NOTICE: This post references card features that have changed, expired, or are not currently available

Yesterday morning, I received an offer to get up to 35,000 United miles with a personal loan from Prosper. The offer is for 1 mile for each dollar borrowed. Is that a good deal? Is it worth it to take out a loan just to get the miles? Could I take out a $35,000 loan, get 35,000 miles, and pay back the loan immediately so as to avoid interest payments? Let’s see…

Soft Pull

Applying for a loan from Prosper doesn’t lead to a hard pull on your credit report. Splashed all over the Prosper website are assurances that “Checking your rate will not affect your credit score.” However, according to forum posts found here, accepting the loan does affect your credit score. OK, so we can at least click through and see what the deal is…

What does it cost?

Most loans have closing fees. Prosper is no different. On their help page, found here, they list the following closing fees:

| Prosper Rating | Closing Fee |

| AA | 0.50% |

| A,B | 3.95% |

| C-HR | 4.95% |

If no other costs were involved, then one might consider paying a 0.5% fee to get miles. That would be like paying half a cent per mile. I would never suggest paying 3.95% or more, though. That would be like paying 4 cents or more per mile, plus you would incur a hard inquiry on your credit report. That’s a terrible deal.

My Experiment

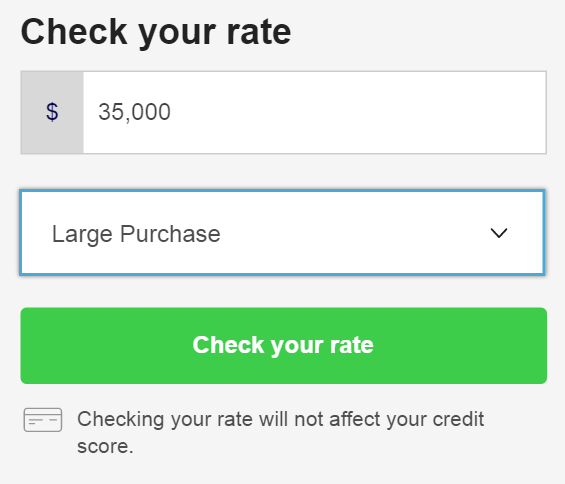

I was curious if I could qualify for that Prosper AA rating, so I clicked through to check my rate. Look how easy it is:

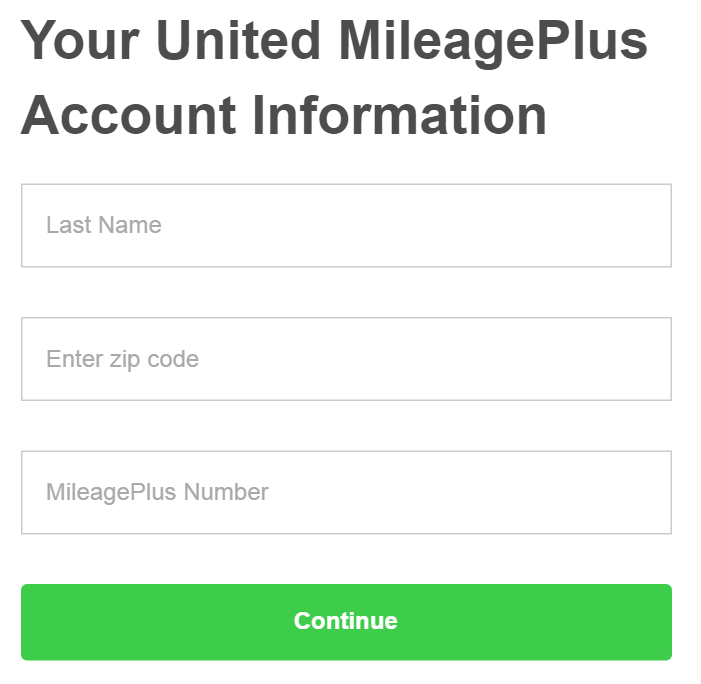

Oh, wait, there’s a bit more, but not much:

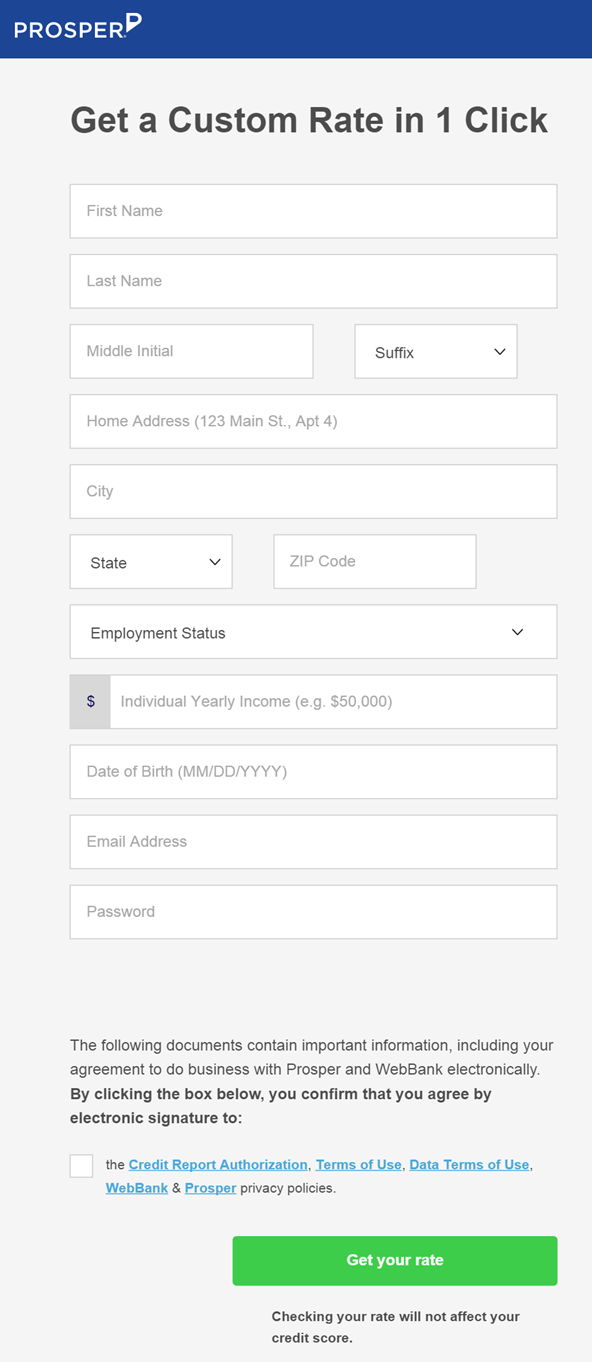

Then, “Get a Custom Rate in 1 Click”. Make sure to use the Tab key to go from one text box to another because if you use a mouse you will click more than once, and that would make a liar out of them:

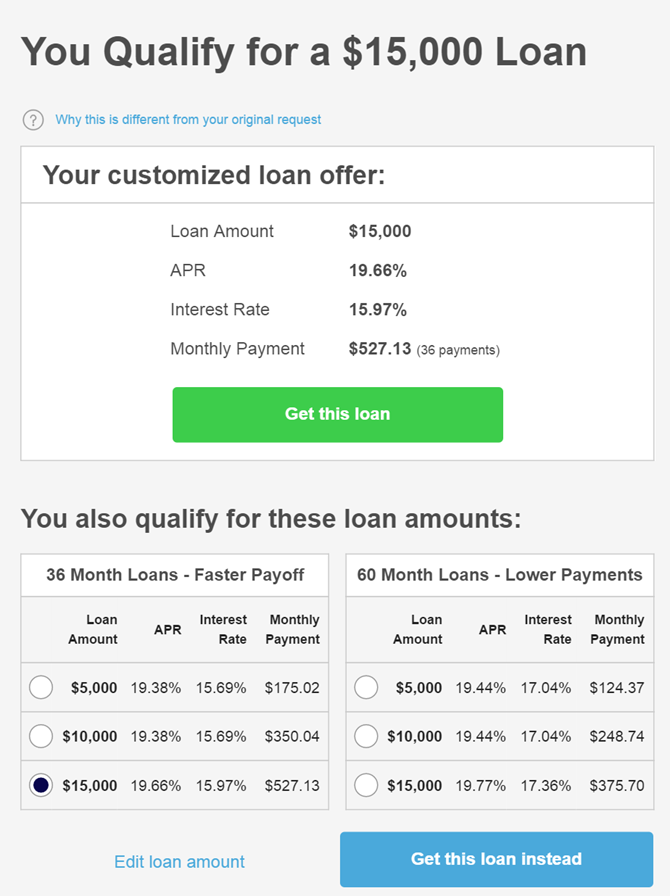

Then, finally, this:

OK, so they’ll loan me $15K instead of $35K. But, they still don’t show the closing fee!

Not to be daunted, I clicked “Get this loan”.

A few text boxes and clicks later, I finally got the answer I was looking for:

Origination Fee: $750, Amount Financed: $14,250

If we calculate the fee as a percentage of total ($15K), we get a rate of 5%. However, if we calculate it as a percent of the amount financed ($14,250), we get a rate of 5.26%. Either way, that’s a ridiculous amount to pay for a loan, especially if you’re just in it for the miles.

If I were stupid enough to go forward with this, I’m unclear whether I would get 15,000 United miles or 14,250. If we assume that I would get 15,000 miles, and that I would turn around and pay off the loan immediately so as to avoid interest charges, then my total cost per mile would be:

$750 / 15,000 miles = 5 cents per mile

Summary

Unless you somehow qualify for a Prosper AA rating, this is a terrible deal.

[…] Should you borrow money to get up to 35,000 United miles from. – Jan 27, 2016. Applying for a loan from Prosper doesn't lead to a hard pull on your credit report. Splashed all over the Prosper website are assurances that “Checking your rate will not affect your credit score.” However, according to forum posts found here, accepting the loan does affect your credit score. OK, so we can at. […]

Always be wary of a clause that forbids early payment (or does so at the scheduled expense rate, incurring the interest as if you had kept the loan out the entire time).

good detective work Shawn, echo the thanks…. Alerting us to likely bad deals out there, that’s a great service too in raising our guards, saving time & aggravation.

You’ve left out one other reason not to do this deal: It’s United. ‘nuf said.

I was offered a $20,000 loan for $800 origination fee. 4 cents per mile = still a terrible deal.

Thank you for taking the time to calculate this for us.

Next time I see this offer in the mail I’ll just sherd it right away.

Prosper is like LendingClub, and I invested $5k in play money to screw around with it. It’s amazing how many people willingly get themselves into these loans with terrible terms. But it’s at least easy and convenient to do it online, so that’s likely a driver. I will say that I’ve had TONS of welchers on their loans that I contributed to. And even though my interest is hovering around 8% after welchers I still don’t feel comfortable with people borrowing my money without paying it back so I’m drawing down my balance and will close out my account when I get to $0.

Not sure this post was worthy even of midnight pillow talk with wife.

Also, you and Gary crossed streams.

Interesting. I invest in Lending Club (Prosper competitor) and have had a few loans pay off immediately after funding. Always wondered what those borrowers were up to.

i saw the title and the answer was pretty clear to me, even without analysis…

I bet they are pricing the miles into your loan – try the same quote process in another browser and see if you get different rates.

Oops – not the same quote process, try for a regular quote without the miles.

Wait, so there is an origination fee AND a closing fee? I don’t think they’re the same thing. Which makes this a really really bad deal…

I’m pretty sure its just one fee. Still, it’s a bad deal.