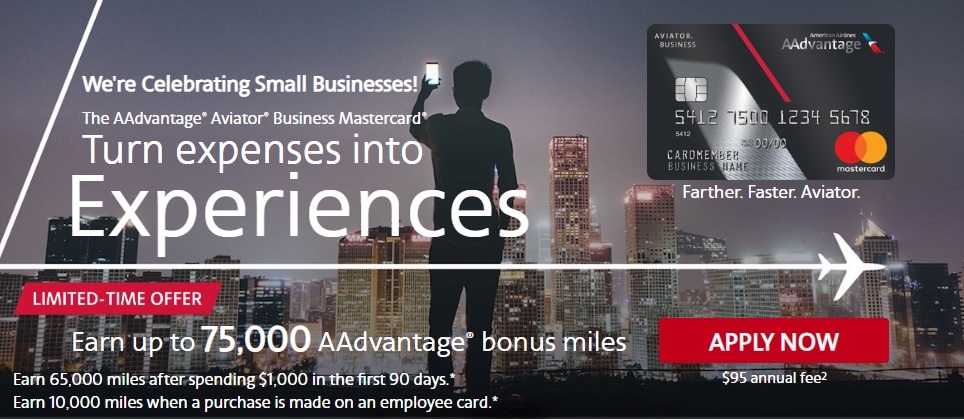

The AAdvantage Aviator Business Mastercard is once again offering up to 75,000 miles for new accouns: get 65,000 miles after $1,000 in purchases in the first 90 days and 10,000 additional miles when a purchase is made on an employee card. While we’ve seen the personal card offer 60K after a single purchase, this is still awfully low hanging fruit for 75K miles. The catch is that Barclay’s can be a tough approval for a business card — but if you qualify and have a use for the miles, this can be a good deal.

The Offer

| Card Offer |

|---|

ⓘ $-95 1st Yr Value EstimateClick to learn about first year value estimates Not currently available It appears that this card is not available at this time.$95 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Expired 2/6/23: 80K miles + a $95 statement credit after $2K spend in first 90 days. |

Key Card Details

| Card Name w Details & Review (no offer) |

|---|

$95 Annual Fee Earning rate: ✦ 2X AA, office supply, telecommunications services, and at car rental agencies ✦ 1X everywhere else Card Info: Mastercard issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: $99 companion certificate with $30K account year spend Noteworthy perks: ✦ First checked bag free ✦ Preferred boarding ✦ 5% bonus on miles earned the previous year after AF is paid ✦ 25% statement credit on in-flight purchases |

Quick Thoughts

Let’s get the obvious out of the way to start: American Airlines miles aren’t particularly useful for travel on American Airlines. Like most airline currencies, the sweet spots lie in partner redemptions.

For example, American just recently added the ability to see and book award availability on Cathay Pacific via AA.com. Until then, you had to search for availability via the British Airways or Qantas site and then call AA to make a booking. You can now do so online, and at 60K miles for a business class ticket between Asia 1 and the 48 states & Canada or 70K for to and from Asia 1, and those opportunities make this bonus look pretty good. You could of course book the same awards for only 50,000 Alaska Airlines miles (and get a free stopover on a one way award on top of it), though you won’t pick up that many Alaska miles in a single credit card welcome bonus, which makes this offer potentially appealing.

American miles can also be great for travel in premium cabins on Japan Airlines or Etihad (another partner that became available for online booking this year). On the other hand, if your aim is to get to Europe, American miles can be more challenging to use.

Anecdotally, it additionally seems that Barclay’s business card approvals aren’t quite as generous as other issuers, with a number of readers reporting being asked for documentation, so keep that in mind and feel free to share your experience in the comments.

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

Overall, this is a pretty interesting offer that also came around in May of 2019. With the various AA cards on the market, it’s relatively easy to pick up a nice stash of AA miles, which could also be convenient if you’re looking to book multiple passengers.

H/T: Doctor of Credit

[…] 75K AA offer returns on Aviator Business card […]

[…] 75K AA offer returns on Aviator Business card […]

[…] 75K AA offer returns on Aviator Business card […]

I currently have this card and received the welcome offer under one of my businesses. My question is, while currently having this card under one business – if I apply for and I am approved under another business I have, would I still receive the welcome bonus (of course after meeting the minimum requirements)? In other words, can we get this card under two different businesses at the same time? Or is there a waiting period (e.g. you can not get this card if you had it or closed it in 12 months).

[…] 75K AA offer returns on Aviator Business card […]

I currently have this card and received the welcome offer under one of my businesses. My question is, while currently having this card under one business – if I apply for and I am approved under another business I have, would I still receive the welcome bonus (of course after meeting the minimum requirements)? In other words, can we get this card under two different businesses at the same time? Or is there a waiting period (e.g. you can not get this card if you had it or closed it in 12 months).

Since I already have this card, what are the thoughts on getting approved for a second?

Chances are somewhere between slim and getting struck by lightning on the moon is my best guess. Many have had trouble opening an Aviator again even after theirs had been closed for quite a while. I woudln’t expect them to be comparatively loosey goosey on the business card. I’m not speaking from experience here, just from the general feel I get from the stories I’ve read.

Nick

Had it before 2 years ago maybe ?? I just got one like 65 days ago and got the 65k and didn’t want to risk 10k more (they close it). I did the spend and was going to mothball the card but spent anyways . I went to Crete and didn’t set up auto-pay or any warnings so a $53 fine when I came back . Barclays showed me how to set the auto-pay up and REFUNDED my fines in 12 hrs . Always good to keep a card open with them No Hassles getting any again or ANY card with Barclays.

CHEERs

Hi, do you think this higher bonus will return anytime soon?

Any problems from Barclay if earning the companion fare with ms?

[…] 75K AA offer on Aviator Business card […]

[…] 75K AA offer on Aviator Business card […]

[…] 75K AA offer on Aviator Business card […]

Does having the personal card disqualify you from getting the business card/bonus?

Nope.

Presently, I have two CitiBank AAdvantage cards. If I get the 75 K miles added to this account and cancel the Barclaycard a year later do the 75k points stay in my account?

Yes.

David

I opened 2 a year or so ago canceled personal @ 11 months Reuped my Bus c got 7500 points for $1k spend . No they don’t get ” Funny with the Money ” like Thank You points do ..

CHEERs

If get the card add an employee to get the additional 10K, does that prevent the employee from opening their own card with their business and receive their own 65-75K bonus?

shouldn’t be

Absolutely not. I’m not aware of any issuer who won’t let someone get a bonus because they were an AU on that particular card.

If I add an employee card for the extra bonus will that employee’s credit be hit with a hard pull?