NOTICE: This post references card features that have changed, expired, or are not currently available

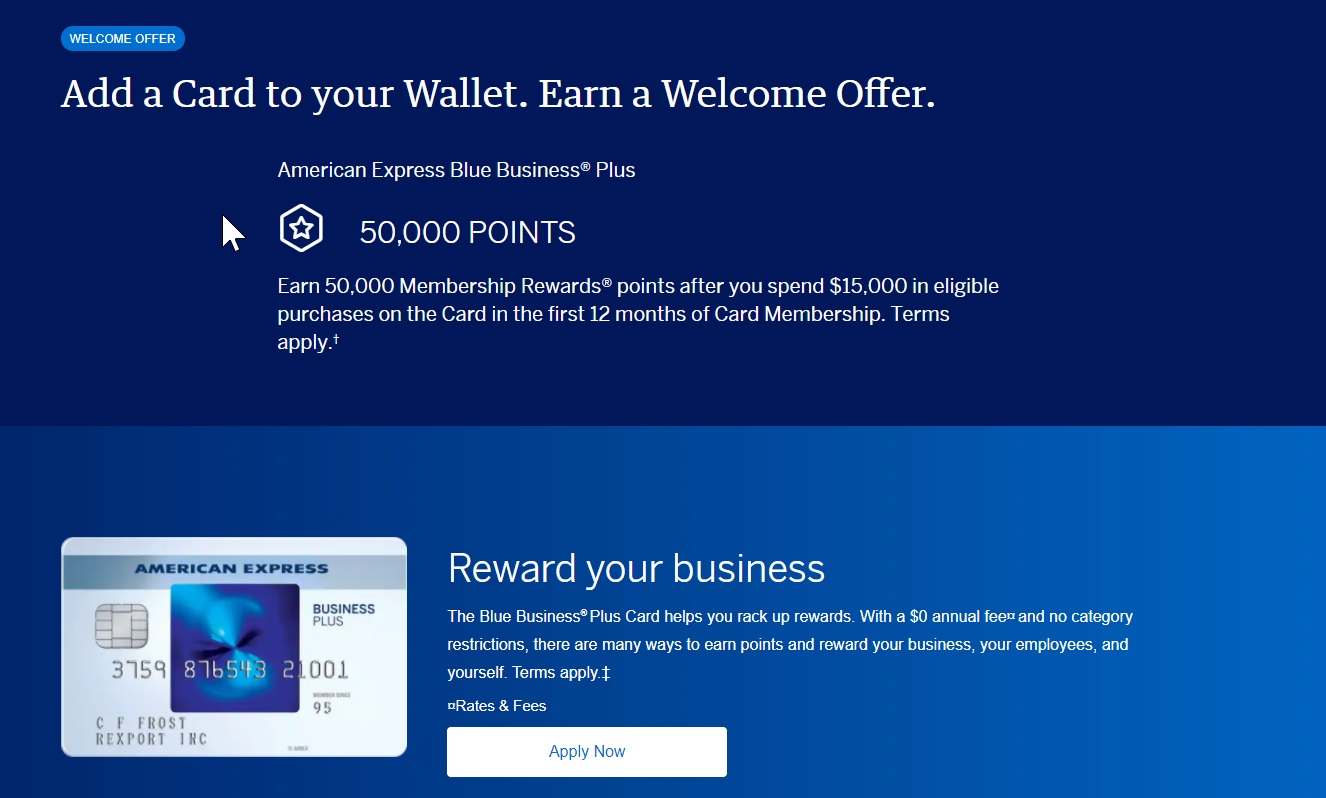

Doctor of Credit reports an amazing targeted offer on the Blue Business Plus card: 50K Membership Rewards points after $15K in purchases in the first 12 months. Given that you also earn 2x on eligible everyday purchases for the first $50K in spend each year on this card, you would end up with a total of 80K Membership Rewards points after $15K spend in the first year. On a card with no annual fee, that’s an awesome offer.

The Offer

- American Express is out with a targeted offer on the Blue Business Plus credit card good for 50K Membership Rewards points after spending $15K on purchases in the first 12 months

- Direct link to log in and apply

Key Card Details

Note that if you click on the card information below, you’ll be taken to our dedicated card page with current public offer information. For the targeted offer, see the link under “The Deal” above.

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: 2X rewards for all eligible purchases (up to $50K per year) with no annual fee makes this card a winner. Click here for our complete card review No Annual Fee Earning rate: 2X Membership Rewards points on all eligible purchases, up to $50K spend per calendar year (then 1X thereafter). Terms apply. (Rates & Fees) Base: 2X (3.1%) Card Info: Amex Credit Card issued by Amex. This card imposes foreign transaction fees. |

Quick Thoughts

Again, given that this is a 2x-everywhere card for the first $50K in eligible purchases each year and that the card has no annual fee, this would be a tough offer to ignore for those who can meet the spend. While $15K spend seems like a tall order for a 50K bonus, it’s a great deal for those who would otherwise consider this card because ordinarily this card comes with no bonus at all or 10K via referral (we’ve occasionally seen 20K or 30K offers). Many people would like to have this card as an everyday spend card anyway, so getting a big bonus like this would be a nice way to add it to your wallet. It’s also a great way to keep your Membership Rewards points alive since it has no annual fee and you can transfer to airline and hotel partners with it, so having this card would mean that you could always cancel other cards you no longer want and maintain your Membership Rewards points balance.

Unfortunately, it is targeted and I imagine highly so. You’ll need to log in to apply and if you get a message that says “Sorry, this offer is no longer available”, it means you are not targeted.

If you’re eligible, this is definitely an offer worth considering.

This offer just showed up in my Platinum card’s amex offers. I signed up immediately. I’ve finally captured my white whale!

I’m an idiot. I thought I was targeted because when I click on the link, while logged into amex, the offer appears. But when I click “apply now,” I get “the offer is no longer available.” Much ado about nothing. The good news is that I now understand a lot about overpaying taxes for other SUB purposes 😉

The offer comes up for me but if I currently hold 5 personal Amex cards, am I really eligible?

I don’t think you can use a referral with this improved offer. So, I would forego a 30K P2 referral to get this improved offer .

If I had that, I would just get the 40k total for $3k spend.

No dice. Still grateful that Amex gave me 30k referral for platinum card per referral. Can’t have anything. I just wish Amex points were as easy to use as chase or citi. For domestic flights and hotels almost useless.

If you have a Schwab Platinum this is $1,000 for $15,000 spend which makes it better IMO than the $1,105 for $20,000 Venture offer.

Not targeted and still stuck in Amex jail sadly..going on a year now.

Hopefully the past few months of putting spend on all three of my cards will finally get me out.

Sad watching these great offers go by..

So who does get invited to this party? Despite 800+ scores, my wife and I always get the”Sorry” greeting. What are the characteristics of those who Amex is targeting?

Probably people who don’t have any AMEX cards or AMEX cardholders who don’t have an AMEX business card

I don’t understand it. Amex loves giving me and P2 the pop up, but we are both targeted for this. She doesn’t have any amex cards at the moment, but I have the hilton bus, platinum, delta blue and blue cash everyday (the latter 2 being downgrades that I will eventually cancel).

It’s because likely the targeted offers are from a program in the marketing department but the welcome offer approvals are screened in a different system. Those systems don’t talk to each other.

You meet the marketing screeners but fail the welcome offers screeners.

It’s frustrating. Just like the great Capital One Venture Visa that the bloggers were all hailing a few months back. We both got rejected but my barely-employed son with not a pot to p!$$ in was immediately accepted. I guess Cap One is looking for suckers who will likely run up big balances and pay them big interest payments. Banks are getting skilled at targeting their markets, but I sure wish I knew the rules so I don’t keep wasting hard lookups.

“No card for you!” says the Card Nazi.

CapOne is super sensitive to previous inquiries. So they were probably okay with giving your son his first or second credit card with no credit to his name, but not you or your wife since (I assume) you sign up for cards regularly.

The reality is this game will get tougher as time goes on. Software gets better and draws information from more sources. Better offers will go towards people who they think are more profitable.

No one knows the logic by which credit card companies decide it’s worth several hundred dollars to “acquire” a particular individual as a customer. I don’t see why a high credit score would particularly contribute to the decision, however. In this case one might guess that they’re looking for business owners with significant spend on business credit cards from other issuers from whom they might capture profitable business.

My concern is that this will delay me from signing up for other cards for quite some time and there have been so many good ones these days (now delta, Hilton, etc). P2 and I are already nearly $20k backed up with brex, jetblue and Amex platinum offers. I suppose I could ms the jetblue and brex bonuses with Simon gc’s, but I would still be choosing the bbp over those other increased offers (like delta and Hilton) along with the challenge of having to ms the jetblue and brex bonuses. So tempting, I’ve always wanted this card (and I’ll need a way to keep my platinum MR points alive), but $15k is taking a lot of opportunity away from other SUBs. Any tricks to increase spend on Amex cards?

I should also mention that I have opened 13 cards (7 pers+6 bus) in the last 24 months (technically 21 months, when we essentially started playing the points game) and P2 has opened 9 in the last 21 months (5 pers + 4 bus). I wonder if it makes sense to take this offer to slow our velocity for the rest of the year, or if we can probably keep going with SUBs without a problem. Does anyone have any thoughts on how many cards you can sign up for before we start getting rejected? I understand the rules within each bank, but at what point does chase or amex look at the total # of cards I’ve signed up for in the past 24 months and deny me?

Chase always looks at the number of cards you’ve signed up for in the last 24 months and denies you when that number is five or more. They count cards from all issuers, but most business cards don’t count in the number.

Amex looks only at their own cards that you’ve signed up for and evaluates a number of factors. You can have either four or five credit cards at a time (not counting charge cards like the Platinum and Gold). They’ll also deny you bonuses for various “gaming-like” activities according to an algorithm that is not published but is believed to include things like canceling the card within the first year, only putting enough spend on a card for the original bonus, and so on.

Thanks Larry. I guess I knew all of that, but I was thinking more about the big picture as if there was a total where all companies start denying you. That was dumb since it depends on each company, as you mention with chase and amex. Some are more sensitive to total inquiries (chase, barclays, capone) and some aren’t but set their own limits on cards (amex).

I just hate to pass on this 50k offer because it’s by far the best offer I’ve been eligible for so far (10k/$3k through P2’s $125 referral is the only other option), but it’s a lot of spend. For the same spend P2 and I could currently get 300k hilton points, 180k delta points, 100k+10x MR points and $500. When I put it like that, it seems like a no-brainer to pass on this bbp offer but what makes it appealing is that it is so much more than its previous best offer of 20-30k (but for much less spend). I’m torn.

If your long-term goal is to continue opening the dozen or so new cards that you’ve been opening between you and P2, then it may not matter to you to have a fee-free “everywhere else” card for non-bonused spend since you’ll generally be earning better than 2x return while working on a new card bonus. On the other hand, I’m not sure whether or not the dozen-cards-per-year velocity is something you’ll keep up long-term. Having a card like this one for unbonused spend when you’re not otherwise working on a bonus (or when you can easily knock out bonuses with MS, which may change over time for you) could be valuable. In this case, you’re talking about $1,250 in spend per month — which obviously isn’t nothing but neither is it huge. I’d be willing to divert that from other bonuses for the long-term quality of having a card to keep Membership Rewards points alive that earns a great return on unbonused spend and doesn’t add to 5/24 count. I’d be even more comfortable with it giving the timing: if you can float all or a significant chunk of the $15K spend until you get your tax refund back, you could always make a large tax payment.

But I do see your dilemma. And if at some point P2 ends up with a 30K referral link that gives you a 10K welcome bonus on the BBP, the net bonus (40K points between the two of you) will be almost as much with much less spend (assuming you value P2’s MR points the same). So maybe that’s an argument for not applying for this given everything else you’ve said.

Thank you Nick. This is exactly the type of response I was hoping for, and you make a great point about prepaying taxes. I’ve never done that before, but maybe applying for this card and doing that is the way to go. Is there anything wrong with grossly overpaying (like paying $15k now but actually ending up with a rebate and asking the IRS to send me $16k back)?

I do need a way to keep my MR points from the platinum 100k+10x offer alive as well. Another option could be to downgrade to the everyday preferred, right? I suppose the issue there is that it’s not a very useful card (and it would then take up one of my 4 amex card slots).

I’m not a CPA, so I’m in no position to give tax advice, but my understanding is that when you have paid too much tax, you get a refund. Happens to millions of Americans every year it seems.

I’ve never prepaid taxes (other than withholdings). So, there’s nothing to worry about with making a payment toward 2020 taxes (whether personal or business) right now then reporting it on the 2020 tax return (before submitting it in the coming month) and getting a refund? I assume other people here have done that with success?

Done — thanks for the heads up!

Should note that I have had the amex popup for a while (for platinum and delta cards, including earlier on the same day) but no pop-up when I applied for the BBP 50k offer.

Darn. Not targeted.