NOTICE: This post references card features that have changed, expired, or are not currently available

An easy way to find the best Amex signup bonus offers is to visit Frequent Miler’s Best Offers page. But, that page focuses on the best publicly available offers. This post details a number of ways to get targeted offers that may be even better. American Express doesn’t offer signup bonuses to those who have had the particular card before, so it is especially important with Amex to signup only for the very best offers.

Another advantage to seeking targeted offers is that some of these offers do allow you to get a bonus even if you’ve had the card before. Double and triple check the fine print. If your targeted offer does not say something like “Welcome bonus offer not available to applicants who have or have had this product” then you can get the bonus again!

1. Call Amex

If you’re an existing Amex customer it’s worth calling Amex to ask if you qualify for any special signup offers. If you’re aware of good targeted offers, ask specifically about those as well. This simple technique often works surprisingly well.

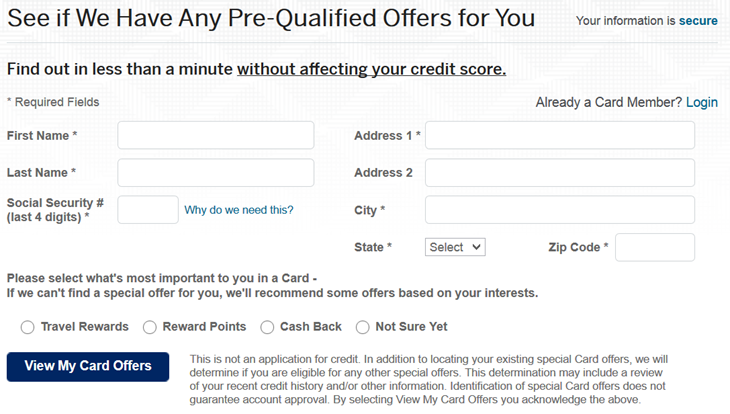

2. Check for pre-qualified offers online (personal cards)

Amex lets you look for pre-qualified offers online. Browse to AmericanExpress.com, click “Cards”, then click “View all Personal Charge & Credit Cards”. Unless Amex remembers previous browsing sessions, you should then see something like this offering to let you “Check for Pre-Qualified Offers:”

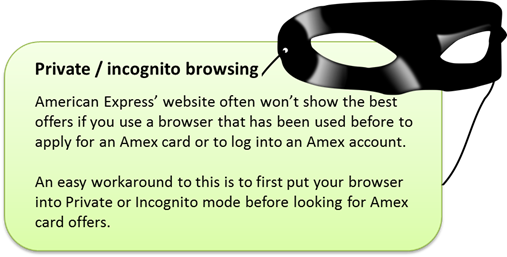

You may be able to skip all this by simply clicking this link within a new private browser window. You should then see a screen like this:

Fill out the form and see what happens.

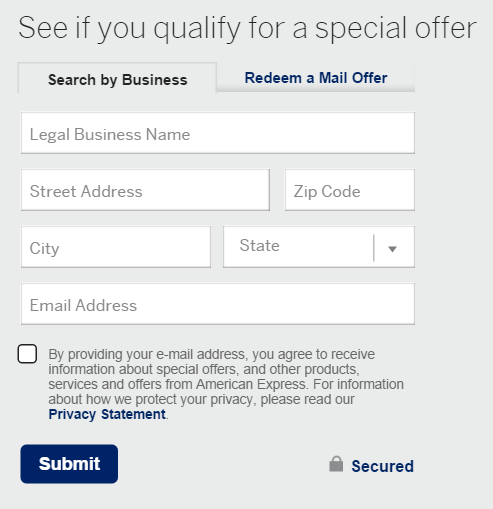

3. Check for pre-qualified offers online (business cards)

Browse to AmericanExpress.com, click “Cards”, then click “View all Small Business Cards” (or, go to this link from a private window). Scroll down and look for the option to “see if you qualify for a special offer:”

I haven’t personally had any luck getting better offers this way, but it’s worth a few minutes to try.

4. Amex Offers

Sometimes Amex will offer a signup bonus through Amex Offers. Simply log into your Amex account and scroll down to look at your available Amex Offers. For an example, see: Bet You Didn’t Know: Amex Business Card Apps Without a 12 Month Wait. Personally, I have yet to see one of these offers, but it can’t hurt to look.

5. CardMatch Tool

Click through this link to see if you are targeted for any good offers. People often report finding offers of up to 100,000 points this way. For example, a couple of years ago, my wife signed up for a 100,000 point Amex Platinum offer that she found through this tool.

Click through this link to see if you are targeted for any good offers. People often report finding offers of up to 100,000 points this way. For example, a couple of years ago, my wife signed up for a 100,000 point Amex Platinum offer that she found through this tool.

Note that this is an affiliate link. In other words, if you click through to the CardMatch Tool from here, and successfully sign up for a credit card, I’ll earn a commission*.

6. Enroll in Loyalty Program

Amex partners with brands such as Delta, SPG, and Hilton. You may be able to find a better signup offer for their co-branded cards by signing up for a loyalty program. For example, this Reddit thread describes how to possibly get a better SPG card offer by signing up for a new SPG account. And, even if it doesn’t work to get a better offer, you might get a great offer for free nights, as described here: SPG: Two free nights (cat 1-5) after two stays!.

7. Offers by mail

Often, the best American Express offers are delivered via regular mail:

- Make sure you opt-in for mail and e-mail communications with Amex. Miles to Memories shows how, here: Targeted Offers Without the Once Per Lifetime Limitation.

- To get targeted business card offers, one option is to buy a web domain. I discuss this option here: How to (maybe) receive targeted Amex business card offers.

8. Upgrade instead of applying new

Amex often offers bonuses for upgrading from one version of a card to another. For example, a common offer is 50,000 points to upgrade from the no-fee Hilton card to the $75 Hilton Honors Surpass. These offers don’t tend to be as good as new signup bonuses, but they have some advantages: 1) You keep your existing account number; 2) There is no new account on your credit report; and 3) There is no credit inquiry involved in upgrading. Read more here: How to find Amex upgrade offers online.

Don’t apply for an inferior offer expecting a bump

With some card issuers you can apply for an inferior offer and then call or send a secure message to ask to be bumped up to a better offer. According to Doctor of Credit, though, Amex will not match higher signup bonuses.

* Note: I don’t usually include credit card affiliate links within blog posts. One exception is when a post, like this one, is intended to become a permanent resource page on this site.

Is there a limit to how many business gold cards can be obtained within a certain period of time? I used to get a new card about every month without issues. But ever since September, after obtaining my most recent card in August, I am getting an automatic cancellation of the application with the reason that I “just recently obtained a card within the past few months.” I’ve been trying monthly, so I’ve had 3 cancelled applications over the past 3 months.

Got linked to this page from somewhere else on your site, but reference to SPG makes me think this is too old to trust..FYI

Number 5 — Cardmatch Tool –> Link no longer working.

Fixed. Thanks!

[…] Watch for targeted offers without lifetime restrictions. Search your targeted offer for a section titled “Offer Terms” and search for words like these: “Welcome bonus offer not available to applicants who have or have had this product.” If nothing like that is found anywhere in the offer terms, you should be good to go. See also: 8 ways to get the best targeted Amex signup bonus offers. […]

Anyone know if incognito is still working? It worked for me in the past, but recently I have had no success with it (I get the standard offers). Wondering if I should stop trying.

Great timing for this question. Earlier today I tested it with my Best Offers links. I found that the Premier Rewards Gold card showed me a 50K offer (after $2K spend) when I used Chrome Incognito, but only showed me the public 25K offer in Firefox Private mode. So, yes it still works. Try multiple browsers.

[…] See: 8 ways to get the best targeted Amex signup bonus offers. […]

[…] The two big 100K signup offers are now gone… Sort of. The Chase Sapphire Reserve 100K offer is still available in-branch until March 12th. Online, you can only get 50K. And the Amex Business Platinum 100K offer really is gone (and was replaced with a much worse 75K offer). That said, Amex often has better limited time offers and targeted offers for this card. See: 8 ways to get the best targeted Amex signup bonus offers. […]

[…] Sometimes you can just call the bank up and request if they can inform you about any special credit offers. This has worked in the past at places like American Express. […]

[…] 8 ways to get the best targeted Amex signup bonus offers […]

I got targetted offer for 50K points if I spent 1k in 3 months. Just applied.

A year ago before I applied for the PRG there was an offer on my old Blue Cash for the Platinum card with a 40k signup bonus. After I got PRG ther Amex offer on my old Blue cash switched to converting it to the Blue Cash preferred with no sign up bonus at all and the first year fee was not waived so pay 75 annual fee for nothing.

I have received 100,000-150,000 offers recently but have an issue about the $10K spend required in 90 days. What MF is still available to get me there?

I assume you mean MS? MF sounds kinda harsh 🙂

Overview: https://frequentmiler.com/how-to-increase-credit-card-spend/

I’ll let you know how it goes, but there could be another route for another sign-up bonus on a Hilton card. Hubby and I visited a Hilton Vacation Club sales pitch in Hawaii. The rep claimed the Amex card they offered was a completely different card than the ones on-line (it has the same stats as the regular no-fee Amex Hilton – 40,000 HHs with $750 min spend in 3 months, 7X on Hilton, 5X on groceries, gas, etc), so we each applied and got the cards. I got this bonus 5 years ago. Hubby never got it. If my sign-up bonus posts, then this IS another route. If it doesn’t, the sales rep was full of BS. I’m betting on the latter. Hubby should get his points no matter what happens to mine.

I’m cool either way, I plan to buy VGCs at gas and grocery stores for the 5X points and use the cards to pay for a car repair. The insurance company of the guy who dented my car already sent me the money to pay for the repair.

Very interesting. I’m looking forward to hearing the results!

Several years ago I downgraded from AMEX Hilton Surpass to a no-fee Hilton. Is it possible to upgrade that no-fee Hilton back to the Surpass product and get that upgrade bonus?

So I just checked what upgrades are available using me. I am eligible to upgrade to the Hilton Surpass but am ineligible to get the bonus twice on the same product. That answers my question.

I believe Amex added the once per lifetime on upgrades for this card.