NOTICE: This post references card features that have changed, expired, or are not currently available

Buying Amex gift cards through cash back portals had been a key part of my strategy for increasing credit card rewards. When buying Amex gift cards, it was possible to earn credit card rewards for the purchase, plus a cash profit from the portal that well exceeded gift card fees and shipping costs. Please see “My Amex gift card strategy” for more details about how I used to use Amex gift cards.

Unfortunately, in August, the TopCashBack portal added a new restriction to the purchase of Amex gift cards. Cash back was only available for denominations of $200 or less. Soon, other portals added the same restriction.

Dealing with large denomination Amex gift cards is hard enough. Dealing with many $200 gift cards is too much. It seemed that, until the terms changed back, the deal was done.

Predicting a reversal

In the post “Amex gift cards: Is the deal done?” I pointed out that, in prior years, Amex has withdrawn their gift cards from portals completely in the September-ish timeframe. Each time, they’ve returned to portals after a month or two. It is possible that this new $200 limit is just a different approach to the same thing. If so, we may see the new terms ease up sometime soon (I’d bet mid-October).

Current state of rebates

Out of curiosity, a week or so after the changes, I started poking around the various portals. I found that many still had cash back terms that seemed to allow large denomination gift cards. For example, I found the following:

- The Marriott Shop My Way portal said that gift cards up to $2499 were OK (but the portal has since changed the terms to the now standard $200 limit).

- Similarly, Swagbucks didn’t have a posted limit at the time, but it now shows the $200 limit.

- Extrabux, and Extra Rebates still list the old $2,000 limit.

- RebateBlast says that you can buy gift cards up to $3,000.

I decided to run experiments to see if any portals continued to pay out for $2,000 gift cards. I tried a few of the portals that still specifically allowed high denomination cards (at the time) and I tried one portal that I’ve had luck with in the past even though it explicitly limited rebates to $200 and smaller gift cards.

So far, thanks to Amex denying many of my orders (as they often do), I only have two decent data points:

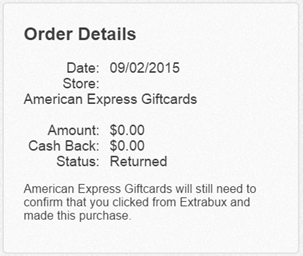

- Extrabux initially showed my 1% cash back pending, but then reversed it out with status “returned”. Extrabux states the following restriction: Cash Back is not available on gift card denominations over $2,000. My gift card was exactly $2,000. I hadn’t returned it. I submitted a support ticket and I’m waiting to hear more.

- SimplyCashBack still shows my 1.5% cash back as pending, but I have little hope for it since the portal explicitly states: Only Gift Cards with $25, $50, $100, $200 denominations or a variable load of $200 or less are eligible for cash back. The cash back for this order is shown as pending until November 13th, so it may be quite a while before I know for sure whether or not this is working.

Point Chaser gave us hope recently when she published “You CAN Still Earn Cash Back on $2,000 American Express Gift Cards.” She has had luck with Extrabux, and pointed out that their terms still allow denominations up to $2,000. Unfortunately, several readers (including me) commented that ExtraBux hasn’t worked out for them. Point Chaser followed up with a new post advising people to hold off on purchasing Amex gift cards until further notice.

Bottom line

It appears that the ability to earn cash back for large denomination Amex gift card orders truly is dead… for now. Hopefully the terms will change again. If/when they do, I’ll let you know. In the meantime, I’ll keep testing various portals and I’ll report my results within the Frequent Miler Laboratory.

Update: As expected, my $30 pending payout from SimplyBestCoupons has been reversed.

[…] the dollar amount to see the details. There, I found that I had one pending payout of $30 (which will surely be reversed soon) and a negative payout of $225. […]

ExtraBux, AMEX GC purchase tracks normal, but they just reversed it on the purchase made 9/8 for about $1.5k as a test.

Very depressing news………..just when I thought I had a system to pay the mortgage and get miles……….but I believe it has something to do with AMEX annual reporting……….maybe some banker/reader has the clue needed………

sub

The 2013 shutdown was the first 2 weeks of October. The 2014 shutdown ran 4 weeks from 9/2 thru 9/29. The pattern (over an obviously short 2 year sample) indicates earlier and longer shutdowns. And the earlier part held true this year, as the shutdown began August 20. But for length I’d think 6 weeks max for 2015, and we are now beginning week 6, so if the shutdown doesn’t end next week, AGC is D-E-A-D. RIP.

If AGC really is dead, question is where to go now for MS – the mall (in person) and giftcards.com (now 6.95 per 500 plus 1.99 shipping (without promo code), minus $5 for the rewards program, nets to about $4 cost per $500) seem the best for non-bonus category spend (although I’m trying an experiment to see if I get bonus MRs on the business rewards gold, since giftcards.com codes as “advertising services”). Without a bonus category, the return is acceptable with a 3% card (Discover Miles with first year doubling), putting it in the same general area as using 5X Ink cards at Staples, but without the hassle of dealing with multiples of $200 cards. But without the profit from AGC, its not worth the bother to MS with a 2% card. And the cards with bonus categories at grocery and drug stores are few and limited. We need something NEW! (No reselling please.)

Actually, in 2014 many of the main portals stopped paying out cb on Amex orders. Some portals such as TCB and BF got the terms and promptly posted them at the beginning of August 2014 and they didn’t return back to the good cb terms until mid-October. Plus, that was the time Amex revised their website so they used that down time to make revisions which including lifting the 14 day limit up to a higher value. So, this year and last year are very similar in time frame for some of the portals. In fact, I was able to place more orders later this summer than I did last summer. We all hope the cb will return for normal AGC orders in the upcoming month and certainly before the holiday shopping season. They know the higher value AGCs do get bought for gifts.

It was in July 2014 that Amex began enforcing the no cash back when coupon codes used (language that had previously been on the portals for quite some time but had not been enforced). This led to some people not getting cash back when Amex first started enforcing it. But I do not consider that a “shutdown”. No, AGC were removed from portals on September 2, 2014, and did not return until Sept 30. When AGC returned, the going cashback rate was also much less than previously. During the first 8 months of 2014, portal rates were typically around 3% (reached 3.5% at one point). When AGC returned after the shutdown, portal rates were consistently 1.5%, albeit with somewhat regular sale rates of 2.00-2.25% being offered starting in mid-October. This pattern held until August 20, 2015, except for a short shutdown (about a week IIRC) at the end of December 2014.

I am sticking with my 6 weeks max, so next week is the expected return (if they return). I’ve had my doubts that AGC will return this time because of the nature of the “shutdown” this year – it could just be a way to “keep some orders coming in so the revenue doesn’t dry up completely while they decide on the coming years marketing strategy” as a different Mike posted above. On the other hand, Amex has a history of limiting the denominations on which cash back is paid (the $2K limit started in February 2015 and has been in place since.) The $200 limit may just be a continuation of what they started in February.

If I had to guess, this has to just be a different method than completely withdrawing like they’ve done in the past. They have to know this isn’t a good deal when the portal payout is less than the fee on the gift card. This way they keep some orders coming in so the revenue doesn’t dry up completely while they decide on the coming years marketing strategy.

I’m assuming you haven’t heard any updates from your contacts at any of the portals? I know last year even the portals themselves didn’t know it was coming back until a few days beforehand.

You are still blogging about this even now that it is dead. You must really be running out of topics.

Coupon Cactus was still showing 0.5% cb and only exempting $3K cards as of Sunday (they have since changed to the $200 language). I placed an order Sunday and it is tracking at zero. I have a screenshot and have inquired and waiting to hear back. Needed to order some to meet a minimum spend anyway so took a shot at getting some cb. We will see how it goes, but will be pushing them to honor their T&C.

My recommendation – don’t do it. Even if some shopping portals didn’t change their T&C, you will not be paid since Amex will deny a payment to shopping portal and shopping portal will reverse a cashback for you (if it was tracked). This is how it always work – if merchant doesn’t pay, shopping portal doesn’t pay either. My story – I used to buy these cards from ShopAthome all the time,even when T&C on major portals changed. Until 9/3 everything was paid, but after that date cashback for my new purchases was reversed. ShopAthome researched (reached to Amex), who told them a reason for not paying – only denominations up to $200 were eligible. Shopathome was kind enough to honor their mistake (since they didn’t update their T&C) and paid me. Now they added $200 restrictions in their T&C. I believe other shopping portals will work in the same way.

Thanks for saving me the work!