good value awards can count on getting around 0.92 cents per point value or better.

For those who do the most extreme cherry-picking, the data here is good news as well. The 90th percentile had previously stood at 1.01 cents per point, but it has now risen by a little more than 10%. My guess is that this reflects the inclusion of international Marriott properties, which sometimes offer a much better value proposition than the domestic properties we used to confine our searches to.

Reasonable Redemption Value: 0.76 Cents Per Point

Our Reasonable Redemption Value (RRV) for Marriott points was previously set to 0.76 cents per point, and that’s where it remains after this analysis. RRVs are intended to be the point at which it is reasonable to get that much value or better for your points. Therefore, we believe that the median observed value is a good choice for our RRV.

- Reasonable Redemption Value for Marriott: 0.76 cents per point

- Reasonable Redemption Value for those who cherry-pick awards: 0.92 cents per point

Overvaluing vs. Undervaluing Points

There is no perfect way to estimate the value of points. Decisions we made here in some ways overvalue points and in some ways undervalue points. The hope is that these things roughly offset each other.

Factors that cause us to undervalue points

- With hotel programs that offer 4th Night Free Awards (IHG, with some credit cards), or 5th Night Free Awards (Hilton & Marriott), or award discounts (Wyndham), we do not consider the point savings in our analyses.

- With hotel programs that offer free parking on award stays to top-tier elites (Hyatt), we do not factor this in.

Factors that cause us to overvalue points

- We do not use discount rates (other than member rates) in our analyses. In real life, many people book hotels cheaper (and sometimes far cheaper) by using AAA rates, government & military rates, senior rates, etc.

- We do not use hotel promotional rates. Often, individual hotels have deals such as “Stay 2 Nights, Get 1 Night Free” which can greatly reduce the cost of a stay.

- We do not use prepaid rates in our analyses. Sometimes these rates are significantly lower than refundable rates.

- We do not factor in rebates, which can be earned from booking hotels through shopping portals.

- We do not factor in extra points earned on paid stays for those with elite status.

- We do not factor in rewards earned from credit card spend at hotels.

- We do not factor in hotel loyalty program promotions: Most promotions, but not all, only offer incentives for paid stays. We often see promos offering bonus points, double or triple points, free night awards, etc.

- With hotel programs that waive resort fees for top-tier elites on paid stays (e.g. Hyatt), we do not factor this in.

Conclusion

Based on the latest analysis, we’ve left our Marriott RRV at 0.76 cents per point. The idea is that you have an equal chance of getting that much value or more from your award stays.

This might seem bizarre to some folks who have seen the prices of their favorite hotels go up this year, or who have read numerous articles about the “devaluation” earlier this year.

Our second RRV analysis of the year, this time with much more data, doesn’t necessarily disagree with any of that…there are certainly many properties that are much more expensive than they were last year.

However, when looking at a large swathe of properties throughout the US, we’re still seeing the median value hanging out in the same 0.7-0.8 range that it’s been at for the last three years. Bonvoy points may be worth much less at certain properties, but we’re not seeing the same thing program-wide, although that’s cold comfort to people who were stashing their points for an outsized redemption in the Maldives or at the JW Marriott Masai Mara.

For a complete list of Reasonable Redemption Values (and links to posts like this one), see: Reasonable Redemption Values (RRVs).

Imagine consistently getting 2.5 cents of value out of Marriott points. Certainly, a niche redemption. But, you’ll never hear about it in a public forum.

I’d like to know . . .

Thanks for all the effort and getting to a value based on actual data. I am surprised the the wide range though and curious that where you get more than 1cpp.

So far I have been eyeballing the value around 0.7cpp. If it is much lower than that then I would not use points.

I also don’t use points just based on redemption value, I know that is not part of this article, but how many nights I get is very important, I don’t have points for upper class splurge.

G&T:

(The above salutation sounds like what I should be indulging in while sitting on the dock at Lake Washington.)

This data substantiates the value of the work you guys have accomplished in the past to arrive at your RRVs.

As a Marriott loyalist (among my least admirable attributes) it’s much appreciated.

However, the Gondola site still seems a bit too invasive for my (paranoid) appetite.

So, sorry, but I’ll continue to rely on your research and credibility.

Thanks for all you do to keep us entertained and informed.

Appreciate that you now have access to a much more robust dataset via Gondola. Amazing how close the old methodology seems to be (without the crazy tails of such a large set). I do miss the old, “follow along with pencil & paper at home” in a way that anyone could replicate for their destination. I also wonder about RRV with differentiated subsets. e.g. domestic v. international.

If you have the Chase Marriott Bold card, you can pay with with points at $.008 per point. EX. If you book straight with points, the Santa Ynez Valley Marriott is 40k per night (6/17-6/18) but the pay with points would be 25,000 points (based on $180 per night room rate). This opens up a lot of opportunities for value as you can book a hotel with poor point redemption (like the aforementioned example) and just do the statement offset instead.

And you’ll earn points on that stay and spend too. Dropping the net points price even lower than the 25k.

The Bold card doesn’t get a lot of press so that’s interesting to know. That said it seems it’s mainly of value to those generating a lot of Marriott points directly (probably through work travel, living out of hotels, or very expensive stays). Transferable points would be better off cashed out closer to 1cpp to pay directly for the booking, or at 1.5 – 1.6cpp via the USB AR or Chase Aeroplan card as a travel redemption where you still earn points and bonuses as a cash booking. The transfer bonuses from AMEX and Chase to Marriott have rarely been high enough to make the 0.8cpp option a better value.

I am surprised there is no mention of the Chase Marriott Bonvoy Bold Pay Yourself back at 0.8 CPP for the first $750 per annum. So 0.76 is not a very reasonable redemption value for the first $750 per year.

That’s outside the purview of this post, as it’s a credit card benefit. This post is about the value of Marriott points when using them towards award nights.

This really helps the community understand that RRV is a point estimate in the middle of a nebulous fuzzball. And, it’s not until one looks at a specific redemption that a person sees their own value.

In that sense, you’ve shown that a Marriott redemption is like quantum mechanics.

As I think about it, understanding Marriott’s elite breakfast benefit is the same way. 🙂

LOL!

The problem with these kind of valuations is that they don’t account or factor in the complete failure of Marriott to police its Bonvoy participating properties and ensure that promised benefits are, in fact, provided to eligible guests. So even if you find a high-value redemption, the overall value of the Bonvoy points is still significantly lower because you can’t count on the promised benefits being delivered.

I’d argue that this has nothing to do with the value of the points and everything to do with the value of status with Marriott.

Points are worth less if you don’t get what you’re expecting to receive.

Sorry, FNT, you’re just wrong. If you use X amount of point and get shitty service or if you use $Y and get the same shitty service, the point is worth $Y/X per point. As how it is calculated. It has nothing to do with points and 100% what Brutus pointed out, the brand value of Marriott.

I agree with you that Marriott does suck at policing the individual brands. For instance, some property showed up at a whopping 0.17 CPP in the FM analysis. That being said, how elite benefits are managed across the brands is completely unrelated to this CPP study. Cpp based on a pure price to points comparison, it has absolutely nothing to do with Elite benefits.

Points are worth X to someone without tier status and benefits. Points are worth Y to someone with tier status and benefits.

Precisely. Taking this point further, those with Marriott status but without Hyatt status (or whatever hotel brand) will give a slight bump in value to the former while discounting the latter since you know one offers a reasonable chance of getting some food or upgrade benefits via status while the other has a chance pretty close to 0%.

Wow, gotta go chase after this mythical 3+ cpp redemption now.

Would be interesting to see what the top and bottom of value properties are.

I’m also curious about the property that attains 0.17 cpp. What were they thinking they just going to get away with charging 90k points for a $150 property? They need to be shamed.

I would assume it’s a very cheap international property that has maybe a 20K per night award floor but a cash rate around $30.

First off, thanks for this update. I have tremendous respect for the data based rigor you’ve always put into your approach . As much as I have to respect the dataset, my personal experience disagrees with the conclusion. I would love to see you add the dimension of domestic RRV vs international. As someone who tends to do a lot of offseason travel, with the category minimum inflations, I run into many frustrations where small town limited service hotels still want 35k points for $100/n rate. The higher minimums exacerbate this.

I also appreciate you acknowledging not being able to factor in “discounted rates.” A complicating factor is that I generally find that the effective discount available for Marriott off of the rate you’re basing your analysis on to be much higher than brands like Hyatt for example. The differences in discount percentage that other rates provide contributes to a disconnect between RRV and the back of the envelope, points vs miles calculations made at booking.

I love these RRV updates, even if the values haven’t changed much / at all. Keep it up Greg 🙂

I’ve been a Marriott elite for eight years. I must say I’ve taken many many bites of the apple. Marriott points are just bonus that I have also taken advantage of. Good loyalty program.

The numbers don’t lie (Bonvoy does, but that’s a separate issue).

When valued against actual money, I think hotel points actually increased in value during the post-pandemic travel disruptions and we’re seeing a return to the mean. This analysis shows a 10% INCREASE in the value of Marriott points AFTER the recent price adjustments — if you were to rerun the analysis with prices and redemptions just before the points increases you probably would have computed a value closer to 0.85.

If I recall, something similar happened with Hyatt — the RRV of their points increased to something over 2 cpp despite hotels shifting up in level, then dropped the next year closer to the historic value of 1.7 cpp. Is that correct?

If points are going to maintain their cash value then the number required for a redemption will need to rise (and fall) with the cash prices for rooms. If you expect redemption rates to stay the same during a period of high cash prices your baseline expectation is not a steady value but INCREASING value

Of course what is not considered is the significant cash price increases for Marriott properties which of course directly relates to the point value.

Did you actually read the article? This is based off the cash price of Marriott properties.

Yes. The analysis is correct, but Marriott’s cash price increases IMHO is what has kept the point value stable. But to the extent Marriott’s have increased their cash prices more than the competition it is still a devaluation.

That actually hasn’t been the case recently. If you look at the tables, we do track the median and mean for cash prices as well. Those have been essentially stable since our 2023 analysis. The increase that we saw was between 2020 and 2022, but it’s flattened out since then.

I stay at MMF rates and Where I normally go (at the same time of year, same place and often the same properties the price has gone up substantially. Of course it may be specific to my destinations. I also book 11-12 months in advance.

I also look at international destinations – Belgium and the rest of Europe which is not the subject of the article. But I do not doubt and appreciate frequent miler and your analysis.

Absolutely, we try to be very clear about what we’re looking at and what we’re not – and international destinations and special offer codes are two of the “nots.” We can just say that, for our samples, we haven’t seen significant change in median or mean cash rates over the last two years (ish).

I should have been clear in my post that I frequent European Marriott properties on the friends and family rate which have gone up at the properties I regularly have stayed at. I totally understand getting called out. I am normally more precise.

All of these calculations address only half of the equation. As a Titanium I earn 10 points per dollar at Marriott spend, plus a 75% bonus as Titanium plus 6 points per dollar paying my bill with the credit card. That’s 23 points per dollar. If points are worth $.07 each then my Marriott spend is getting $1.60 value per dollar (10 plus17 plus 6). I know, this only works for Marriott hotel spend, but that’s the only time I use the Marriott card. Otherwise, Chase points is best.

How about this instead?

23 points per dollar * 0.7 cents per point = 16 cents per dollar = 16 percent reward rate.

You are correct Fred. Haven’t had my morning coffee yet. Thank you