NOTICE: This post references card features that have changed, expired, or are not currently available

My wife and I have four AAdvantage Aviator Red MasterCards. Yep, we have two each. Before American Airlines and US Airways merged their loyalty programs, the Barclaycard US Airways MasterCard offered a terrific signup bonus: 50,000 miles after first purchase. At times, the bonus was a bit lower – 40,000 miles, if I recall correctly. And, sometimes the offer included 10,000 anniversary miles. To complicate things a bit, sometimes the 10,000 anniversary miles were promised for every anniversary. More recently, the miles were promised only for the first anniversary.

Today, the US Airways cards have been (or, for some, are in the process of being) converted to AAdvantage Aviator cards. They now earn American Airlines AAdvantage miles. And, importantly, the cards are no longer available for new applicants. That said, considering how good the signup bonus was while it was available, I’m sure that a large percentage of readers have at least one Aviator card.

What type of anniversary bonus, if any, do you have?

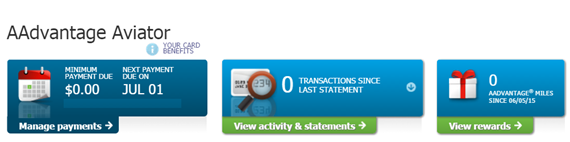

Yesterday, Point me to the Plane showed how to determine if your card is eligible for a 10,000 mile anniversary bonus. I checked my accounts and confirmed they were as I expected:

After logging in, I clicked “View rewards”:

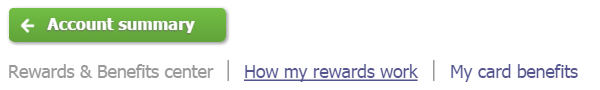

Then, I clicked “How my rewards work”:

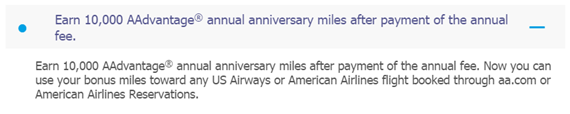

Both of my cards and one of my wife’s cards showed the following:

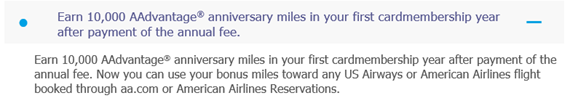

The text shown above indicates that the account is eligible for an anniversary bonus every year. My wife’s second card, had a different message:

My wife’s second card is eligible for the anniversary bonus only once. The text specifically says (bolding is mine): “Earn 10,000 AAdvantage anniversary miles in your first cardmembership year after payment of the annual fee.”

Bonus Mile targeted offers

One of the best features of the old US Airways card was that card members frequently received targeted offers for bonus miles. My favorite offers were for 15,000 bonus miles after $500 (or $750) spend per month for three months. Fortunately, even after converting to the Aviator card, people are still receiving offers like these. Checkout this Quick Deal for details about recent offers.

To see if you’ve been targeted, check for emails sent from: email@offers.aviatormastercard.com. It might even help to add that to your address book to reduce the chance of those emails being sent to your spam folder.

Many Aviator flavors

Barclaycard went bonkers creating new options for cardholders. There are now four different versions of the AAdvantage Aviator personal card (and, there’s a business card too).

Most people will have been automatically converted to the Red card. Doctor of Credit has a great post summarizing the four card types (found here). Here’s my summary of his summary:

| Aviator | Aviator Blue | Aviator Red | Aviator Silver | |

|---|---|---|---|---|

| Annual Fee | $0 | $49 | $89 | $195 |

| Earning Rate | 1X AA, .5X elsewhere | 2X AA, 1X elsewhere | 2X AA, 1X elsewhere | 3X AA, 2X hotels & car rentals, 1X elsewhere |

| Major Perks | 10% rebate on awards; free checked bag; Priority boarding | 10% rebate on awards; free checked bag; Priority boarding | ||

| Other Benefits | Reduced mileage awards (5K discount) | $100 flight discount with $30K spend; Reduced mileage awards (7.5K discount) | 5K EQMs with $20K spend; 5K more for $40K spend; $99 Companion certificate after $30K spend; Reduced mileage awards (7.5K discount) | |

| Eligible for continued anniversary bonus | Yes | Yes | Yes | Yes |

I find the last row of the table the most surprising. Apparently if you are already eligible for anniversary miles, you’ll continue to receive those miles with the no fee card.

Can you switch?

I had assumed that Barclaycard would make it easy to switch from one Aviator card to another, but that doesn’t appear to be the case. I called Barclaycard yesterday and asked if I could downgrade one of my Aviator Red cards to the no fee Aviator card. The rep I spoke with checked both of my cards and, in both cases, she told me that downgrading (or upgrading to Silver) was not an option for that card. I then asked to speak to a supervisor. After a very long wait, the supervisor told me the same story. According to that supervisor, my options are:

- Keep the cards as-is.

- Cancel one or both cards.

- Wait and call again in the future to see if any downgrade or upgrade options have been made available.

I’ll go with option 3. I’m certainly not willing to cancel since I highly value both the 10,000 anniversary miles and the occasional 15,000 mile promotions. That said, if I could continue to get the anniversary miles with a no fee card at some point in the future, I’ll gladly do that.

MileCards suggests that card changes may become easier once US Airways and American Airlines complete their merger. They wrote:

We’re also hearing there may be more broad availability of product changes by November, when US Airways and American Airlines fully merge systems.

That doesn’t make a lot of sense to me, but you never know. At the very least, the completion of the merger can be a reminder to me to check my options with Barclaycard once again.

Which card is right for you?

In the unlikely case that you are offered a choice between cards, here are my recommendations. Pick the sentence that best represents you:

- You are a heavy spender and you want to earn (or keep) AAdvantage elite status: Get the Aviator Silver card. This is the only Aviator card that offers AAdvantage Elite Qualifying Miles (EQMs) with high spend. Note: Some think that you can increase your chance of being offered the upgrade to the Silver card if you put a lot of spend on the Red card.

- You often fly American Airlines without elite status: Keep the Aviator Red card. For $89 per year, you’ll get a free checked bag for yourself and up to 4 companions; Group 1 boarding; and a $100 AA flight discount if you spend $30K per year on the card.

- You often book AAdvantage awards: Keep the Aviator Red card. For $89 per year, you’ll get 10% of your miles back when you book awards (up to 10,000 miles per year). Plus, you get access to AA Reduced mileage awards.

- Everyone else: Downgrade to the no fee Aviator card. Don’t use it for spend, just keep it in a drawer for the following reasons:

- To keep anniversary bonuses coming (if eligible)

- To keep the ability to upgrade to a different Aviator card in the future if/when your goals change

- For the possibility of receiving lucrative targeted offers (I don’t know if Barclaycard will offer these to no-fee cardholders, but its possible).

Should you cancel?

If you have an Aviator card, but you don’t want to pay the annual fee, I recommend checking first to see if you can downgrade to the no annual fee card. If not, then consider the following factors:

- Do you think you’ll ever want an Aviator card? Since Barclaycard doesn’t offer these to new account holders, its unlikely you can ever get one again once you cancel. So, if you only have one Aviator card and you think there’s a chance you’ll want one in the future, you should probably keep it for now.

- Is your card eligible for anniversary miles each year? If so, the $89 annual fee is, in my opinion, a very good price to pay for 10,000 miles. Keep the card.

- Are you often targeted for 15,000 miles after three months of $500 (or $750) spend? If so, keep the card.

If none of the above factors apply to you and you’re not getting more value from the card than its $89 annual fee, then you might as well cancel it. I’d recommend waiting until the annual fee comes due, though. Often, the best targeted promotions are offered right around that time…

From my UPGRADE OFFER on my Home page of the Red card it explains the Silver upgrade, then clicking Tell Me More I found this:

By accepting this upgrade offer, you will no longer be eligible for the 10,000 anniversary miles benefit available through your current reward program.

So, no more anniversary miles if you upgrade to Silver.

Thanks — that’s good to know!

Was about to shut down the card as annual fees came close, just received 15,000 miles offer by mail for $500 spend Feb – March every month! No registration needed.

hey my rewards says that im eligible for 10% of redeemed points back every year i redeemed 50k this yr all i would get back is 5k is that worth it for a $89 annul fee

The limit for the rebate is 10K per year. If you were to get back10K per year, then $89 would be well worth it. For 5K per year, I would only keep the card if you take advantage of other benefits: checked bags, for example.

[…] If you have an AAdvantage Aviator card, you can see if your card qualifies for a 10,000 mile anniversary bonus by logging into your account, clicking “View rewards”, then clicking “How my rewards work”. More details can be found here: Should you keep, upgrade, or downgrade your AAdvantage Aviator card? Do you have a choice? […]

I’ve had this card for quite some time. Will I lose the miles earned if I cancel?

No, you won’t lose any miles. Do keep in mind though that you’ll need to have activity in your AA account every couple of years (either spending miles or earning miles is fine) in order to avoid having your account expire.

my wife and i both have red cards that were switched over from us airways cards that we got to get the 50k bonuses….i never use the card. i dont fly aa that often either but like that i have it in case we do soi can get free luggage. had the fee waived on both cards once already. my question is if i manage to get them downgraded to the no fee cards would it still allow me to keep my aa miles from expiring? even if i dont fly them within the 18 months or whatever time they allow you to keep them for? that would be my main concern for keeping the cards at all.

I don’t know whether the card keeps your AA account alive automatically: my guess is yes. But, even if it isn’t automatic, you could keep your AA account alive by just charging a couple of dollars to your AA card every year or so (since you would then earn AA miles). That activity will reset the clock.

Just called and could not get the Anniversary bonus or get the annual fee waived despite numerous attempts. Was transferred to a manager, and was told the same thing and had her explain my benefits again. After some discussion, she finally capitulated and waived half my annual fee. Keeping the card mostly for the free checked bag on American for four folks.

Jake, was this for Aviator Red? I was going to cancel my Red, but based on this article I will pay the $89 annual for the 10k bonus anniversary points which I confirmed I will still receive. Please clarify if you have the red card as you should be eligible for 10k bonus annual miles, EVERY year hereon after, not just the 1st year (at least in my case), thanks.

My aunt just tried to call in to cancel her AAviator Red card. I would not have advised this, but that’s what she wanted to do. She was told that if she cancelled they would take back any of the miles that she had earned through their program. I know this is generally un-heard of, so I researched in my paperwork and there IS indeed some language that indicates that they reserve the right to take back any miles for several different reasons listed in the paper (which is not in front of me at this moment), including if you close your account.

Is this even possible? I mean if the miles are already in her American Airlines account, and if some of them have even been used already, then how would they be able to get them ‘un-deposited’?

She called American Airlines and that representative said they had never heard of anything like this.

She has decided to keep the card for the moment, and I advised that maybe when she calls again closer to her anniversary date that she ask for a downgrade instead of closing the account.

Any thoughts about this, or anyone have a similar experience?

I’m sure that your aunt’s miles are safe. The only miles that she might lose are from recent credit card spend that has not yet posted as miles.

I don’t have anniversary offer, just this:

Receive 10% of your redeemed AAdvantage® miles back into your AAdvantage® account. (10,000 miles maximum each calendar year).

I earned 50k miles so that’ll be 5k bonus, I’ll cancel the card!

I have one of the holdover Aviator no fee cards, and frankly, I’m thinking to dump it soon. Followed your guidance to check, but no offer of a 10K bonus, nor have I received any offers of miles for spending. What do you mean when you write, “if eligible?” Yes, I get that some will counsel to keep it for the credit record. But Barclays is notorious for being stingy with new credit cards — and I’m seeing other Barclay’s cards that have more practical benefit to me (even the Wyndham card), and I don’t want to hazard getting turned down for a new card because of hanging on to a card with no current utility whatsoever.

“If eligible” just meant “if your card has the 10K annual bonus”. It sounds like yours does not. I see what you mean about wanting to dump it. Just keep in mind that you then will never have the option of getting a Barclays Aviator card in the future unless their contract with AA changes.

Last week I received the targeted AA offer of Platinum status for earning 12K EQM or EQP by October 9. If I upgrade to the Silver card will those EQMs post before October 9th?

I don’t think so. First you would have to spend at least $20K to get 5K EQMs. Second, if it works anything like the US Airways card used to, the EQMs may not post until January. Third, its very unlikely that the EQMs would count towards that Platinum status challenge.

Thanks for showing how to check the anniversary bonus. Mine has the 10,000 anniversary bonus every year.

I had two Aviator Red cards and called to combine the credit limit into one account when the first annual fee posted. I have Citi Aadvantage personal and business cards, too. Enough AA cards! I foresee using AA less after this year. My daughter plans to move back to the US from Japan in Spring ’16. I find AA miles better for travel to Asia, but not great to Europe because so many of their flights are BA with huge fees. And I won’t need to go to Asia every year now.

I called to ask if I have the 15,000 miles after $500 spend for 3 months on my card. The rep said no. I’ll email too. It can’t hurt.

I called today (July 1, 2015) and was offered to have my annual fee waived for the next year. That’s nice, but was also offered to upgrade for free to the Silver card for a year (no credit pull either). The silver offers 10-15k MQM miles after some pretty high spend…but you need 25k MQM’s just to quality for the lowest elite tier and I don’t fly that much (just a few times internationally on points). So it’s probably not worth the upgrade to the Silver at this point. If anyone thinks I’m wrong, please let me know. Thank you

If you don’t have Global Entry you can get the fee waived with the Silver card. Plus the companion certs if you find those useful.

I called Barclay 2 days ago and WAS upgraded to the silver card. I have been a long time Barclay credit card customer, over 10 years; not sure if that is a factor. I did the 30,000 mile Chairman Challenge last year and am now spoiled so want to get those 10,000 EQMs.

Very helpful post, I thought that I had the 10K annual bonus miles but was unsure how to confirm it (other than calling Barclays).