NOTICE: This post references card features that have changed, expired, or are not currently available

Updated 3/15/2017

If you’re interested in applying for the Chase Sapphire Reserve card, or really any Chase card, what follows is a step by step guide designed to help ensure approval…

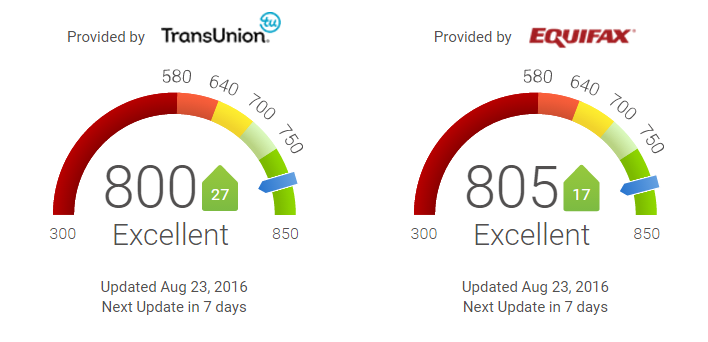

1) Check your credit score

There are many ways to check your credit score for free. Here are a few easy options:

- Discover offers free FICO credit scores from Experian for customers and non-customers alike

- Experian offers free FICO credit scores via their phone app and via their freecreditscore.com website

- Many credit card companies offer free credit scores. Simply log into your online account and click around until you find it 🙂

- Many websites offer free estimated (FAKO) scores

If your credit score is below 700 then you are probably better off working towards improving your credit score rather than signing up for new cards.

Continue to next step if your score is Very Good or Excellent:

2) Determine your 5/24 status

If you sign up for lots of credit cards, you may be subject to Chase’s dreaded “5/24 Rule”. Chase will frequently deny applications when an applicant’s credit report shows 5 or more new cards in the past 24 months. This total includes accounts in which you are an authorized user and includes accounts from other banks.

You can determine your 5/24 status by viewing your credit report (I use the free website Credit Karma to do this) and counting all credit cards that show an open date of two years ago or less. You should include cancelled cards in your count as well. Note that inquiries are not part of the 5/24 calculation.

For detailed instructions see: How to count your 5/24 status.

If you have 4 or fewer new cards on your credit report, then you should be good to go! There is no need to read further. You can signup online or in-branch. Either way, your chance of success should be pretty high.

Please click the “Credit Card Offers” tab on the Frequent Miler menu bar to view credit card offers.

If you have 4 or fewer new cards after subtracting out cards in which you are an authorized user, then you have a good chance of success after calling for reconsideration. In other words, you are likely to get denied initially, but you can then call reconsideration at 1-888-270-2127. If the agent tells you that your application was denied due to too many accounts in the past 24 months, then point out the accounts in which you are an authorized user and ask that those not be considered. You may have to call a few times (and/or ask for a supervisor) to find a person willing to help.

Continue to next step if you have opened 5 or more accounts in the past 24 months:

3) Try to get pre-approved

Many readers have reported getting approved for the Sapphire Reserve card despite being far over 5/24. Most of these readers reported that they went in person to Chase and learned that they were pre-approved.

Here’s how to learn if you are pre-approved:

Visit a Chase bank. Tell the banker that you are interested in applying for the Sapphire Reserve card but you want to check first to see if you are pre-approved. If so, apply!

NOTE: A banker who knows you may be willing to check your pre-approval status over the phone.

Via a personal conversation with Doctor of Credit I learned that online approvals may not help circumvent 5/24 rules. However, if you want to take a chance and look for online approval anyway, here’s how:

- Check online with Chase. Chase has a website (here) where you can check to see if you are pre-qualified for any offers. Unfortunately, this site rarely shows anything worthwhile. It’s important to note that the online tool may not show that you are pre-qualified, but a banker may see that you are.

- Try the CardMatch Tool to see if you are pre-qualified for any Chase offers. Like the Chase site mentioned above, if you don’t find that you are pre-qualified through this site, you might still find that you are pre-qualified if you talk to a Chase banker. Disclosure: The CardMatch Tool link is an affiliate link. If you click through that link and apply and are approved for any cards on the CardMatch Tool site, I will be paid a commission.

Continue to next step if you are over 5/24 and you are not pre-approved for the Sapphire Reserve card:

4) Join Chase Private Client

UPDATE 12/15/2016: Private Client status can help with approvals, but it is no longer a silver bullet for getting around 5/24.

This is one of those “easier said than done” kind of things. Chase Private Client status is great in lots of ways (details here), but getting that status may or may not be an option for you. Here are a few options:

- Have $250,000 on deposit with Chase. This includes checking accounts, savings accounts, and investment accounts. While I haven’t tried it, it should be possible to switch an un-managed retirement fund to Chase in order to qualify.

OR: - Convince a Private Client banker that you plan to deposit $250,000 or more with Chase.

OR: - Open a joint account with a current Private Client member. This should automatically give you Private Client status.

Private Client members seem to be mostly immune to 5/24. I write “mostly” because most readers with Private Client status have reported success with Chase applications despite being over 5/24, but a few have reported otherwise. Once you get Private Client status, you can apply online or in-branch. Even if you’re not immediately approved, it should now be possible to get approved by calling Chase’s reconsideration line: 1-888-270-2127.

Please click the “Credit Card Offers” tab on the Frequent Miler menu bar to view credit card offers.

Continue to next step if you are over 5/24, you are not pre-approved for the Sapphire Reserve card, and you cannot get Private Client status:

5) Wait to dip under 5/24

If you stop applying for new cards for a while, your “new” accounts will eventually become old (as in, older than 24 months). While you’re waiting, you can still rack up lots of points by signing up for a bunch of business cards that don’t show up on your personal credit report. Please see: Curing 5/24.

Don’t call until denied

Most people who apply for the Chase Sapphire Reserve card have reported getting a pending decision. For example, they may be told that a decision will be made in 7 to 10 days. While many people like to call the reconsideration line (1-888-270-2127) to speed up the process, I recommend waiting.

When you apply for a card, you essentially have three chances for approval: 1) automated instant decision; 2) automated decision after application goes pending; and 3) reconsideration.

Those who call for reconsideration before step 2 is complete force Chase to bypass that step. It is possible that a recon agent will deny an application that would have been approved by the the automated process in step 2.

If you wait, you have an extra chance of approval. If that process results in a denial, you can still then call 1-888-270-2127 to try to overturn the decision. In fact, I recommend calling several times if the first time isn’t successful.

No Guarantee

The suggestions listed above are suggestions that I think will help you get approved for the Sapphire Reserve card (or any Chase card, for that matter). That said, I am not in any way affiliated with Chase. I have no inside knowledge of their processes. And, it is my understanding that many factors beyond your credit score and 5/24 status are considered when evaluating a credit card application.

In other words, while I believe that the suggestions shown above will help, I can’t guarantee success. Not even close.

Helpful Links

- Best credit card offers

- Chase Sapphire Reserve Complete Guide

- Introduction to Flexible Points Programs

- Getting to Know Ultimate Rewards: Earning Points

- Getting to Know Ultimate Rewards: Using Points

- Getting to Know Ultimate Rewards: Transferring Points

Great post¡ thank you.

I applied for the RESERVE. I called today and they told me that I would be getting a letter from Chase asking for a proof of address. Is that a good sign?

I don’t think it is good or bad. It just shows that they couldn’t confirm your address through public records, so they’re going to ask you to mail in proof.

Applied 1/10/17 and got the pending 7-10 days note. It has been 14 days and no notification from Chase. I am under the 5/24 rule. Any thoughts on call the recon line at this point? I have pretty high limits with my other Chase cards that could be lowered for this card.

I’d only recommend calling if you need the card right away… or if you’re very impatient 🙂

Thanks! I will just wait. It just seems like 2 weeks is a long time to not hear anything.

Applied for CSR, 1/10/17, got pending notice. Wait 7-10 days. Should i just wait for either an acceptance/denial letter before I call recon line? I know some have called before, while some have waited. Just thought i see if it has changed at all since this post, whether it matters calling right away versus waiting. Appreciate.

I recommend waiting because calling means skipping the possibility of an automatic, off-line, approval.

I applied on the 9th and I also got the pending notice so I waited until Saturday the 14th to call 888-270-2127 and after being put on hold a couple of times after answering what seemed like the same questions I put on the application I was approved. Just had to move 25k credit line off my 57k IHG card….

Happy Happy Happy 🙂

Folks,

CSR appl. denied 8/20/16 because I was beyond 5/24.

Waited til 12/28/16 and until I was below 5/24.

Applied online.

Approved after 36 hours with 25K initial limit.

Credit Score: 750, annual income 120K, no late payments on other cards (CSP, United Mileage Plus, and Freedom), credit history less than 2 years (!!; lived in Europe for many years), home owner in CA.

Thought you might like to know.

Good luck everyone.

If denied for the 5/24 rule, how soon can you apply once the fifth account is out of the 5/24 window? Example, if the oldest account was opened on Dec 1st, 2014, are you already 4/24 in the system on December 2nd or you should wait longer? Even waiting until you have 3/24?

I’d recommend waiting until the next calendar month (January, in your example). Some people have reported that they tried within the same month but were still denied for 5/24.

Got denied with exactly 5/24 excluding AU. Tried to discuss it with the rep but wouldn’t budge. Bummer that even being on the cusp does not help.

Was told 5/24 does not apply, they just thought too many cards were applied, which is 5 in 24 months.

Data Point more than anything

I applied with a banker last week. Got the denial letter today for 5/24 rule. I’m at 4/24 with out AU card and asked the lady to look at my credit report again. She said I had 7 cards. 2 of them were more than 2 years old, I was AU, and I even removed them from my report before applying. I pointed out that it was more than 2 years but then she pointed to the other 5 cards. I told her that I’m an AU on one of those and it shouldn’t count. I had even removed myself as AU 2 months ago for this. She said, “we consider all accounts on your credit.” She was incredibly unhelpful and wouldn’t budge. I’m waiting to hear back from my banker to see if she will have better luck. She was even the one that encouraged me to apply and said the AU shouldn’t count.

You can also simply try calling again and ask for a supervisor if the first person doesn’t budge

[…] How to get approved for the Sapphire Reserve 100K offer [NEW] […]

[…] the post “how to get approved for Sapphire Reserve 100K offer” I suggested that people who have signed up for 5 or more cards with any banks in the past […]

Called reconsideration. They said I had over 20 cards open in the last two years. Knew I shouldn’t apply but couldn’t help myself. I am out of the country but will check with a Chase banker when I get back.

[…] Christopher wrote: […]

[…] The first challenge is to get approved for the card: How to get approved for the Sapphire Reserve 100K offer. […]

Great post, Greg! I realize there is not a way to positively know how long the 100,000 point offer will stay around, but do you have a “best guess” on how long it might last? There are six of us planning a trip to Italy in Sept/Oct 2017 and it would be wonderful to still have the Priority Pass Select available without having to renew the card (which most probably won’t do). My friends are not travel hackers, so I’m in charge of making recommendations on earning points. Should we jump now or is it safe to wait? If we do wait, does Chase usually give notice of when it is pulling the offer? Thanks so much for your advice!

I think we’re likely to get some warning. Affiliate blogs are usually told that something will change on a given date, but they aren’t told what exactly. So, at that point I’m sure there will be many posts saying something like “This may be the last chance for 100,000…”

In other words, I believe you can safely wait it out a bit.

I am happy that I am able to get the card approved for my dad. He only opened one card within the past 24 months. 100,000 Ultimate Rewards points on my way. Yeah!

Both me& my buddy walked into Chase and some to a personal banker about the sapphire reserve card. He checked the system to set of we pre-approved and born of us were, even though we are both over 5/24 easily. My approval came right away after he entered some info on his computer. My buddy had a pending and it took literally 2 mins for him to call and get it approved. Applied on Monday and received card on Thursday via UPS urgent delivery.

Sorry about typos, but was killing time waiting on the tarmac.