NOTICE: This post references card features that have changed, expired, or are not currently available

UPDATE: This post is out of date. Please click here for up-to-date coverage of paying taxes by credit card, debit card, or gift card.

It’s tax season (“Wabbit season!”) which means that it’s time to answer the age old question: “Should I pay federal taxes with a credit card?” Whether you owe federal taxes or just like the idea of giving Uncle Sam a short term loan, the answer is probably yes. Details below.

Background

Here is some key information you’ll need to know about paying taxes with credit or debit cards:

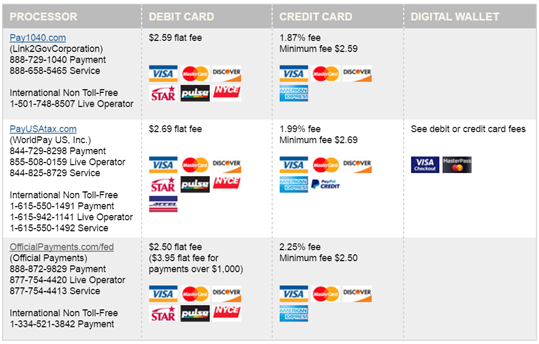

Credit card fee 1.87% to 2.25%: The IRS maintains a list of companies that accept credit and debit cards towards tax payments. You can find the current information by clicking here. Currently there are three separate payment processing companies on the list. At the time of this writing, debit card fees range from $2.50 to $2.69 per transaction and credit card fees range from 1.87% to 2.25%.

Two payment limit (per processor): The IRS maintains a table of frequency limits for paying taxes via credit or debit card (found here). In general, they say you can make up to two payments per tax period per type of tax payment. For example, you can make 2 payments every quarter to your quarterly estimated taxes, and you can make 2 payments every year to your annual taxes. Important: In my experience, these limits are enforced per payment processing company. That means that you can really make up to 6 payments per tax period per type of tax payment. An IRS advisor I spoke with several years ago did not think that there would be any problem with making more than 2 payments by using different processors. Since then, I have made more than 2 payments per tax period many times and never had any issues. That is, of course, just my own personal experience. I can’t guarantee that your outcome would be the same.

No cash advance fees: I’m often asked whether credit card companies charge cash advance fees when paying taxes by credit card. The answer is no. All three payment processors agree (via their FAQ pages) that the payment is treated as a purchase not a cash advance. You can find FAQ info here, here, and here.

Fees may be deductible: The IRS page says the following:

- The fee is deductible for personal tax types as a miscellaneous itemized deduction. However, only those miscellaneous expenses that exceed 2 percent of the adjusted gross income can be deducted. For more information, refer to Publication 529, Miscellaneous Deductions.

- For business tax types, the fee is a deductible business expense.

View tax payment history: Once you’ve made payments through online processors, you may want to see proof that the IRS received the amount you sent. You can view your past payments at any time by signing up with this government website: www.eftps.gov/eftps/. Full details of how to signup and view your past payments can be found here.

Top 5 reasons to pay federal taxes with a credit card or gift card

1. Profit

A number of credit cards earn cash rewards greater than 1.87%. You can find the top options here. The best of the best is the Discover It Miles card which earns 1.5% cash back and doubles all cash back after the first year of card membership. So, if you have the card and you’re still in your first year of card membership, then you’ll make a profit by paying your taxes with your credit card. Since you’ll earn 3% cash back on both the base tax payment and the processing fees, your profit should be approximately 1.186% of your tax payment.

Example:

- $10,000 tax payment + 1.87% fee = $10,187

- Cash back earned at 3% = $305.61

- Profit = $305.61 – $187 = $118.61 (1.186% of $10K)

2. Meet minimum spend requirements

If you recently signed up for new credit cards, chances are good that you have to spend thousands of dollars in order to earn the associated signup bonuses. Paying taxes is a fairly cheap and easy way to accomplish that.

3. Buy miles cheaply

Several credit cards offer up to 1.5 miles per dollar for spend. In these cases, a 1.87% tax payment fee means that you can essentially buy miles for 1.22 cents per dollar.

Example:

- $10,000 tax payment + 1.87% fee = $10,187

- Miles earned at 1.5X = 15,281

- Cost per mile = $187 / 15,281 = 1.22 cents per mile

Cards that offer 1.5X airline miles per dollar:

- Chase Freedom Unlimited (New): Earns 1.5 Ultimate Rewards points per dollar for all spend. Pair with a premium card (e.g. Sapphire Preferred, Ink Plus) to transfer points to several airline or hotel programs. This card is now available to sign-up over the phone or to product change from another Chase card.

- Amex EveryDay Preferred: Every billing period in which you use the card 30 or more times for purchases, you get 50% more points. So, even though you’ll earn just 1X base points in paying taxes, you can earn a 50% bonus just by using the card frequently. Points can be transferred to a large number of airline programs.

- Chase MileagePlus Club: Earns 1.5 United miles per dollar for non United airlines spend.

- BOA Virgin Atlantic World Elite: Earns 1.5 Virgin Atlantic miles per dollar for non Virgin Atlantic spend.

4. Earn valuable big spend bonuses: elite status, free nights, companion pass, etc.

Many credit cards offer bonuses for meeting high spend thresholds. You can find a comprehensive list here: Best big spend bonuses. Here are a few examples:

- Citi Hilton HHonors Reserve: Spend $10,000, earn a free weekend night.

- Amex Delta Reserve: Spend $30,000, get 15,000 bonus miles plus 15,000 Medallion Qualifying Miles (towards elite status). At $60,000 spend, get another 15,000 bonus miles and 15,000 Medallion Qualifying Miles.

- Chase Southwest cards: With Southwest, when you earn 110,000 points in a calendar year (including points earned from credit card spend) you get a companion pass good for an unlimited number of flights for the rest of that year and all of the next calendar year.

- Chase Ritz Carlton Rewards Visa: Earn Platinum status with $75,000 in annual spend. After that, you may be able to buy back status annually for 40,000 points (see this post for details).

- Barclaycard JetBlue Plus, or JetBlue Business (New): Spend $50,000 and get Mosaic status which offers free changes and cancellations; free checked bags; expedited security; early boarding; free drinks; enhanced point earnings; and 15,000 bonus points upon qualifying.

5. Liquidate Visa/MasterCard gift cards cheaply

Visa and MasterCard gift cards are debit cards. As such, they qualify for low flat fees for debit tax payments: $2.50, $2.59, or $2.69 (depending upon the tax processor you use). In other words, your cost to liquidate $500 gift cards will be approximately half a percent (0.5% to 0.54%). That’s pretty cheap.

If you use $500 Visa/MasterCard gift cards, then you can pay the following amounts:

- Pay1040.com ($2.59 fee): Make a $497.41 payment.

- PayUSAtax.com ($2.69 fee): Make a $497.31 payment.

- OfficialPayments.com ($2.50 fee): Make a $497.50 payment.

The biggest problem with this is the IRS imposed 2 payments per processor limit. Online, this means that you can liquidate no more than 6 gift cards per type of tax payment. Via phone, though, you may find a tax processor willing to accept multiple debit cards for a single overall payment. That’s always seemed like too much of a hassle for me, but if you try it, please report back your results via the comments below.

UPDATE: Reader Charles reports that OfficialPayments accepts multiple gift cards via phone. His last success at doing so was just last week: March 9th 2016! FYI, when you make multiple payments over the phone, you do pay the $2.50 fee for each gift card.

See also: Best options for buying Visa and MasterCard gift cards.

[…] According to reader Charles, OfficialPayments treats Vanilla brand gift cards as credit whereas the other processors will treat them as debit. […]

Question: If I use my Amex Business Platinum to pay my estimated taxes- would such a payment of $5000 qualify me for 5x bonus points?

If you pay $5,000 or more in estimated taxes with your Business Platinum card, you’ll earn a 50% point bonus. That means you’ll earn 1.5 points per dollar.

Note that you can’t include the card processing fee in the total since that is usually charged separately. In other words, you might think that you could pay $4910 in taxes since the 1.87% fee would push you over $5,000, but in reality, you’ll have one charge for $4910 and another (the 1.87% service fee) for $91.82.

What if I pay more then owe? Will I then just receive back the difference as a check from IRS?

Yes a check or direct deposit

I have a question. How do you report tax you paid using these online companies when you file your tax return?

Will IRS send you some document showing that you paid extra tax?

Thanks,

No. The IRS will not send a document to you. You keep track of your estimated payments. I usually print out my confirmation email and stick it in my tax file. When you prepare your tax return, enter in your software (or give the info to your tax professional) the date and amount of your estimated payments.

Is there anyway you can pay them after you complete filing income tax and find out you own them money?

Yes, you can pay taxes online after filing your taxes.

If I use AMEX Platinum CC to pay taxes, does AMEX count as purchase since lately they do not count as purchase for GC purchases and took back bonus points?

Thanks

Yes paying taxes is fine. To be clear: they do count gift cards as purchases, but the terms of their signup bonuses say that you can’t meet the requirements with gc purchases, so they may revoke the signup bonus in that case (but you would keep points earned for spend)

I opted to pay and liquidate a $200 Amex GC via Pay1040 yesterday for a $3.67 fee even though I won’t owe any taxes at all for 2016. I believe I accidentally had it applied to 2015 taxes though. Hope that doesn’t cause an issue. When can I expect to receive this $196.33 back? I hope there isn’t any trouble trying to get it back. Thanks

Normally, after you file taxes the IRS will send you a refund. If you applied the payment to 2015, I’m not really sure what will happen. My guess is that the IRS will figure out that you overpaid for 2015 and will refund the total.

So Amex GC is definitely processing as debit?

Can I make a tax payment even though I dont owe any tax? Will the amount paid now will be refunded when i file my taxes later in March 17?

Yes, you can, and yes it will be refunded. Make sure to include whatever you pay now in your tax forms where you show the amount withheld

DP : I tried to use a registered Style Everywhere Visa (Metabank) gift card from OfficeMax today on the Official Payments website and received an error message. I went ahead and used a Vanilla Visa (Bancorp) gift card on the OP website and it was processed successfully.

Thanks for the data points Charles!

I recently tried to use Visa (Metabank) gift cards from Office Max/Depot to pay taxes through Official Payments but was unsuccessful. They may now be hard coded to not work at Official Payments.

Thanks for that data point. Curious if you registered your name and address with your gift cards first?

Yes, the cards were registered. Also, these cards would NOT work for buying money orders at USPS. They DID work at Walmart for buying money orders. Vanilla Visa gift cards by Bancorp will work with OP.

Would the official payments method work if you have a bunch of the Staples rebate VGCs (which actually has a name embossed on each and every card)?

I ask because I have them with family members’ names on them… would official payments care if I’m paying for “Tim Doe” using cards with “Jim Doe” “Janet Doe” “Tim Doee” etc?!

Trying to get rid of all these dang $15-20 VGCs

Seriously? Save yourself the hassle and just load the cards to your Amazon GC balance.

You would be charged $2.50 for each gift card. That’s a huge fee as a percentage. I wouldn’t recommend it.

[…] For full details, please see: Top 5 reasons to pay federal taxes with a credit card or gift card. […]

[…] Pay Federal Taxes: Fees start at 1.89% for credit cards. Over-payments, if any, will be refunded after you file your year end taxes. For full details, please see: Top 5 reasons to pay federal taxes with a credit card or gift card. […]

[…] For full details, please see: Top 5 reasons to pay federal taxes with a credit card or gift card. […]

DP: 9/14/2016 OFFICIALPAYMENTS worked with USB GC. Used 9 of them in one phone call. However, they went as 9 separate payments. Not sure if IRS would like it 🙂

Datapoint: Official Payments will only run OneVanilla Prepaid MasterCards as a CREDIT with the higher fee (2.25%). Pay1040.com and PayUSAtax.com will run them as DEBIT.