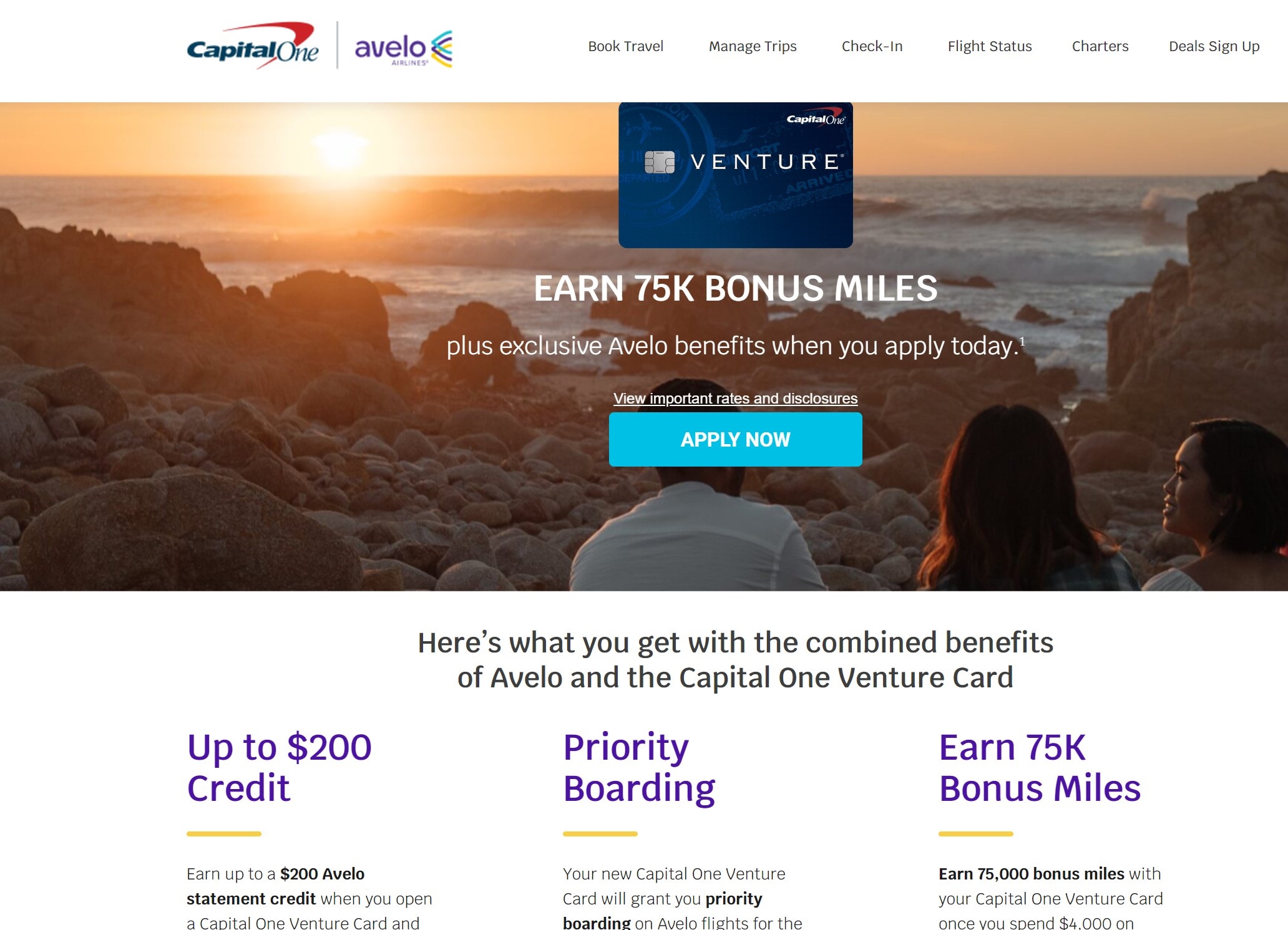

Avelo Airlines is a newer low-cost carrier that started up (or rebranded?) during the pandemic. I’ve seen their planes once or twice in an airport but haven’t paid much attention to them. Apparently, that’s where Capital One and I differ because, only available through the Avelo Airlines website, Capital One is offering a new welcome bonus on the Capital One Venture Rewards Credit Card that includes Avelo benefits and a statement credit for an Avelo purchase in the first year.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $1205 1st Yr Value Estimate$250 travel credit valued at $220 Click to learn about first year value estimates 75K Miles + $250 Capital One Travel credit 75k miles after $4k spend within first 3 months + $250 to use on Capital One Travel in your first cardholder year$95 Annual Fee Alternate Offer: Alternate offer for 75k miles + $300 travel credit available for some via referral pre-approval Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 75k miles after $4k spend within first 3 months + a one-time $250 Capital One Travel credit to use in your first cardholder year FM Mini Review: This card earns 2 miles per dollar, which are worth exactly 1 cent each toward travel. This makes the return on spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their miles to airline miles & hotel points. Click here for our complete card review Earning rate: 2X miles everywhere ✦ 5X miles on hotels, vacations rentals and rental cars booked via Capital One Travel ✦ 5X miles on Capital One Entertainment Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Receive up to $120 application fee credit for Global Entry or TSA PreCheck® ✦ Redeem miles for travel at value of 1 cent per mile ✦ Convert miles to airline miles & hotel points ✦ No foreign transaction fees |

Quick Thoughts

This offer is only different the the general public offer in that it includes priority boarding on Avelo and the statement credit when you make an Avelo purchase in the first year. In other words, there is no benefit for someone who doesn’t plan to fly Avelo.

At the same time, it doesn’t hurt to apply through this offer and we’ve replaced our best offer link with this one because if you want the Venture card you may as well open it under this offer just in case you end up buying an Avelo flight in your first year. If you do happen to live in a market served by Avelo and you fly them even occasionally, the priority boarding and statement credit could obviously be nice.

I’d rather have the Venture X card long-term since that card has better long-term value given the anniversary miles and statement credits toward Capital One Travel purchases, but I could imagine this deal being worth it for someone who could take advantage of the Avelo part of the offer.

H/T: Miles Earn and Burn

HI Nick. Do the anniversary miles of the Venture X cover the difference in annual fee between the two cards? Trying to determine what one to apply for.

Once you remove the 300$ in cap one travel benefits, you are left with a $95 fee for the venture X. That’s the same as the fee for the venture. On top of it, you get 10000 anniversary points, which is atleast $100 (but potentially much higher). It’s a no brainier.

Any idea what the miles are worth?

I can’t even try to book a flight on their website since it will not open calendar or enter a date on the homepage.

I don’t think there’s any such thing as Avelo miles. This card still earns Capital One miles, which are transferable to all of Capital One’s partners (Air Canada, Avianca, Turkish, Avios, Virgin Atlantic, Wyndham, etc etc)

Any DP of people being declined when pre-approved? C1 hasn’t been kind to me this far and I’m hesitant to burn 3 hard pulls for another rejection

Yeah, you never know. The pre-approval tool is completely unreliable. That said, I’m not sure what you’re worried about in terms of pulls. I find that most people seem far more concerned than necessary about the effects of a hard pull. It’s like a 5-10 point drop in your score that lasts for maybe 6 months – it’s really not a big concern IMO. Maybe it was an issue back in the day when you could get approved for 5 BOA cards in a day and that sort of thing, but I never had trouble getting approved for stuff even with like a dozen or more pulls on my report. I think what makes some people unduly concerned is that denial letters sometimes cite “too many inquiries”, but the reasons in denial letters are often total BS. We had a reader last year who reached out because a denial letter said “too many new accounts” – and she had opened a total of *zero* new accounts in the previous 24 months. The letter just gives you a reason – it’s often not the real one. Ok, stepping off my hard pull soap box now.

Thanks Nick. I’m 4/24 and have held back so many apps because I haven’t wanted to hit 5/24, and then not be able take advantage of no longer being in chase jail to go on a credit card application spree due to having too many hard pulls. My approach has been to just stick with Amex business cards to let everything settle down. 18 months is a long time though. There about 6 or 7 cards I’ve got my eye on so maybe I’ll just try to direct the pulls certain directions using strategic bureau freezes.

Well the three pulls don’t make any difference there – a new account does. I can certainly see not wanting to give up a 5/24 slot and passing on a particular offer (whether this or whatever other card) because you don’t want the new account if you’re approved. But it’s irrelevant whether you get 1 pull or 3 in that case – it’s not the pull that puts you over 5/24, it’s the account itself (and that’s only an issue if you’re approved). Chase is counting new accounts, not new pulls.

To your point about freezing: it is possible to get approved with C1 with 1 bureau frozen (resulting in two pulls rather than three). Not guaranteed, but possible. They won’t approve with two bureaus frozen.

Hey Nick, here are all the destinations served by Avelo: https://en.wikipedia.org/wiki/List_of_Avelo_Airlines_destinations

They have 3 home bases: Burbank, CA; New Haven, CT; and Orlando, FL. Raleigh, NC will be a new base on February 2023. If you live or travel through those airports, this version of the Venture X could be a winner.