NOTICE: This post references card features that have changed, expired, or are not currently available

Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email.

Greg wrote this morning about the upcoming United MileagePlus prepaid debit card and how it may become a way of amassing United miles cheaply and easily. If you’re looking to further pad your United balance, there is a targeted offer good for up to 75K total miles for the United MileagePlus Explorer card, and it only takes a couple of seconds to see if you’re eligible.

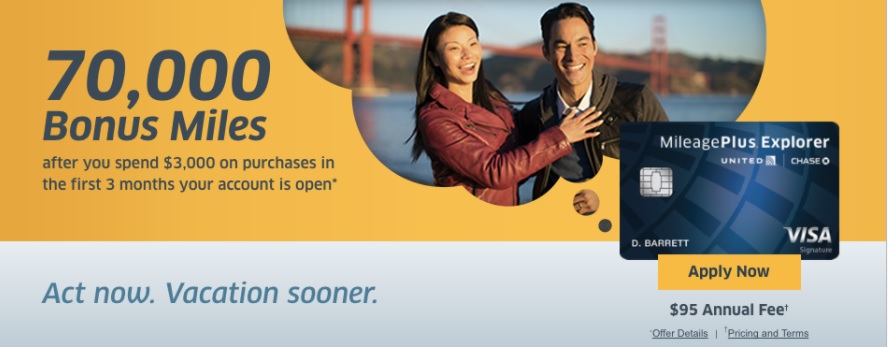

The Offer

- 70,000 miles after you spend $3,000 on purchases in the first 3 months

- 5,000 miles after you add the first authorized user and make a purchase in the first 3 months

Card Details

- $95 annual fee not waived the first year

- 2X on tickets purchased from United

- 1X everywhere else

- First checked bag free for you and a companion on United-operated flights

- Priority boarding

- 10,000 mile bonus after spending $25,000 in a calendar year

How to see if you’re eligible

Upon clicking the link to this offer — direct link here (not an affiliate link) — you will be prompted to log in to your MileagePlus account. You should then see an offer for either 50K or 70K miles. My wife and I only received the 50K-mile offer, but many people have reported seeing the 70K-mile offer despite never having received the snail mail targeted offer. While this won’t be available to everyone, it’s worth a shot if you’re in the market for more United miles. Note that this card is known to be subject to the 5/24 rule. Therefore, if you have opened 5 or more accounts in the past 24 months, you will not be eligible to open this card. If you are not over 5/24 and you have a small business, you might consider the Ink Business Preferred as that card comes with an 80K point sign up bonus (albeit with a greater minimum spend). Those points could be transferred to United (or any of Chase’s Ultimate Rewards partners). However, if you’re looking for benefits like the free checked bag and priority boarding in addition to the sign up bonus, this MileagePlus Explorer offer is as good as we’ve seen in recent years.

[…] Up to 75K United miles with targeted MileagePlus Explorer offer […]

[…] Up to 75K United miles with targeted MileagePlus Explorer offer […]

[…] Up to 75K United miles with targeted MileagePlus Explorer offer […]

[…] Up to 75K United miles with targeted MileagePlus Explorer offer […]

[…] Up to 75K United miles with targeted MileagePlus Explorer offer […]

[…] Up to 75K United miles with targeted MileagePlus Explorer offer […]

I currently hold a Mileage Explorer Card (approved in May 2015, received 50k miles)

If I cancel my card, am I eligible to receive the current offer of 50k miles for signup again?

The application states “This product is available to you if you do not have this card and have not received a new cardmember bonus for this card in the past 24 months.”

I’m getting mixed feedback. Some people say I have to wait 24 mos from when I cancel my card

Others are saying if it’s been 24 mos since I received the signup bonus, I can cancel my card, and then literally reapply again and be eligible for the bonus

If that is the case, how long should I wait after canceling before reapplying? It’s been over 24 mos since I received the signup bonus, so if I cancel now, can I reapply in a few days? wait a week? a month?

The date you were approved doesn’t matter at all. All that matters is when you received the sign up bonus points. You need to wait 24 months from when you received the sign up bonus. If you were approved in May 2015, you couldn’t have gotten the signup bonus until at least June of 2015. I would check your account and be sure that it’s been at least 24 months since you got the bonus. It’s obviously possible if you met the spend right away, but I would suggest double-checking.

As for closing the card and opening again, there been conflicting reports. Conventional wisdom has been that you need to wait a week or two for your account to clear the Chase system so they don’t reopen your old account. However, at least one reader has reported that they cancelled the Fairmont card and reopened it the same day when they were phasing out the Fairmont card and they were able to get the bonus again. Ymmv. If you’re not in a hurry, I’d give it a week or two after canceling. That said, you might be able to do it in less time than that.

Nick: thanks for clarifying. I just double checked and my bonus miles were deposited on 7/15/15. I’m glad you pointed that out, as I figured it was 24 mos from when my card was approved. So looks like I can quit now and wait a couple weeks (end of July) then reapply. Good thing is the link you provided shows that 70k offer for me. hopefully it’ll still be there in a couple weeks when I am eligible to receive the bonus again.

I presume closing my card now ( 24 mos before reapplying.

sorry got cut off. I presume closing my card now ( 24 mos before reapplying again is ok and I don’t have to wait until after 7/15/15–when my last bonus posted)

oh, and is it ok to tell the CSR that I’m closing the account b/c I want to re-sign up to get the 70k offer or shoud I just make up an excuse.

I actually was going to close the card in May, when my $95 annual fee hit, but they gave me a $100 statement credit. DO you think they’ll be any problems if I close it anyway? (hopefully they won’t flag me since I did get the credit but still am closing the account).

[…] Up to 75K United miles with targeted MileagePlus Explorer offer […]

[…] Up to 75K United miles with targeted MileagePlus Explorer offer […]

Just a data point supporting what you said about 5/24. I was targeted for this deal 2 months ago with a mailer and thought that would bypass 5/24. I was wrong and was rejected at 6/24 despite being targeted, 800+ credit score, United Silver, Chase Private Client and high income.

Did you try in-branch application? Maybe that can bypass the 5/24 rule?