There are new offers out this week on both the Chase Marriottt Bonvoy Boundless card and Chase Marriott Bonvoy Bound card this week that require less spend to trigger than the previous lower offer. While we saw an even better offer last year, this new offer is an increase over the most recent one. Note also that the referral offers, which provide free night certificates instead of points, also feature the newly-reduced spending requirements.

The Offers & Key Card Details

| Card Offer |

|---|

ⓘ $1346 1st Yr Value Estimate5 Marriott 50K Free Nights valued at $1520 Click to learn about first year value estimates 5 x 50K Free Night Certificates ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Earn five 50K free night certificates after spending $5,000 on eligible purchases within the first 3 months (Offer Expires 7/16/2025)$95 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: None |

| Card Offer |

|---|

ⓘ $713 1st Yr Value EstimateMarriott 50K Free Night valued at $304 Click to learn about first year value estimates 60K points + Free Night Certificate Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 60K points + 50K Free Night Certificate after $2k spend. Terms apply. No Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: None FM Mini Review: The best use for this card is probably to downgrade from the Ritz or Boundless card to avoid the annual fee. That way, you can always upgrade again when you need the annual free night or other perks |

Quick Thoughts

Last year, we saw an offer for 5 free nights worth up to 50K points each (long since expired). That offer had incredible potential value, but with the certificates scheduled to expire a year from issuance, it was more difficult to commit to that for many who were uncertain of travel plans.

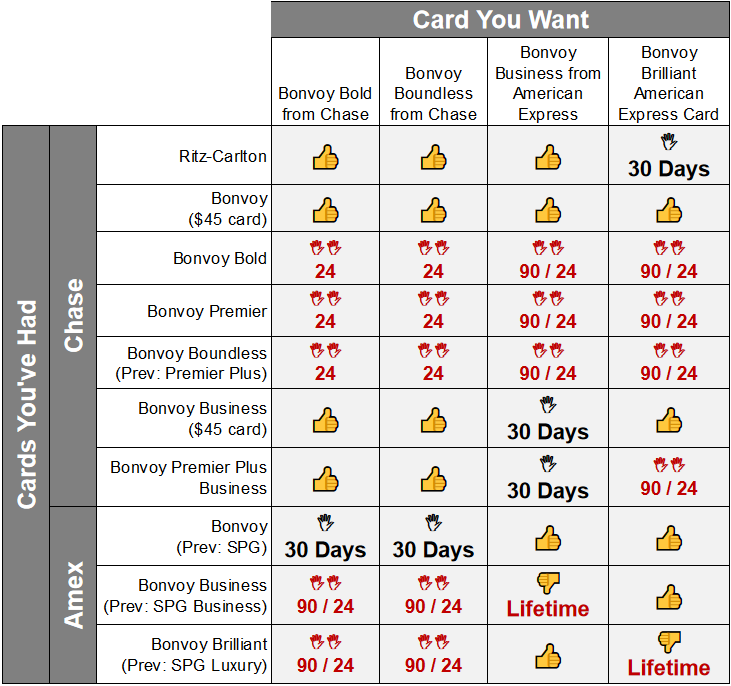

I have no idea whether we will see that offer again, but in the meantime, these offers are worth a bit more than usual and they require very low relative spending to trigger them. Keep in mind though that getting a bonus on one of these cards could cause you grief in trying to get a bonus on the Amex side. See our matrix below for eligibility criteria. You can see that if you do apply for one of these cards, it will lock you out of new Bonvoy bonuses for 24 months. Note that you can get both of the Amex cards in proximity to each other, just not if you’ve gotten a Chase card recently. It is a confusing and complicated system.

As noted at the top, the reduced spending requirement also applies to the referral offers on these cards, which each provide free night certificates instead of points. While the value of the free night certificates on the Boundless has slightly more potential value (given that you could get 3 free nights at 35K each, which would otherwise cost you 105K points), I’d personally rather have the points for the flexibility to use them towards more nights at lower categories or a night at a higher category property (and the ability to cancel and have points that could be used far in the future as long as I keep my account active). However, if you have a specific use case in mind and relatively firm plans, maybe you prefer the idea of certificates.

As noted at the top, the reduced spending requirement also applies to the referral offers on these cards, which each provide free night certificates instead of points. While the value of the free night certificates on the Boundless has slightly more potential value (given that you could get 3 free nights at 35K each, which would otherwise cost you 105K points), I’d personally rather have the points for the flexibility to use them towards more nights at lower categories or a night at a higher category property (and the ability to cancel and have points that could be used far in the future as long as I keep my account active). However, if you have a specific use case in mind and relatively firm plans, maybe you prefer the idea of certificates.

I wish chase had the application rules checker pop like amex. If I just have a bold card (from an old downgraded premier card) can I still get the boundless?

No, you cannot hold the Bold and the Boundless at the same time. You’ll either have to cancel your Bold or product change it to the Ritz card in order to be eligible for the Boundless.

Thanks @actualmichael! Wondering if there’s a way to get the Brilliant, the Ritz and the boundless. Does this plan sound doable? Apply for the Brilliant, then upgrade the bold to Ritz, then apply for the boundless? (we do anticipate some significant travel in 2021 and want to maximize our Marriott balances). Thanks in advance!

Yes, it seems that you could hold all 3 (all 4, in fact, since there is a Bonvoy Business card offered from Amex. However, any time you are jumping between AmEx and Chase, you will have to wait 24 months. So you could open the Brilliant and upgrade your Bold to the Ritz, but because you’ve opened the Brilliant (and assumingely received a SUB on it) within the last 24 months, you will be ineligible for the SUB on the Boundless for 24 months from the date that you received the SUB on the Brilliant. It’s annoying, but that’s the way all 3 parties have it set up. If you just wanted to maximize your Marriott points balance right now, I’d open up the Brilliant and the Business Bonvoy back to back.

Any successful recent DP’s regarding product change to the Ritz-Carlton after a year?

Is there a way to see what the offer and spend requirement is for a Chase Marriott card you just received?

If you open the Chase app, there should be a bar towards the bottom of your cards account screen showing how much you need to hit your bonus and how much spend you have left in order to hit it.

Boundless and Bold cards. I see boundless and bound cards.

Application rules are just simply effed up.