Update 12/19: Through 1/31/26, inKind is doubling its referral bonus from $25 in dining credit to $50. This doesn’t affect the $25 that the referee gets off of a $50 check, but it’s the perfect opportunity for household referrals, since a couple could get a total of $75 back if one person refers the other.

~~~

inKind is an app that allows you to settle your bill at over 3,000 restaurants, bars, and cafes across the US. Put simply, you can pay your restaurant bill in the app using the credit card of your choice at restaurants that participate and earn credit card rewards as well as “cash” that can then be spent on future inKind purchases.

When inKind first launched, I had seen it advertised (and knew that both Stephen and Nick used it), but then I looked for local restaurants and didn’t see much available near me.

So, I let it get off my radar…which was a mistake.

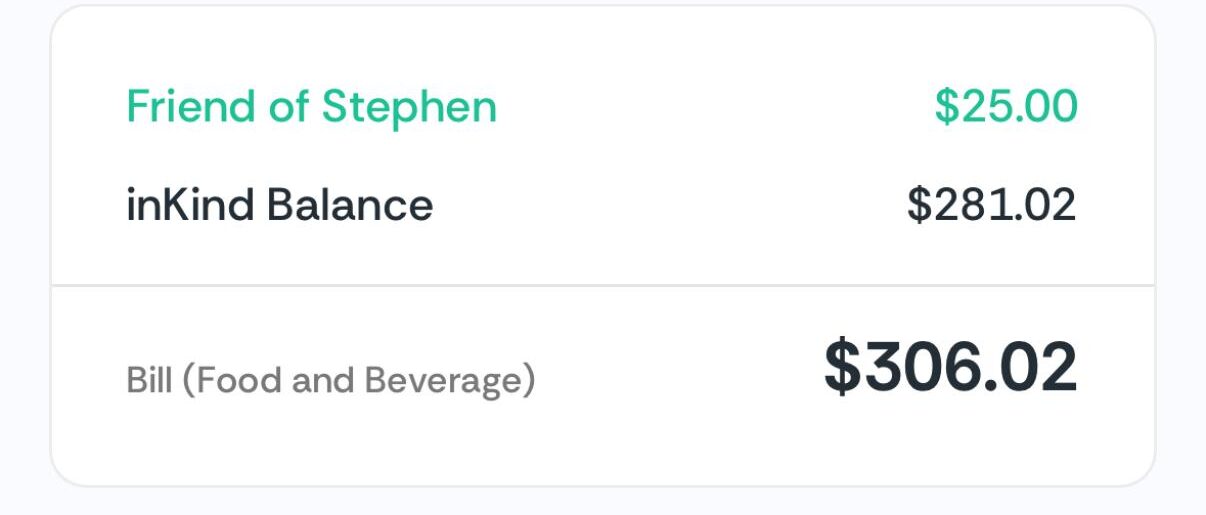

On a recent trip to Hawai’i, I knew that I’d be taking some family out for dinner and saw that a couple of local restaurants that we all liked were on inKind. I was able to buy $300 in gift cards for $180 during one of Costco’s regular sales and combined that with a $25 referral bonus from Stephen Pepper, enabling me to treat my in-laws to a ~$300 meal for ~$170 out of pocket…all for simply paying my bill through the app:

The ever-increasing number of restaurants and bars that take inKind, combined with the frequent offers that can be had to get discounted inKind cash and the ease of use, makes this an app that anyone who dines out regularly should have.

Here’s what you need to know about how to get started.

How to enroll for inKind

- First, it’s worth checking to make sure that there are restaurants in your city or the cities you intend to visit (you can search here on inKind’s home page). inKind has added a ton of outlets over the last couple of years, but there are still some “deserts for dessert.”

- Sign up for inKind through a referral link. You don’t have to sign up through a referral, but if you do, you’ll get a $25 reward to use on a dine of $50 or more (and we’ll get some referral dollars to spend).

-

- Feel free to use one of our links with our thanks:

How to use the inKind app at restaurants

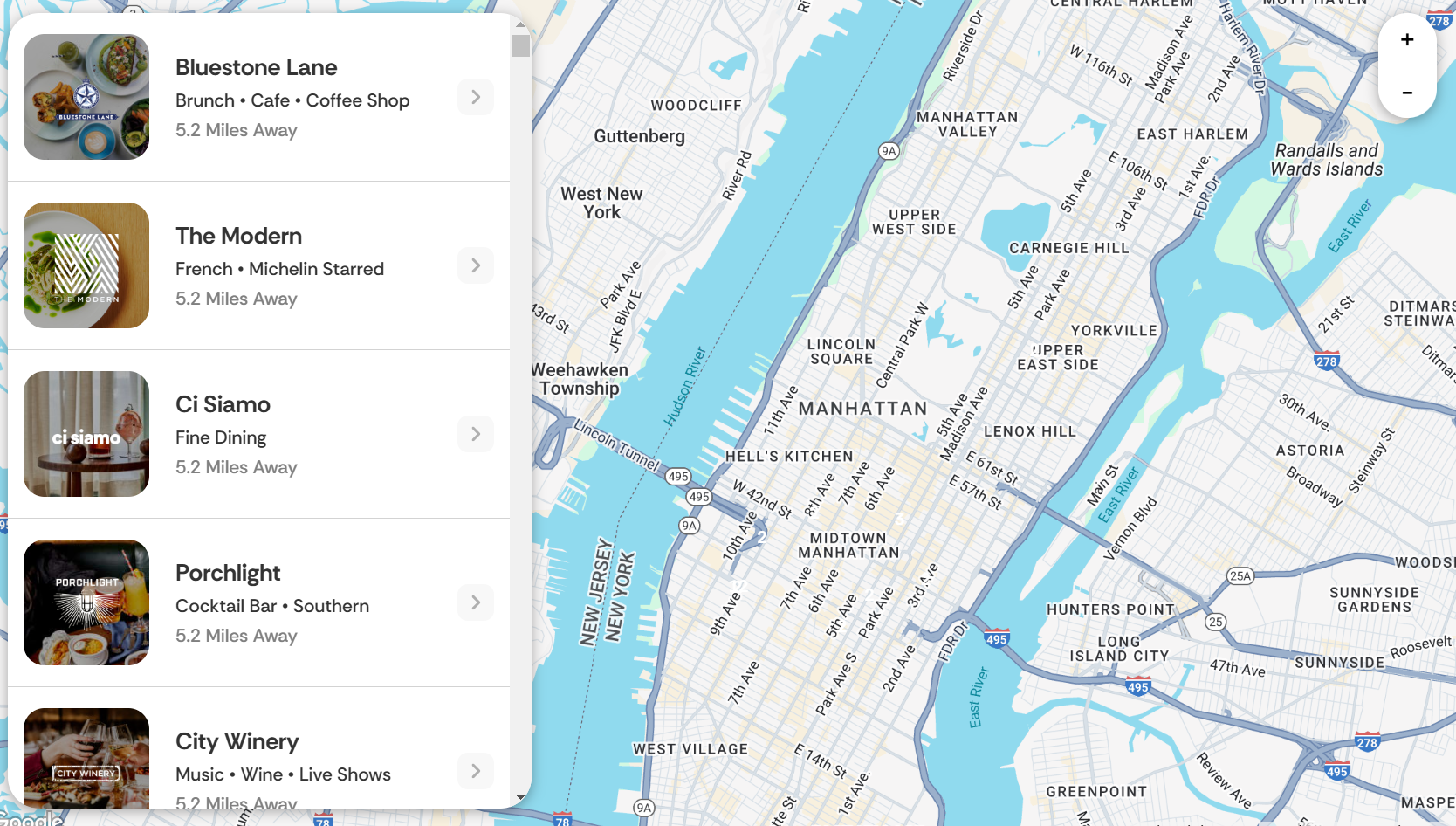

- Search for nearby inKind restaurants either in the app or search on their home page.

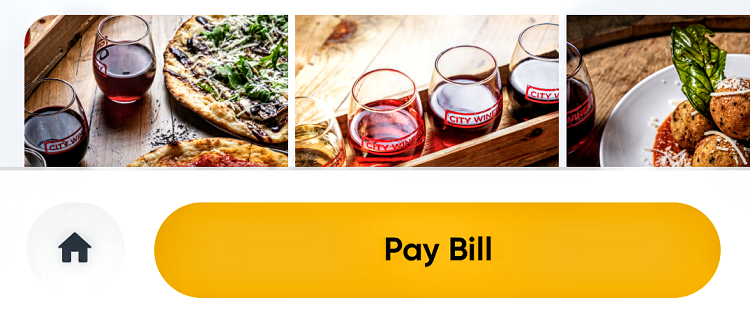

2. After you finish your meal, your server brings the check. Open the app, select the restaurant, and then tap on “Pay Bill:”

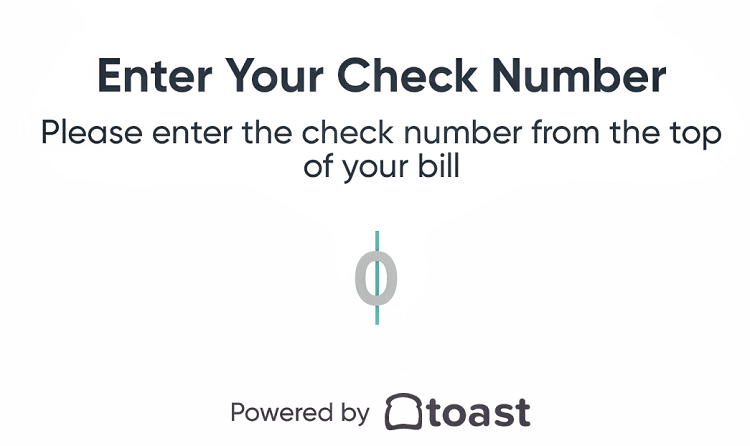

3. The next screen will have you enter the check number, which should be easy to find on the check.

4. The following screen will then show you the total bill and provide a section to enter the tip. You can pay for the entire balance of your meal using inKind credit, but the tip has to be paid for separately on a credit or debit card within the app.

5. Submit the payment, and you’ll then get a confirmation in the app that your bill has been paid:

6. The restaurant server will then receive notice that your bill has been paid and you’re good to go.

inKind “cash” and “cash back”

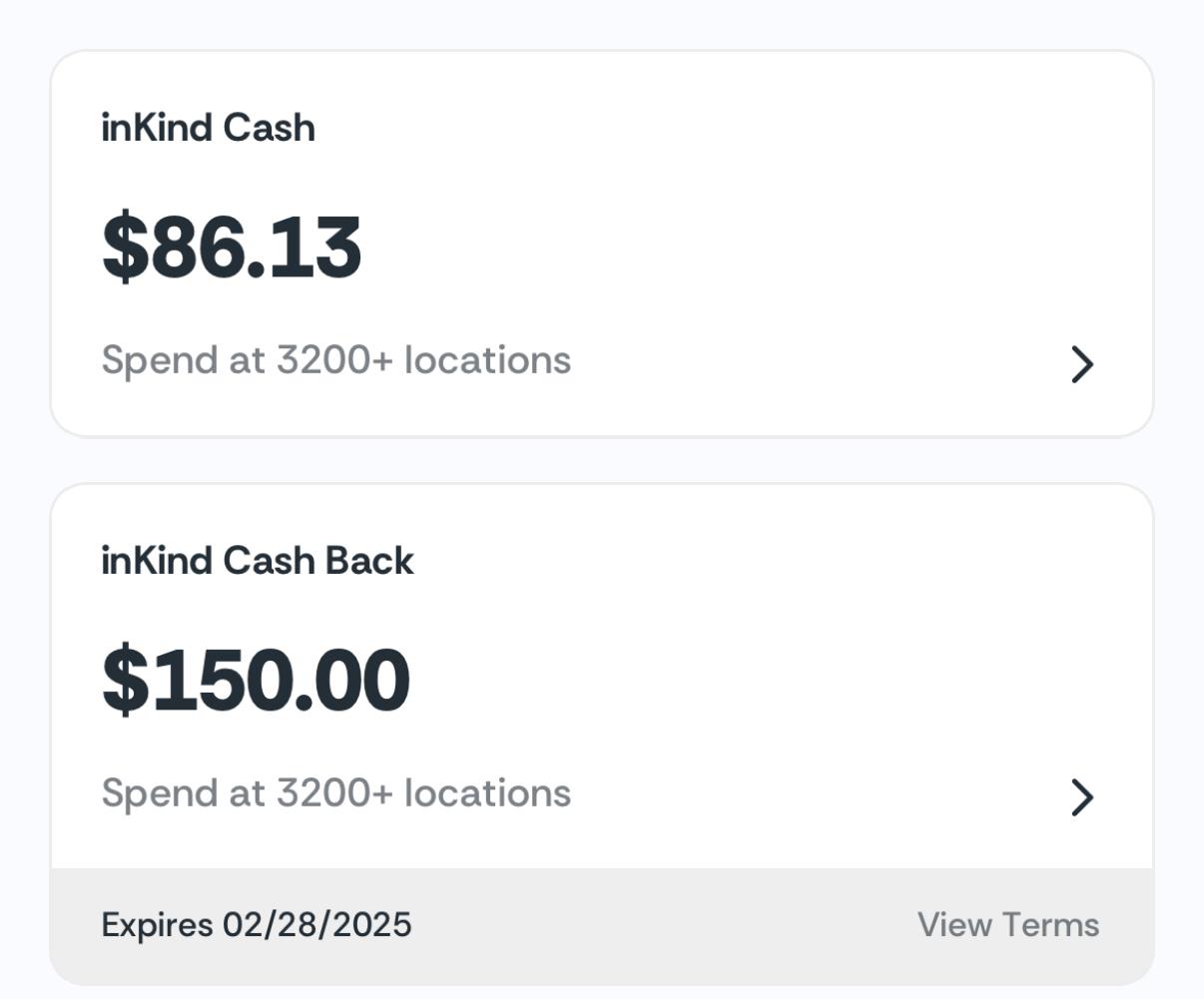

There are two primary types of balance that you can accumulate with inKind: “inKind Cash” and “inKind Cash Back.”

inKind Cash

inKind Cash is the result of prepaying for credit that can be used at any inKind restaurant. There are two components that make up your inKind Cash – the purchased amount and the promotional amount, both of which have different expiration policies.

For example, if you were to take advantage of an offer from inKind to buy $200 in credit for $120, the $120 would be the “purchased amount” and would never expire, while the “promotional amount” would be the additional $80 and have an expiration of three years from the date of purchase. The funds on inKind gift cards purchased through Costco or another retailer never expire.

There are several ways to get great discounts on inKind cash:

- Buy gift cards. Costco regularly has gift cards on sale for 30% off, or $69.99 off $100. Occasionally, they will go on sale for 40% off, and you can then buy $100 in cards for $59.99.

- Card-linked spending offers. American Express, Chase, and Citi frequently have card-linked offers that allow you to get large discounts on pre-purchasing inKind credit.

- inKind promotions. inKind itself will run regular promotions that either increase the amount of credit you get for dining or give you a discount on pre-purchasing credit.

inKind Cash Back

inKind Cash Back are the rewards that you earn for paying or “engaging with the program.” There are two primary ways to earn Cash Back

- Dine and Earn. When you pay your bill using the app using a credit card on file, you’ll get up to 20% of the amount you paid back (excluding tip) to spend on another visit. If you pay part of your bill with your inKind balance, you won’t earn that 20%.

- Refer friends. inKind always has referral offers going that allow both sides to earn credit when the person who is referred meets the purchase minimum (usually $50) on their first visit.

The terms say that cash back from both referrals and dining will expire 60 days from the date it was earned, and that the oldest cash back will automatically be used first.

Quick Thoughts

I’m a little embarrassed at how long it took me to get on the inKind train, but I’m all aboard now. The amount of area restaurants on the app, combined with the ease of getting discounted inKind cash, means that I can now save a bundle going to places that I would already go to and maybe try a new one every now and again.

There are still many smaller towns where there’s little to no inKind restaurants, and it’s more or less useless internationally, but I continue to be amazed at what is there and how fast the selection is expanding. It’s worth taking a look at for anyone who likes to dine out.

Check your local area before jumping in bed with InKind. Philly has exactly six in the program and none of those are on anyone’s Top 10. We wasted hours trying to use this. Three guys at Bluestone coffee spent 20 minutes trying to figure out how to make it work for a latte and a Danish and finally gave up. I had to pay cash. Be very careful.

i assume since you are still paying with your card of choice, this would stack with an airline/hotel dining portal correct?

and I was today’s years old when I learned that the gold card had a risk credit.

We just got back from 5 days in NOLA – have found buying the $59~$64.99 Costco GC are great for inexpensive meals when traveling – we actually used an in-app limted time $20 off $30 promo on both P1/P2 with $65 Costco GC for the difference.

P3 (MIL) had no intrest in using referall bonus – she allowed us to use her Phone number for referall – setup InKind app up on my business phone – cousin was passing thru town on way to beach celebrating her Husband’s retirement – so we treated them to some BBQ – even with tip it was only a net $3-4 dollars pp to treat them to lunch after referall and InKind cash back on meal added MIL as P3 AU on an Amex Gold (10K bonus) so also earned 4X on spend toward Bouns MSR.

Have actually found several amazing local restaurants not on out radar because of InKind- but I do have to wonder just how long InKind will be around (think they may have subsidized promo’s and SUBs, so I will only buy a 1-2 GC if we have a planned immediate use.

I you go out to eat regularly, and have expensive in-kind restaurants in your neighborhood/region, you should consider getting the In-kind Pass where every month (12 times a year), you get a coupon for $50 off $150+. I have had the in-kind pass for almost 2 years (about to renew for a 3rd) – I use it every month.

The in-kind pass costs $100/year.

Great tip! Thanks!

Also if the InKind location is also on the Resy Platform and you have Amex Resy Credits (Amex Gold, Plat or Delta card) then you can pay tip or if you don’t have enough InKind Cash the difference and tip. This method also triggers the $25 Amex Brillant credit.

Happily Learned this on accident in January.

Perfect timing as add BIL as an AU on a Gold card earlier this month and also picked up a $100 Inkind GC at Costco for $64.99 last week (now back up to $74.99).

What does the balance charge on the credit card code as? regular TOAST* charge from the same restaurant or something else? Trying to figura out If i can use my BofA custom cash with dining 3% selection

Bofa works with inkind on both food and tip transaction.

bofA does not look at the merchant name, it looks at the merchant category code MCC

Does that mean it code as Restaurant? Trying to figure out which is the best credit card to use for paying the tips.

In my experience, the tip component does code as restaurant.

If a location only lets you pay bill (not let u order thru app) your still able to use a gift card and a promo correct ?(25 off 50 or similar)

Stumbled upon another stack by accident – Resy (for the tip portion on the Amex Gokd card).

We spent the past weekend at the Ritz-Carlton, Portland celebrating our 31st Anniversary – two inKind restaurants one across the street in the Moxy – ‘Sunrice’ – Filipino comfort food for my Pinay Queen and the other ‘Bamboo Sushi’ two blocks away.

We stacked a Costco $59 GC (Dec 2024) with @Tim ‘s $25 referral – we enjoyed three meals with the referral and the $100 GC.

The tip triggered $18 of $50 Gold Resy credit (a little suprised when I saw the email) – we actually have a Resy Dinner reservation to use our Resy credits later this week.

Needless to say will be buying more $100 inKind GC for $59 later this week on 1/29/2025 when they go back on sale at Costco.

Meh, I am in a major US city and there are very few places that accept it. Luckily one of them is Bluestone lane and it’s like 300 feet from my work, otherwise I would never use this. I probably will stop getting coffee there once I run out of all the credits from those amex offers a while back.

Yeah every time I check the participating locations near me, I can’t think of prepaying for them even with a 50% off coupon attached. It’s just a bunch of hip chains or place you order prix-fixes. If I ever decide to go fancy or travel to cities with abundant local options, I may join the train.

inkind is in large (and I mean top 10 populated cities in america) cities only. I’ve gotten a LOT of mileage when they had the sign up discount, but they annoying “expired” $30+ worth of “Cashback” end of ’24.

Am I able to use the 25 off 50 reward in combination w Inkind cash back on same check?

Yes, you can.

Oh! Thanks! You’ve tried it? It says that Inkind cash back can’t be combined w other offers. So wasn’t sure and didn’t want to spend the 50 but not be able to use my inkind cash back

Just to clarify, there’s two types of inKind credit: “cash” and “cash back.” If you’re a new user, you won’t have any “cash back” because you only earn that through paying for dining and making referrals.

inKind “cash” is what you get through pre-purchasing credit and/or gift cards. That can be combined with the $25/$50 (which was the example I used in the second paragraph at the beginning).

A little late to this discussion but google took me here. I use inkind a fair amount and haven’t found a restaurant yet that allows me to use any credit on my account (costco GC’s, etc) on the same bill as a promo ($25 off $50 etc). How are you making this happen? Thanks!

Anyone figure out if there’s a feature or site to do a sort by rating? Ideally I’d combine their list with Yelp when traveling to see if it’s worth it. I was checking some randomly in Chicago and most were not places with a rating I’d bother with.

Not sure, but I live in Chicago (west loop) and some of the best rated bars and restaurants are on inkind. If you really hit anything in west loop you’re not gonna go wrong. If i’m not mistaken there are a few michelin stars on there, and many many honorable mentions. Plus you can stack with happy hour/restaurant week/other promos that make it very attractive. Highly dependent on where in chicago you’re looking at, but if you look at restaurant hubs you’re bound to find multiple world-class restaurants on there.

Is it me or does this site have the worst map search/name search of any site?

agreed

Charlotte doesn’t offer much either–and way less than Toast more generally does. Hoping this continues to expand, as it would be very useful at regular destinations.

Thanks for the writeup Tim!

Not much in the greater Boston area in terms of “real” restaurants. Last I checked, it was Figs and Rosa Mexicano. Other than that, lots of coffee shops. It’s an in kind wasteland otherwise.

@Mark, I just used inKind at Alcove 1/14 and I see that MIDA (all their locations) are on the app as well. Not sure when you last checked, but there does seem to be a nice variety.