NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

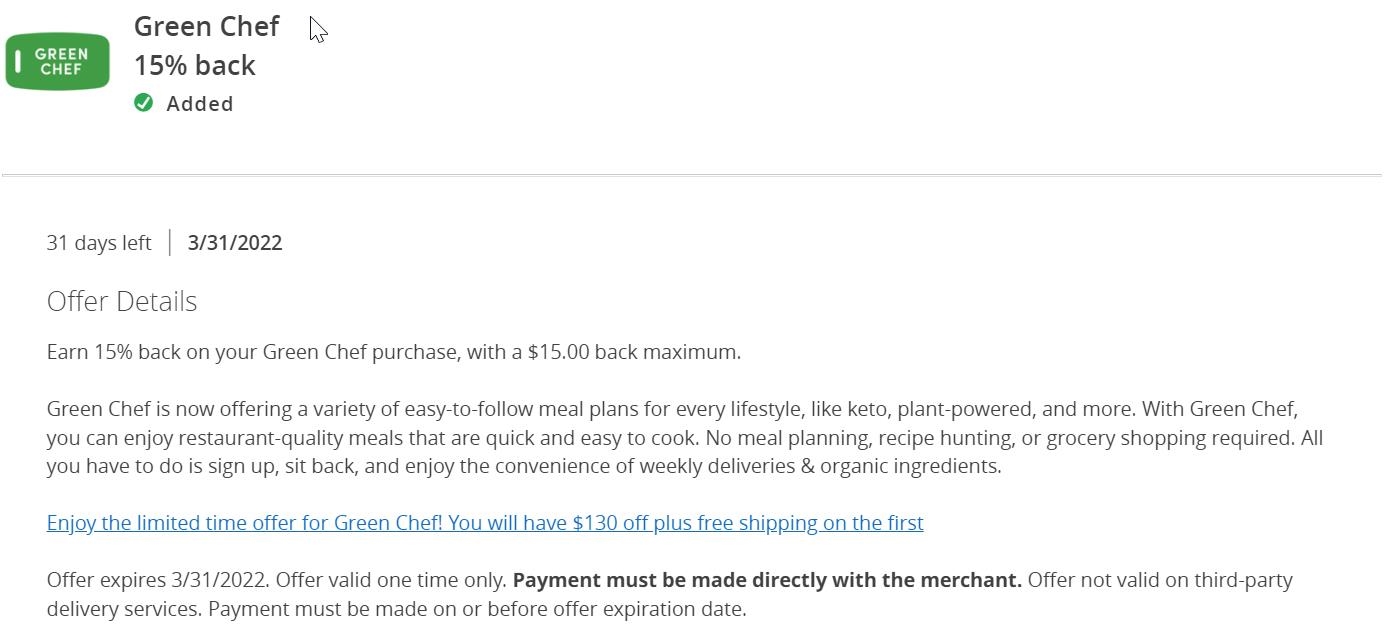

Green Chef has a boosted rate on the American Airlines Shopping Portal, giving 2200 AAdvantage Miles and Loyalty Points when paying for one order on a new sign-up. There is also a stackable Chase offer that gives 15% back on up to $100 in purchases. The cheapest plan is 3 meals for 2 people which comes out to ~$40 after discounts and including free shipping. With the Chase/BOA Offer, the total cost is ~$34.

The Deals

- Earn 2,200 American Airlines AAdvantage miles when ordering from Green Chef after clicking through from the American Airlines shopping portal.

- Stack with targeted Chase/BOA offer for 15% off aup to $100 of Green Chef.

- Direct link to offer.

Key Terms

- Not eligible on purchases made with coupon or discount codes that are not found on this site.

- Not eligible on gift cards, gift certificates or any other similar cash equivalents. Purchases made with a gift card may be ineligible.

Quick Thoughts

Green Chef is a meal kit delivery service that provides a variety of options for various dietary preferences, including keto, paleo, etc. The company uses organically certified ingredients and emphasizes green eating and living. Green Chef is a certified organic company that emphasizes its commitment to sustainability and green practices, noting that its meals produce less waste than grocery store meals. It claims to be the only meal kit that offsets 100% of its direct carbon emissions and plastic packaging.

The AAdvantage shopping portal has been offering 1,500 bonus miles on Green Chef orders, so this offer is almost 50% more miles than normal, a nice bonus for those of us playing the AA Loyalty Games. I personally haven’t had any issues with clawbacks of miles earned through the AA portal, but it’s worth noting that some have. I haven’t heard of any issues with the various meal kit offers, though. Never mind, I spoke too soon, there are comments about some folks having issues with both Sunbasket AND Green Chef.

this offer is stackable with a Chase/BOA Offer for 15% off of up to $100 in Green Chef purchases.

Green Chef has a current promotion for new sign-ups that automatically stacks and provides 50% and free shipping off of the first order. I chose the cheapest option of three meals, but ou can certainly choose larger orders if you want to try more options.

You can easily skip as many deliveries as you’d like through the online portal. My usual drill is to stay signed up but skip deliveries until the miles have posted and then cancel.

There have been several AA portal offers with meal-kit services, my wife and I did Sunbasket and quite enjoyed it. I value these meals a little more than some will, as they will legitimately provide three meals for my wife and I (that we don’t have to shop for). I would probably try it by itself for around $20, so for me, it’s like buying 2200 miles/points for $14. If you don’t value the meals, though, I don’t think 2200 miles for $34 is terribly compelling.

The opportunity cost for some of these AA deals is quite high. Swagbucks is currently $40 back on Green Chef, so you’re effectively paying 1.8 cpp since the deal is the exact same work with the exact same possible discount stacking.

And FWIW, SB was $50 recently, so passing up on that would have been 2.27 cpp.

That’s a really good point, but I’m not sure that opportunity cost should be applied in that way here. Or, let me put it a different way: if you were going to sign up for this meal kit anyway, then yes, your cost is the $40 you are giving up from Swagbucks (but then you shouldn’t include the cost of the meal kit as part of your cost). But if you are doing the deal only because you want to get rewards, I don’t think it is accurate to include the $40 as part of your cost. Instead, your cost is simply the amount paid (and perhaps subtracting the amount you value the meals at).

I agree with you that the actual cost is what you paid, but you could say that the opportunity cost is the cost of choosing the AA portal vs. Swagbucks.

The effort you do in obtaining this deal (activating offers, subscribing, canceling) unlocks one of the following rewards:

a. $40 ($50 when the offer is increased) in the form of Swagbucks

b. 2,200 AA miles/loyalty points

As the difference between choosing the two options is as simple as clicking through a different shopping portal, you’re effectively buying 2,200 AA miles/loyalty points for $40.

I think this is touched on in other posts on FM with regard to choosing the optimal credit card for a purchase. Suppose I have I have the BoA Premium w/ 2.625% back and an IHG card earning 1x for a $100 purchase, and I make these arguments:

Purchase I’m making anyway (organic spend): “I got 100 free IHG points.”

Purchase I’m making for the rewards (manufactured spend — let’s say 0.5% liquidation fees so that IHG points could at least be potentially worthwhile): “I bought 100 IHG points for 0.5 cents each.”

In both cases, you’d agree with my actual cost. But you’d argue that I effectively bought IHG points for 2.625 cents each in both scenarios because I should have just used the BoA Premium card instead.

We agree on what opportunity cost is, but there’s a separate question about how to account for “Excess Cost” in the AA loyalty game spreadsheet…

Let’s start with the basics (which I expect we agree): You should never combine actual cost and opportunity cost. Always pick one or the other. For example, imagine buying XYZ for $30 where you have the option to earn 1K AA miles or $10 back from portals. In that case, you need to account for either the $30 cost OR the $10 opportunity cost. There is no world in which the AA miles cost you $40. You have to pick one comparison or the other, not both (comparison 1: buy $30 XYZ or don’t buy it. Comparison 2: use AA portal or cash back portal).

So, how do you know which to use? My rule of thumb is to base it on whether you would have bought XYZ anyway. If yes, then you shouldn’t account for the $30 in the spreadsheet under “excess cost”. There’s nothing “excess” about the $30 that you were going to spend the $30 one way or another. Here, you should enter $10 as the excess cost since the relevant comparison is which portal you should use. If you plan to buy XYZ only for the AA miles, and you wouldn’t have bought it anyway, then the relevant excess cost is the $30.

So, my rule of thumb approach to determining Excess Cost is based on whether you would buy the thing anyway:

It does look like we agree on all the basics and definitions, but on the topic of accounting for it in the spreadsheet, I think it makes more sense to say:

Excess cost is the greater of your adjusted* cost or your opportunity cost.

* Adjusted cost = amount paid – value of goods received. For a purchase you would have made anyway, you can set the value equal to the amount paid and treat the adjusted cost as $0.

You essentially have this in your spreadsheet already, as you have in your mouseover for Excess Cost:

1. You bought something you don’t want in order to earn points: Put the full purchase price into this cell.

2. You bought something you want, but you paid more in order to earn points: Put the price difference in this cell.

3. You used the AA eShopping portal instead of a cash back portal: Put the amount of cash back you would have earned here.

The only thing that isn’t addressed there is what to do when you have a value for #1 or #2 (depending whether you wanted the item) but also #3 because both AA and portal cash back are available. I guess that’s what we’re talking about here. You could say my suggestion then, is that it doesn’t matter whether you wanted the item or not — you just need to take whichever amount is largest.

If we run your XYZ for $30 with 1k AA vs. $10 back example through my proposal, we do get the same results:

Yes (purchase anyway): Adjusted = $0; Opportunity = $10; Enter $10

No (would not purchase): Adjusted = $30; Opportunity = $10; Enter $30

And that will always be true as long as the amount paid is greater than the opportunity cost. What if the opportunity cost were higher? Imagine the portal were offering 1k AA or $1000 back…

It goes without saying that you’d recommend everyone take the cash, in which case the transaction doesn’t get entered into your spreadsheet at all. But let’s say I didn’t listen to you and took the miles. How do I account for that on the spreadsheet? It would pretty disingenuous, I think, to pass up on $1000 cash back and claim I only paid $30 for 1k AA. I expect we’d agree that my cost here was more like $1000. You could even think of it like I just took the $1000 portal cash back and then turned around and bought 1000 AA at a really terrible rate.

In fact, any time the portal cash back option is profitable (opportunity cost > adjusted cost), the transaction can be viewed as if you just took the cash and bought AA miles/loyalty with it.

Last example I promise 🙂 Imagine if you did this deal as written, got 2200 AA, and logged your cost as $34 (amount paid) in your sheet. Nick does the same deal but takes $40 cash. He doesn’t log it since no AA are involved. In a completely independent transaction, I offer to sell him 2200 AA for $40. He accepts my offer and logs 2200 AA in his sheet at a cost of $40. You both have spent the same amount of total money and acquired the same total miles, but you have different costs in your sheets now. My argument is that you should have put $40 (opportunity) cost in yours and both wound up the same in the end.

I agree, that’s a good way to do it.

Excess cost is the greater of your adjusted actual cost or your opportunity cost.

I don’t see it that way. Yes you can say the opportunity cost is $40 for getting miles and LP points. However those are 2 separate items you treated as one.

I value AA miles alone at 1.1c which leaves $15.80 cost. Pick whatever value you want. Now ask if $15.80 is worth 2200 elite points (LP) to you? Scale that up to your elite goal to decide. For example, 75k* 15.80 / 2200 LP = $539 for platinum.

I wasn’t forgetting that LP have value — I did mean the combined AA miles+LP.

Since you’re earning them together at the same time and at the same rate, you can add their values together and treat them as one after figuring out their values independently.

We can take your value of redeemable AA miles being worth 1.1c each.

For LP points, do it the other way and ask, “How much is Platinum status worth to me?” If the answer were $500 for example, then you could say each LP is worth $500 / 75000 = 0.667c. If it were $750, then you value each LP at 1c.

These examples would mean you value combined AA miles+LPs at 1.767c (Platinum = $500) or 2.1c (Platinum = $750).

Then you can compare that to the cash back offer to decide which portal to use and whether a deal is worth doing.

In this case, I’m only arguing that you’re effectively buying the combined AA miles+LPs for 1.8c each because $40 is available, so your value should be above 1.8c to choose the AA shopping portal.

Yes. That’s the same but you’re reversing my calculation.

I personally think it’s easier and more practical to put a price on miles alone first to figure this out my way, because i know how to value miles absolutely or within a tight range. I have a lot of regular experience with their value and they also don’t expire.

Trying to value elite status in advance is more difficult since it is more personal and there are so many variables. 1) elite status expires, 2) its lifespan depends on when you earn it 3) its value depends on whether you have MM status already— meaning gold and platinum are both worth $0. 4) its benefits depend how much you’ll travel in the following year and where and how heavy those routes are filled with elites or out of a big hub 5) you earn valuable gifts if you can add on 30 flights but that’s worth $0 at 29.

I’m doing this deal now, with my Chase Hyatt card: 3 meals for 2 people, about $34. I don’t see anything with this particular deal requiring a minimum subscription period, though–am I missing that somewhere? Meaning, could I simply cancel after the 3 meals?

I can’t promise that there won’t be clawbacks, but yes you should be able to cancel after earning the miles

I feel like a broken record, but does anyone know why FTD.com miles are counting as bonus miles when clearly they are not.

No idea

Hey all. Has anyone tried going through their own AA portal to redeem offers for a second player?

I echo Alex’s sentiment that the momentum of this fizzled out quickly and without an expensive Rocketmiles stay or MSing (not an option in my area unfortunately) Plat/Plat Pro looking much less likely.

The only way I really see it working is if you can do all of the portal offers for one AA account.

Do you mean trying to do P2 offers on one AAdvtantage account number? If so, I’d be skeptical that it would work long term, although you might get a few to slide by. No harm in trying with something cheap like Market Watch though.

A quick thought I have been having. With our attempts to reach 75k or 125k AA loyalty points, we need a lot of these types of opportunities and I imagine many people are like myself and not seeing a lot of new avenues. Simply Miles started off the year with a bang but since then I haven’t seen anything compelling (hopefully more will come!). I think part of how we value our miles in these deals depends on the ease of collecting them otherwise. So while 2200 miles for $34 might not be compelling with many alternatives, it becomes more compelling when opportunities are more scarce. In other words, part of how we put a value on these points is the cost of obtaining them elsewhere (Greg and Nick make this point frequently about not valuing Hilton points above .5 cpp even if your redemptions are higher than that because you can often purchase them for that).

This is a great point, on both sides. The more you care about AA status, the more valuable each loyalty point becomes and inversely, the less you care about it, the better the CPP proposition has to be. I do some MS on the Hy**t Biz card at 1x, which is almost like buying Hyatt points at 1 cent each because of liquidation costs. I’d never do that in a vacuum, but the elite nights are worth it for me.

AA shopping portal has turned out to be a terrible experience. Never got credit for my sunbasket purchase and customer service with the portal has been awful. So Tim, now you HAVE heard of issues with meal delivery and getting points.

I got my AA miles from Sunbasket right away (within days).

My 1/15 purchase to Green Chef however, did not trigger. I contacted customer service at the 15 day mark, they confirmed my transaction, and contacted the merchant. 2 weeks later around 2/16, I got an unsolicited update from customer service saying they were still waiting on confirmation from the merchant. I’m guessing I will get another update soon as another 2 weeks will have passed.

It seems like Green Chef is not very good about resolving these inquiries from Cartera.

Mike, did you get the portal message with the amount saying that the purchase tracked or did it just not show-up as having been completed?

The visit was tracked, but the transaction was not. I sent in my order confirmation email which shows same date as my visit and order number.

Ah, ok. It seems like the poor tracking issue is sometimes getting confused with the clawbacks (understandably, since they’re both happening at the same time). Thus, I’m trying to keep track of which offers are actually getting clawed back vs poor tracking by the portal. it seems that some merchants, in particular, are more likely to not track.

Jonny, that sucks, I’m sorry to hear it. I’ve never seen such inconsistency through a portal as we have with AA…and there doesn’t seem to be any rhyme or reason to it, as far as we can tell. I’m going to update the post linking to your comments so folks are aware.