NOTICE: This post references card features that have changed, expired, or are not currently available

CashBackMonitor has unveiled yet another groundbreaking new feature. They now let you set your own point values within their system. Here’s why I’m excited…

Background

Online shopping portals are a great way to increase rewards for purchases you plan to make anyway. The idea is to log into a portal and, from there, click through to an online store to make your purchase. Portals generally offer either bonus points (or miles) or cash back. Usually the bonus is based on the purchase price and is listed as, for example, “5 miles per dollar”. That means the portal will give you 5 miles for every dollar spent, in addition to any points you get from your credit card automatically.

One of the tricks to maximizing portal rewards is finding the right portal. If you plan to shop at a particular store, how do you know which portal will offer the most rewards for that store? Enter – Portal Finders. A number of websites are available to help you find the best current portal rates, but many of these sites are incomplete or inaccurate. A few years ago I ran a number of experiments to try to find the best Portal Finder. In the end, CashBackMonitor proved to be the best (See: The best portal finder. A new king is crowned). Since then, I’ve used that site almost exclusively and have never looked back.

Recently, CashBackMonitor added a great feature in which they track historical point values (details and story here). Now, barely more than a week later, they’ve added configurable point values…

Configurable Point Values

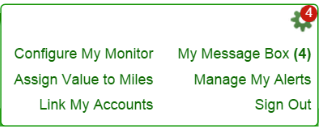

If you log into CashBackMonitor, a number of features become enabled such as the ability to set alerts, configure your home page “My Monitor” with the merchants and portals you’re most interested in, and more. Now, there’s one more thing… Assign Value to Miles. After logging in, hover over the cog icon on the top right of the page and you should see this:

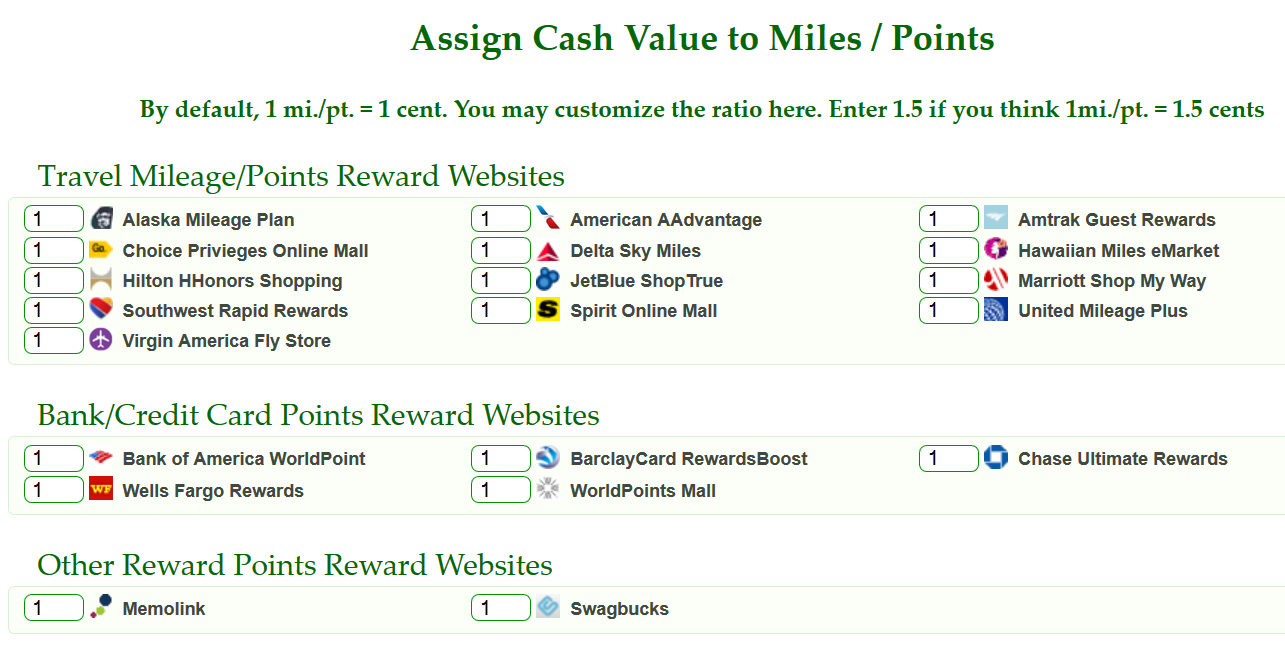

Click on “Assign Value to Miles” and you’ll see something like this:

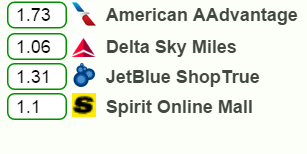

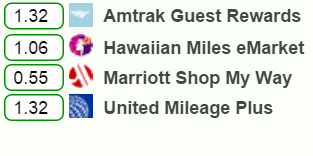

As you can see above, by default each type of point or mile is assumed to be worth 1 cent each. I went through and added my Fair Trading Prices to each type of point as follows:

|

|

Why this is worth doing

By setting point values according to how you value them, it becomes much easier to compare portal rates. For example:

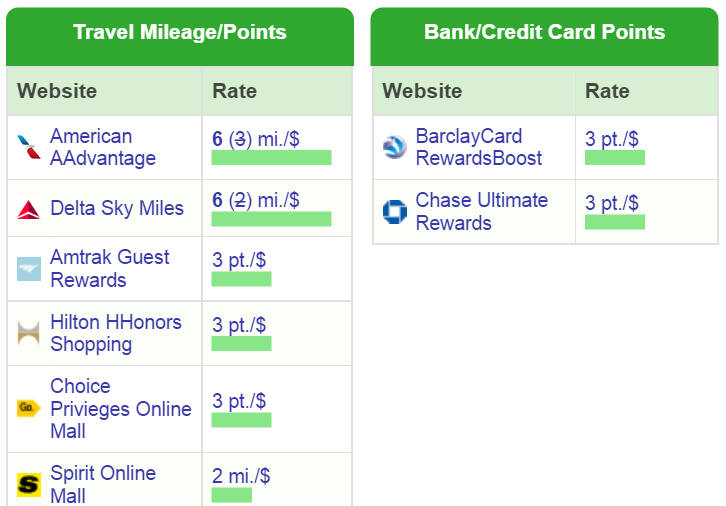

Without setting point values, here is what today’s view of Sears’ portal opportunities looks like:

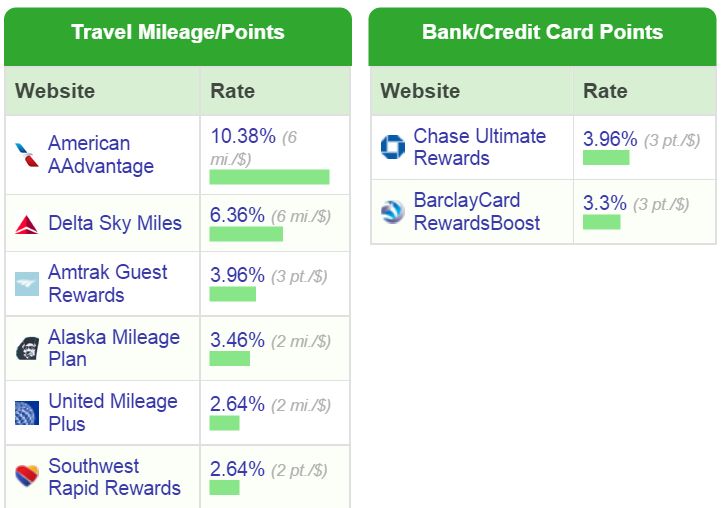

With point values set, based on Fair Trading Prices, we get a different picture:

Notice in the original view, Hilton, Choice, and Spirit were in the top 6 options for Travel Mileage/Points. With the new point values, those options are replaced with Alaska, United, and Southwest. Even though the Alaska, United and Southwest portals pay fewer points per dollar, their points are worth much more so it makes sense. Similarly, since I value Chase Ultimate Rewards higher than BarclayCard Rewards, Chase jumps to the top of the list under Bank/Credit Card Points.

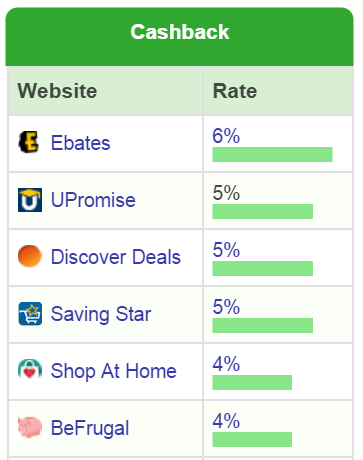

Not only do the configured point values help with the sort order of portals, but they help with comparing to cash back rates too. Here are the best current cash back rates for Sears:

You can now see at a glance that two mileage portals give you better rewards (based on your point valuations) than the best available cash back. You can choose either 6% cash back from Ebates or the equivalent of 10.38% back (in the form of 6X miles) from the AAdvantage eShopping Portal.

Choosing your point values

The point values you enter into CashBackMonitor should not be set to the best redemption value you are likely to get, but rather to the amount you would be willing to pay for points in that program. The reason? Choosing to earn points instead of cash back is really the same as buying points. If you choose to earn 10X points on a $100 purchase rather than 10% cash back, then you have essentially “bought” 1000 points for $10 ($10 is the amount of cash back you would have received had you chosen the cash back portal). That’s 1 cent per point.

To get started, I’d recommend plugging in the values I show above (which are derived from my Fair Trading Prices page). Then, adjust individual values as needed. For example, perhaps you already have plenty of AA miles and wouldn’t want to buy more at a high rate. In that case, lower the AA estimate. Or, maybe you’re not interested… ever.. in flying Spirit. Fine. Lower that value down to .1. Or, perhaps you’re working towards earning the Southwest Companion Pass. In that case, you might increase the value of Southwest points, since points earned from the Southwest portal do count towards the companion pass.

[…] got to choose from Upromise at 5% or Alaska Mileage Plan Shopping at 2x. The benefit of Cashback Monitor, is that you can add in your own values for points, which helps, but you have to realize what your opportunity cost […]

[…] Cashback Monitor offers all the info you need for Cashback Portals, Miles and Points portals, Bank Points, and whatever swagbucks is. In fact, you can configure your Cashback Monitor to show you the values of each portal based on your value. […]

Wow, never realized that CashBackMonitor had that many cool features. I have always used EVreward due to its lightweight setup but I guess I have to give CMB a second chance. Thanks for sharing!

[…] CashBackMonitor adds configurable point values (The Frequent Miler). Great tool. […]

[…] CashBackMonitor adds configurable point values – This new feature makes it much easier to compare values across a number of different portals. […]

[…] you can see, I haven’t loaded my configured values into Cashback Monitor just yet, but, that not withstanding, I think the winner is clear — American […]

[…] CashBackMonitor adds configurable point values by Frequent Miler. Another really nice upgrade by CBM, they listen to user feedback and implement it which I absolutely love. […]

Anyone notice the Amex Gift Cards list never shows up on CBM?

Amex Gift Cards is #1 or #2 on the most popular store list on the front page of CBM. And here is the store page for Amex Gift Cards

http://www.cashbackmonitor.com/Cashback-Store/American-Express-Gift-Cards-Business-Gift-Cards/

Thanks for that info. For some reason when I go to the A list and click Amex gift cards it never shows up.

Check that. I just realized I was on cashbackholic. Thought I was using the same site. Thanks for setting me straight.

CBM is great. Now it makes them phenomenal. You know what, if I can set alerts from CBM, I may look at your quick deals as a secondary source for improved payouts from now. Hard but true. 🙂

There’s nothing wrong with that! Portal Alerts is better for those who don’t know which stores they’re interested in. CBM alerts are better for the stores you know you care about.

Great stuff!

Outstanding post (as always), thanks! Kudos to cashbackmonitor.com.

Very cool, thanks for sharing!