NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Doctor of Credit reports on what could be an attractive offer for those looking to beef up their Capital One miles with a no-fee card and a reasonably low spending requirement: some people are seeing an offer for new cardmembers to get 40,000 Capital One miles after spending $1,000 in purchases in the first three months with a new Capital One VentureOne card. While I’d sooner recommend the Venture X or even the Venture card, there are some people for whom this offer might make more sense.

The Offer

- Some people are seeing a cardmember offer for 40,000 Capital One miles with $1,000 in purchases with a new Capital One VentureOne card

Key Card Details

Note that if you click on the card name below, it will take you to our dedicated card page with current public offer information rather than this targeted offer.

| Card Name w Details No Review (no offer) |

|---|

No Annual Fee Earning rate: 1.25X miles everywhere ✦ 5X miles on hotels and rental cars booked via Capital One Travel ✦ 5X miles on Capital One Entertainment Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Redeem miles for travel at value of 1 cent per mile ✦ Convert miles to airline miles & hotel points |

Quick Thoughts

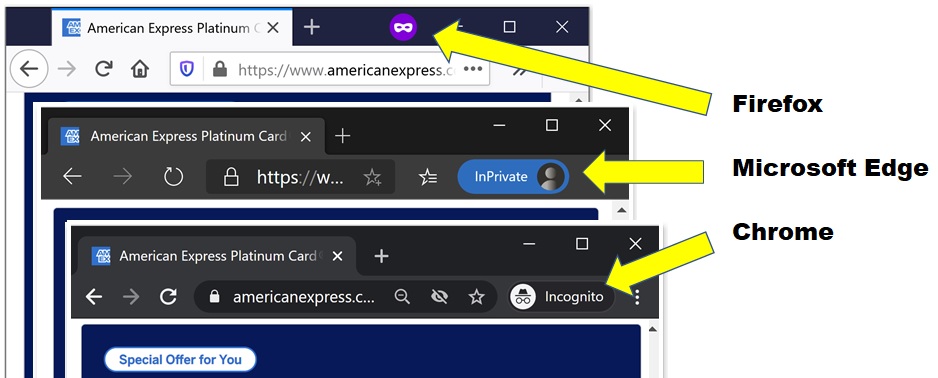

This offer is showing up for some people but not others. It may depend on which browser you use — I sometimes find that I see targeted offers when using a browser that I don’t often use for instance.

The VentureOne card earns a paltry 1.25 miles per dollar spent, which represents poor return on spend, so this card isn’t a great option for long-term everyday use.

However, keep in mind that even the VentureOne card can transfer miles to airline partners. If you are looking for a card with no annual fee and a low spending requirement that gives you points you can use to reimburse yourself or transfer to partners, this could certainly fit the bill. At a base level, 40,000 miles can be used to offset $400 in travel expenses which is a good bonus on $1K in purchases. Transferred to Turkish Miles & Smiles, it could potentially cover a couple of economy class United round trips within the United States.

That said, I think most people would be better off with the Venture Card and its larger bonus or even better yet with the Venture X if you can meet the spending requirement and front the annual fee. Since the Venture X card comes with an annual $300 travel credit and 10,000 miles at anniversary, the benefits can more than offset the entire annual fee. The welcome bonus on that card is much higher at the time of writing, though it also requires a lot more spend.

Capital One did not approve me for Venture but gave me VentureOne. Credit score around 800.

Do you get 2 free lounge visits?

Can you have a VentureOne and a Venture X?

Yes, you can. Capital One has no restrictions in that regard.

I guess the better question is how long after getting approved Venture X can you apply for this?