NOTICE: This post references card features that have changed, expired, or are not currently available

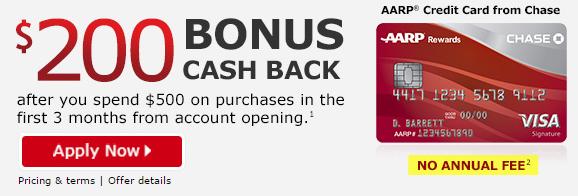

Chase is offering a $200 sign-up bonus on their no annual fee AARP credit card. You do not need to be a member in order to be approved for the card.

The Offer

$200 bonus cash back after you spend $500 on purchases in the first 3 months from account opening.

Cashback Earnings Rate & Info

This card earns cashback in the following ways:

- 3% cash back rewards on purchases at restaurants.

- 3% cashback rewards on purchases at gas stations.

- 1% cash back rewards on all other purchases.

Here is how the cash back is earned and tracked:

Your Cash Back rewards are tracked as points in this program. Each penny in Cash Back rewards earned is equal to 1 point. Your points can be redeemed for cash back or any of the other redemption opportunities provided through Chase. A minimum of 2,000 points is needed to redeem for cash back.

How to Apply

This offer has been added to the Best Signup Offers page. You can find the direct link there.

Never miss a Quick Deal, Subscribe here.

[…] $200 Sign-Up Bonus & 3X Categories with the AARP Credit Card from Chase […]

[…] $200 Sign-Up Bonus & 3X Categories with the AARP Credit Card from Chase […]

[…] $200 Sign-Up Bonus & 3X Categories with the AARP Credit Card from Chase […]

[…] $200 Sign-Up Bonus & 3X Categories with the AARP Credit Card from Chase […]

[…] $200 Sign-Up Bonus & 3X Categories with the AARP Credit Card from Chase […]

[…] $200 Sign-Up Bonus & 3X Categories with the AARP Credit Card from Chase […]

[…] $200 Sign-Up Bonus & 3X Categories with the AARP Credit Card from Chase […]

[…] Hat tip to Frequent Miler […]

You can actually redeem for Cash, Gift Cards or Travel – Not limited to just cash redemption.

Do you believe the 5/24 will apply to this card?

[…] Frequent Miler, you can now get $200 when you sign-up for the Chase AARP card and complete the minimum spending. […]

is this offer targeted to certain people? I can not find where to apply.

The link to the offer is on our Best Signup Offers page.

https://frequentmiler.com/best-credit-card-sign-up-offers/

Shawn, I received this offer the other day in snail mail. Do you have indepth analysis/thoughts on this offer? I understand it’s a good bonus and the catagories are interesting for everyday spend.

However this is a cashback card with no annual fee and not a points card where you could possibly leverage a higher return on specific loyalty program rewards. I am interested in hearing/reading your thoughts about cash vs. points options going into the new year. Do you think cashback is the way ahead for the near future?

Thanks in advance for anything you can add.

Tough age requirement on this AARP card. Sorry 18 year olds in AL and NE.

“You must be at least 18 years old to qualify (19 in AL and NE). An applicant, if married, may apply for a separate account.”

Does anyone know if the “points” earned can be combined with other UR points such as Chase Sapphire Preferred – similar to how Freedom points work? Thanks.

They are not Ultimate Rewards points, so they can’t be combined with any other UR points you have.

Hmm so they call it points but it’s only redeemable for cash?

Yeah pretty much. Each point is worth $.01 towards cash.