NOTICE: This post references card features that have changed, expired, or are not currently available

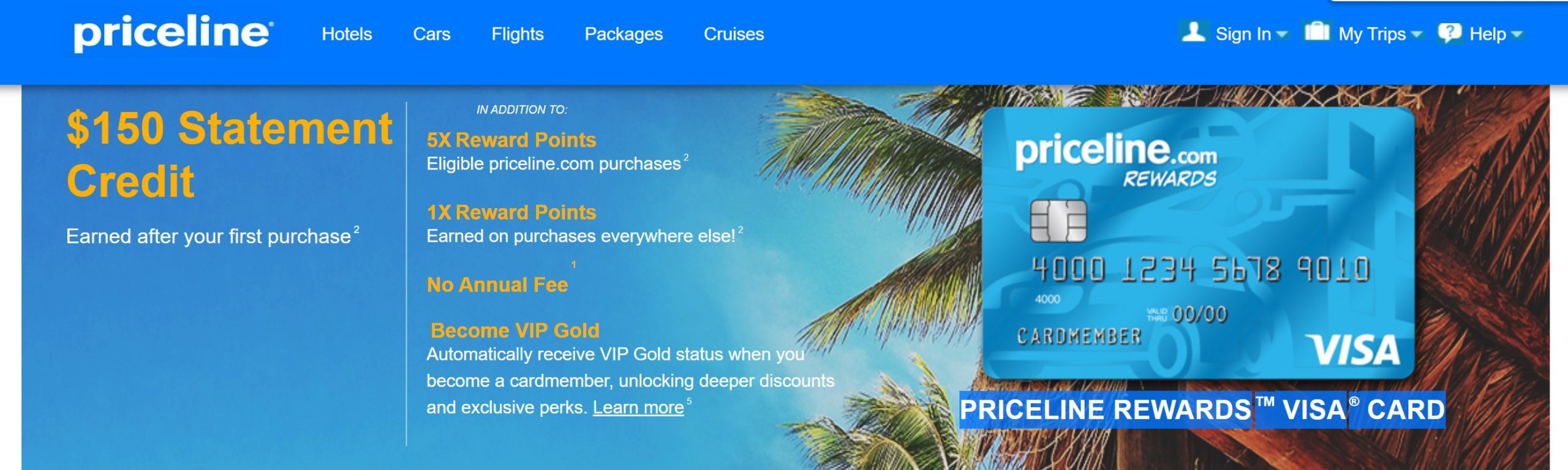

The Priceline Rewards Visa is currently offering a $150 statement credit after first purchase on a newl, but y-approved card. This card is not terribly rewarding, but a hundred and fifty bucks is a decent bonus on a single purchase and thus it might be interesting for those looking on the fringes for new bonus opportunities.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $240 1st Yr Value Estimate$200 statement credit valued at $200 Click to learn about first year value estimates $200 + 5K Points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler $200 statement credit after first purchase + 5,000 points after spending $500 in the first 90 daysNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Earning rate: Earn 5x on eligible Priceline.com purchases. Earn 2x on gas and restaurants. Base: 1% Dine: 2% Gas: 2% Brand: 5% Card Info: Visa Signature issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: Automatic Gold status in Priceline VIP Rewards program ✦ Up to $120 Global Entry or TSA PreCheck application fee statement credit each anniversary year if you spend $10,000 on purchases |

Quick Thoughts

This card isn’t very rewarding at all for ongoing spend. The Priceline Rewards Visa offers just 1x on most purchases. Even with 10% back on redemptions against eligible travel & Priceline.com purchases, that’s only a return of 1.1% on most purchases if we’re counting that rebate as generously as possible. That’s awful.

It does offer 5x points on eligible Priceline.com spend, which could be a solid return combined with 10% back when redeeming points for a statement credit against travel & Priceline purchases. I hate the minimum $25 redemption since it means that you’ll never redeem all of your points (since you’ll get that 10% back that can’t be redeemed until you have another $25). However, a hundred and fifty bucks is a decent cash back bonus on a card that has no annual fee and only requires a single purchase. A pack of gum could get you $150 and that’s not a bad trade if you’ve run through most of the major card bonuses.

Barclays has been a bit of a wild card in terms of approvals over the past couple of years and I’d sooner want their Wyndham cards (particularly the business one) or an Aviator Red, but this will surely appeal to some.

Where is my 150 dollar bonus at?

[…] Hat tip to Frequentmiler […]