Citi has spent the last year revamping its ThankYou points-earning cards. The Citi Premier was rebranded as the Strata Premier with minimal changes to benefits. A new ultra-premium card called the Strata Elite was recently launched with a 100,000 point welcome offer in branch or 80,000 points online.

Citi also recently did away with the Rewards+ card, replacing it with the Strata card instead. It initially wasn’t available for new applications, but that’s now changed and there’s also a solid – for Citi – welcome offer on the card. If you’d like to enter the new Strata-sphere with a no annual card, now could be a good time.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $284 1st Yr Value EstimateClick to learn about first year value estimates 20K Points 20,000 points after $1,000 spend in the first 3 monthsNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 30,000 points after $1,000 spend in the first 3 months (expired 1/13/26) FM Mini Review: Excellent bonus categories. Points transferable to select airlines. Recommend pairing this card with Citi Strata Premier and/or Citi Double Cash. Earning rate: 5X Hotels, Car Rentals and Attractions booked on cititravel.com ✦ 3X grocery ✦ 3X gas stations & EV charging ✦ 3X select transit includes car rentals, ferries, commuter railways, subways, taxis/limousines/car services, passenger railways, bridge and road tolls, parking lots/garages, bus lines, and motor home and recreational vehicle rentals ✦ 3X self-select category (Fitness Clubs, Select Streaming Services, Live Entertainment, Cosmetic Stores/Barber Shops/Hair Salons, or Pet Supply Stores) ✦ 2X dining Card Info: Mastercard World Elite issued by Citi. This card imposes foreign transaction fees. Noteworthy perks: Transfer points to airline and hotel partners (at reduced ratios and no AA) ✦ Earn $5 Lyft credit after 3 eligible rides See also: Citi ThankYou Rewards Complete Guide |

Quick Thoughts

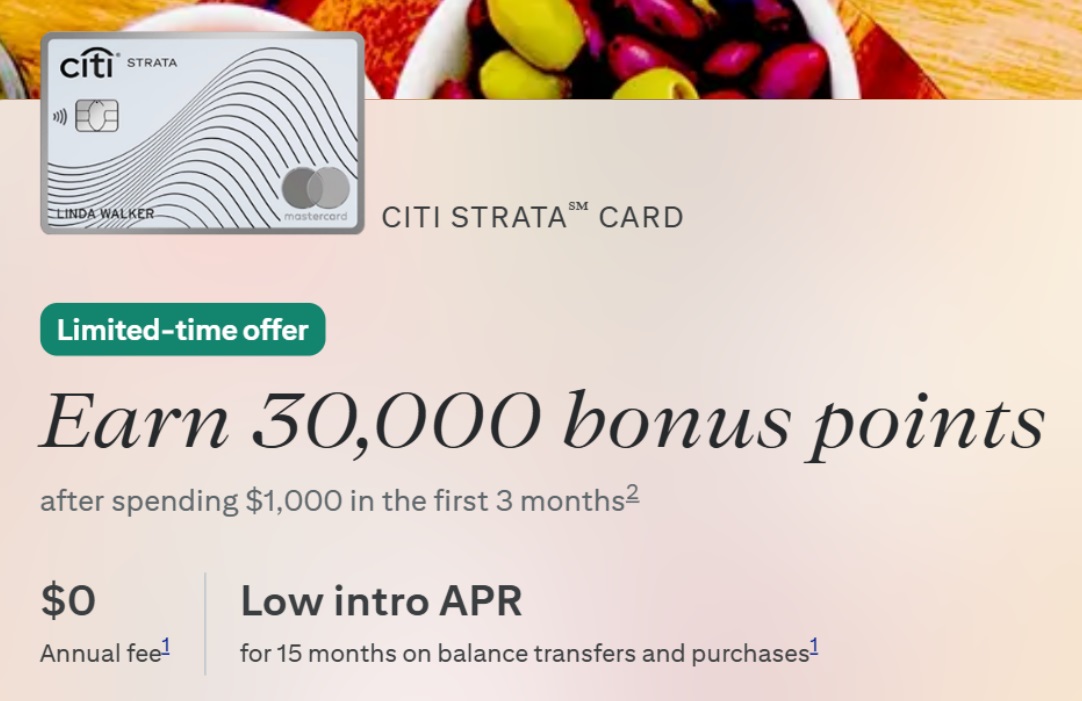

As you can see above, the welcome offer can get you 30,000 bonus ThankYou points after spending $1,000 in your first three months of card membership. That’s not a huge bonus, but considering Citi has gone through periods in the not-too-distant past of not offering any kind of welcome offer at all on some cards, being able to earn 30K points is a decent enough bonus for a card with no annual fee.

It has some good spending categories too. For hotels, car rentals and attractions (but not flights) booked through the Citi Travel portal, you can earn 5x. You’ll earn 3x at grocery stores, at gas stations and for EV charging. There’s a separate 3x category where you can choose from a selection of categories including fitness clubs, pet supply stores and more, plus you earn 2x on dining. Overall, that’s a pretty good everyday card for someone who doesn’t want to pay an annual fee for their credit card(s).

Thanks to a recent change, Citi cards with no annual fee can now also transfer to travel partners, with the exception of the newly-added American Airlines as you need a premium card for that option. The transfer ratio isn’t as good because your ThankYou points will only transfer on a 1,000:700 basis in most cases rather than 1,000:1,000. However, considering Chase doesn’t allow you to transfer to partners unless you have a premium Ultimate Rewards-earning card, it’s welcome that Citi has this as an option now.

Ultimately though, it’s hard to recommend applying for this card when you could instead earn 60,000 ThankYou points on the Citi Strata Premier card or 80,000-100,000 points on the new Strata Elite. Although those cards both have an annual fee ($95 and $595 respectively), the large number of additional ThankYou points you earn and other benefits will more than offset that cost. If you then don’t want to pay an annual fee after the first year, you can product change to this no annual fee Strata card or a Double Cash.

FM fam

This card also offers 3x on Select Transit

Interesting for a no annual fee card

From citi website:

Select transit includes car rentals, ferries, commuter railways, subways, taxis/limousines/car services, passenger railways, bridge and road tolls, parking lots/garages, bus lines, and motor home and recreational vehicle rentals.

Applied, went to pending at 5/24 and 0 Citi cards in the past year.

If you have this card, could you transfer your TY points to a spouse at a 1:1 ratio, and then spouse with a Strata Premier or Elite could use those points transfer those points to AA or other partners at full value?

Yes

Thanks. P2 has a bunch of Custom Cash TY points currently stranded in her account without ability to transfer or redeem for good value. This will help. She had a Rewards+ card but Citi closed it for nonuse prior to converting them to Strata’s.