NOTICE: This post references card features that have changed, expired, or are not currently available

My pick for the single best all-around travel rewards card is the Chase Sapphire Reserve Card. No other single card offers as good of a combination of rewards (3X travel & dining; 1.5 cents per point travel value) and perks (lounge access, primary car rental coverage, etc.). Plus, cardholders can add other cards to their wallet to earn more Ultimate Rewards points with no additional annual fees: Chase Freedom Unlimited (1.5X everywhere); Chase Freedom (rotating 5X categories); Chase Ink Cash (5X office supply purchases, phone, TV, and internet). For more, see: The BEST travel rewards card.

As good as the Sapphire Reserve card is, it is missing some key perks found on similar cards. Here are the perks I miss most…

Visa Infinite Discount Air Benefit

Even though the Sapphire Reserve card is a Visa Infinite card, it does not include the Visa Infinite Discount Air Benefit found on other Visa Infinite cards such as the Chase Ritz Carlton card, or the CNB Crystal Visa Infinite card.

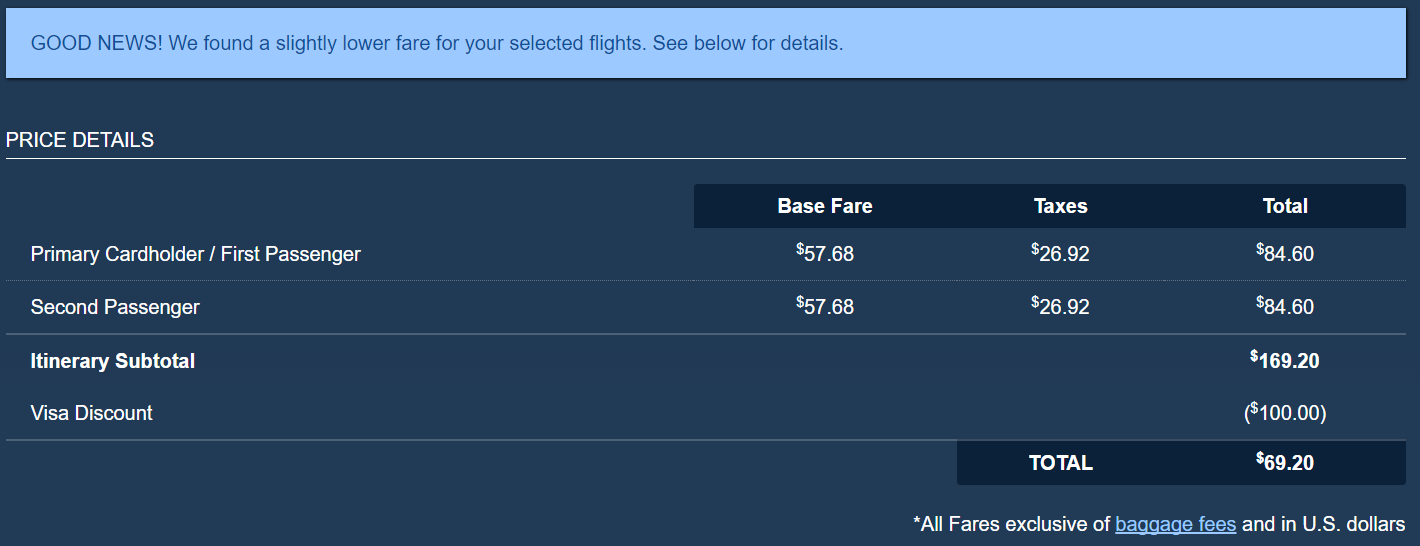

This benefit saves you $100 when you book 2 to 5 people on a round-trip domestic economy airline ticket. As I’ve written about before, the savings can sometimes be extreme. For example, yesterday I found round trip flights between Los Angeles and Vegas that were priced at $85 each. Using this $100 discount, it’s possible to buy two tickets for $70 total:

Gogo Inflight Wi-Fi Benefit

Two Visa cards, that I know of, offer 12 inflight wi-fi passes per year: US Bank FlexPerks Visa, and the CNB Crystal Visa Infinite card. The Amex Business Platinum card has an arguably even better benefit: It offers 10 passes each calendar year, but unlike the Visa passes, these work on international flights!

United Club Access

Yes the Sapphire Reserve offers Priority Pass Select lounge membership. And, yes, it is the good version of that membership: it allows you to bring any number of guests in free with you (up to any limit imposed by the lounge itself). But, despite Chase’s partnership with United, the Sapphire Reserve does not provide any form of United Club access. The card also does not provide access to AA or Delta clubs, but that’s hardly surprising given that Chase doesn’t partner with AA or Delta.

Meanwhile, the following competing cards offer access to AA, Delta, and United clubs as follows:

- Amex Platinum cards (business and personal): Free access to Delta clubs when flying Delta same-day. No guests permitted free.

- Amex Delta Reserve card (business and personal): Free access to Delta clubs when flying Delta same-day. No guests permitted free.

- Chase United MileagePlus Explorer Card (business and personal): 2 United Club passes per year

- Chase United MileagePlus Club Card: United Club membership gives free access to United clubs for cardmember and travel companions.

- Citi AAdvantage Executive World Elite MasterCard: Free AA Admirals Club access for both primary and authorized users and their travel companions.

Hyatt Elite Status

Amex Platinum cards offer free SPG and Hilton Gold status, just by being a cardmember. And the Chase United MileagePlus Club Card similarly offers Hyatt Platinum status. I think that the Sapphire Reserve ought to at least offer low level Hyatt status automatically (soon to be named “Discoverist”), and mid-tier status (“Explorist”) with high spend. See also: 5 things I hate about World of Hyatt.

Reader Input

What perks do you think are missing from the Sapphire Reserve card? Comment below.

Also to note: the CSR doesn’t have access to a Visa Infinite benefits portal, which is available to other Infinite cards (such as here). The concierge service is available only by phone (+1-312-800-4290) or email (concierge [at] myvisaconcierge[.]com). I inquired about the portal, and got this reply:

Thank you for having Visa Infinite Concierge assist with your request for benefits portal clarification. At this time, Chase Sapphire Reserve credit cards do not have a benefits portal. We understand the confusion this may have caused.

Actually, the CSR card I received in March 2017 does have access to the Visa Infinite benefits portal and concierge service; my parents have already returned from the trip the Visa Infinite concierge booked for them, and the travel points are in my account.

All I want is no annual fee on the AU cards. With option to pay for Priority Pass membership if they want.

That’s a great suggestion.

My strategy was simply to app for the RCR card and Explorer card to fill in those holes.

When banks dream up new cards, there’s always a design budget to work with, be it spend rewards, spend perks (e.g. visa discount air), or intrinsic perks (e.g. lounge access). I’d prefer cards be great in one category than mediocre in three. A scenario where you have a great reward card like the CSR and a couple cards that have low rewards but great intrinsic perks make great combos. You can think of intrinsic perk centric cards like the MileagePlus Club as basically a paid membership.

I like the card the way it is. Asking “what if..” doesn’t help anyone.

You should write an op ed for Bloomberg Businessweek

I have the JPM RC CC but haven’t had a chance to use the $100 off air travel benefit. They do not support SWA or some other LCCs, only the big guys. Does domestic = Hawaii, Alaska and other US territories?

Yep, Hawaii and Alaska are included. I don’t think other US territories work though because the terms state: “This offer is valid only for round-trip travel between cities within the 50 United States of America with participating airlines at a commercial airport.”

Merrill + no fee card offers 12 Lounge club passes free and if you spend 50000 $ it will offer delta club access .

I can’t find info about the 12 lounge club passes online. Do you know where I’d find that?

https://www.loungebuddy.com/blog/lounge-club-membership/

Its 10 free visits and 27$ for additional visits.

Check DOC’s post too. Just got it approved for this.

Amex SPG offers boingo and gogo for free.

Yes SPG offers free Boingo internet, but not Gogo