NOTICE: This post references card features that have changed, expired, or are not currently available

Chase has confirmed details about the Chase Ritz-Carlton and Chase Marriott Business cards, as well as details on how the new free night awards will work. Most of the key pieces are things we expected, though there is a bit more detail to fill in the blanks. One major negative change: the business version of the Marriott Rewards card will no longer earn an elite night credit per $3,000 spend when the new benefits launch on August 26th. No word on the fate of that benefit on the personal card, but it would stand to reason that it may disappear there as well. Free night awards are kind of a bummer in my opinion. Details to follow.

Chase Ritz-Carlton Credit Card changes

Starting August 26th, the Ritz-Carlton Rewards card will earn points at the following rate:

- 6x at Marriott properties (including Ritz / SPG)

- 3x at restaurants, car rental companies, and airline tickets purchased directly from airlines

- 2x everywhere else

Additionally, the card will gain a couple of benefits:

- An annual free night award that will be valid at properties costing up to 50,000 points

- Automatic Gold status (though this is fairly meaningless as the new Gold status won’t be worth much)

The card is losing the annual 10% premium on points earned, but it is scheduled to keep all of the other current key benefits, including:

- 3 club level upgrades annually valid on paid stays of up to 7 nights

- $100 hotel credit for each 2 night or longer stay (subject to availability – must book a special rate, but can be stacked with the club level upgrade)

- Airport lounge access via Priority Pass (currently comes with unlimited guests)

- $300 annual credit for airline incidentals

- $100 discount when you book 2 or more round trip domestic economy class tickets via the Ritz Visa Discount Air website (this benefit can be used repeatedly)

- Platinum status with $75K spend per cardmember year

- The current signup bonus is not slated to change yet — it’s unclear how the 2 free Ritz Tier 1-4 certificates will be treated in the new program

Ritz changes analysis

We already knew about most of the above. There were two key things that stuck out at me:

The new free night award can be valuable, but it still kind of stinks.

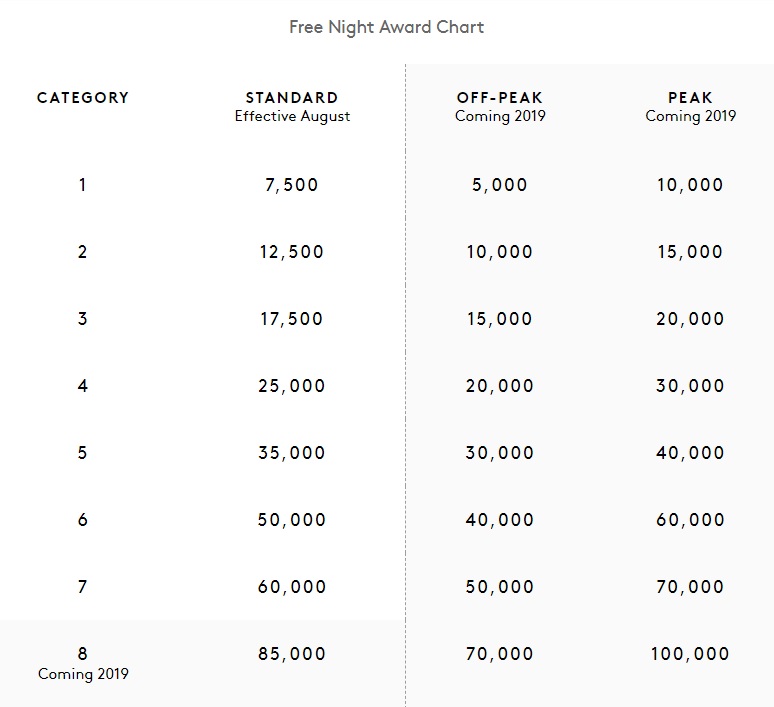

From August until early 2018, Marriott is only using “standard” award pricing. That means that the annual free night award that comes with the Ritz-Carlton card will be valid at up to a Category 6 property if your anniversary date falls sometime after August 26th and before early 2019. As a reminder, here is the chart:

However, it starts to get….murky….in 2019. We got confirmation today that the annual free night certificates that come with the various credit cards will be valid based on the rate the hotel is charging at that time of year. In other words, when peak and off-peak pricing take effect in 2019, the maximum category for your free night award will vary depending on whether you stay in peak season, off-peak season, or “standard” periods. In other words, this free night award will get you the following:

- Max “peak” award = Cat 5 (40K points)

- Max “standard” award = Cat 6 (50K points)

- Max “off-peak” award = Cat 7 (50K points)

On the one hand, that sounds kind of good — in 2019, you might be able to land a Category 7 property during off-peak times. As that is (sort of) the top tier for the rest of 2018, there will surely be some really awesome properties in that category still in 2019.

However, my bet on this is that you’re only going to be able to go when you don’t want to be there. Think ski country in monsoon season. A beach destination during great white breeding season. A major city during….well, who are we kidding? Is New York is ever going to charge the off-peak pricing for its Category 7 properties?

Realistically, the free night award is going to be valid at a Cat 6 “standard” award level — but even more realistically, I could imagine a world where your best available options quickly become Cat 5 awards, whether peak or not — meaning you may end up having to settle for a max of 40K in value. If that doesn’t sound like much more than what comes with the cards that cost $355 less per year to hold (like the Marriott Rewards Premier Plus and SPG business / SPG personal cards), that’s because it isn’t — those cards will come with free night awards valid up to 35K points. Of course, those free night awards could well turn into the same situation. The saving grace for the 35K awards is that the worst case scenario is you’ll end up with a Cat 4 property. Those properties by and large are the same properties you can book today with your annual free night certificates. In other words, you’re not going to lose a ton of value on those annual certificates…but you won’t necessarily gain as much value on the premium cards (Ritz and SPG Luxury) as it sounds when you hear “up to 50K”.

But the value proposition on this card could turn out to be great

Of course, I could be wrong. Marriott could turn out to be incredibly generous with award pricing and this could turn out to be a fantastic annual benefit. If it does turn out tn be easy to book a Category 6 standard award, the Ritz card will turn out to be a phenomenal value since it offers:

- $300 in airline incidental credits annually

- $100 repeatable airfare discount for 2

- The free night award

You could certainly come out well ahead of the annual fee with just those benefits. If you use the club level upgrades and $100 property credit, all the better. But I do have a healthy bit of skepticism about how easy it is going to be to use the free night award at something better than Category 5. Don’t get me wrong — it should still be easy enough to get yourself a $200 or better free night….though as I noted yesterday, thanks to Marriott charging resort and “destination” fees on free night awards, that free night might not be so free. Pretty soon, they are going to add a “doorbell fee”, “nightstand fee”, and “electricity surcharge”. Kidding, of course. Don’t get any ideas, David Flueck.

As you can tell, I’m of two minds on this card. If you can use the airfare discount a few times a year and you use even most of your airline incidental credits, the free night is gravy. Stuff like the global entry reimbursement, lounge access, etc is like adding butter to your gravy. For a market of people, this card will have real value. Some will prefer the $300 property credit planned on the SPG Luxury card over the airline incidentals credits, but the repeatable airline discount would push the needle in favor of the Ritz card for me.

Overall, it’s not terrible — I’m motly just surprised they didn’t surprise us with something we didn’t expect. There is obviously good value there – just no “exciting new benefits” really.

Marriott Premier Plus Business Card

On the business card front, there was a small surprise: Chase isn’t launching a new product at all, but rather changing the name of the current card. Existing card members will keep using their old card until it expires / is replaced, but both new and existing cardmembers will have the same benefits beginning August 26th. The $99 annual fee isn’t changing. However, the card’s new earning structure is. Beginning August 26th, the Marriott Premier Plus Business Card will earn:

- 6x at Marriott properties (including Ritz and SPG)

- 4x at gas stations, restaurants, and on shipping, Internet, cable, and phone services purchases

- 2x everywhere else

Additionally, the card will come with a free night award valid at any property worth up to 35,000 points (set to work the same as set forth above in this post). That’s a change from the current Marriott Category 1-5 certificate that the card has earned, though it should theoretically be valid at the same calibre of properties.

Other benefit changes include:

- Spend requirement for Gold status drops from $50K to $35K (though the value of Gold status drops as well since it no longer comes with free breakfast)

- No more elite night credit per $3K spend on the card – this is unfortunate for those who would use spend to top off for an extra night or two of credit when close to a threshold

- The 15 nights of elite credit that come with this card will not stack with elite credit from other cards

- The card is losing price protection, return protection, trip cancellation, and trip interruption coverage.

If that sounds like a net loss to you, I would agree. While the free night may get you a nicer room than in the past, and the earning rate at the 4x categories is more than before, considering the Reasonable Redemption Value of Marriott Rewards points (0.72 cents each), the return isn’t very exciting for a bonus category at a rough rate of return of 2.88% based on that valuation. On the other hand, if you regularly redeem your Marriott points for more value, those categories might suit your needs.

Bottom line

The changes to these cards more or less fall in line with what we have seen through the rest of the Marriott / SPG card porfolio. In yesterday’s post, I said that I’d be sending my Marriott and SPG cards out to pasture. I mentioned that barring a huge new benefit on the Ritz card, it wouldn’t be far behind. Today’s announcement probably doesn’t do much to change that. Lucky for me, my anniversary date does fall between August and the end of the year, so I’m hopeful that I might be able to earn a 50K free night award before I lay that card to rest. At this point, I don’t think that will be enough to keep me around another year.

More info

Please see our Marriott SPG Ritz Transition Guide, or click through to the guide via any of these topic links:

- Transition overview

- Unified award chart

- Potential chart mappings (old to new)

- Elite status transition

- Lifetime status transition

- Point earnings now vs. August

- Point transfers to Airline Miles

- Free night certificates

- Travel packages

- United & Delta partnerships

- Free breakfast / lounge access

- Suite Night Awards

- Credit card changes

- New program pros & cons

- Short term opportunities

- Q & A

- All Frequent Miler posts regarding the Marriott SPG transition

H/T: The Points Guy

I realize this post is ancient history on here, but I would be very interested to hear back from Nick R. and any of the other comment authors who spent $10,000 in the Ritz Carlton Rewards Card before the end of July 2018 to learn whether that succeeded in achieving Marriott Platinum status for the rest of 2018 after the two rewards programs merged in mid-August 2018.

I am in this category myself (I obtained the RC card in 12/2016) and did not receive MR Platinum status in mid-August 2018 despite having spent more than $10,000 on my RC card in April 2018. Since then, I have placed multiple phone calls to MR phone agents and even to JP Morgan Chase’s usually very helpful customer service reps, and to the extent I have been told anything, it’s that spending $10,000 on the RC card by July 2018 to achieve Marriott Gold status for 2018 post-merger would not in fact qualify the cardholder for MR platinum status in 2018 post-merger. Has anyone been able to achieve Platinum status solely based on $10,000+ spend on the RC card by July 2018 that’s so far proved impossible for me to obtain? Thanks for any insights anyone can provide!

Yes, I did automatically get Platinum Status. It wasn’t on Day 1 for me – it took a couple of weeks, but I got Platinum and I wouldn’t have earned it based on my stays ($10K spend was it). I completed the spend in July.

As for escalating, I’m honestly not sure there’s anyone specific you can call if it didn’t happen automatically.

[…] No uncertain terms there for sure. Sadly, it looks like the window of opportunity has firmly shut on this one. Congratulations to those who got in recently and who should therefore be picking up Platinum status in the new program (since the first-year Gold status should transition to Platinum). Of course, existing cardholders will continue to hold the Ritz card and enjoy its benefits, some of which are changing a month from today (See: New details on Marriott & Ritz cards: no more elite credit per $3K spend, free night changes, mo…). […]

Has there been any discussion on the Ritz club level upgrades being applied to Marriott properties? In the past, it has only been allowed at Ritz because it was different programs. Now that all hotels are in one program, could these be used at Marriott and SPG properties?

Good question. I haven’t heard anything about that and they said that the club level upgrades are remaining the same. While Ritz won’t be a separately loyalty program, it’s still a separate brand, so I suspect they will only be valid at Ritz properties (kind of like how even if you have Platinum status in the new program, you don’t get the same benefits everywhere — no breakfast at Ritz, but free breakfast at St. Regis for example). So I think it is unlikely that they will work outside of Ritz properties — but it’d be nice if they did.

Question regarding the optimal timing to upgrade the Marriott card (as a family of 5 we get good value out of the certs): How does the card anniversary date and related perks change with the upgrade? My current Marriott card anniversary date is 12/1; expiration date for upgrade bonus of 20K points is 12/31. I feel like I should wait for my 15 elite night credit and free night cert on current card to post, and then upgrade thereafter, in that window before 12/31. Will that make a difference in how certs and elite nights post (i.e. is there a potential double dip here)?

For those following this thread of discussion, I received confirmation again today that if you receive Gold status before the programs merge (i.e. from opening the Ritz card this year or doing $10,000 spend as an existing user), you will transition to Platinum in August. That answer has not changed.

[…] Marriott is gently picking the lowest fruit to kill/devalue, bye bye elite credits per $3k spend! New details on Marriott & Ritz cards: no more elite credit per $3K spend, free night changes, mo…. […]

Thanks Nick, Good info! It looks to me like the Ritz-Carlton will be the one keeper for me (I have Marriott Rewards, SPG, SPG Biz, and R-C). Not being able to stack nights credit beyond one card makes it pretty marginal to keep these others (for me). Btw, I have been grandfathered at $395 on the R-C. Do you know if that will continue?

If my Marriott business free night is issued on Aug 2, will it be converted to max 25K or 35K after Aug 26?

Good question! Starwood anniversary certificates issued after August 1st will be 35k, since they announced these benefits as taking effect August 26th, I would think your certificate is going to be worth 25k. It’s possible that those issued after August 1st will become 35k, but I wouldn’t count on it.

For the sake of clarity for others reading this, the old Marriott Rewards Premier (personal, non-plus) will only be getting a 25k certificate. I expect that existing certificates from that card and the Marriott business will be converted to 25k, but those business card certs issued after August 26th will be 35k certs.

From August until early 2018 (should be “2019”)

Hi Nick. Getting the Ritz card this weekend so that I, in theory, would have Platinum status through Feb 2020. I have a question around this. Currently I am status matched Gold through both SPG and AmEx Platinum. Those two will remain gold come August since they are status matches and not earned. In your opinion, will the Ritz card Gold status ‘trump’ the status match from the aforementioned CCs so that I am assured Platinum? Appreciate an informed guess on this issue since it really hasn’t been addressed in any posts I have read anywhere. Very much appreciate all the analysis around this transition- as we want to do what we can to protect our 500k plus points after they all get combined.

Greg and I have discussed this. We think status from the Ritz card will trump. Essentially, our assumption is that the computer system will first check to see if you qualify for status from the Marriott/Ritz side before looking at matched status. As you recognize, that’s an educated guess. I’m not sure that even Marriott’s internal IT people would know the answer for sure.

I’m hoping it works that way because I have Marriott matched from SPG (Amex Platinum) and I’m working on finishing the $10K spend on my (existing) Ritz card. So I believe in it enough to put $10K spend into it for what that’s worth.

[…] New details on Marriott & Ritz cards: no more elite credit per $3K spend, free night changes, mo… […]

I have a question on the elite night credit on the business card, will I get my 1 night credit per 3k spend up to July? Or will I only get the credits up to July and what I spent this month won’t be credited?

Second question anyone know if the spending requirement on the highest level of status ($20k I believe) is for hotel stays only, or will that include spend on credit cards?

My assumption is that you will get the elite night credits based on spend you do through the end of July. I’m basing that on the fact that you’re supposed to get 3 Marriott points per dollar spent on the SPG cards to the end of July. I would assume that that means all current benefits stay at least that long. These new benefits were announced to begin on August 26th. I imagine that means that spend before then should theoretically earn the elite night credit still. At the very least, July spend should be safe.

Hello Nick – If we apply for the Marriott Rewards Premier Business Credit Card now, would we still get 15 nights credit towards status for 2018?

Yes.

The Ritz does Tiers they could of done a Tier 4 or 5 Hotel at least but at least they are adding something since they are taking away the 10% bonus

There will be no more tiers in August — it’s a unified award chart.

Nick, I understand that as I’m currently Marriott Gold earned through the Ritz Card, I will become Platinum elite in August. I opened the card in November 2017. Will my new Platinum status be valid until February 2019 or 2010? If I complete the $10k spend by the end of July, will that extend my new Platinum status until Feb 2020?

Currently, it would be valid until Feb 2019.

If you complete the $10K spend by the end of July, it would be valid until Feb 2020.

(the reason for that is that you technically earned Gold status in 2017 for the 2018 year, which ends Feb 2019. You haven’t re-qualified during 2018 for the 2019 year. The criteria for re-qualification is to either do 50 nights during 2018 or do $10K spend on your Ritz card….so you would need to do that $10K spend in order to earn your 2019 status, which expires Feb 2020).