NOTICE: This post references card features that have changed, expired, or are not currently available

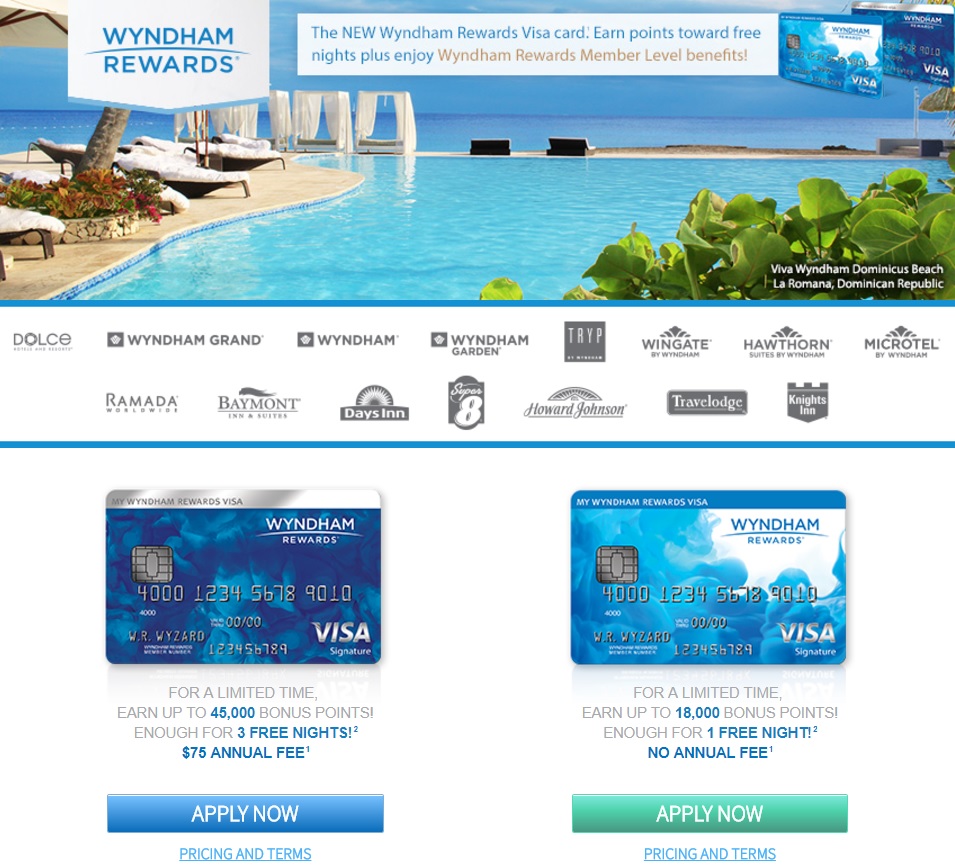

The sign up bonuses have increased on the Barclaycard Wyndham Rewards Visa cards. The current sign up bonuses are 45K total bonus points after $2,000 spend on the annual fee card or 18K total bonus points after $1,000 spend on the no-fee card. Remember that all Wyndham hotels cost 15,000 points for an award night and cash-and-points awards require 3,000 points plus a cash copay.

The Offers

Wyndham Rewards Visa – $75 Annual fee

- Earn 45,000 points: 30,000 points after first purchase and 15,000 additional points after $2,000 in purchases in 90 days

Card Benefits

- Earn 5X at Wyndham properties

- Earn 2X on gas, utilities, and grocery store purchases

- Earn 1X everywhere else

- Anniversary bonus of 6,000 points each year

- $75 annual fee is not waived the first year

- Automatic Platinum status

Wyndham Rewards Visa – No annual fee

- Earn 18,000 points: 15,000 points after first purchase and 3,000 additional points after $1,000 in purchases in 90 days

Card Benefits

- Earn 3X at Wyndham properties

- Earn 2X on gas, utility, and grocery store purchases

- Earn 1X everywhere else

- No annual fee

- Automatic Gold status

Quick Thoughts

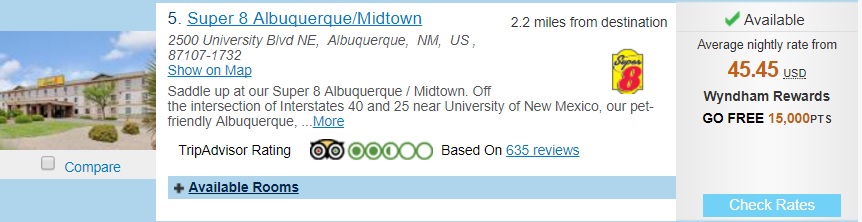

While Wyndham is often-overlooked, the enhancements made in recent years make the program interesting. All properties cost the same 15,000 points-per-night for an award stay — meaning that whether you stay at the Super 8 Albuquerque Midtown or the Wingate by Wyndham Manhattan Midtown, the price is the same: 15,000 points for a free night.

“Go fast” cash and points rates can present even better value at 3,000 points and a variable cash copay that can be quite good. And sometimes it can be even more interesting, like when Greg booked an 8-bedroom house in England for 15,000 points a night (and I booked a 9-bedroom estate). While that deal has long gone, you can still book cottages.com properties for 15K points per bedroom, which presents some nice opportunities in the European market. Of course, they’ve had their share of epic fails, but the recent addition of a partnership with Caesar’s palace means that the sign up bonus on the annual-fee card could net you three nights at Caesar’s, not to mention status matching. That’s a good value.

These cards certainly aren’t for everyone. Still, the sign up bonuses make them worth consideration as you certainly can get good value out of them. When I booked the estate in England, I lamented that I had used 15K points last summer for a night in a Days Inn in Utica, NY. While that certainly sounds like a poor value, it was the night before an event — when even that Days Inn was going for $245 plus tax (and nobody else in town had award nights available). There is value in diversification and wisdom in hoarding and cherry picking, and these cards might be a good opportunity to do so.

As always, links to these offers have been added to our Best Offers page, where you can see all of the best current public offers.

H/T: Doctor of Credit

[…] with the increased 45K/18K signup bonuses on the Wyndham Rewards credit cards, you could get a really nice value out of your points. Wyndham has plenty of properties worldwide […]

If only I could convince my wife to stay at a cheap Wyndham property for 2 nights….

I have 3 personal barclay cards and 1 business card. I highly doubt they will give me another card. Any idea how long the bonus will be this high? If I cancel one or two cards (which I really don’t want to do) how long would I probably have to wait before getting approved for a new card with them?

I got the card at 30k bonus. Within 10 days the 45k offer came out, so I asked for a change to that offer given the timing. They declined that request despite providing the comparison to Chase’s IHG card that will do so out to 90 days. Disappointing. Any ideas on success here?

I haven’t had to approach Wyndham on this issue but have always had success with Citi & Chase. I would call back & ask to discuss it with their escalation dpt as 10 days is completely reasonable.

“Wyndham rewards will expire 48 months after they are first deposited into your account unless your account is canceled sooner due to inactivity. An account is considered inactive if no account activity has taken place over an 18-month period.”

I post at least several bonus points utility pmts monthly to my Wyndham Rewards cc automatically to keep the program active.

Points expire?

It was at 45k then dropped to 30k for a while, now back to 45k. Good timing, was just getting ready to apply.

I don’t understand how WR cc bonuses have increased – haven’t they been at these same levels for about a year now?

I enjoy WR points, too, & picked up 30k on the Daily Getaway promotion a coupla months back. I essentially spent $150 for a free night at Dolce Silverado Resort at their $600 night 1,400 sq ft cottage! The other I am using at the Tremont House in Galveston for Dickens’ Christmas – rooms run $450/nt during the event.

Wyndhan otherwise lets you buy 5k points/year to add to your account. As these are the only 2 ways to “buy” points I have found, I take advantage of them (& waiting for another Scotland castle special to show up next spring!).

I also just received notice from Wyndham I can earn double points on ALL my cc spend into Sept. I believe it’s targeted but be on the lookout if interested – it came via regular mail, & you have to register for the promotion.