NOTICE: This post references card features that have changed, expired, or are not currently available

Following Amex’s second wave attack on Bluebird and Serve cardholders, it may seem strange for me to write about options for buying Visa gift cards. After all, Bluebird and Serve are/were among the best vehicles for liquidating Visa and MasterCard gift cards. Shouldn’t I be writing more about options for liquidating gift cards rather than options for buying them?

Following Amex’s second wave attack on Bluebird and Serve cardholders, it may seem strange for me to write about options for buying Visa gift cards. After all, Bluebird and Serve are/were among the best vehicles for liquidating Visa and MasterCard gift cards. Shouldn’t I be writing more about options for liquidating gift cards rather than options for buying them?

Well, yes and no. I’ve recently covered options for unloading gift cards in a couple of posts:

- Bluebird Serve Birdpocalypse: How to liquidate remaining gift cards

- Connecting the dots: Prepaid cards that allow debit reloads

As I wrote in “Credit Card Spend in 2016 and Beyond,” the days of free and easy “manufactured spend” (the art of increasing credit card spend without spending more overall) are mostly behind us. We’re left now, for the most part, with two options for increasing credit card spend: 1) pay fees; or 2) incur risk. After all, someone has to pay the credit card transaction fees involved in manufacturing spend.

In the post, “Connecting the dots: Prepaid cards that allow debit reloads,” I showed how to find Bluebird / Serve alternatives. One thing that is unfortunately true about most alternatives is that they charge fees. At a minimum, expect to pay monthly fees and/or reload fees. For example, a number of cards identified in the post “Reload Cards with Free Bill Pay” have no monthly fees, but unlike Bluebird and Serve* they do charge $3.95 to $4.95 per $500 in-store reload. Without Bluebird or Serve, we’ve added about 1% to our manufactured spend costs (a $4.95 fee is approximately 1% of a $500 reload).

* Note: Some versions of Serve do charge monthly fees or reload fees. See: Complete guide to the many flavors of Serve. Which is Best?.

With costs for liquidating gift cards going up, it is important to identify opportunities to reduce costs involved in buying gift cards. In the Bluebird / Serve world, in which liquidating gift cards was free, many of us commonly paid $3.95, $4.95, or $5.95 for each $500 Visa* gift card we purchased. In other words, we paid on average about 1% in order to manufacture spend. Today, if we can buy gift cards for free (or close to it), then we can keep our overall costs down to prior levels. Rather than paying to buy Visa gift cards, we’ll pay to liquidate them.

* Note: For convenience, in this post I refer mostly just to Visa gift cards even though MasterCard gift cards are equally relevant.

Best options for buying Visa gift cards

The best options for buying Visa gift cards change regularly. Options for buying cards online or in-store come and go. Sometimes it is possible to recover all or part of a card’s fee by clicking through a cash back portal to buy gift cards. Sometimes not. Sometimes credit cards incur cash advance fees when purchasing gift cards. Usually not. Most Visa gift cards have PINs (useful for liquidating those gift cards), some do not.

To keep up with the ever changing gift card landscape, we maintain the following page on this site: Best options for buying Visa and MasterCard gift cards. It’s not unusual for us to update this page several times per week. When major changes happen in this space, we leave a comment on the page as well. If you’re interested in staying up to date, I highly recommend subscribing to comments on that page. Write something like “sub” and check the box that says “Notify me of follow-up comments by email.” Over the weekend, I completely reformatted the page to show key pieces of information more clearly: card fees, how to set PINs, whether or not cash advance fees might be charged, etc.

Among the options listed on that page, my current go-to options are:

- I order online through giftcards.com. At the time of this writing, portal rebates for giftcards.com top out at 1.5%. If you buy four $500 Visa gift cards, the total purchase price with shipping comes to $2035.25. A 1.5% portal rebate is based on the pre-shipping charge of $2027.80 and should come to $30.42. That more than covers the gift card fees and almost covers the shipping charge as well. In other words, with a 1.5% rebate, these gift cards are very nearly fee free. Keep in mind that you generally have to wait 60 to 90 days before portal rebates become payable.

- I do not buy gift cards from giftcardmall.com because they cancel all of my orders. Otherwise I would happily use my AT&T card for its 3X online shopping bonus.

- I order online from Staples.com. Staples.com sells $300 Visa gift cards, each with a $8.95 fee. That’s not cheap. And, unfortunately, portals do not pay out for gift card purchases made at Staples.com. That said, I’m happy to use my Chase Ink Plus card to buy these Visa cards since Chase Ink cards earn 5X points at office supply stores. Each $308.95 purchase results in 1,545 points. If I wanted to, I could cash in 895 of those points to reduce my net card fees to zero and still earn 650 points per $300 card (i.e. ~2.2X). That’s pretty good!

- I buy in-person… sometimes. I haven’t bought many gift cards in-person since my Serve cards were all frozen in January. However, I can’t pass up easy 5X point opportunities. Since both Chase Freedom and Discover are offering 5X at gas stations this quarter, I’ve made my way repeatedly to a numerically named convenience store that is conveniently coded as a gas station. The register allows purchasing Vanilla brand gift cards with a credit card.

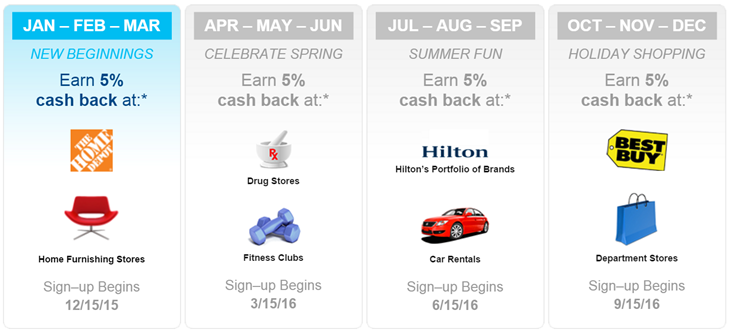

Beginning in April, my Chase Freedom cards will be finding their way to grocery stores:

Beginning April 15th, my Citi dividend card will make a few appearances at drug stores (note that you can’t sign up for a new Dividend card, but you can product change from another Citi card to the Dividend card):

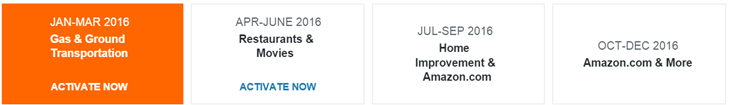

My Discover card, though, will stay home for the rest of the year:

I won’t use my Discover card at restaurants, movies, or Amazon.com because my Citi Forward card already gives me 5X rewards for those categories (sorry, but the Forward card is no longer available – you can’t get it by applying new or by product changing). I may use my Discover card online, though, in the 3rd and 4th quarters. At that point, I’ll hopefully be able to recreate this fun: Sears Quintuple Dip Results, and why I should have bet more on Discover.

UPDATE: As a reader pointed out, my Discover card is eligible for Double Cash Back for 12 months (through ~July). So, 5% cash back from Discover really means 10%. As a result, I will choose Discover over Forward for restaurants and movies in April, May, and June.

Metabank do not..Make sure to look on the back of the packaging..it will say if Meta or Bancorp….Because package is identical for both

subscribe

Bankcorp One Vanilla Visa and MasterCard work at the Post.Office..But Metabank do not..Make sure to look on the back of the packaging..it will say if Meta or Bancorp….Because package is identical for both

Swipe card ..Select debit…Enter any pin for first time use…Easy peasy… One vanilla visa / mc Bancorp only!!

I got $500 VGC issued by Sunrise Bank. Where does this one work? at WM or PO?

I know that:-

Bancorp works at PO

Metabank works at WM

What bout my VGC issued by Sunrise Bank, where can i liquidate this one to buy MO?

sub

sub

So I can buy this prepaid Vanilla Visa card using another credit card.and it not being turned into a debit transaction. What $$ amounts can you choose from..Does it work at. WM in Arizona?

Yes when you purchase gift cards in a store it never counts as a cash advance

Greg,

Any updates on purchasing prepaid cards via credit cards for 2017?

We try our best to keep this post up to date: https://frequentmiler.com/go/buy-visa-mastercard/

few questions:-

For Vanilla One Visa Debit cards:—-

1) Which Vanilla should be bought? There is one Non-reloadable with $5.95 fee and there is another Re-loadable version with $3.95 fee. Which one to buy and why that one? Kindly explain.

2) One Vanilla card, can i use it at WM to Buy MO? I tried but it kept on going to credit as soon as i swiped…..could not do so….any trick around that?

3) if WM does not work, someone said, PO is good to get MO with Vanilla. But wouldn’t i face same issue at PO where it will keep going to Credit instead of Debit like WM?

1) You should be able to find non-reloadable Vanilla Visas with a $4.95 fee. I’d recommend those. The reloadable versions usually cannot be bought with a credit card. If you can, the downside is that you have to register it before you can use it

2) No. WM doesn’t like Vanilla Visas as debit cards for transactions of $50 or more.

3) In my experience, PO works fine.

subscribe

sun

Thanks for great info. Sub.

Which card(s) do you use to use to purchase from giftcards.com

I like to use cards in which I’m working towards meeting the minimum spend requirements to earn a signup bonus.

[…] My current go-to options for buying Visa gift cards – A look at the best options currently available for buying Visa gift cards. […]

A problem with loading Visa Gift Cards that I bought from Giftcards.com on Jan. 29.

1) My new SERVE One VIP account was opened after the “Jan.8 BB/SERVE Kill”;

2) Tried two RiteAid stores on Feb. 27, both failed loading one $500 VGC from Giftcards.com (the cashier told the funding failed so it was void. Later, I checked the balance on Giftcars.com, the transaction activity showed -$500, b/c failed funding and void, the balance remained $500.);

3) Then tried KATE machine on Mar. 4, Sat., failed again and no receipt. Worse, I checked the balance again on Giftcards.com, this time the $500 was gone, the transaction activity was not shown up right away, next Monday, I called Giftcards.com, the Rep. told that it might take 2-3 days to see the transaction activity and unable to tell how soon the $500 will be refunded to the card.

4) As of Mar.10, today, the transaction shows -$500 at Walmart, balance is still $0, I called Giftcards.com again, I was told that at least it takes 7 business days, weekend excluded so at least 10 days to see the money refunded. I’ll keep updated.

I hope it doesn’t happen to you. I know such risk is a part of MS.

Tom, thanks for this detailed caution!

Tom,

Can you keep us up to date on how your issue is handled?

Update – My correction:

B/C I also did $500 from my PayPal Biz Debit Card, I didn’t know it was reversed/credited back to my PP account until tonight I found out from my PP activities.

When I loading at KATE, it didn’t print me any receipts. That one transition of the PPBDC loading was not shown on SERVE transactions.

I never had any problems with PPBDC loading in the past, not even once. I mistakenly thought the missing $500 was from the VGC.

Luckily, before I left WM that night, I complained about no receipts from the KATE, a staff opened the KATE machine and only one receipt was printed.

Tonight I checked the receipt again carefully,

be clear, the VGC $500 loading was actually successful.

Great to hear. Thanks Tom.

Has anyone actually gotten the cash back from iconsumer? I know it slow but I hate to put more spending until the pay what is showing in my account portal.

So asked what the limits for iconsumer. The answer is $2,500 limit per transaction including the fees.

I don’t think they’ve been around long enough for anyone to have been paid yet since it takes 90 days for cash back to become payable.

Do you feel comfortable in spending more money from giftcards.com through iconsumer portal ?

Even if we buy 5000 $ worth of gift cards per month , the payout will become approx 220$ after 3 months. And we need to spend 300$ out of our pocket till that time.

Do you think Iconsumer will be able to payout that much? They may come up with a clause like abusing the system and may deny payments. And its been available from June 2015 , so if we have reliable reports that we are getting good payments from iconsumer it will be huge risk.

I feel comfortable with it because the portal is run by the same people who’ve run iGive for many years.