NOTICE: This post references card features that have changed, expired, or are not currently available

Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email.

There’s a new promotion today to get up to 30,000 American Airlines AAdvantage miles by opening an investment account with Betterment. While I’m not very familiar with Betterment, the bonus may be attractive if you’re looking to open an investment account (though I’d of course recommend doing your due diligence with regard to whether or not Betterment offers the type of investment platform you’d like to have).

The Deal

- Open a new investment account with Betterment, make qualifying net deposits within 45 days and maintain those deposits for a minimum of 60 days and you can receive bonus AAdvantage miles per the following tiers:

- Net deposits of $15,000 to $49,999, get 5,000 AAdvantage miles

- Net deposits of $50,000 to $99,999, get 15,000 AAdvantage miles

- Net deposits of $100,000 or more, get 30,000 AAdvantage miles

- Direct link to this promotion

Key Terms

- Valid only for new customers who open a taxable Betterment account by 4/18/18 and fund the account with $15,000 or more in net deposits within 45 days of account opening

- Net deposits are determined by determining assets deposited minus assets withdrawn and transferred out of Betterment

- Must be outside assets new to Betterment

- Rollovers and tax advantaged accounts like 401Ks, IRAs, etc do not qualify

- Allow 3-4 weeks from the end of the holding period to see the AAdvantage miles post to your account

Quick Thoughts

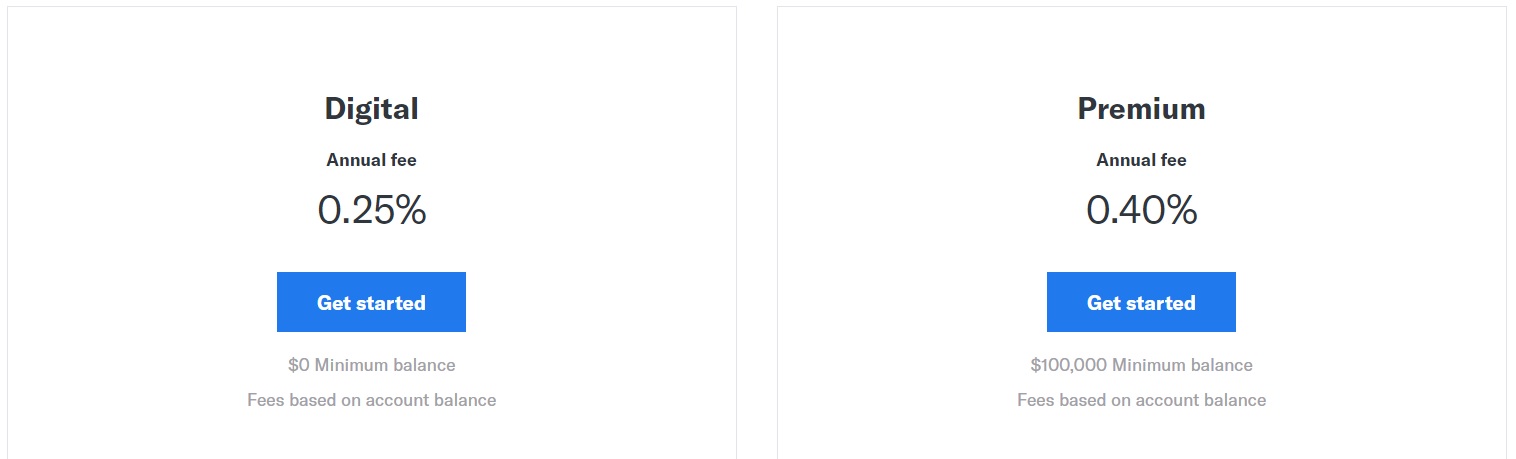

I don’t have any experience with Betterment, but the bonuses aren’t bad if you’re looking to start an investment account or move investments from elsewhere. The miles probably wouldn’t be enough to pique my interest if I were happy with my current brokerage account — but a bonus is nice if it’s something you were already considering. For what it’s worth, they advertise unlimited advice for 0.25%. If it’s good advice, that may be an attractive price. If you’re investing more than $100K, you also have the option to pay 0.40% for a few more bells and whistles:

Read more of the details on pricing here.

I’ve deposited $50,000 after reading this post, thinking that this is like Fidelity or Bankdirect mileage account thing. I’ve had an account with Fidelity in the past and currently has 2 accounts with Bankdirect. I do not lose any money but just get miles. With this Betterment BS, i’ve already lost almost $2000 out of $50,000. I called them and they said this is an “investment” account where they actually invest my money into something. What is going on here? What am I supposed to do? All i wanted was some AA miles and withdraw money after 60 days. I regret reading this post so much. I don’t know what i was thinking.

[…] Hat tip to Frequent Miler […]

[…] Up to 30,000 American AAdvantage miles for funding a new investment account […]

I’m also a pretty big fan of Betterment, especially for people who don’t have much investing knowledge. I actually talked about Betterment recently in a class I teach because I think it’s a great place to start the investing journey for people who don’t want to or don’t have the experience to pick their own investments and many people probably should not be picking their own investments anyway. I think they do a good job of picking a reasonable asset allocation given the goals you set up when you begin putting money in the account. For people with significant investing knowledge or experience, I agree with the comment that you can do a little better picking your own funds from Vanguard, Fidelity or Schwab. However, for anyone who is relatively new to investing and just wants to get started saving money in a meaningful way I don’t think you can do much better than Betterment.

What i planned was to withdraw money in 60 days with some AA miles. I thought this was like mileage accounts by Fidelity or Bankdirect. I deposited my $50,000 and they’ve already lost a lot. I didn’t even know they are actually investing my money into something. I don’t know what I was thinking.

I wonder if they issue a 1099 and if so, how they value the miles.

Fees are really tricky with investment accounts. 0.25% is a lot less than a traditional money manager (Morgan Stanley, Merrill Lynch, etc.) will charge, but because of compound interest, even 0.25% can materially reduce the amount you’ll have left after many years (for example, at retirement).

The alternative is a discount brokerage like Charles Schwab or Fidelity — they typically don’t charge any account maintenance fee, but charge $5-$10 per trade instead. If you trade a lot (which you should not — tons of research shows individual investors lose money by trading), then Betterment’s fee might be lower overall. If you don’t trade much, someone like Schwab or Fidelity probably charges lower fees overall.

I’m going to research this more as an admitted miles whore, but I’m wary about leaving the money in there any longer than is required for the bonus.

Btw, don’t take any results over the past 8-10 years as an indication of future success — virtually any investment strategy has been up big over that time.

Betterment is great! I’m up big over the past two years with them and if you get 3 referrals they give you a free year. Wish I could get in on this.

Everybody in the market is up big over the past two years