NOTICE: This post references card features that have changed, expired, or are not currently available

I rarely log in before searching for availability and prices whether with airlines or hotels whether for paid or award travel. Sometimes, as was long the case with United, it is because I want to make sure I see award space that is available to partners. Other times, as is often the case with hotels, it is because I am too lazy to enter my password when all I want to do is see prices. Yesterday, a reader pointed out something I’ve been missing with Marriott thanks to my laziness: availability for the rate that includes a special $100 property credit when you book with either your Marriott Bonvoy Brilliant or Ritz-Carlton credit card automatically shows up when a cardholder searches while logged in. That’s the good news. The bad news is that it just doesn’t make much sense to book this rate in most circumstances.

The $100 benefit

Both the Marriott Bonvoy Brilliant American Express Card and the Chase Ritz-Carlton Visa Infinite card come with a $100 property credit when booking a paid stay at a Ritz or St. Regis property of two nights or more.

Amex makes it clear that you only get the credit when you use your card to book direct using a “special rate”.

Meanwhile, the Chase Guide to Benefits is written in a way that makes it sound like any paid stay of two nights or more will qualify (though that isn’t true).

This $100 hotel credit benefit essentially requires booking the hotel’s “Standard Rate” for a stay of 2 nights or more. To my knowledge, the rate for the Ritz credit long required calling Marriott to book and I recall reading on Flyertalk that you could try searching with rate code Z34 to find the rate and availability, though as of a few years ago it wasn’t possible to book the rate that includes the $100 credit online.

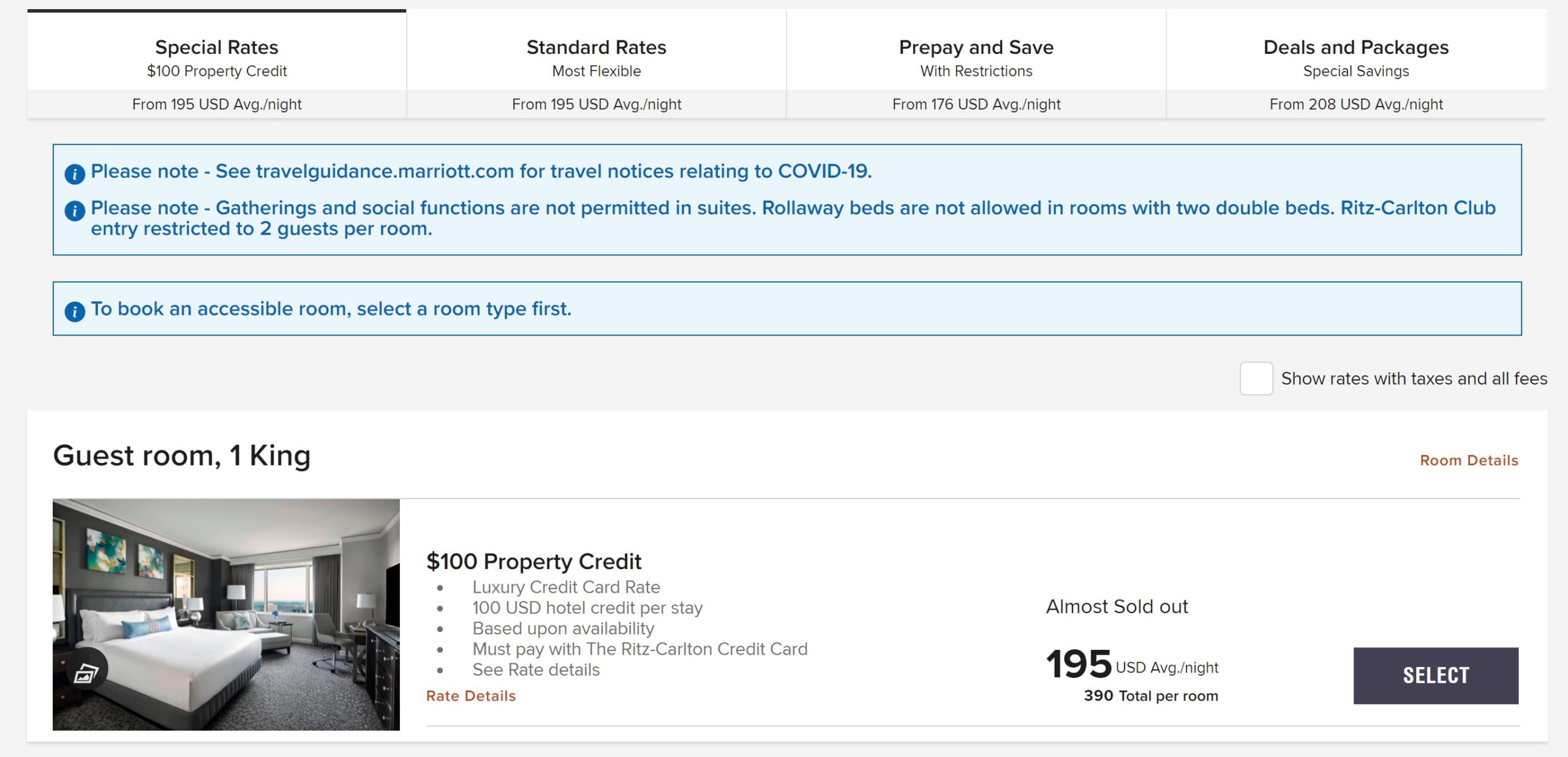

However, a reader named Mark pointed me to this Flyertalk thread which showed screen shots of rates including the $100 credit when using the Ritz-Carlton card. After reading through that thread and his email, I realized that Marriott was showing this rate to cardholders when logged in. I typically only log in at Marriott.com when I am ready to pay for a reservation I’ve found, so I hadn’t noticed this before. But sure enough, when I’m logged in, the first set of rates I see at a Ritz or St. Regis property on a stay of 2 nights or more is a section of “Special Rates” that includes the $100 credit and indicates that I must pay with The Ritz-Carlton Credit Card (a Bonvoy Brilliant cardholder sees something similar).

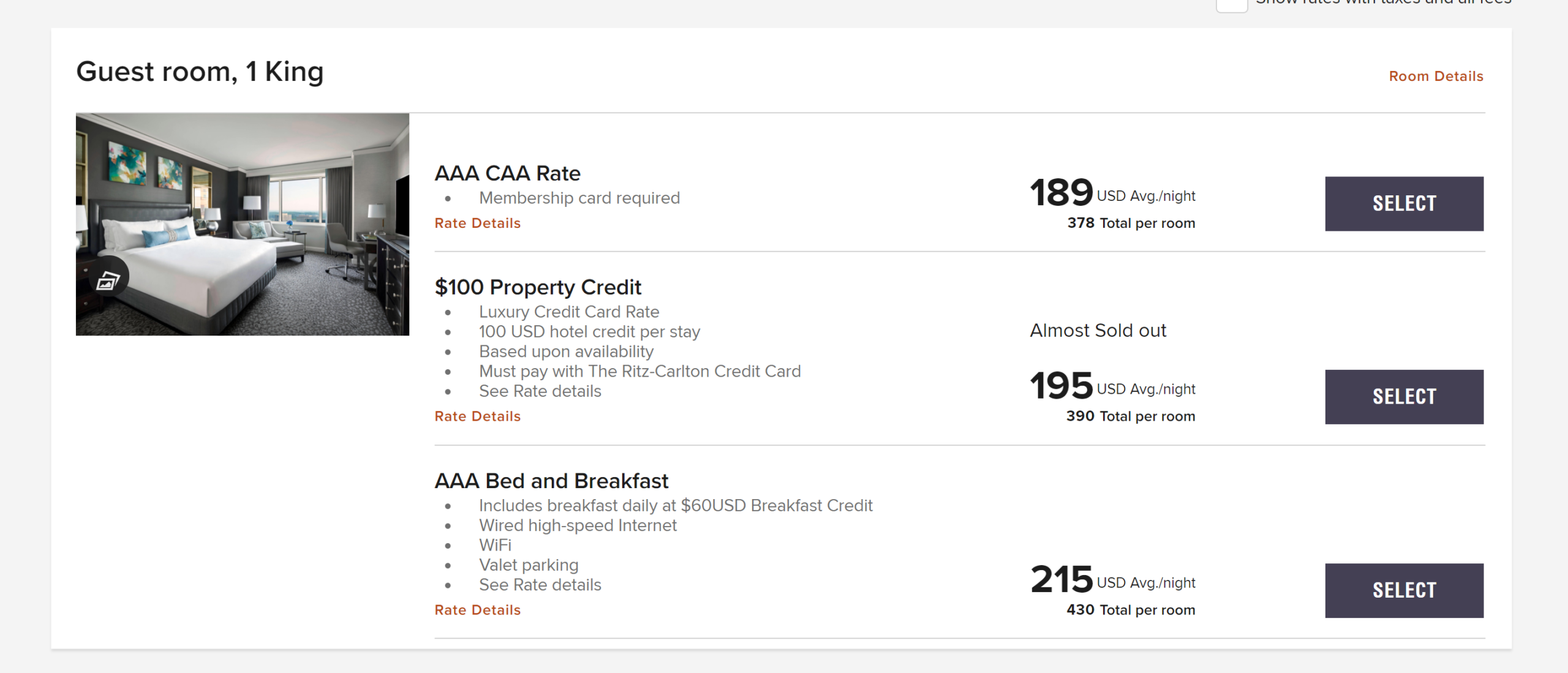

One thing I had long realized about the credit and its associated rate was that the rate it uses appears to be the “Standard Rate” for the hotel rather than any sort of discounted advanced purchase rate or other package rate. For example, you can not book this $100 property credit in conjunction with the AAA rate. If you search for the AAA rate for the same example hotel shown above, you’ll see that the nightly rate is a few bucks cheaper (or $20 more expensive to include a $60 breakfast credit).

One thing I had completely forgotten about is that the Ritz card’s credit is also available at St. Regis hotels and the Brilliant card’s $100 credit also works at either Ritz or St. Regis properties. However, the benefit works the same either way: it requires the standard rate and can not be booked in conjunction with other special rates (though it should be entirely stackable with the Bonvoy Brilliant card’s annual $300 property credit).

For those who enjoy reading terms & conditions, these are the rate terms on the $100 Ritz credit for an example property:

- Guest must stay at least 2 nights and purchase an eligible

Member Retail Rate or Retail Rate in order to receive the 100

(USD) credit. - The credit can only be used on Incidental spend that was

incurred during the stay, up to 100. This includes dining, spa

services and hotel recreational activities that are not managed

by a third party. - Credit must be used during the original reservation and is

not valid on consecutive reservations in the same hotel. - The credit cannot be applied toward the room rate and is not

valid on Room and tax, gratuities, service charges, or services

provided by a third party. Excludes alcohol where prohibited by

local ordinances. - There will be no refund issued on any un-used portion of the

credit. - The credit is non-transferable and cannot be combined with

any other offer or promotion. It does not apply to packages,

discounts, negotiated or group rates. It does not apply to

American Express FHR/THC/Centurion, Virtuoso, Signature,

Ensemble, TLG Select, Ritz-Carlton Club Members and

Ritz-Carlton and St. Regis Resident Owners offers booked

through HRS. - Guest must pay for their stay with their The Ritz-Carlton

Credit Card from JP Morgan

Why I’ll (almost) never use this credit

While it’s kind of cool that you can now see this rate code online (it looks like it has been possible since at least sometime in 2019, though I haven’t been searching for many reservations at Ritz and St. Regis properties since 2020), I would not recommend using this rate in most circumstances. The reason for that is that this rate offers no advantage over booking through preferred partner programs. Almost all (or maybe all?) Ritz and St. Regis properties are available for the same rate through Amex Fine Hotels & Resorts or Virtuoso and you get not only the $100 credit but also breakfast for two people (which is something I will not get with my elite status at Ritz-Carlton properties). See: Getting the elite experience without elite status via credit card and preferred partner hotel programs. And then you could pay with another credit card and perhaps leverage an Amex Offer or spending bonus (or use any card I want through Virtuoso). There just isn’t a benefit to booking this rate through Marriott.com. (Note that in some cases the credit through Amex FHR or Virtuoso may be more restrictive such as when it is only a spa credit)

The one instance where the $100 credit rate can make sense is if you have the Ritz card and you intend to use one of your annual Ritz club lounge upgrades. While I’ve read reports of those club lounge upgrades being extraordinarily difficult to use (and I’ve encountered my own difficulty recently), in the past I was able to use a club lounge upgrade in conjunction with the $100 property credit benefit on a Ritz stay of 2 nights. The Ritz club lounge upgrades must be booked over the phone and based on my recent experiences they must be applied by someone from a specific team at Marriott Rewards (Luxury & Lifestyle Services is what I believe it was called). A regular phone agent, even when calling the Titanium line and waiting on hold forever, could not handle a club upgrade certificate booking.

Many people highly value Ritz-Carlton club lounges. Marriott elite status will not get you into a lounge at a Ritz and my understanding is that complimentary upgrades to club rooms at Ritz properties are quite rare. I think that Ritz lounges universally offer five “food presentations” per day (Ritz regulars correct me if I’m wrong on that). I am sure that quality varies, but I’ve heard plenty of good things about the fare at Ritz lounges. If you’re looking to have lounge access, you won’t be able to apply one of those upgrade certificates to a stay booked through Fine Hotels & Resorts or Virtuoso. I was told by several reps that it couldn’t be done on a Marriott STARS booking despite the fact that the on-property STARS contact and my STARS agent thought that it should be possible. I tried multiple times without success.

Because of the fact that I have to call anyway to apply the club upgrade, my first instinct would be to book the entire reservation online via an agent. The one instance I can imagine where it might make sense to book one of these rates online is if a shopping portal has a particularly strong payout for Marriott. I don’t know for sure that this “Special Rate” that includes the $100 credit will qualify for portal cash back, but I assume it will since it says it is a commissionable rate. If there is a particularly good portal rate, maybe it would make sense to book this credit and save some money and maybe it would even be possible to apply a club upgrade over the phone afterwards without voiding cash back. However, that is a number of maybes and even if that all worked out one time I think you definitely run the risk of the cash back being voided when an agent modifies the reservation to add the club upgrade. Still, if Rakuten were offering 10x at a time when I was looking to make a booking, I would probably accept the hassle and give that a shot.

Curiously, in the exclusions above for the $100 credit that comes with the Ritz card, I see the exclusion of Fine Hotels & Resorts and Virtuoso, but I do not see an exclusion for Marriott STARS bookings. Since they exclude other programs like Fine Hotels & Resorts and Virtuoso that include a $100 property credit, my guess is that Marriott will not let you stack STARS and the Ritz credit for a $200 property credit, particularly in light of the fact that I was told several times that the ability to use a club lounge upgrade required a rate code that wasn’t the STARS rate code (despite it being the same cost). Still, I don’t see where it expressly says that you can’t use the $100 Ritz credit benefit in conjunction with a STARS booking. Again, I doubt it works but maybe it’s worth a swing for someone who loves talking to phone agents.

Bottom line

The Marriott Bonvoy Brilliant and Ritz-Carlton credit cards each offer a benefit of a $100 credit on a paid stay of two nights or more at Ritz or St. Regis properties booked at a qualifying rate. While that rate had previously required phone bookings, I hadn’t realized that Marriott had brought the functionality online for those who have one of the cards and when they are logged in. That’s nice, though the truth is that this benefit isn’t worth much to me since there are other even better programs that include a $100 property credit and also other benefits like breakfast for two and a better chance at a room upgrade and those programs typically do not require booking with a specific credit card (though in the case of Amex FHR it does require having a Platinum card). The one time when this might come in handy is if you can stack it with either a Ritz card club lounge upgrade or great shopping portal (or possibly even both). Otherwise, you’re better off using a preferred partner program for your booking.

Do you have any insights into when the Ritz club rooms will be fully operational?

or, is there any way to check other than calling the individual properties?

And, I’d be interested in knowing whether they’re back to their full functionality or still limited due to covid. I’ve never tried a stay with club room priveleges, and am anxious to try, but only if I get the full deal.

Can you use a RC club-level upgrade with a reservation booked under the best-rate guarantee?

Doubtful since the club upgrades require booking a specific rate code that comes in at the Standard Rate, which isn’t even the best rate that Marriott offers never mind matching to someone else. There is very likely some sort of “member” rate that beats the “Standard Rate” that you can book directly through Marriott — so there is some cost involved in using the club upgrades in not necessarily booking the cheapest price you can find for the room (though in some cases you won’t find a cheaper price on third party sites, so YMMV). Again, doubtful that would work, though I haven’t tried it.

Great writeup Nick, and thanks for the shoutout! In the screenshots above showing the special “$100 Property Credit, Luxury Credit Card Rate,” I see one of the bullet points says, “Must pay with The Ritz-Carlton Credit Card.” Do you also have the Marriott Bonvoy Brilliant from Amex?

I do not have the Brilliant. I meant to check with Greg about how it displays because I know he has both. Stay tuned…

I have both cards and I only see the Ritz language. I expect that if I didn’t have the Ritz it would show up with something like “Must pay with the Bonvoy Brilliant card”

Thanks for confirming, Greg! I too have both cards and only see the Bonvoy Brilliant language (which is the card I got first).

I have 6 RC Club Level Upgrades cluttering up my Bonvoy “Free” Award Certs

Yeah, in my experience — 3x, maybe? — the thinking has to run like this:

If you are committed to a Ritz stay where you have found a qualifying rate over 2 days that is only mildly (as opposed to obscenely) over-priced; and

if you are then committed to working the club lounge hard to amortize the cost of the stay;

then the $100 credit can be some icing on the cake, i.e., to get you out of the club for lunch by the pool or some such one day.

Otherwise, like you say — hard pass.