NOTICE: This post references card features that have changed, expired, or are not currently available

Did you know that you can get identity theft insurance for free? Unlike Equifax’s one-year free option, multiple services offer free insurance without an expiration date…

Equifax Hack Rx Background

We’re all pissed off by Equifax’s failure to protect our personal information. A natural reaction is to demand justice and compensation. Justice will take time, but a criminal investigation is under way. And compensation may come via a class action lawsuit or, better yet, many individual arbitration claims. Regardless of all that, your number one priority now should be to protect yourself. Equifax just gave away the key to your castle. It’s time to change the locks, add surveillance, and make sure you’re insured.

Equifax has offered everyone one year of free protection in the form of their Trusted ID Premier service. In my post “Is the Equifax cure worse than the hack?” I argued against relying on that service. After all, Equifax lost our data and they’re only offering protection for one year. After a year, they get to try to sell us their paid service. That isn’t right.

Fortunately, alternative services exist to help protect you for free and with no expiration date. Via this “Equifax Hack Rx” series, I’ll help you find them…

Free Identity Theft Insurance

Obviously the last thing anyone needs is to have their identity stolen. But, if it does happen, it’s good to be insured. Here are two services that offer absolutely free identity theft insurance:

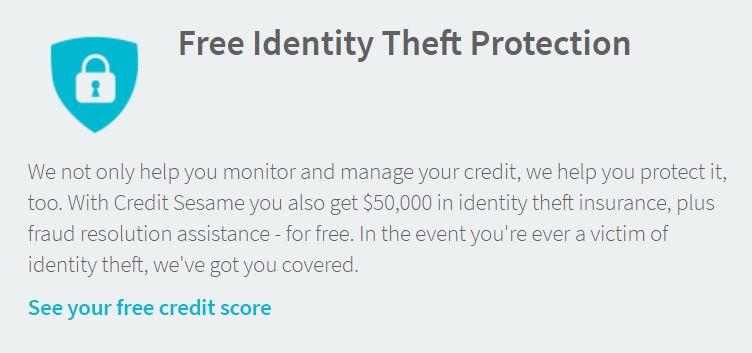

Credit Sesame: $50K free identity theft insurance

I’ve been a long time user of Credit Sesame's free credit score and monitoring service. I use the service primarily for its free credit monitoring. When any changes or inquires are made to my TransUnion report, Credit Sesame sends me an email. What I didn’t realize all of this time is that they also offer free identity theft insurance with $50,000 of coverage. This insurance is automatic. Simply sign up for Credit Sesame and you’re covered!

Credit Sesame’s identity theft insurance covers the following (More info can be found here):

- Fraud or embezzlement

- Theft

- Forgery

- Data breach

- Stolen identity event

- Unauthorized Electronic Fund Transfer

Full disclosure: At the time of this writing, the above link is an affiliate link and I may earn a few dollars if you use it to sign up. Many thanks!

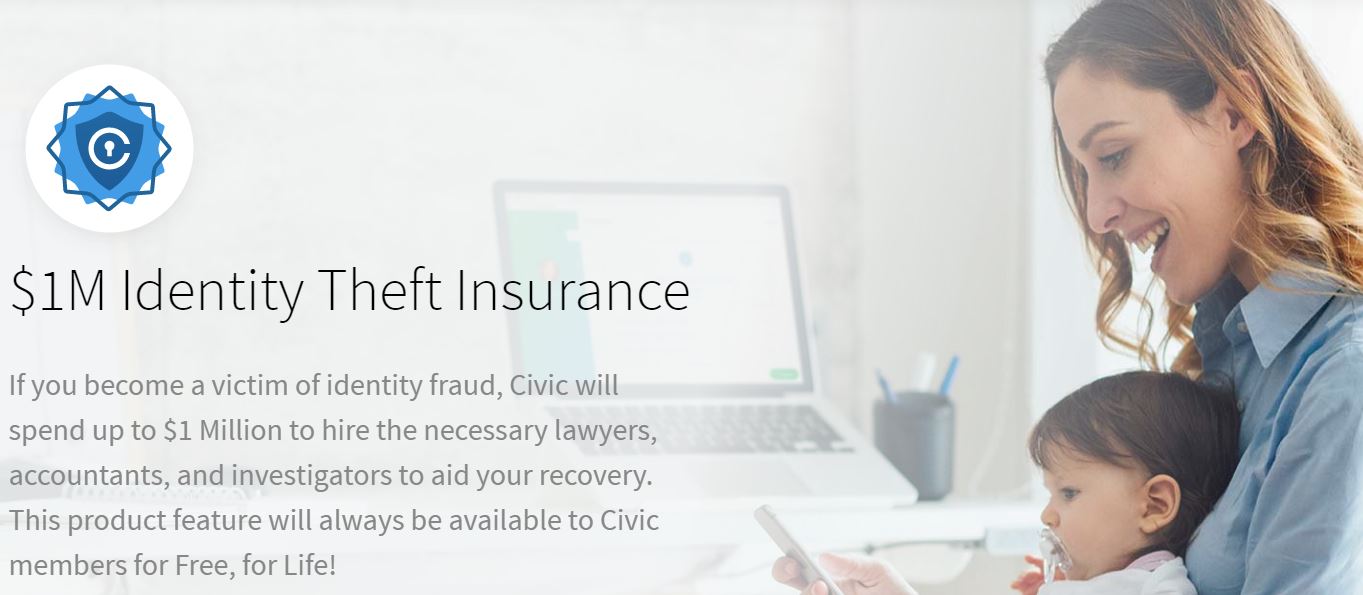

Civic: $1 million free identity theft insurance

UPDATE: Civic has discontinued their free identity theft insurance.

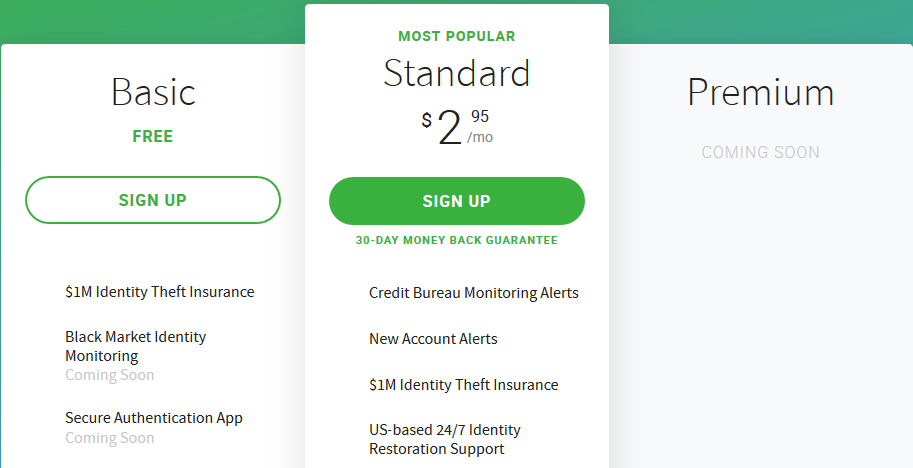

I had never heard of Civic before researching this post, but they appear to be a legitimate startup company. TechCrunch posted an interesting article about them in 2016: Civic launches a free service that aims to stop identity theft before it happens. Since that article was written, Civic added fees for most of their services, but not for identity theft insurance.

Signing up for Civic’s free Basic plan is quick and easy (I signed up yesterday). My only gripe is that the first screen you see upon completing registration is an alert demanding that you “upgrade now”. Keep in mind that you don’t have to upgrade to get free identity theft insurance.

Civic’s identity theft insurance covers the following (More info can be found here):

- Fraud or embezzlement

- Theft

- Forgery

- Data breach

- Stolen identity event

This is the same list as in Credit Sesame’s coverage, but Civic’s list does not mention “Unauthorized Electronic Fund Transfer.” My guess is that unauthorized electronic fund transfers are covered under other headings such as theft.

UPDATE: Civic has discontinued their free identity theft insurance.

Wrap Up

Credit Sesame and Civic offer offers free identity theft insurance. There is some risk in entrusting more companies with your private information, but personally I’ve decided to assume that my data is already exposed and to seek opportunities to protect myself rather than to protect the data. Before signing up for any new services like these, you should decide for yourself whether you’re willing to risk making your personal information even more accessible to hackers in exchange for protection once they get that data.

The primary downside I see to either service is that they will advertise paid options to you. Save money by not upgrading.

Future Equifax Hack Rx posts will cover other free ways to protect yourself: proactive surveillance, full credit monitoring, and more. Stay tuned. And, if you haven’t done so yet, please consider subscribing to Frequent Miler emails. Those are free too.

[…] I previously reported that another free service, Civic, offered up to $1 million in protection, but they no longer do. […]

[…] Equifax Hack Rx: Free Identity Theft Insurance […]

[…] Equifax Hack Rx: Free Identity Theft Insurance […]

[…] Instead of freezing your credit (or in addition to it), another option is to closely monitor your credit and take action only if a malicious event occurs. If such an event does occur, you might not be held accountable, especially if you report the event immediately. And if the crime does end up costing you money, you may be able to recover those funds through identity theft insurance (see: Equifax Hack Rx: Free Identity Theft Insurance). […]

It looks like both only monitor TransUnion for free. I also have the Experian app, which seems to monitor for free as well. What about Equifax – any free options? Or better yet, one that does all three? (seems unlikely)

Regarding credit freezing, this seems like a really inconvenient option for people like us, no? Or is it as easy as a few clicks and instantaneous?

CreditKarma monitors both TU and EQ, for free. A nice combo with the Experian app.

[…] Free Identity Theft Insurance: After the Equifax hack, you may be wondering what options you have to protect yourself if your identity was stolen. Many are leery about taking Equifax’s help to protect them and rightfully so. Luckily there are a couple of options for free identity theft insurance available. […]

Those among your readers who are homeowners might also call their insurance companies. We added identity theft to our policy for just a few dollars a year a while back; thankfully we haven’t needed it as yet. Perhaps renter policies and/or umbrella policies offer such coverage as well.

I just noticed that Discover is also offering a free service that includes notifying you of any new accounts showing up on your Experian credit report or if they find your social on suspicious websites. I did a little reading and it looks like they started offering this in July. Has anyone used it? What do you think?

That’s correct. Might as well turn it on if you have a Discover card (I’ll discuss this option more in a future post). Experian credit report Monitoring is limited to showing new accounts though. I don’t know why they don’t also provide alerts for new inquiries.

Here’s what Discover says about it:

We are offering a free new monitoring service for Primary credit cardmembers that helps cardmembers look out for potential fraud threats beyond their Discover card accounts. Once you sign up for the service we will send you alerts via email (and text message if you prefer).

The service consists of two different types of alerts:

1) We’ll notify you if we find your Social Security Number on any of thousands of risky websites that we are monitoring.

2) We’ll monitor your Experian® credit report every day and notify you when new credit cards, mortgages, car loans or other credit accounts are listed in your name—even if they’re not Discover accounts.

Thanks for the great posts as usual!

I signed up for free CreditSesame account, however, I can’t seem to turn on the free credit monitoring and identity protection. I tried clicking on the green “Free Credit Monitoring and Identity Protection” area but nothing happens. In my Alerts tab it says “My Credit Monitoring is Off.” Any help? Thanks again!

Have you tried logging out and back in?

Thanks, yes, I actually logged out and then back in with Chrome, Firefox and IE, thinking it was maybe a browser issue.

I signed up for Credit Sesame, but I can’t figure out how to turn on credit monitoring. Their FAQ say to go to Finance and click on the Credit Monitoring Tab. There is only a My Monitoring Tab, which brings me to another page with two likely possibilities: a tab that says “credit monitoring” but which only shows alerts (there are none since I just signed up) and a credit card offer. The other likely possibility is a box that says “Turn on your free Credit Monitoring” and a link on green words saying “Free Credit Monitoring.” This brings up another page where I can select how to receive credit monitoring. I checked both boxes for email and push alerts and clicked “Update” at the bottom, but my Credit Monitoring button still says “OFF” and I cannot click on it to change it. I am emailing them as well but thought others here might have the same problem or a solution.

Strange. It sounds like you did the right things. Did you try logging out and back in? If that doesn’t work, it’s possible that it takes overnight (or some other amount of time) to enable.

I am having the same issue. Any resolution?

Interesting– and am considering Credit Sesame but what exactly is their Business Model? It may be “free” to consumers but they must generate revenue in some way. Not sure, but from glancing at the T’s and C’s doesn’t this mean that they harvest your creditworthiness information and then share it (though hopefully not your personal info) with banks, credit card companies and other for purposes of marketing to you “prequalified” offers etc.?

“DESCRIPTION OF SERVICES

The Service is a personal finance information management service focused on finding prequalified loan options for the consumer, tracking and collecting consumer information, including but not limited to, credit score, loan and credit card monthly payment, total amount and interest rates, and home value, and product information, such as loan, eligibility, and requirement information from major banks. Based on this information collection, consumer is presented with a view of his/her current key financial figures in assets, debt and credit areas of personal finance, as well as, top loan and financing recommendations personalized to consumers profile and preferences using our proprietary technology and analytics, which information, alerts and updates may be presented to Members in the form of

periodic emails.”

They do use your information to try to sell you services such as loans, credit cards, paid subscription for credit services, etc. You do not have to buy anything they try to sell you, but seeing their ads is a cost of a sort.

Thanks. But I wonder if they also sell the info to third parties to do their own marketing (since they are harvesting valuable creditworthiness info and lists they could sell.) I don’t mind online ads but don’t think I want to increase junk mail and spam. Guess everything has its price.

I don’t know. I haven’t researched that question yet.

Could you clarify something that sounds counter-intuitive:

The post initially argues “…I argued against relying on that service. After all, Equifax lost our data. Should we really rely on them to protect it?…” implying (correctly so) that the protection service being offered by Equifax may be as vulnerable to getting hacked/losing our data again.

But then you go on to recommend Credit Sesame and Civic, with the argument “…Personally, I’ve signed up for both because.. why not?” Really? Do you think these services are not vulnerable? Do they have higher safeguards in place against hackers or data theft than Equifax? It would be great if you could inquire and include safeguards that they have in place to protect data. A comparison of the safeguards between the 3 options would actually be the best.

The risk of loss further loss of data due to hacking of a credit monitoring website is quite significant. The more services you sign up for, the more risk you are taking. What is the additional benefit of signing up for a 2nd service? Do you anticipate you will get paid twice the amount in case of loss from identity theft?

That’s a great question. I’m operating under the expectation that our personal information is already freely accessible to hackers. The question in my mind now is not how to keep our information secret, but rather how we can protect ourselves from those who get access to that information. Making sure that we are insured is one of the steps we can take.

When I wrote that I didn’t trust Equifax to protect us, I didn’t really mean that that can’t be trusted to protect the data itself (although that’s obviously true), but rather that their identity protection services may not be trustworthy. More importantly, they’re only free for a year so signing up for Equifax’s services gives Equifax an easy way to sell us those services a year from now. That would be a huge win for them. Do we really want to reward them for their own blunder?

All of that said, you are right. There is a cost to signing up for more services. As you point out, the chance of your personal information getting exposed goes up with each service you subscribe to. In my mind, that’s a very small cost since I believe the information is already out there, but it is prudent to be careful. Each person needs to decide the benefit of each service vs. the cost of potentially exposing their information some more. I’ll add a bit of a warning about that to the post.

And to answer why sign up for both services: I’m comfortable with Credit Sesame, but they only offer $50K of protection. With Civic, they might go completely out of business at any time for all I know. So, I see signing up with them as an easy way to extend the insurance to $1M, but it may not be as long-term as we’d hope.

These are exactly the questions I have, thank you for putting it clearly. And thank you, Greg, for your thoughtful reply. This is definitely a “between a rock and a hard place” situation.

Sorry, I don’t have links ready available, but numerous reports have been surfacing over the past week or two that Equifax will be allowing for free credit freezes going forward, and there may be something in the works for the other two major credit bureaus to do the same. If this were to pan out, would this (credit freezes) be the cornerstone to your personal credit security strategy?

I’m sure Greg will answer with his take — but here’s mine: it’s possible that an identity thief has enough information to lift your freeze (you set a PIN — but if you lose your PIN, they have a system to create a new one, and an identity thief may now have enough personal information to do that). I’ve personally used freezes for years — but I don’t think they are the complete answer at this point. Hence this series :-).

There was a Senate bill introduced by Democrats to allow consumers to freeze all 3 credit reports as needed, for free. Given the current political climate, I don’t know how likely it is to pass, but I certainly hope it does.

Credit freezes are an effective way to prevent various types of fraud, but not all. As Nick pointed out, there is a lot that criminals can do with the information that has been hacked even if your reports are frozen.

So, yes, credit freezes are a key tool to use, but not a complete solution.

Have you checked the credit-worthiness of either of those two companies? Can Civic really pay $1 million to multiple victims?

No, I haven’t checked their credit worthiness. I expect that they pay a small amount to an insurance company to cover their subscribers and that it is the insurance company that would have to pay out.

Credit Sesame has been around for years, so I feel comfortable that their insurance is solid. I can’t vouch for Civic.

Civic did a pretty big ICO a few months ago. They have plenty of money now