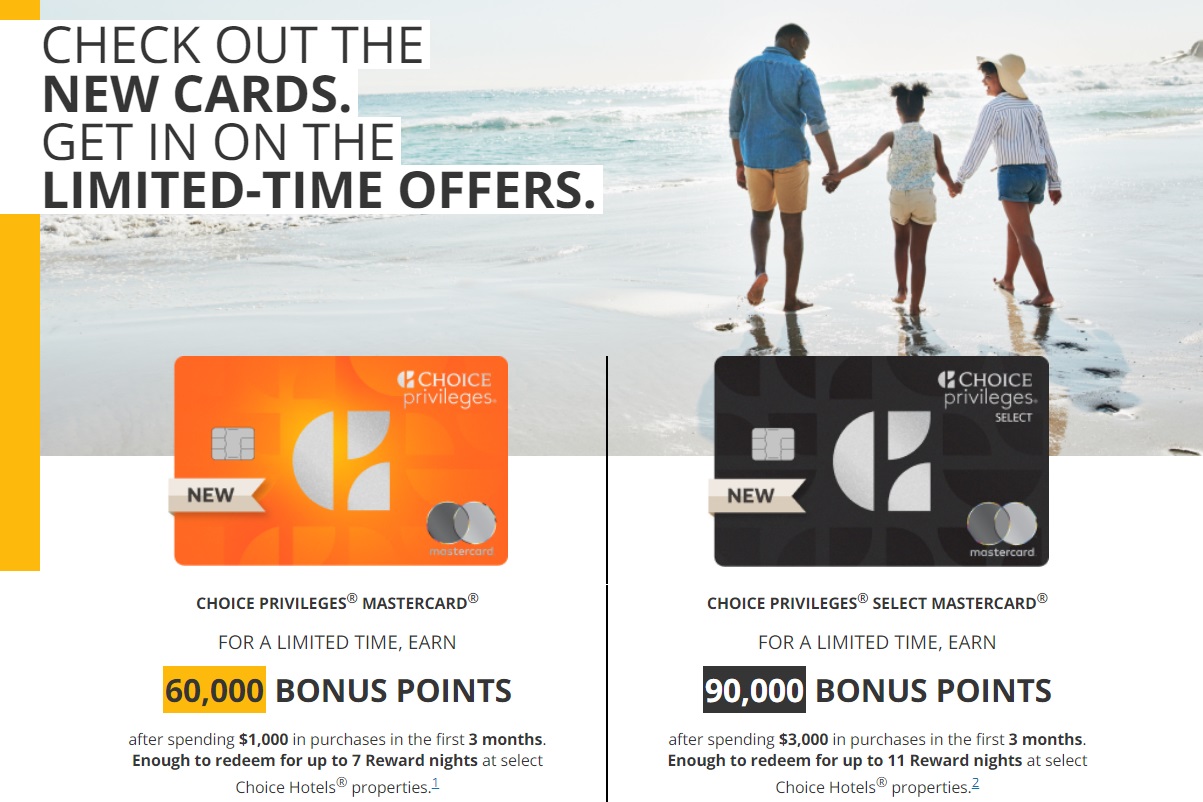

Choice used to only have one credit card and it was issued by Barclays, but they now have two credit cards which are both issued by Wells Fargo.

Existing cardholders are in the process of having their accounts moved over to Wells Fargo, with both new cards now available for application. The card with the annual fee is a surprisingly compelling option and is a keeper card thanks to the bonus points you’ll earn when renewing the card each year.

The Offers & Key Card Details

Consumer Cards

| Card Offer and Details |

|---|

ⓘ $234 1st Yr Value EstimateClick to learn about first year value estimates 60K Points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 60K after $3K spend in first 3 months$95 Annual Fee Alternate Offer: Choice members may be targeted for a higher offer Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Worth getting for the welcome offer and keeping for the 30,000 anniversary points. The 5x categories could also be interesting for some. Earning rate: 10X at Choice Hotels ✦ 5X at gas stations, grocery stores, home improvement stores, and phone plans ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Wells. This card has no foreign currency conversion fees. Noteworthy perks: Automatic Platinum status ✦ 30,000 bonus points each card anniversary ✦ Cell phone Protection ($25 deductible, $800 max per claim) |

| Card Offer and Details |

|---|

ⓘ $378 1st Yr Value EstimateClick to learn about first year value estimates 60K Points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 60K after $1K spend in first 3 monthsNo Annual Fee Alternate Offer: Choice members may be targeted for a higher offer Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Decent bonus for a no-annual fee card, but not a great keeper unless you value the Choice Gold Status Earning rate: 5X at Choice Hotels ✦ 3X at gas stations, grocery stores, home improvement stores, and phone plans ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Wells. This card has no foreign currency conversion fees. Noteworthy perks: Automatic Gold status ✦ Cell phone Protection ($25 deductible, $800 max per claim) |

Quick Thoughts

Let’s start with the no annual fee card. The welcome offer is a little disappointing because when it was with Barclays it was possible to earn 80,000 bonus points a couple of times. It’s therefore a little surprising that Wells Fargo isn’t matching that level of offer, but I guess that would mean they’d need to bump up the welcome offer on the card with an annual fee to differentiate it a little more and they might not be keen on doing that.

The no annual fee card has some interesting bonused spend categories, earning 3x at grocery stores, gas stations, home improvement stores and on phone plans. That’s not bad for a card with no annual fee, but there are better options out there and so I wouldn’t recommend putting spend on the card after earning the bonus from the welcome offer.

The new Wells Fargo Choice Privileges Mastercard Select card which comes with a $95 annual fee on the other hand is far more interesting. You can earn 90,000 Choice Privileges points after spending $3,000 in the first three months which I think is the highest bonus we’ve ever seen on a Choice card. Similar to the no annual fee card, it also offers bonused spend at grocery stores, gas stations, home improvement stores and on phone plans, except it’s at an enhanced 5x rate.

Perhaps most notable of all is the fact that you earn 30,000 bonus points when renewing the card each year. 30,000 points are worth well in excess of $95, so it’ll be worth paying the annual fee each year and racking up the points, similar to the Radisson credit cards of old.

Greg has pointed out that the ironic thing is that if you’re interested in racking up Choice Privileges points, you’d likely be better served by another bank – Citi. That’s because the Citi Premier card also has a $95 annual fee and currently comes with a welcome bonus of 75,000 ThankYou points. Those transfer to Choice on a 1:2 basis, so that’s worth 150,000 Choice points – 66.67% more than you’ll get with the Wells Fargo Choice Privileges Mastercard Select card.

Some of the bonused spend categories work out better on the Citi Premier card too if you’re mainly interested in Choice Privileges points. The Citi Premier card earns 3x at grocery stores and gas stations while the $95 annual fee Choice card earns 5x. However, the 1:2 transfer ratio effectively makes the Citi Premier a 6x card in those categories for Choice purposes with the same annual fee.

What the Citi Premier card doesn’t have is the 30,000 bonus points at renewal each year. If you’d be using the Citi Premier card solely to rack up Choice points, you’d therefore need to spend $30,000 or more in those bonused spend categories to outweigh the points earned from that renewal benefit on the Choice card. It can be both/and rather than either/or though. If you have both the Citi Premier and Choice Privileges Mastercard Select cards, you can earn the bonuses on both, renew the Choice card each year to pocket the bonus points while putting grocery and gas station spend on the Citi Premier card.

[…] 12:29 Wells Fargo Choice Hotels Cards (FM) […]

[…] 12:29 Wells Fargo Choice Hotels Cards (FM) […]

I had the choice card at Barclays. Do you recommend cancelling the card?

The select card also gives TSA Pre check or Global Entry Credit

First–love the FM blog! You guys rock—here’s my POV: I’m no Choice hotels fanboy, but have found some use for Choice (and pre-merger Radisson Rewards) as well as Best Western rewards for small-town, out-of-the-way stays. We think of these as the “backup-to-the-backup programs.”

These aren’t aspirational properties, but do come in handy on a road trips, the odd business trip, kids sports in another town—-and most of all: redemptions in Europe with these brands have been amazing. Check out the Best Western in Garmisch, Germany (wonderful!) or try booking a Hyatt in Scandinavia (largely only Radisson and BW…odd).

Sure, the points aren’t worth much but they do add up over time. Easy to attain “top status” helps move up the meager points accrual with a kicker of 10-12% cash back from portal bookings (Rakuten frequently has Best Western at 12%+ cash back, Choice occasionally at 10%) and the periodic “$50 gift card” or “future free night” promos that seem to come up at regular intervals with both of these brands….add it all up and you’ve got some solid value for the times when there’s just not a (for example–) Hyatt/Marriott/suite option in the area.

And lastly, we’ve been pleasantly surprised at the cleanliness, convenience (+pet-friendly) and value of many of the new/updated BW & Choice properties. As for upgrades: while we haven’t been upgraded to a rock-star suite, we have enjoyed complimentary upgrades to larger rooms, rooms with full kitchens, and desirable locations/views at no charge. These hotels are often small-business, family-owned properties that remember customers and provide a warm welcome….that’s been our overall positive experience—thanks!

The card with the annual fee has no fee the first year, so it’s kind of a no-brainer to get that one. Probably you can even get the additional 30k after the first year and still cancel in time to avoid paying anything at all.

Could you explain the elite night credits? I’m not sure I understand. Are they free stays apart from using points? Thanks.

Also, like Kate, I won’t be supporting Wells Fargo. I don’t plan on charging anything on this card.

Elite night credits are what you need to earn to reach higher status levels. In the case of the Choice Privileges program you need to earn 10, 20 or 40 elite night credits to earn Gold, Platinum or Diamond status respectively.

As the Select card comes with 20 elite night credits, it means you’ll automatically get Platinum status each year simply by having the card. If you then stay 20 nights at any Choice properties in a calendar year you’ll earn Diamond status as that would mean you’d reach 40 elite night credits.

D’oh, thanks. Now I get it. That’s the “automatic Gold status” part.

I canceled my no annual fee Choice card a couple of weeks or so because I did NOT want to be converted to the Wells Fargo. Just received new WF cards in the mail. Called the number to ask what’s up, but no one to answer until end of month/May 1.

Same thing happened to my wife and I. We canceled the Barclay Choice card well over a month ago, yet we received brand new Wells Fargo Choice Cards today. Kind of a bummer because I’d like to apply to the 90k offer, but the terms say : “You may not be eligible for an introductory bonus rewards offer if you opened a Choice Privileges Mastercard Credit Card or a Choice Privileges Select Mastercard Credit Card within the last 15 months from the date of this application and you received an introductory bonus rewards offer – even if that account is closed and has a $0 balance.” even though we didn’t technically open the card Wells Fargo may consider this as opening a new card and make us ineligible for the bonus.

What if you get both Choice cards? Do you get 30 nights and now only need 10 nights for Diamond status?

Would appreciate FMs take on the choice loyalty program. At first glance it seems rather lackluster but maybe I’m missing something?

Nope, you’re not missing anything! It’s not a very compelling loyalty program because they don’t even offer room upgrades as a benefit for any of the tier levels.

Hopefully the bonus on the 90k card goes up as the 90k is only equal to a 45k TYP bonus as you point out, which is kinda low. And the 30k annual bonus for a $95 AF suggests Choice is selling these to Wells for around a rate of 0.3cpp, so there should be financial room for Wells to offer a bigger SUB.

So I presently have the Barclay’s Choice credit card. And just received the new Wells Fargo card in the mail. Will I be eligible for the 60000 bonus points? ( or the 90,000 if I ask to upgrade?)

I doubt you’d get the 90k points for an upgrade, but you should be able to apply for the card to earn the 90k points as a new card welcome offer. We’re not aware of Wells Fargo having rules about getting the same card and bonus again, so it might be possible to get the 60k card instead if you’d rather go for that one.

It might depend on when the OP opened his current card. Per the T&C:

You may not be eligible for an introductory bonus rewards offer if you opened a Choice Privileges Mastercard Credit Card or a Choice Privileges Select Mastercard Credit Card within the last 15 months from the date of this application and you received an introductory bonus rewards offer – even if that account is closed and has a $0 balance.

I just called Choice Rewards. Told them I had the old Barclay’s card and asked if I’m still eligible for the sign up bonus. They said I am eligible to receive the 60000 points after spending $1000. I’ll keep the card for that reason

James, that is very interesting. Did they show that to you in writing somewhere?

Call WF, not Choice.

Need to call Well Fargo, not Choice. Even the reps at Wells Fargo probably don’t really know.

I called Wells Fargo. They transfered me to Choice. Nothing in writing. But that’s what the woman told me. It’s a new card, spend $1000, earn the bonus points of 60000

Please let us know if you get the 60000 points after $1000 spend. I have the card and would then put $1000 on my card.

I called card services phone number on the back of the card and was told the transfer from Barclays does not count as a new card and therefore would not be eligible for the 60000 point bonus.

I hope you prove me wrong.

James – Did you spend the $1,000. If Yes, did you get the 60,000 point bonus?

Nope! Now suddenly Wells Fargo seems to be in charge. Lol they told me I wasn’t eligible since I had Barclay’s card. I told them I was told otherwise previously. Also told them how ridiculous it is for me to accept this new card without getting the bonus. I officially have a complaint and they are looking I to it. Told them I don’t want card without bonus.. think I got my last bonus some ten years ago!! Side note, my mom who had Barclay’s card only since like 4 years ago, canceled her card like 2 years ago and she is getting the 90000 bonus after applying for new card

Thank you for the informative reply. And Yes – welcome any updated information.

My complaint was looked at lol and they concluded I was not eligible for the sign up bonus. So, on the 24th of this month I should get the one time 8000 points for spending 10000 dollars per anniversary year, and once i do, i will call and cancel this card.

Thank you for remembering to reply. I will keep my Choice card to keep the points active.

also a lower deductible on the cell phone insurance then most others.

“ therefore need to spend $30,000 or more in those bonused spend categories to outweigh the points earned from that renewal benefit on the Choice card.”

I may be missing something here Stephen, but if you spent $30K on the CITI Premier card wouldn’t you earn 3X for 90K points which would transfer to Choice 1:2 for a total of 180X CP points? I’m probably just reading this wrong.

You would, but if you put that $30k of spend on the Choice card you’d earn it at 5x which is 150k, plus the 30k from the renewal points for a total of 180k. $30k at grocery stores or gas stations is therefore the break even point where the Citi Premier matches the Choice card, with spend above that making it better than the Choice card if you’re going for an either/or approach with the two cards.

Got it! Thanks!