NOTICE: This post references card features that have changed, expired, or are not currently available

Chase is currently out with a couple of interesting targeted offers on both the Marriott Rewards Premier Credit card and the Hyatt Visa. Targeted members of each program should receive an email offer to apply.

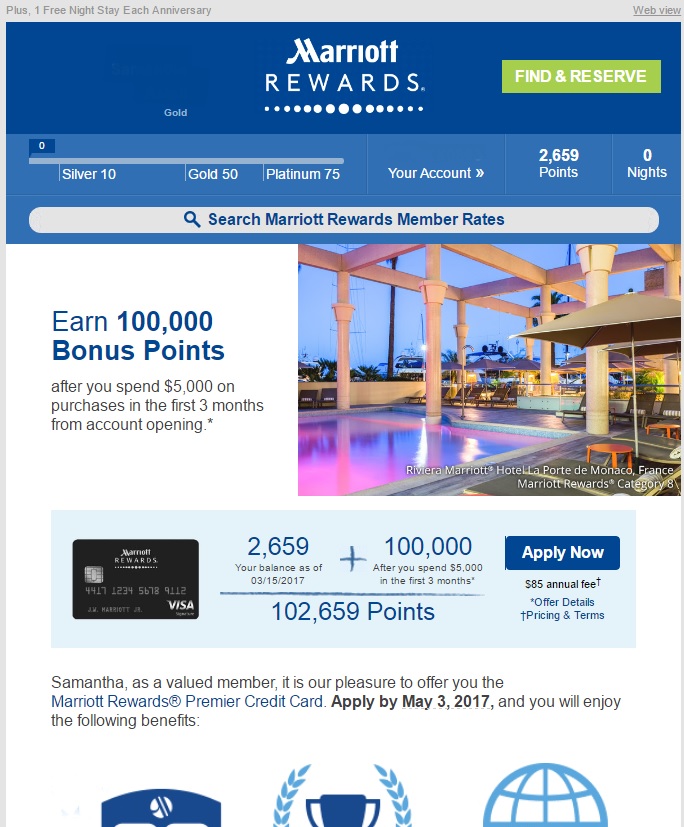

Chase Marriott Rewards Premier Credit Card — 100,000 point offer

The Offer:

- 100,000 Marriott Rewards points after spending $5,000 in the first 3 months

- 7,500 bonus points when you add an authorized user and make a purchase within the first 3 months

- $85 Annual Fee NOT waived the first year

- 1 free night at a Category 1-5 every year after your cardmember anniversary

- 5x Marriott; 2x at airlines, rental car agencies, and restaurants; 1x everywhere else

- 15 nights towards elite status; 1 extra night for every $3k in spend

- This card has been subject to the 5/24 rule

Is it worth it?

This is a great offer on this card in comparison to the normal bonus of 80k + 7.5k. The 107.5k total bonus points for meeting the spend and adding an AU makes the sign up offer a bit higher than the current SPG card offers — 107.5k Marriott points can be converted to 35,833 Starpoints. Following Greg’s well-founded logic on investing in change, this seems like a great time to apply if you were targeted and are under 5/24. This card has been known to be subject to Chase’s 5/24 rule, which means that you are likely to be rejected if you have opened 5 or more new accounts in the past 24 months, including authorized user accounts. This card can be worth keeping for the annual free night, the value of which can certainly exceed the $85 annual fee.

Chase Hyatt Credit Card 40,000 point offer

The Offer

- 40,000 Hyatt points after spending $2,000 in the first 3 months

- 5,000 bonus points for adding an authorized user and making a purchase within the first 3 months

- 1 free night at a Category 1-4 annually after your cardmember year anniversary

- $75 annual fee is NOT waived the first year

- 3x Hyatt, 2x airline, rental car agencies, and restaurants, 1x everywhere else

- This card has not been subject to 5/24 (though YMMV)

Is it worth it?

This really depends on how you’ll use the points. The typical offer on this card is for 2 free nights anywhere in the world. If you use those nights for a top-tier Hyatt (normally 30k points per night), you would get more value from the standard offer. However, the 40k point offer allows you to book more nights at a lower-tier property. For example, in late 2015 I stayed at the Hyatt Regency Saipan for just 8,000 points per night. Cash rates during my stay were over $350 per night, with club rooms over $500 a night. We enjoyed some great sunsets from the Regency Club:

And some very clear water for snorkeling:

So, again, this will depend on how you use the points. This card has not been subject to the 5/24 rule, though one never knows when that could change.

Both offers are worth a look — check your email to see if you have been targeted.

Thanks for your quick reply. I appreciate your sending the link to the screen shot showing that some people who received the 40k bonus point targeted offer also received the offer for 5k for an AU. I’ll probably give it a try.

In your description of the Chase Hyatt targeted offer of 40,000 bonus points, you indicate that 5000 additional points are given for adding an authorized user who makes a purchase within the first 3 months. I received the targeted offer for the 40000 bonus points, but it did not mention the 5000 points for adding an authorized user. I called Chase twice trying to get clarification on this point, and was told that, once approved for the card, and after adding an authorized user, I’d have to call Chase requesting the 5000 additional points. Frankly, I wish Chase Hyatt’s targeted offer was explicit on this point, because the additional 5000 points for me (and others, I assume), is a consideration. The public offer of 2 free nights explicitly mentions that 5000 points is given for adding an authorized user. Is there any way you can get Chase/Hyatt to make this part of the targeted offer?

Sorry, we don’t have any inside friends at the bank who make up the offers :-).

That said, the authorized user bonus has been a fixture on most of the point-earning Chase cards for some time (5K CSP, 2.5K Freedom, 2.5K Freedom Unlimited, 5K IHG, 10K Ritz-Carlton, 7.5K Marriott). I can’t guarantee you’ll get the points since it’s not in the offer, but our instinct is that we would see reports otherwise if people weren’t getting it.

I see someone on Flyertalk posted a screenshot of the targeted email they received, which did mention the 5K for a AU:

http://www.flyertalk.com/forum/28085197-post3988.html

It’s possible that nobody without that language has applied. If you applied under the 40K and didn’t get 5K for adding the AU, you could try a secure message and ask. Chase is normally pretty good about matching offers. Again, I can’t guarantee that will all work, but I would expect it to.

[…] recently reported a targeted offer for the Chase Marriott Rewards Premier Credit Card. There is now a public offer on this card with a […]

Just as a point of clarification for me (if you don’t mind): when we say “This card has not been subject to 5/24,” we mean that the card has a reasonable likelihood of approval even if you are already over 5/24. However, if approved, I am assuming that it adds to your X/24, ie, you will then subsequently be (X+1)/24 for any future credit card applications.

Is that assumption correct? Doing my best to get under 5/24 to be able to get more Chase cards in the future, and I probably wouldn’t apply for the Hyatt card if this is true… thanks!

You are correct on all points.

My husband just got a 70,000 mile bonus offer from United. Looks like everyone is feeling generous!

Nick/Greg

I’m currently staying at a JW Marriott. I’m gold. Was offered a second room for a $100 per night due to my status. Is this a gold benefit? Is it this resort only? Are they trying to move inventory? This resort goes for $500 a night this weekend. I’m staying on a 7 night certificate. Any thoughts?

No, that’s not a normal Gold benefit. I’ve never heard of that before. I’ve heard of people being offered upgrades at check-in for cash co-pays (whether to a better room or maybe to a club level room at a Ritz where status won’t get you that) — but I’ve not heard of someone being offered another room. Probably just a function of inventory being available and perhaps the check in agent thought you’d like the extra space.

Does the Marriott’s offer has 5/24 language? I’m asking because I found an offer when I log into marriott.com and there’s no “5 cards or more” language, only “received bonus in the last 24 months” language…

Would appreciate your input!

Hi Andrew — the Chase 5/24 rule is not a written rule, it’s an internal rule. It’s never been written into any of the application forms. From trial and error and a great deal of compiled experience, people have come to know which cards are restricted by this rule and which cards are not. The Marriott card is one that is known to be covered under the rule and the Hyatt card is not. Of course, that could change at any time — but I wouldn’t apply for the Marriott card expecting success if you’re at or over 5/24.

Does this card come with in branch pre qualified offers as well?

Good question! I’m not sure.

Thanks! Yes, I hoped it’s spelled explicitly as it is in Citi’s applications…

Edit: Apparently, the 5/24 language did appear on an application at some point. But it isn’t usually there (despite the fact that it applies to many cards).

I wish I could get my hands on the 40k hyatt offer…would be more useful to me.