NOTICE: This post references card features that have changed, expired, or are not currently available

A reader reached out on Twitter this morning reporting that his Chase Ritz grocery store bonus points were not posting to his Marriott account. As many readers will remember, all of the various Marriott Bonvoy credit cards (including the Ritz card) are currently offering 6x points up to $5K spend through the end of July as part of Chase’s COVID-19 enhancements. After some sleuthing, I see why he thought that: Chase and Marriott are making this extra confusing depending on how you look at your account and grocery points from Ritz spending are lagging a month behind. This problem does not affect the other Chase Marriott cards as best I can tell. The good news is that the points are indeed posting, but it is extremely confusing. You may just want to take my word for it and stop reading now, but if you’re up for trying to make sense of the nonsensical, here’s what’s going on.

@FrequentMiler listening to your podcast. does Ritz cc earn 6x on supermarket spend in May/Jun/Jul? I didn’t receive it for May

— Gary Rind (@garyrind) June 20, 2020

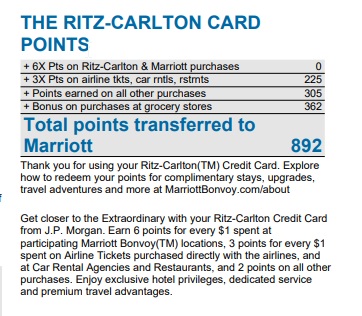

My May Chase Ritz statement

In May, I barely used my Ritz credit card at grocery stores. Here were my points totals from my May Ritz-Carlton Credit Card Statement:

As you can see above, I had the following earnings:

As you can see above, I had the following earnings:

- 225 points for airline/rental car/restaurants

- 305 points for “all other purchases”

- 362 points for the grocery store bonus

My points from the Ritz card typically post to my Marriott account around the 21st or 22nd of the month (this will come back to prominence later in the post).

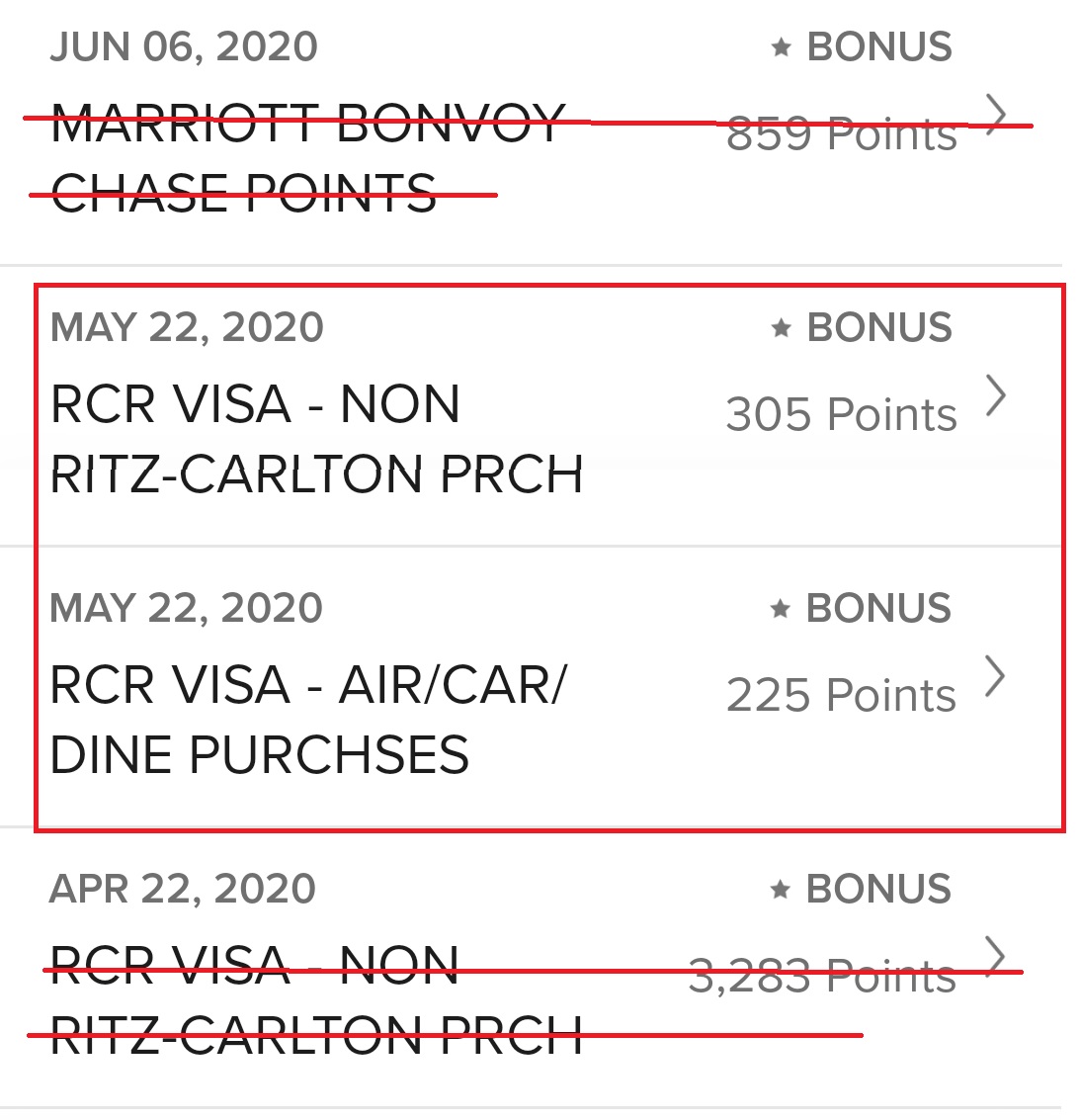

My May Marriott activity in the Marriott app

However, in the Marriott app, my account only shows the first two sets of points (225 and 305) and it shows they posted on May 22nd. I am including the entry before and after as shown in the app to demonstrate that there were only these two entries in all of May:

That would make it seem like the grocery points are missing from May.

However…..

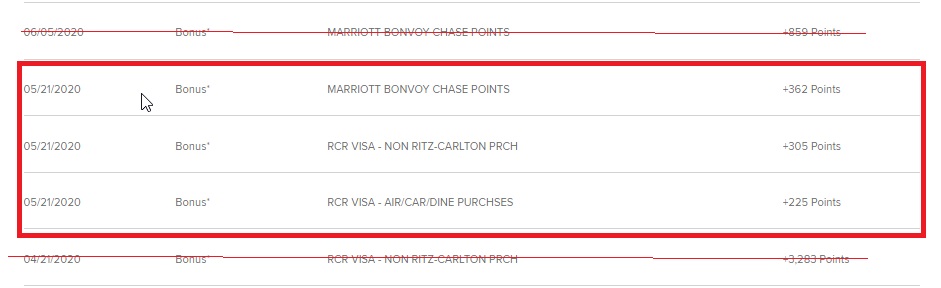

My May Marriott activity in the desktop view

Oddly, when I log into my Marriott account on a desktop browser, my activity is different. As you can see below, not only are there now three entries from May, the date (May 21st) doesn’t match the app (May 22nd), but the point totals do match and now include the grocery bonus.

Further confusing is the fact that the 362 bonus points, which are clearly the grocery bonus from the Ritz card, show up as “Marriott Bonvoy Chase Points”. That’s confusing because I also have a Chase Marriott Bonvoy credit card. Points from the Ritz card have always posted as “RCR Visa” (as the other two entries above from May 21st have) and points from the Bonvoy Premier card post as “Marriott Bonvoy Chase Points”. However, in this case, the 362 points obviously match the grocery store bonus from the Ritz card. My Bonvoy Premier card did not have a matching number of points and the statement cut date is not the same time of the month — there is no doubt that the 362 points shown in the desktop screen shot above are the Ritz grocery bonus.

So it appears that I did indeed get the correct number of points, it just doesn’t show correctly in the app.

However, it does get at least a smidge more confusing yet….hang with me here.

My June Marriott activity in the Marriott app

To make matters as clear as mud (but simultaneously kind of less confusing?), I noticed that I had an entry showing in the Marriott app from June 19th. It’s the 362 bonus points that the desktop account shows posted on May 21st.

There’s my 362 points! Why in the world did it post almost a month later in the app? I have a guess…

An important question: Did the 362 points dated June 19th in the app and May 21st on desktop show up in my desktop account on May 21st or did they show up on June 19th and get backdated?

I can’t quite say with 100% certainty (because I wasn’t paying attention before today), but based on the experience of the reader who reached out, I think the grocery points are lagging a month behind and posted backdated on desktop but with the actual post date in the app. The reader who reached out showed me his June account activity on desktop, which is missing the grocery bonus. My bet is that about a month later, in July, his grocery bonus points will post with a July date in the app and be backdated to his June statement date on desktop.

In other words, my statement just cut yesterday. I went back through my Marriott account and my Ritz points always post to my Marriott desktop account dated on the 20th or 21st of the month. In the app, those same points earned from my Ritz card are always dated the 22nd or 23rd. Today is the 22nd and the points from my June statement do not yet show in either the app or the desktop site. My bet is that my non-grocery spend will show up tomorrow — the app will show the actual posting date of June 23rd and the desktop will be backdated to show June 21st. Then, around July 19th, I bet I’ll get the grocery points separately and the app will show those points posting on July 19th but the desktop version of the site will backdate that to June 21st. Again, that’s my bet based on our collective screenshots and activity.

Does this happen on other Chase Marriott cards?

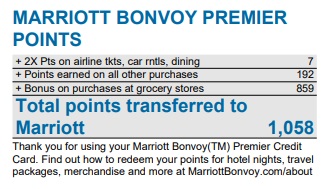

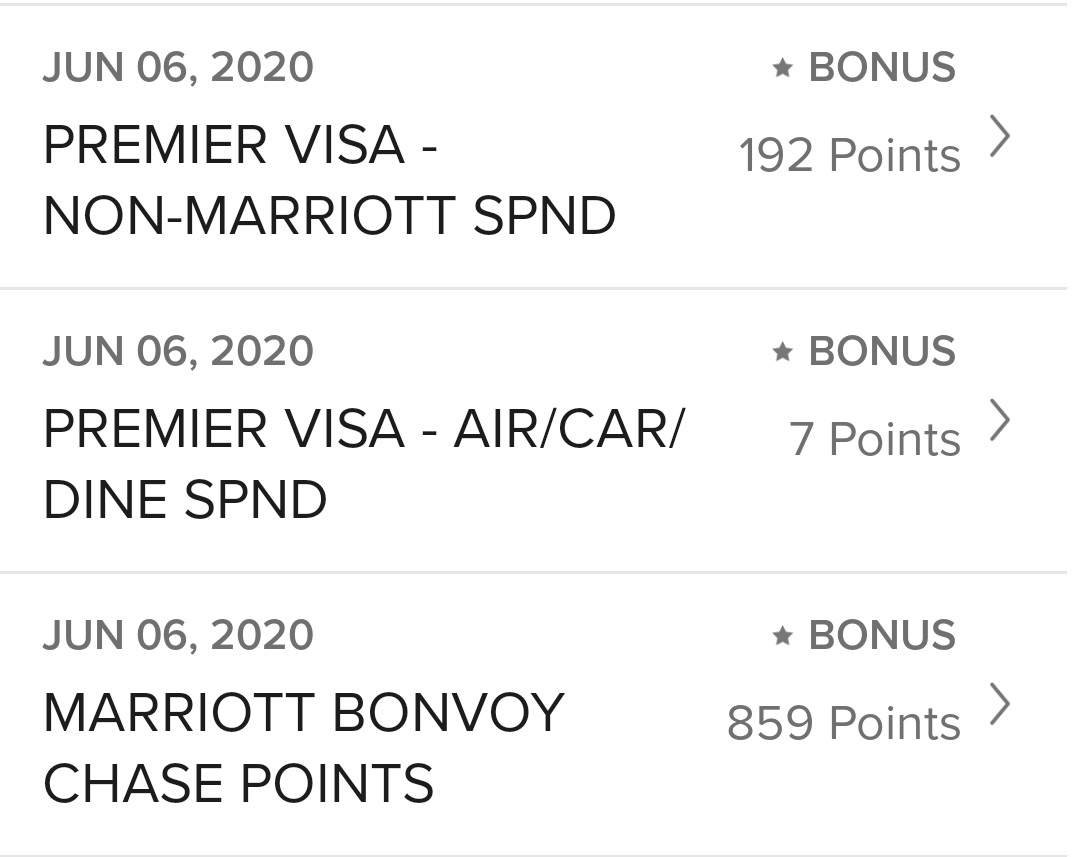

Always eager to kick up the confusion a notch, Marriott doesn’t have this wackiness affecting other Chase Marriott cards. Here are the points from my June 5th Chase Marriott Premier credit card statement:

If that’s hard to read, it should be:

- 7 points from airline/car/dining

- 192 points from “all other purchases”

- 859 points from grocery stores

And sure enough, that posted exactly as shown in my Marriott desktop account dated June 5th:

And it posted in the app dated June 6th:

So this month-long lag only appears to be affecting the Ritz card. I’m not positive that it is affecting all Ritz cardholders, but since a random reader and I seem to have matching experience, my bet is that all Ritz cardholders have the weird lag and Bonvoy Premier cardholders don’t (the reader also has the Premier and his Premier points posted correctly).

Bottom line

If all of the above doesn’t confuse you, you get three gold stars. I am not entirely surprised that this non-normal spending bonus is posting in a non-normal way, but it’s definitely confusing, especially so since the lag only appears to happen on Ritz cards. The good news and really the bottom line here is that my grocery spending bonus points did indeed post for my May activity and I expect they will for everyone else, albeit on a separate timeline. I certainly hope that’s true as I did use my card more often at the grocery store on the statement that cut yesterday.

[…] that the points were simply delayed by the increased bonus. As I wrote the other day, there was a lag in my grocery bonus points on the Ritz card from May grocery spending (though grocery points from my June statement subsequently posted with […]

[…] Yes, the Ritz card *is* earning the grocery bonus, but it’s confusing. by Frequent Miler. […]

Had this problem too, I contacted Chase after my grocery points but did not show up with the rest but they basically just said “the points have been sent.”

Anyway, given the identical posting for RCR and Marriott card, do you think it would have any impact on people with both looking to maximize the grocery bonus?

Hi Nick, do you know if the $300 Ritz credit can be used for groceries or restaurants?

This is what I wanted to find out too, SM to chase a month ago rendered a No response.

No, it can’t. I called to check last week because a reader said they heard it would, but they said no. I don’t expect Chase will make those credits easier to use given that this card is no longer available for new applicants. At the same time, the Ritz travel credit is pretty easy to use. See this post for what works:

https://frequentmiler.com/ritz-fee-credits-what-works/

Ugh, that’s really disappointing! I respectfully disagree that it is easy to use if I am not flying… Even SW gift cards don’t work. They’re very generous with award fees, and I don’t think they would crawl back like AMEX, do you have any suggestions on which program to use to book some awards that may carry fees, claim the credit and then later cancel the awards at no penalties? Or may be I completely overlooked other easy ways to use?

Did you check that link?

1.Find a cheap one-way Southwest flight. Pay attention to the price difference between “Wanna Get Away” and “Business Select. Get it as close to a $300 difference as you can.

2. Book the “Wanna Get Away” fare

3. Once the charge posts, upgrade the flight to Business Select.

4. Once the upgrade posts, call Chase and get the upgrade refunded for the travel credit.

5. Once that posts, cancel your Southwest flight and refund the price of the ticket to your Travel funds

6. Congrats, you now have ~$350-400 Southwest Travel Funds that expire on 9/7/2022

I just did this a week or 2 ago and it worked fine.