NOTICE: This post references card features that have changed, expired, or are not currently available

After a recent golf tournament, my father-in-law responded with one of his favorite movie quotes when asked how he did on Sunday afternoon: “I coulda been a contender”. That quote could just as likely been attributed to the Bank of America Premium Rewards card when the final benefits were announced — but is that a fair assessment? This week, we took a closer look at that card, we learned which would be the gateway drug to our hobby first credit card for Greg’s soon-to-be 18 son, and we got some prescriptions to help ease our suffering from data leakage. Read on for this Frequent Miler week in review.

How to dodge Plastiq cash advance fees

Plastiq can be a great way to meet minimum spend or hit a big spend bonus if you have bills to pay that can’t normally be paid by credit card. I also like it for the sake of automation. I pay a small monthly bill where the biller only accepts a check, and I enjoy the “set it and forget it” aspect of automating payment through Plastiq. However, some transactions could code as a cash advance — and that’s a bad deal. Read on for how to make sure you don’t get zapped with an unexpected fee.

Can you earn 4.59% back on everyday spend with the new BOA Premium Rewards card?

Spoiler alert: Probably not. But note that probably not ≠ no, and that’s an equation I like. After the application for the new Bank of America Premium Rewards card went live (See: 50K offer now live: BOA Premium Rewards Credit Card), I dug into the terms of Preferred Rewards to see if a double dip might be possible. Read on to dream a little dream with me…

Is it a keeper? My take on BOA’s new Premium Rewards Card

Bank of America’s new card was originally rumored to compete with premium cards like the Chase Sapphire Reserve and the Amex Business Platinum. When the final benefits were announced, most people had a ho-hum reaction and seemed surprised that BOA didn’t introduce more of a competitor to the aforementioned products……or did they? Turns out, the card may just be good enough to become Greg’s everywhere else card — which is more than can be said for its “premium” competitors. Read on to find out why.

Planning a teen’s first credit card

This post made me nostalgic. When I was Greg’s son’s age, I opened my first card with Capital One — just for emergencies (….and maybe a T-shirt). I must have had a tragic first year of school, because I sure found a lot of emergencies. But I digress — in this post, Greg gives us his plan for his son’s first credit card. I’m going to throw him a suggestion out of left field: get a Lowe’s store card. My rationale? While I would tell an 18yr old to avoid most store cards like the plague, phone reps are known to grant wild credit limit increases on the Lowe’s store card that might lead to an easier path to approval with the majors down the road. No, it’s not going to earn points or be exciting for a student, but it would be a cornerstone of my long-term strategy if I were starting over.

Equifax Hack Rx: Free Identity Theft Insurance

I know a lot of people are angry about the Equifax hack. While I’m certainly no less angry than anyone else, I would categorize my primary emotion as concerned. And while I hope that Alex Bachuwa makes Equifax pay for its sins, the truth is that even if Equifax paid out every penny they have to every person affected, it wouldn’t make a difference: you can’t unsteal that information. It’s out there and it sucks. But a wise friend of mine once gave me a sage piece of advice that I’m holding onto: It’s going to be OK, because it has to be. While we can’t control the information that’s been leaked, we can accept that fact and do the best we can to protect ourselves going forward. In this post, Greg covers one part in a series of the prescriptions to treat your hackeditis Equifaxis: Free Identity Theft Insurance. Read on to get some protection.

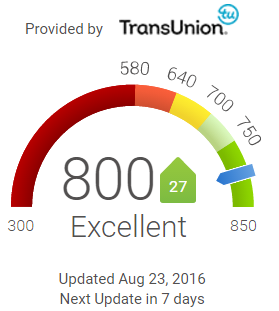

Equifax Hack Rx: Free credit monitoring

It’s always been a good idea to monitor your credit. Now, it’s essential to your long-term financial health. In the next treatment installment in this series, the good doctor (Greg, that is — no disrespect DoC) prescribes free monitoring services so you can be alerted to anything alarming. Contrary to what some are saying, credit freezes are not a catch-all solution thanks to the scope of the hack.

Avios transfer bonus: solid use of SPG/Marriott points

British Airways is offering a transfer bonus on Avios converted from hotel points. As is often the case, Marriott Travel Packages is an excellent use of the bonus. Two surprising takeaways from this post: First, IHG might not be a bad choice either. Second, though I left this out when writing the post, it’s interesting that Starwood is not included in the promotion this time around. Could this be Marriott prepping us for life after Starwood? Or is it British Airways that doesn’t want to offer that generous of a bonus? I’m not sure — but a conversion to Marriott and a Travel package remains the best value regardless.

That’s it for this week at Frequent Miler. Check back soon for our week in review around the web and this week’s last chance deals.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)