NOTICE: This post references card features that have changed, expired, or are not currently available

Thanks to my interest in manufacturing spend to increase credit card rewards, I’m always excited to see new options for moving money around. New no-fee prepaid cards can be exciting too (Remember Redird?). How about one product that does both? Via Laptop Nomad on Inside Flyer I learned about a new product called Revolut.

Revolut is made up of two parts: an app (iPhone or Android) and an optional physical prepaid card called RevolutCard.

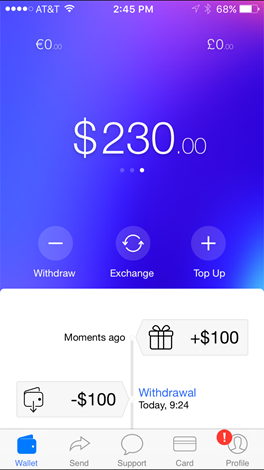

The app is an interesting product all on its own. Once you sign up, you can add money for free with a debit card or via online bank transfer. Once money is added, you can convert funds between US Dollars, Euros, and British Pounds at will. You can send money to other Revolut customers, or you can spend the money in your account by using the included virtual MasterCard (each user gets their own card number, expiration date, CVV code, and PIN). You can also withdraw money to your bank account (theoretically).

Within the Revolut app, you can also request a physical card: the RevolutCard. This appears to be a prepaid card with true Chip & PIN capability. It can be used for credit, debit, or ATM transactions worldwide with no fees (other than unavoidable fees such as those charged by ATM operators).

Fees

None… yet. Revolut promises no fees for the first 12 months of being a customer. Here are the details from their FAQ:

The Revolut app and multi-currency card are completely free.

Revolut offers the very best exchange rate available and applies no charges or fees. We guarantee this for the first 12 months of being a Revolut customer.

The photo above is taken from a Revolut video. The Revolut lady is apparently so happy about Revolut that she stands on her head. She follows up with a cartwheel (not shown).

Adding Funds

I was interested in seeing whether debit gift cards would work to load Revolut. I first tried a US Bank MasterCard gift card (that I had bought as OfficeMax). After registering my name and address with the gift card, I clicked “top Up” in the Revolut app and entered my gift card details. No dice. How about my no longer useful US Bank Buxx card? Yep, that worked. I successfully moved the final $300 from my Buxx card to my Revolut account. Nice! Later I tried a $300 Metabank Visa card from Staples.com. No only did that not work, but it also resulted in my Revolut account being blocked by their automated security. At their request I emailed a photo of my passport and my Buxx account showing the successful $300 top-up. In less than an hour my account was unblocked!

I was interested in seeing whether debit gift cards would work to load Revolut. I first tried a US Bank MasterCard gift card (that I had bought as OfficeMax). After registering my name and address with the gift card, I clicked “top Up” in the Revolut app and entered my gift card details. No dice. How about my no longer useful US Bank Buxx card? Yep, that worked. I successfully moved the final $300 from my Buxx card to my Revolut account. Nice! Later I tried a $300 Metabank Visa card from Staples.com. No only did that not work, but it also resulted in my Revolut account being blocked by their automated security. At their request I emailed a photo of my passport and my Buxx account showing the successful $300 top-up. In less than an hour my account was unblocked!

It’s also worth noting that you can only top up a total of $1500 per year unless you verify your identity. The app has a built in “Verify My Identity” feature which is apparently intended to scan your drivers license or passport. Unfortunately, I couldn’t get either to work. My account now shows “Sorry, we couldn’t verify you automatically. We will review…”

Invite a friend

When you click the “Send” button at the bottom of the app, you’ll see an option to “Invite a Friend. And get £5, when they top-up.” So, I invited my son. He signed up with my link and added $25 (of my money) to his account. I expected 5 pounds to appear in my account, but it didn’t. Luckily, the app has an in-app Support-Chat feature. I used that and within minutes support rep Gus had added $5 (not £5) to my account and signed off with a friendly “cheers”.

Rather than trying to make money off your friends, I’d recommend having them try a promo code so that they can get £5 (or $5) themselves. According to this page, anyone can use the promo code MSE when registering the app and they’ll get £5 (or $5) after adding £10 (or, maybe $10), to their account.

Before trying this yourself, though, I highly recommend you read the rest of this post…

UPDATE 10/28/2015 1:15PM: My son loaded with a PNC debit card and was charged a foreign transaction fee. Make sure to use a debit card that has not foreign transaction fees when topping up.

Send money

My son used the Send Money feature to send $25 to my account (it was my money, after all). The app automatically found people in his contacts that were Revolut users (i.e. it found me). And, the rest was just as simple as you’d expect. He typed in the amount to send and the $25 appeared in my account pretty much right away. Cool.

Exchange funds

I didn’t have any real immediate need to exchange funds, but I tested out the feature anyway. I started by converting $10 to €9.05. Then, I took my €9.05 Euro balance and converted it to £6.52. Then, I took my 6.52 Pounds and converted to US Dollars. I figured that if Revolut was really using published exchange rates without taking any off the top, I would end up with $10 back. In the end, I got back $9.97. In my mind, that’s close enough. The missing 3 cents could be due to necessary rounding when converting from one currency to another.

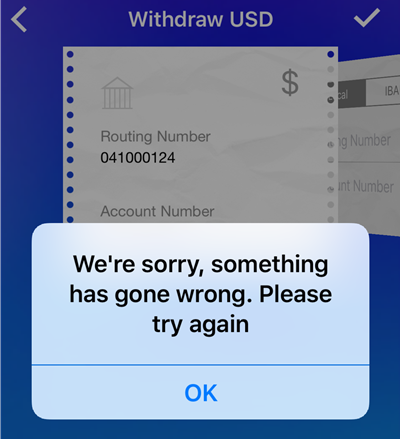

Withdraw

The Withdraw feature turned out to be a bit more difficult than I had hoped. When I first clicked “Withdraw”, I entered my bank routing number and account number and the amount I wanted to withdraw. The result: “We’re sorry, something has gone wrong. Please try again.” So, I tried again, but with the same result.

Via support chat, Gus informed me that:

We do not allow withdraws to local US bank accounts yet. You will need to use IBAN and swift (putting your account number in the IBAN section).

Thanks Gus, but ugh. I checked with a couple of the banks that I have accounts with to see if they would charge a fee for accepting an international transfer. PNC? $15. US Bank? $16. Luckily I had recently opened a CitiGold checking account (to get 50,000 points, of course). Citi normally would charge a fee, but not to CitiGold customers. Cool. Citi told me to use their swift code: CITIUS33. As Gus suggested, I put my account number in the IBAN section and CITIUS33 in the BIC section. Result: Error. I tried again. Another error, but this time $100 disappeared from my account (luckily it reappeared a few hours later).

Later, I chatted with support again, and Anuj (what happened to Gus?) told me that it should work now. So, I tried again and it appeared to work! Unfortunately, it will most likely take several business days for the funds to show up in my account, so I probably won’t know for sure about this feature until next week.

The card

Revolut lets you request a physical RevolutCard, for free. Unfortunately, the first few times I tried to request it, the app timed out. Finally, after my son surprised me by ordering his card without any trouble, I tried again and it worked!

I’m looking forward to trying out the physical card once it arrives.

My take

I really want to like Revolut, but at this point it feels less than half-baked. If you read through the post, above, you’ll see that I encountered quite a few bugs or incomplete features while testing out the Revolut app. Often, though, things would work after a while. It felt like there were a couple of programmers watching my struggles and fixing code on the back end in real time. If that’s true, that’s worrisome in itself since I’d like to see financial systems (especially the back-end systems) go through rigorous testing with every release.

It was disappointing, but not surprising, that Revolut wouldn’t accept my gift cards for funding. I would like to try other debit cards to see what works and what doesn’t, but I don’t really want to get my account locked again. If you try any interesting cards, please let me know the results.

Aside from the manufactured spend angle, I think that Revolut and the RevolutCard has great promise for travelers and/or those who need to exchange money with people in other countries. In the latter case, it seems close to perfect: no fees, instant transfers. If they ever get around to supporting US bank accounts, it will be especially useful. For travelers from the US, the card offers a free and easy way to get true Chip & PIN capability (most US credit cards now offer only Chip & Signature). I still recommend using a rewards credit card with no foreign transaction fees as your primary method of payment while traveling, but having the RevolutCard in your pocket for unattended terminals and for ATM withdrawals may make sense.

My recommendation right now is to wait until Revolut cleans up the bugs and adds support for US bank accounts. Why the caution? If you add money to your account, I can’t promise that you’ll be able to get it back. If you try Revolut anyway, please let me know how it goes.

Hi my name is Kathy . Your lack of success with a Staples prepaid card through Metabank. I have a Prepaid NetSpend Mastercard debitcard through MetaBank. It has a routing and account number associated with it and wanted to wire transfer international funds from an online casino directly to my Netspend Mastercard. The casino requests a SWIFT OR IBAN CODE for wire transfer but MetaBank doesn’t have a swift code. DO YOU THINK IM ASKING FOR TROUBLE TO REQUEST THE WIRE TRANSFER WITHOUT AN ASSOCIATED SWIFT CODE? NOW IM THINKING MASTERCARD MUST HAVE A SWIFT AND AN IBAN CODE. Do you know how or what department at Mastercard I could contact to load my card directly through Mastercard or associating a Mastercard Swift Code with a Mastercard prepaid card such as NetSpend? Hope Im not being presumptiuous to jump in on your website and discussion. –

Kathy aka itskathysnet in Salt Lake City.

WARNING DO Not USE REVOLUT

My card has been blocked for five days. In app support useless. You wait hours for response then referred to others who don’t respond

When I eventually got a guy he couldn’t confirm my money was still safe. No good at all . If I had been abroad relying on Revolut I would have been in trouble

I had same experience 🙁

Just returned from New York where I could not use my card with the pin they provided leaving me without cash.even though I had $700 on it. Support via app was terrible and would not give me an email,address to complain to. I have since found an address for them I will be complaining this ruined the last few days of my holiday. I gave used other prepaid cards before with no problems

Ugh. This should have been such a good product…

Laura it seems you don’t know how use the Revolut card. You can see your PIN via the app and change it easily.

If you see their Facebook page they have acknowledged recent problems from the post on 2nd April and stated what some of the problems have been that they do not have enough staff to help with support- I had no pun number attached to my card so changingthe pin was not an option in my case!

As Bort said on Feb 16th, now the fees are creeping in. I don’t mind paying fees for a service but I think it leaves people feeling a certain way about your business when you say no fees because you are trying to be attractive and then not soon after you realize you must charge fees to stay afloat. I’m abandoning the card now because of the fees. I might as well use my own debt card at this point because topping up in USD via debt card is now 3% and there is a 2% charge for ATM withdrawal after 500 pounds or the equivalent. I’m sure more fees will follow. Given that I’m moving to a place where cash is king, this becomes too expensive for me. I’d rather just be charged a yearly fee to use the card. But such is life. I’d been using it for small purchases with no issues but I wouldn’t trust it for larger amounts. Also I’ll note that EVERY time I topped up this card, my bank disabled my debit card. I’m also not able to use this card at any gas stations either. BTW, my verification document status has been “processing” for over a month and no way to get in touch with these people.

Hi !

I plan to open a Revolut account for my next holidays in Canada.

Would somebody know what fee I’ll be charged of for those operations :

French bank –> Revolut account, and then

Revolut card –> Canadian ATM

Revolut card –> Canadian shops

Thanks in advance

Revolut just rolled out some unwelcome changes, including a fee for ATM withdrawals over a certain amount each month (~$700 US) and a 3% fee for debit card loading. Info here:

https://revolut.com/fairusage

I’m not sure about fees to load from your bank to your Revolut account, but as long as you convert the balance to Canadian $ and keep your ATM withdrawals under the fee-free limit you should be fine.

Thank you very much for those informations and for your advices.

I’ll open an account !

I too wanted to love Revolut. However, it is very buggy. This seems like the kind of service that will be great in the future but right now, it’s tough to love. I’ve updated to the latest version as well and while they did overhaul the verification feature, it still doesn’t work and I think their manual verification process is unreasonable.

Financial apps should not be in the “good enough” for release category. It’s disturbing that a basic feature like withdrawing money works sometimes and then sometimes not or that they require verification for any real use but the verification system doesn’t work.

I hope they work these kinks out quickly. One the features I like the most (and hopefully it actually works), is being able to disable the card on our own. I hate that banks do this without warning and I don’t have any control over it. With this card, I would so that’s great.

…See though how I already don’t trust that a feature will work given the ones that currently don’t but should… no business should want that kind of doubt from customers.

I tried to withdraw with ACH today with the new Revolut app, but I still got an error. Anyone have any luck?

No luck for me either. I’m planning to do a small test withdrawal to CitiGold Checking to see if I get hit with a similar fee.

Just a note for you, Greg and all the folks checking this out the Day After Birdopocalypse… (1/9/2016)

Revolut’s website says that Revolut 2.0, the next big release is in just over 3 days.

I would wait until after that to try it. I am going to check it out myself since I have a could VGCs on the way (still, after a couple weeks) from Staples.

Might as well give it a shot, right?

Thanks Carl. Yes, it will be interesting to see if they’ve improved it enough to be worthwhile

Same as you. Wanted to love it, but the app is just so buggy it drives me crazy. Still, if you transfer between USD/EUR/GBP they have amazing rates. Your US based bank may charge a foreign exchange fee – but that’s a ridiculous american thing. I closed my US bank account for that reason. Transferring from my USD Canadian bank card works perfectly – no charges from anyone.

If they hired a decent developer to fix the app, and added a few more currencies, this thing would be incredible.

What Canadian bank do you use for your USD accounts? I tried to top up with my TD Canada Trust USD account but was told that the bank card can’t be used with the USD account, only with the CAD account.

[…] month I wrote about a new prepaid product designed for global travelers: Revolut. Revolut is both a smart phone app and a prepaid debit card. Theoretically, it’s perfect for […]

I also lost $20 on $370 withdrawal to Citi. They blame each other with no real help. Did you get any response?

Yes, they basically said “tough luck”. I’ll post a full update at some point.

I’ve made a swift from Brazil to Citi (bank-to-bank, not using revolut) and appeared less money than I had transferred. So maybe its citi fault. Any update in the issue?

UPDATE: My $150 withdrawal appeared in my checking account as $130. Revolut says that it must be a fee from my bank. Citibank says it must be a bank on their end. Revolut is still investigating.

May have just found another bug with their app…and a major one with their service in general. When I was signing up (which you MUST do from a mobile device – a little sketchy in and of itself – why no website sign ups?) in the section to enter promo/referral code, when I tried to type in the code, the keyboard on my iPhone covers the button which says “I Don’t Have A Code”. So as I began to type my code, the app thought I pressed the no code button and moved on to open my account with no promo.

So I contacted support. They deleted my account and said start over, they are no longer allowed to add credit to customer accounts (ouch!) but when I tried to sign-up again, it says their system already has my phone number registered to an account. Contacted support again. My account wasn’t deleted but only closed. Can’t re-open with same phone number. So, apparently, I can now NEVER have an account with them because of a bug in their software!

Users beware!

Thanks for the added warning. That’s not good

Bitcoin, or any crypto-currency works MUCH better and easier. Wallets have improved to the point where they work really well. There are no limits – you can send a million dollars worth of bitcoin across the world – the cost is minimal – less than a cent for any amount. It is very secure. You don’t give out your bank account information.

I pay my Dishnetwork bill, Overstock, movie tickets, etc. using bitcoin.

I know but you can’t do manufactured spending with bitcoin.

Very good analysis!