NOTICE: This post references card features that have changed, expired, or are not currently available

If you’ve recently signed up for the new Blue Business Plus Amex card, and you have a Platinum or Centurion card, you probably received a notice telling you that since you already have at least one eligible card enrolled in the Membership Rewards First program, they have automatically enrolled your new card in that program “as a special thank you.”

When I first saw this, I thought the memo was about the ability to transfer points to loyalty programs. There’s a basic version of Membership Rewards that comes with some cards (although Amex seems to be phasing these out) where you can’t do those transfers unless you also have a regular Membership Rewards card. I knew that the Blue Business Plus card has the ability to make these transfers, but the card it replaced (Blue for Business) did not. I figured that the notice was an errant leftover from the old card. But that wasn’t the case.

The Membership Rewards Terms for US cardholders (found here) lists cards that don’t inherently have the ability to transfer to airline programs, but it never uses the term “Membership Rewards First” to describe the cards that do have this ability. It’s clear that this is something else entirely.

Benefits of Membership Rewards First (according to the document)

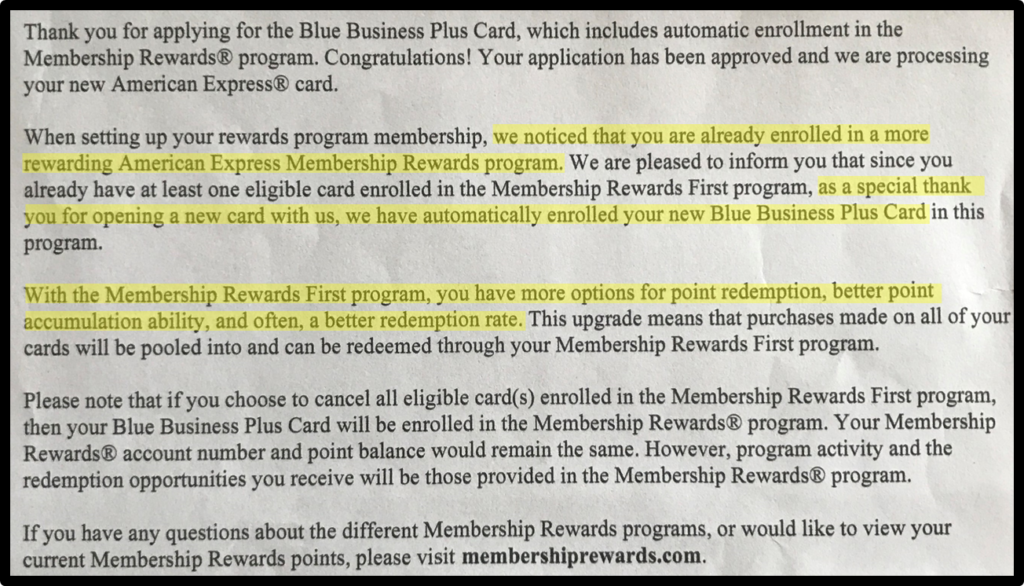

The document shown above says that Membership Rewards First offers the following benefits:

- More options for redemption

- Better point accumulation ability

- Often a better redemption rate

Those things sound great, but when I log in, I don’t see any more options for redemption, nor do I see any better redemption rates. And, yes, the Blue Business Plus card offers better point accumulation ability (2X everywhere, up to $50K per year), but that’s a function of the card not the Membership Rewards First program. In fact, the document specifically states that if you cancel your Membership Rewards First cards (presumably Platinum and/or Centurion cards), you will be downgraded to the regular Membership Rewards program. That won’t change the fact that the Blue Business Plus has better point accumulation ability.

It’s interesting that these letters were sent out only recently. I never received a notice like this when I signed up for other Membership Rewards cards in the past. This makes me think that maybe… just maybe… something good is in the works. Maybe Amex is planning to roll out more options for redemption, better point accumulation ability, and better redemption rates. Depending upon the details, this could be huge.

Benefits of Membership Rewards First (according to Google searches)

After Googling the quoted text “Membership Rewards First”, I found a number of foreign mentions and old mentions.

Candadians seem to have something. This is from the Candadian Business Platinum page:

Membership Rewards First™ Tier

You have instant access to the Membership Rewards First™ Tier of the Membership Rewards program which includes an accelerated earn rate of 1.25 Membership Rewards points for every dollar in purchases charged to the Card1 enables you to enjoy these rewards much faster. And there is no limit to the points you can earn. This tier also gives you access to the entire Membership Rewards Catalogue, including the exclusive First Collection Rewards portfolio, containing an array of premium brands designed specifically for Business Platinum Cardmembers.

So, at least the Canadian version of the program tells us something. They earn 1.25 points per dollar and get to use points to buy overpriced stuff.

Back in the USA, a very old Points Guy post says the following about Membership Rewards First:

- 25% bonus on Pay with Points redemptions for travel. Instead of 1 point= 1 cent, 1 point = 1.25 cents

- Fine Hotels and Resorts program. When you book paid hotel stays with your Platinum/Centurion cards, you get room upgrades, free breakfast, late checkout and other premium benefits.

- Free gifts from high-end retailers. In 2010 select Platinum card members got free Tumi bags. Centurion cardholders received $500 Salvatore Ferragamo gift cards.

- Free companion ticket when you buy an international full-fare business or first class ticket.

- Cruise booking discounts and perks

Most of the above seem to be Platinum and Centurion benefits (some of which no longer exist, or have since changed in form).

Meanwhile, Ask Mr. Credit Card says:

The Membership Rewards First is identical as well except that it has got a couple of more features. The first additional feature is the First Collection. It is a catalog of high end goods (like Mikimoto pearls, Lamboginhi Car) which you can exchange reward points for. It also has the international companion airfare feature, cruise privileges and also exclusive events for card holders.

To me, none of these old posts indicate any real current benefit to the program other than what we already knew: if you have multiple Membership Rewards cards your points pool together, and you get the best benefits from the best card you have. For example, the Business Platinum card currently has the best pay with points for airfare feature (a 35% rebate on your selected airline or business/first class on any airline), you will get that rebate regardless of which Amex Membership Rewards card you use to pay with points, as long as you have a Business Platinum card open and in good standing.

Benefits of Membership Rewards First (according to Amex)

I tried to ask about this via Amex online chat, but the chat rep just quoted stuff from the Membership Rewards terms document rather than giving me any useful information at all.

I then called the number on the back of my card and was transferred to the Membership Rewards department. They simply confirmed that when using the new card I get benefits associated with my Platinum card: better redemption rates for travel, concierge access, sometimes better value for points used to buy gift cards.

In other words, if the Amex rep was correct, Membership Rewards First seems to be simply a branding of a collection of premium features available to Platinum and Centurion cardholders. Nothing more.

Summary

The optimist in me wanted to believe that there was something new and exciting going on here, but I’m now convinced otherwise. The “upgrade” to Membership Rewards First simply means that you’ll continue to get the Platinum or Centurion perks that you were already getting.

Thanks Amex for that meaningless “special thank you”.

MR First back around 2008 did have benefits. The main one was what they called a ‘Points Advance” – where you could borrow upto I think 60K points towards purchase of something. Then the ShopAMEX had promos esp. around xmas. There was one year (they just don’t do this anymore) where they offered a 40% points reduction on their catalog. It was a killer deal – and I recall buying a iMac that was retailing for $3,500 for roughly 365,000 points. Same price iMac today asks for 600K++ points. The branding is the same – but I don’t think I have ever seen the ‘MR First’ logos change. And if you go to the Summary tool – look at the GUI – it dates back to 2008. So perhaps this is just non-updated legacy stuff.

What is my opinion on this article? Am I going to praise it or not? Click here to find out.

[…] What is Membership Rewards First? Are good things coming? […]

Clickbait, nothing more. Ptooey.

If it looks like a clickbait title, then Greg wrote the post. A drawn out, elitist article containing pretty much no information. Nick keeps this blog alive with pertinent posts.

Bye Felicia!

Setup was too easy…

Elitist? I’m not getting that, though as soon as I saw MR First, I was pretty sure it would be wortheless.

Amex is the Jekyl and Hyde of the points world. Some very good cards/bennies/offers on one hand. And some mystifying things on the other. Amex First is a joke and only adds needless confusion. The recent horrific website update is another prime example. Previous version was easily the best/most intuitive card website I’ve used in a long time. Now it pisses me of every time I use it (defaults back to new version even when logging in for the old version)

Also, I recently rec’d email and written notices that request I provide both SSN and birthdate info for some AU cards – both email and letter provide (different) online links that do not work (ie, impossible to visit the links and add the supposed ‘missing” information) – otherwise they said they’d cancel my cards in 30 days. Picked up phone, ended up waiting on hold for 30 minutes while the CSR and supervisor looked at my accounts – only to tell me the information was already linked to my AU cards and to ignore the notices (as I knew in advance, as that info was required when I requested the AU cards in the first place). But it’s even more fubar – rec’d letter after having my AU cards delivered saying they could not approve my AU cards. This has happened several times recently. Whoever is in charge of their CC systems has their head so far up their backside they see daylight.

Maybe eventually you will get better redemption rates with pay with points. In 10 years after multiple devaluations making award charts worthless with 1c value per mile who will want UR or MR without a premium card with a $450 or $550 annual fee instead of a cash back card?

I got this letter with my recent Amerprise Gold and Green cards, too. I had also assumed they were referring to the point transfer abilitu.

Maybe this has been going on forever, but I was surprised when checking out at a drugstore yesterday, it gave me the option to pay with my membership rewards points. I knew I didn’t want to do it, and didn’t focus on the redemption. It felt a little weird to have my MR rewards show up on the screen like that. I have a platinum card and it gave me the option. When my husband used an authorized user Amex everyday card, it didn’t show up.

Membership Rewards First dates to 2006 or thereabouts and was the ‘premium’ version of Membership Rewards that offered 1.25 cents per point for Pay With Points instead of 1 cent, and some of the other benefits of the premium cards [at times referencing Fine Hotels & Resorts, which has nothing to do with MR really, plus some high-end redeption options that aren’t great value].

Roughly speaking for anyone interested in maximizing the value of points it has been a big nothing burger for most.

When MR “First” was introduced, there were some actual benefits. For the life of me, I can’t recall what they were now, but I think it may have been special deals on gift card redmptions. Now… nothing.