NOTICE: This post references card features that have changed, expired, or are not currently available

Is Kickfurther a good way to increase credit card spend and earn a profit? I’ve been testing out Kickfurther for over a year now. Let’s see how I’ve done…

Background

Kickfurther is a platform that lets companies seek funding from the Kickfurther community by offering a return on investment (such as 8% profit in 10 months, for example). Technically, these offers aren’t loans. When you invest in a Kickfurther offer, you are actually buying inventory that is then sold on consignment by the company seeking funds. With Kickfurther, you will earn a profit with each offer that you fund as long as the “borrower” pays out as promised. A nice perk for the points & miles crowd is that Kickfurther allows funding by credit card and, in my experience, it is never treated as a cash advance. Regardless of how you fund these offers, Kickfurther charges a 1.5% fee to withdraw the paid back funds to your bank account.

My Experience To-Date

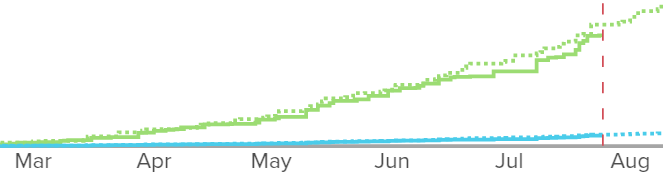

I first wrote about Kickfurther with “My half-baked Kickfurther Review” and then followed up with “Kickfurther review 2. Manufacturing profit and spend.” Even with the second review it was too early to say whether my Kickfurther investments were panning out. But, at the time, things looked good. I published this chart showing results from my Kickfurther investments:

The green bar, above, seemed to show that actual payouts were tracking nicely with expected payouts. So I continued to invest in new Kickfurther offers. Over time, though, more and more offers failed to pay on time. Some were outright cancelled.

Kickfurther no longer provides a chart like the one above, but they now have better data reporting. I threw my current results into a spreadsheet and found the following current status of the consignments that I’ve funded to-date:

Out of 62 consignments that I partially funded:

- 1 was immediately cancelled and fully refunded (i.e. I simply got my money back)

- 28 completed successfully (I earned the expected payout)

- Of the 33 incomplete, 19 have issued partial payments to-date

Some of the above numbers are from recently funded consignments and therefore are too new to have paid back yet. So I filtered to “old” consignments (those funded 12 months ago, or more).

Out of 19 12-month-old (or older) consignments that I contributed to:

- 13 completed successfully

- For the other 6:

- 4 are still paying but very slowly

- Kickfurther has taken legal action with the other 2 to try to recover some of the funds

- The 6 have paid, on average, 27% of the amount I invested.

If we optimistically assume that the 4 still paying will eventually complete successfully, then I’ll end up with the following success rate: 17 out of 19 completed (or may complete) successfully = 89.5%.

Or, worst case would be if the remaining 6 all fail to pay anymore. Then we have only 13 out of 19 completing successfully, and the others completing 1/4th of the way. Let’s call that 14.5 out of 19: 76%

So, my success rate is somewhere between 76% and 89.5%. That’s awful.

My newer investments are looking potentially better. Of those that I’ve invested in since August 1, many have completed successfully and most of the rest are paying out regularly. Still, as I saw earlier, interim results are far from a perfect predictor.

Based on my results to date, if nothing else was changing, I’d strongly recommend against investing in Kickfurther. But, things are changing…

Kickfurther’s New Model

The folks at Kickfurther haven’t been any happier than the rest of us about how poorly the portfolio has done. In fact, in a recent blog post they wrote:

We also feel betrayed and lied to by the small and medium retailers (SMRs) whom we welcomed into the community, who later turned their backs on us. Fundamentally we believed in the trust economy, and that was a mistake.

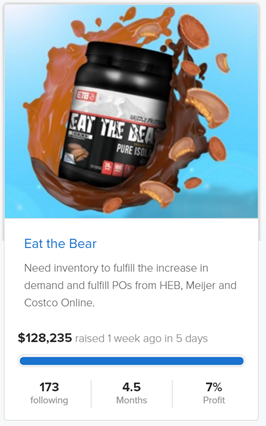

To try to fix things, they interviewed Kickfurther investors who have done well. What was their secret? They learned that the most successful investors primarily bought consignments that were 100% backed by purchase orders. Companies that needed funding so that they could fulfill an order that was already in place were more successful than those who needed money to build and then sell their product. That seems obvious in retrospect!

So, as of the end of January 2017, Kickfurther is posting only 100% Purchase Order Backed Co-Ops. Further, they’ve promised to do the following:

- Verify all Purchase Orders: “

- Place Order: In some cases, the money collected by Kickfurther will bypass the “brand” (the company seeking funds through Kickfurther) and Kickfurther will purchase needed inventory directly on behalf of the brand. This way the company seeking funds can’t simply take the money and run (so to speak).

- Collect Purchase Order Funds: When inventory is delivered to fulfill the purchase order, payment will go to Kickfurther rather than to the brand.

- Distribute Funds: Kickfurther will then distribute funds to the Kickfurther community members who participated.

Theoretically, Kickfurther’s new model should make Kickfurther consignments much more safe.

My take

I’m cautiously optimistic. I expect that Kickfurther’s new model will be much more successful than the old model. But, I have a few big concerns:

- Will Kickfurther itself stay afloat? Kickfurther is actively seeking funding to stay in business. What will happen to open consignments if they go under?

- Will Kickfurther continue to accept credit card funding with no fee? Kickfurther had tried to add a fee in the past, but then rolled it back. If they add a credit card processing fee, the platform may still make sense for investing, but will no longer serve the dual purpose of offering a way to earn a profit and to increase credit card spend.

My go-forward plan is to continue to dabble lightly in Kickfurther to get a sense of how well the new model works. And, over time, I’ll report my results. If they add a fee for credit card processing, though, I’ll bail.

I join the skeptics in being surprised at your cautious optimism. KickFurther has recently been scammed and has gone silent on the three consignments that were, it turns out, fraudulent. Consider that they encourage communication as a means of nurturing confidence in troubled consignments and see that they cannot follow their own advice. Three of my consignments had issues in the last 8 weeks when KickFurther changed (or updated?) their online payment system, resulting in two of them putting checks in the mail – one of them had previously paid without issue, so this was a sloppy rollout by KickFurther. NONE of the companies from which I have received repayments is happy with KF, and it is written all over the comments sections of the various pages. 100% PO backed consignments has, so far, resulted in far fewer consignments at lower returns.

I cannot wait to be rid of KF. I am surprised that this post leaves any room for cautious optimism. I suspect, due to the shrinking volume and the increasing troubles, that KF will be closed or completely restructured under new ownership before the end of 2017.

Kickfurther is probably the worst business I’ve ever encountered, with shady, despicable businesses, owners, managers, whatever you want to call it. I’ll probably have a loss in the thousands of dollars, and I really wish I could do something to make those KF people bleed. They simply do not understand how to run a successful business, and you and I will lose so much money for their failed learnings. I would speak a lot more harshly, but that wouldn’t do any good.

[…] Manufacture spend and profit with Kickfurther? My 3rd review… […]

[…] Manufacture spend and profit with Kickfurther? My 3rd review… […]

I’m new to KickFurther. I started using it in November 2016.

I’ve backed 14 consignments now:

1 paid back fully (and early)

1 has made it’s first payment and is in good standing

1 had a delay in shipment, so i’m still waiting on first payment.

The other 11 have payback times starting March and going through August.

I’m going to have to hold off on any further investments until I see the outcome of this.

It has been pretty easy to get into snag consignments on the public opening of them, so I haven’t used any keys yet. I figure with the popularity of the platform that will be harder.

I can’t believe you still have positive feedback on KF.

Check out this Reddit thread

https://www.reddit.com/r/KFTalk/comments/5az75c/report_your_troubled_offers_here_for_better/

It is horrible. My last month payouts was 66.6%. This month, based on communication and history, I can see myself recover less, roughly 62%.

Of all the completed co-op that I was in, I made $158 after fee and the average rate of return was 6.56%

It was a really bad investment. If I can tell myself to go back, I would not invest any money in this platform.

Did you read this review as positive? It wasn’t meant to be.

Thanks for sharing your numbers. I expect to take a smaller loss, or possibly about break even, but I’m with you in losing faith in the platform itself quite a while back. They copped to the problems with their “trust economy” model and vetting process. But additionally, communication and transparency for troubled co-ops was extremely poor, despite Kickfurther’s self-stated idealistic intentions to the contrary, and this was exacerbated by the way communication on the platform was structured as well as buggy software. My impression was that, besides not really having a plan in place for failed or dishonest offers, Kickfurther couldn’t keep up with their own “success”. I’d speculate that they focused too much on the supply-side (getting more offers) rather than on responding to backers’ concerns. Whatever the reason, their communication has SUCKED and I don’t think they have acknowledged that’s been a problem.

The 100% purchase-order backed offers is about the only thing that could have made me consider dipping my toe back in. But I am going to be very conservative, and there are still reasons I doubt I’ll do more than dabble. First, I agree that the company itself going under is a significant risk. Second, I found the record-keeping to be pretty time consuming. Third, my experience before this change is that it was somewhat hard to get in on the highest quality offers. Some days my schedule was open at the right time and some days it wasn’t. I’m wondering if that aspect will be even worse going forward. However, one nice thing about the new way of doing things is that the loan terms seem to be much shorter.

[…] Manufacture spend and profit with Kickfurther? My 3rd review… […]

My results, out of 10 attempts under their last 2 models:

2 were cancelled for not reaching funding goal (no funds debited) & “adminstratively” (refund)

3 have paid off as promised.

2 are on schedule.

3 are overdue: 1 is at 30% repaid and still trying @ 4 months past due. 1 got a purchase order welched on, but has done a great job of recovering and is now at 75% paid back @ 2 months past original timeframe. 1 experienced customs delays, and has only made 1 of 3 scheduled payments…it’s coffee, so if worse comes to worse, I will drink the damn consignment! 😛

Trust in human beings when money is involved? Omg lol if I were the university that those KF founders attended I’d void their degree

No, void the university itself.

I’ll never touch KF again… I’ll be shocked if it doesn’t face a class action for its lack of ability to collect the inventory that we all bought

I did simpler math on my portfolio. Total Payouts (which include any profit) divided by Total Invested: 75.6%

I stopped investing in Kickfurther co-ops last year. Id did not invest in as many as Greg, only $5k total invested, but all of my co-ops should have already paid out. I have very little confidence there will be any/much money to be made from the remaining items. And I certainly don’t want “my part of the inventory” for the investment that has been cancelled for no-confidence.

Kickfurther has a problem.

Sounds like a poor investment, lesson learned. I still like the idea of using 529 plans to manufacture spend, although it’s not free with gift of college gift cards.

For now, my family is using “regular” spend to meet our minimums.

Is the 529 angle fee no-fee credit card contributions to 529 plans? i wasn’t aware of that one. which plans do you know of which allow this?

I don’t think there is a fee-free option, but gift of college gift cards only have a 1.17% fee if you buy them $500 at a time in-store. See this post for details: https://frequentmiler.com/2016/11/08/pay-student-loans-529-plans-credit-card/

Greg, I read the post about this a while back, but I didn’t see any way to earn much cashback paying off your loans. The best card I have for toys r us is 2% or that I can even think of. Do you know of something better that could make this better than just using my 2% card to pay my loans?

CJ: using a 2 percent card isn’t bad. Or use a card that earns 1.5x miles in order to essentially buy miles for less than a penny each.

Or wait until the gift cards become available at a grocery store

LOL, what kind of business plan relies on the honor system to stay solvent? Luckily it looks like amateur hour is ending, at least hopefully it is.

Unfortunately, this review should have been your first of Kickfurther. It’s easy to wear rose-color glasses when first in a relationship with anything and the long term with this platform suggests that.

Personally, I’ve been burned for more money than I cared to ‘give away’ so I’m out. I imagine the small peanuts this platform offers is not worth the risk for others either, a la Prosper and Lending Club.