NOTICE: This post references card features that have changed, expired, or are not currently available

NOTE: Please also see a newer post: Hacking Hawaii Revised.

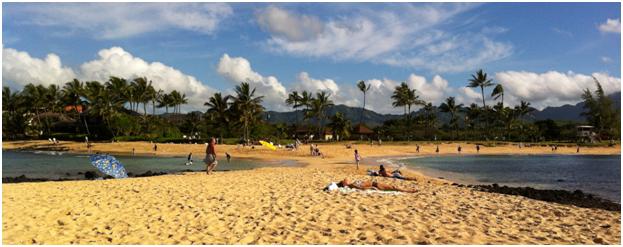

Last week, Mrs. Miler and I were at a dinner with friends when the topic of Hawaii came up. They’ve never been, but they would like to. Their kids have been begging to go, but they feel they need to save their money for future college expenses. I totally understand that, but it’s a shame. I’ve been to many wonderful places around the world, but Hawaii remains my favorite. The photo above is from a trip my family took to the town of Poipu on the island of Kauai. The water on the left, in this photo, is an amazing snorkeling beach. A few hundred feet to the right is a terrific boogie-boarding beach. From there you can ride the waves, watch sea turtles swim, and sometimes watch dolphins play. About a mile further along, are amazing sandstone cliffs which make for exciting and awe inspiring hikes. And all of that is just in the small town of Poipu! Venture out a bit more to see beautiful waterfalls, hike the Waimea canyon, and so much more! And, that’s just Kauai!

So, all of this ruminating gave me an idea and a challenge: find a realistic way for this family of four to go to Hawaii for free.

Hawaii is not an easy destination for this challenge. It’s almost impossible to find low award availability for reasonable dates and times, especially considering our friends would need to book for four. Remember, this needs to be realistic, so the dates of travel are fairly rigid: their kids are both in school so they need to go to Hawaii during a school break. Further, since they live in frigid Michigan, it would be nice if they could go in the winter to get away from the cold. Winter also happens to be the best time to spot Humpback whales in Hawaii. All of this means that they would ideally go during the kids’ winter break from school in February.

For experienced travel hackers, free travel to Hawaii is actually quite easy. The trick is to sign up for lots of credit cards which offer huge sign-up bonuses in the form of airline miles and travel points. Once enough miles and points have been accrued, the trick is to book award flights and hotel nights at the lowest possible cost in the form of miles and points. This is great, but it takes a while if you’re starting from scratch; and it takes a real commitment to learn the ins and outs of credit card signups, minimum spend requirements, award travel booking, and the like.

Instead, this post is for the real family: the one that doesn’t want to wait a year while accumulating points, and doesn’t want to sign up for dozens of cards. And, to make this challenge even harder, I’m going to assume that this family isn’t interested in gift card schemes for meeting minimum credit card spend requirements (e.g. How to meet minimum credit card spend AND get 50,000 to 100,000 extra miles, and How to meet credit card spend thresholds without breaking a sweat). In other words, I won’t ask them to sign up for credit cards requiring minimum spend thresholds that they can’t afford.

Assumptions

In order to make this work, I need to make some reasonable assumptions:

- This family has good credit ratings and has not recently applied for Chase credit cards.

- Both mom and dad will participate in the solution.

- Mom and dad always pay their full credit card balance each month (and will continue to).

- Mom and dad each spend, on average, $1000 per month using credit cards. Even if they don’t spend that much, today, the assumption is that they can by using their cards for all purchases possible: groceries, utilities, cable & phone, restaurants, coffee, etc.

- Mom and dad are willing to sign up for three credit cards each over the course of the year.

The Solution

(Updated on 10/29/2011 due to an error in the original post)

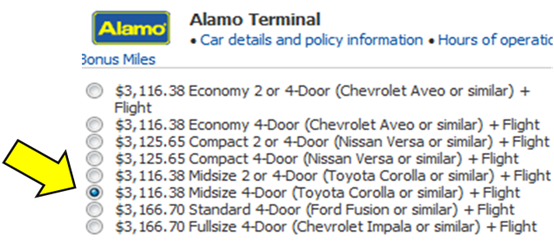

Instead of trying to accumulate airline miles, mom and dad will purchase a vacation package from Delta Vacations. I’ve written before about how it’s possible to save on airfare by buying a vacation package. For example, I found a package that matches up with their kids’ winter break that includes airfare for four and a mid size car rental for a total of $3,116. If they were to book airline tickets alone, without a package, the best current rate for the same dates would be $3660. So, by adding a car, they will save $544! You’re probably thinking that sounds good, but doesn’t sound free. You’re right! Read on:

Mom and dad will use credit card signup bonuses to pay for this trip. Additional credit card signups will provide lodging. There are a few big advantages to this approach over collecting and using miles for airfare. First, there is no need to wait before booking. Mom and dad can start planning their trip right away. Second, everyone in the family will earn airline miles from this trip! This is a long flight, so by the time they are done, the family will be well on their way to accumulating enough airline miles for another trip! Third, this approach includes a rental car. In my experience, to get the most out of a Hawaiian vacation, you really do need a car.

Step by Step

Mom and dad can follow these steps to get their vacation for free:

STEP 1: Sign up for two credit cards each

In one day, both mom and dad should sign up for these cards (note: I do not receive referral fees for any credit card signups):

Chase Sapphire Preferred

After $3000 of spend in three months, this card you will give mom and dad 50,000 Ultimate Reward points each which can be easily and instantly transferred to airline miles, hotel points, or cash.

Chase Marriott Preferred Visa

After your first purchase with this card, mom and dad will each get 70,000 Marriott Rewards points and a certificate for one free night in any category 1 through 4 Marriott!

STEP 2: Use the cards!

When you receive the Marriott card, make a purchase right away: buy a coffee, fill up your gas tank, buy a $1 Amazon gift card, whatever. It may take a while to get your Marriott points so you want to get this started as soon as possible. Once you have made the first purchase, put away the card. Instead, start putting all of your spend on the Sapphire Preferred card in order to ensure reaching $3000 of spend in three months.

STEP 3: Book your Delta Vacation

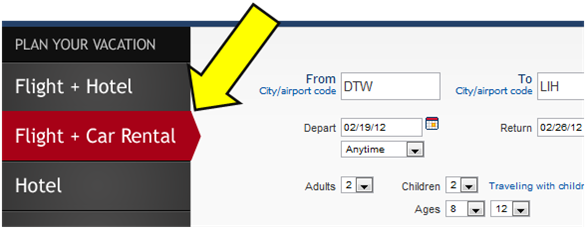

Go to deltavacations.com and book a “Flight + Car Rental” vacation. You might have to play with the dates a bit to find the best price. For example, in order to find the $3116 fare, I put in a Sunday to Sunday trip. Returning from Hawaii is an overnight ordeal, though, so the kids will miss one day of school (Monday) if you do this.

Another trick to note has to do with picking your rental car. You might think that to get the best deal you should take the smallest car they offer. Look carefully at the rates, though, and you might find a better car for the same or even less money.

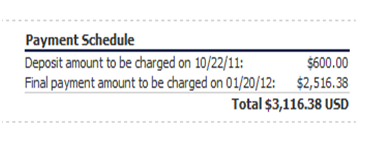

When you get to the payment screen, note that you can pay all at once or pay a deposit now and the rest a few months later.

If you can’t afford to cover the full amount right now from your savings, then just pay the deposit. Either way, make sure to use your Sapphire card since it will help you complete your minimum spend and you will get double bonus points when you use your card for travel purchases.

STEP 4: Book your hotel

Once both Mom and Dad receive their bonus Marriott points they will have a total of 140,000 points to use for redeeming free hotel nights. Marriott has many great resorts in Hawaii and pretty good availability for rewards, so you should be able to find something very nice. If you need a few more Marriott points, keep in mind that the bonus points from your Sapphire cards can be transferred directly to Marriott points! Another option is to find points plus cash options. For example, I found that at the Kauai Marriott Resort (see photo below), you could stay for the week for a total of 150,000 points plus $50 per night. Not bad!

STEP 5: Pay for the vacation, partially, with points

When it comes time to pay the balance of the Delta Vacation package, both Mom and Dad will hopefully have met the minimum spend requirements on their Sapphire cards and have received their 50,000 bonus points each. In order to meet the minimum spend, they had to charge $3000 to each card, so those purchases would have amounted to additional points. So, mom and dad will have, at least, 106,000 points at this time. Redeem those points for cash in order to get $1060 back. Use this money to help pay for the vacation package.

STEP 6: Sign up for one more card

The Chase Freedom card offers $300 cash back after spending only $500 in 3 months. As a rewards card, it gives 1% cash back on all purchases and 5% cash back on specific types of purchases (the types change every 3 months – currently it is for department stores, movie theaters, and charities). After having met the minimum spend on the Chase Sapphire cards, Mom and Dad should each sign up for this card and begin using it for all transactions until they have spent $500.

Wrap Up

For this seven night Hawaiian vacation including airfare for four, a rental car, and resort hotel, mom and dad will shell out a total of $3,116. Thanks to Chase credit card bonuses, though, they will receive a total of $1,660 cash back. So, in total, mom and dad will spend $1,456 which amounts to $364 per person for a fantastic trip to Hawaii! Additionally, each family member will earn approximately 10,000 airline miles that can be used towards future travel! If, instead, this family were to pay for this entire vacation (including lodging at the Kauai Marriott resort), it would cost $4,838 from Delta Vacations or much more if they booked the flights and hotel separately. With this plan, they would save, at least, $3,382!

So, this plan doesn’t quite get the family of four a free trip to Hawaii, but it makes it much more affordable. If you’re really committed to the “free” part, all it really takes is a few more credit card signups, such as this Citibank offer which will give mom and dad 50,000 Citi ThankYou points each after $2500 of spend. Another is the Chase Ink Bold which offers 50,000 Ultimate Rewards points after $5000 of spend in three months. If you go for this card, I’d recommend doing a single application and work together to meet the minimum spend. By redeeming the points from each of these cards (two Citibank cards and one Chase Ink Bold), you will get back over $1500 in cash and gift cards, and now your Hawaii vacation is truly free!

Do you have ideas or suggestions to improve this plan? Please contribute and post your ideas in the comments below!

[…] the U.S. makes visiting so bothersome with the ESTA system; hopefully you’ll visit anyway.) The Frequent Miler has already published a similar post on Hacking Hawaii, although I think there is something to be said for paying for certain things. Hawaii can actually […]

[…] the U.S. makes visiting so bothersome with the ESTA system; hopefully you’ll visit anyway.) The Frequent Miler has already published a similar post on Hacking Hawaii, although I think there is something to be said for paying for certain things. Hawaii can actually […]

How do I book my African safari and how advance should I do reservations?

How do I reserve my African safari and how advance should I get reservations?

How do I book my African safari and how early should I cause reservations?

How do I reserve my African safari and how advance should I make reservations?

What time of year is the advisable time to turn on an African safari?

Hey- Why use the Sapphire Preferred points as cash? They seem so valuable for transfer into other programs.

Can you do this same trick with Citi instead, using the Thank You Preferred 50,000 point bonus?

MileCardInsider: You’re right that there are much better redemption options than cash with the Sapphire Preferred points, but there aren’t many other cards that will give you $500 in cash for simply signing up for the card. So, its true that I wouldn’t personally use my Ultimate Rewards points to redeem for cash, but for people who don’t want to hoard points for the future use, it could be a good option. I don’t think you can redeem Citi Thank You points for cash directly, but please correct me if I’m wrong. With the Citi card my understanding is that for 50,000 points you can get $500 in gift cards or 33% more value if redeemed for travel.

This is a Excellent Weblog You might find Exciting that people Encourage You.

Could you clarify something for me? I’m relatively new at this. My wife is a full time homemaker. Stays home taking care of the kids (couldn’t pay me enough to do that). Can she still apply/get approved for cards based on the “household” income? She has a good (790) credit score. Thanks in advance.

BIGGERdaddy: Yes, give it a try.

Hi,

Great meeting you in Chicago neighbor and thanks for the lift back home to sweet old Ann Arbor.

Email me so I can send u the article of my Hawaii trip that was featured in Inside Flyer to see how it’s really done:-)

Some comments on this blog post:

Delta Vacations rarely will have some great deals but usually it is no bargain! Very often DL emails with coupon codes for $100 off. I don’t think over $3k for 4 plane tickets and 1 wk rental car is a bargain! Or maybe I am too cheap:-)

Chase is getting harder to approve and I think your audience may already have some Chase cards:-) I agree, the Chase Sapphire Preferred card is a MUST!

Remember, Skypesos can be used at the last minute at 35k Skypesos to Hawaii per ticket!

Cashing UR points for cash is generally not a good idea which I am sure you know.

I personally prefer booking National cars separately & pick the car I like in the lot:-)

Waiting to see how many days it will take you before you accept cc referrals;-)

gpapadop: great meeting you too!

Thanks for the comments on the blog post. Keep in mind that this is targeted towards friends who are not into real travel hacking and I forced myself to work within some very limiting constraints and assumptions: they don’t want to wait until the last minute, they don’t currently have miles and can’t wait around till new miles post from credit card signups, they don’t want to do tricks (like those I’ve written about before) to pay off big minimum spends in short amounts of time. Given all of those constraints, this was the best I could come up with, but it would be awesome if you or other readers can come up with better suggestions. I already changed the post thanks to some reader comments and would be happy to again! I’d also be interested in a second post someday that shows the “optimal” path to Hawaii for those willing to really play along.

Regarding Delta Vacations, I think >25% off the best rate Kayak can dig up is a great deal. True, it doesn’t bring the cost per mile down to expert mileage runner amounts, but it is a big discount especially considering it is during high season. My family has personally found and used rates like these for the past four years even though each time we had very little flexibility to our dates of travel. Plus, these awesome trips have helped me retain Delta Gold status and my wife and son retain Silver! And, despite the usual pathetic value of Silver status, we have been upgraded on decent length flights numerous times (but never to Hawaii).

Finally, you are so right that cashing in Ultimate Rewards points is usually a bad idea! I value each point at about 2 cents each whereas cashing them out only gives you 1 cent each. Again though, I was constrained by the assumptions and approach…

Have them each get the Citi TY Premier. 50k bonus (after $2,500 spend in 3 mos) which is good for booking $665 of air travel (plus extra flight points). Also got US companion pass. First yr fee waived.

Although the bonus is a lot smaller, they could also apply for the Chase Freedom card, which is now offering 30,000 bonus UR points ($300) for spending $500 within 3 months. But that’s a lot of Chase cards to be applying for within a few months… maybe they can have one of their kids apply also 😉

glu800: the Freedom is a great idea: we can replace one of the Ink Bold cards with the Freedom card. Mom and dad can work together to meet the min spend on the one Bold card since the Freedom min will be very easy to achieve. Total $ back for those 2 together will be $800 which compares pretty favorably to the $1000 back from 2 Bolds. Thanks for the suggestion! I’ll update the post once I’m somewhere with better internet.

Actually to get the 50,000 bonus on the Chase Ink card, you must spend $5,000 within 3 months, not 5 as you mentioned. It’s a pretty high threshold and one of the reasons I haven’t gotten it yet.

Do’h!

glu800: Thanks for the correction! I’ll try to fix this soon. Hmmm, this really throws a wrench in the plan…

The trip isn’t really “free” – there is an opportunity cost. They could just sign up for the cards and keep the cash at the end instead of spending it on the vacation.

What they should really do is ask themselves what they would do with an extra $2000 dollars. If it’s travel to Hawai’i, then so be it. But maybe they’d put $1000 away and then spend the extra $1000 on a trip to a warm location that’s a bit cheaper to get to?

@Andrew: that’s very true, but I think it is almost always true: if you use airline miles to get to Hawaii, you could instead take two trips to Florida. Even if you outright win a trip to Hawaii, there may be an option to take cash value instead. So, yes, if this family decides to sign up for the credit cards I suggested, they can choose many other ways to spend the bonuses. This is just one. I’m personally such a big fan of Hawaii, that I think it is totally worth it! Others will disagree, and that’s OK!