Last night, I fell victim to the coupon creep. No, that isn’t a person lurking in the shadows with a fistful of coupons, but rather that we way overspent in order to use credits. We had an overnight in Los Angeles. Our kids had been asking about visiting the La Brea Tar Pits, so I booked the closest / most reasonably priced Fine Hotels + Resorts® property, the W Hollywood.

It all started out pretty well: The cash rate was about $450, with $300 coming back as the Platinum card’s prepaid hotel credit. We got “complimentary breakfast for 2”, which was delivered as a $60 breakfast credit. That is stacked with the Platinum member welcome amenity choice of a $40 breakfast credit. We also got a $100 property credit, and the resort fee included a $21 food and beverage credit, which stacked as well. As a result, we got dinner from Room Service on the night of arrival (we otherwise would have ordered from Uber Eats) and we had breakfast in the morning. We ended up overshooting the credits by about $100 on both dinner and breakfast. While we needed those meals one way or another, using the coupon credit certainly encouraged us to spend more than we would have in this case, so it ultimately feels like less of a deal than it should have been.

That is the main danger of the coupon credits: they often encourage us to spend beyond what we otherwise would have, which means we aren’t saving. Watch out for the coupon creep in your own travels, because if you’re simply spending more, you’re not saving anything.

This week on the Frequent Miler blog…

I’ve used all the new Amex, Chase and Citi credits – Here are my favorites

While the opening section of this week in review was a cautionary tale on coupon credits, I have to admit that I have been enjoying some of the latest coupon credits. I think the extent to which one will enjoy these really varies based on preferences. Funny enough, lululemon is a store at which I had never spent a dime before Amex Platinum card credits, so every penny I’ve spent there since the credits launched is money I wouldn’t have otherwise spent. However, I’m loving a couple of the items I’ve purchased there so far. In this post, you’ll read Tim’s take on the various coupon credits, including which he likes most and why.

Amex broke my keep/cancel formula

While the various coupon credits can contain plenty to love, they don’t necessarily grow more attractive with scale. Greg wrote a post this week explaining how, even though he could get more value out of the coupon credits than the cost of the annual fee on some of his ultra-premium cards, the fact is that he’s realized that he doesn’t want the mental stress of tracking it all. I can totally appreciate that, as I have also grown tired of the quantity of coupon credits. While I may not pull back quite as much as Greg is, I am absolutely not enthused about tracking a growing stable of coupon credits.

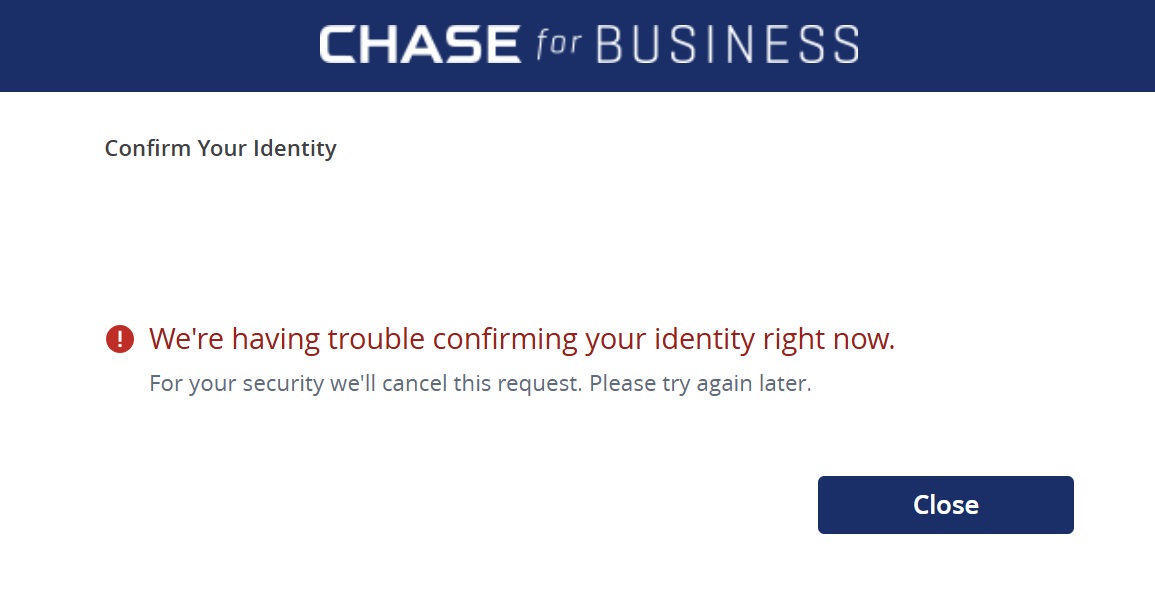

Problems combining Chase Ultimate Rewards points keep spreading

One of the superpowers of Chase Ultimate Rewards points is the ability to easily combine points across the cards in your name or even with another member of your household. That still works for many people, but a growing contingent of folks are running into roadblocks requiring a phone call to Chase every time they want to move points between their cards or even to partners in some cases. This has been a pain point in my household simply because of the fact that we sometimes want to move quickly on combining/moving points to book a valuable award, and that doesn’t always happen at a time when it is convenient to call (in fact, it often happens when we’re stuck in a hotel room with the kids asleep and a phone call is super inconvenient). Some readers have commented to say that while they have issues on desktop, the Chase mobile app has worked for them. I haven’t yet tested that, but I hope to do so sometime soon.

One of the superpowers of Chase Ultimate Rewards points is the ability to easily combine points across the cards in your name or even with another member of your household. That still works for many people, but a growing contingent of folks are running into roadblocks requiring a phone call to Chase every time they want to move points between their cards or even to partners in some cases. This has been a pain point in my household simply because of the fact that we sometimes want to move quickly on combining/moving points to book a valuable award, and that doesn’t always happen at a time when it is convenient to call (in fact, it often happens when we’re stuck in a hotel room with the kids asleep and a phone call is super inconvenient). Some readers have commented to say that while they have issues on desktop, the Chase mobile app has worked for them. I haven’t yet tested that, but I hope to do so sometime soon.

Hyatt to release premium card; add elite status pathway to Chase Sapphire Reserve®

Hyatt is the darling of Chase’s transfer partners, but it has been the odd program out in terms of its limited credit card profile. While Marriott has a litany of cards spread between Chase and Amex, Hilton has 3 consumer cards, and IHG also has multiple consumer cards, Hyatt has been kicking around with just one consumer credit card (and its business counterpart). It sounds like this will change soon and Hyatt will finally compete, launching a premium credit card of its own. While we don’t yet have much by way of detail regarding this card, we do know that Chase also intends to create a path to Hyatt elite status through the Chase Sapphire Reserve card. We expect Explorist status to likely come with $75,000 in purchases on the Sapphire Reserve (IHG Platinum is already a perk at that spending level). A premium Hyatt credit card sounds exciting on the surface, though I have to admit that I share the concern I’ve heard among Hyatt Globalists that a premium card that offers a reduced path to Globalist status and/or access to benefits typically reserved for Globalists feels like it could dilute the program. This, combined with the likely influx of Hyatt points among rewards enthusiasts thanks to the Rakuten–>Bilt–>Hyatt path might make things harder for those of us competing for the same awards and benefits.

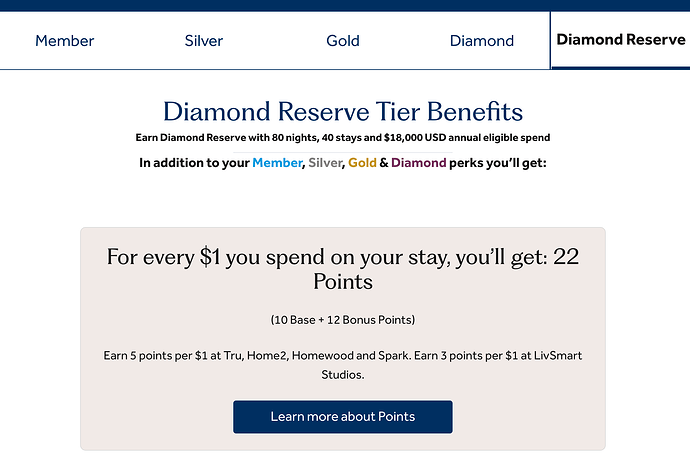

Hilton Honors to launch a new top-tier elite status?

Speaking of diluting elite status, no program has made it easier to get elite status than Hilton, with the top two statuses, Gold and Diamond, easily available as credit card benefits that come with credit cards (no spend or nights spent at a Hilton required). It sounds like that may soon change, with the rumor mill reporting on a new Hilton Diamond reserve status set to come to the Hilton program. We don’t yet know when or exactly what it will include, but it sounds like Hilton will finally introduce confirmed suite upgrade awards, but word is that you’ll need 120 elite nights to get one. I wouldn’t hold my breath on Hilton competing with Hyatt or even IHG here, but maybe they can give Marriott a run for their money.

End of Year Marriott elite plans | Coffee Break Ep76 | 11-4-25

While Hyatt and Hilton were busy stealing headlines this week, Greg and I were busy putting together our end-of-year Marriott elite status plans. Personally, I’ll be coasting my way to the finish line as I am already set to hit 55 elite nights this year, and I am due to reach Lifetime Platinum once credit card elite nights post in January. I look forward to downgrading my Marriott Brilliant card and receiving a prorated refund on that annual fee. On this week’s coffee break, you can hear more about why and find out whether Greg intends to keep his United Silver and Aeroplan 25K by chasing Marriott Titanium once again.

Rove loyalty-eligible stays are now billed by hotels (trigger card-linked offers, earn points)

In what might have been the low-key biggest news of the week, we learned that Rove Miles is now offering the option to book hotels and stack both Rove Miles and hotel points/elite credit/elite benefits/etc. In fact, since the hotel now shows as the merchant of record on the loyalty-eligible bookings, you can even trigger card-linked offers as well, stacking some great deals. This is all particularly good news for Hyatt bookings since Hyatt does not otherwise appear on shopping portals, but I could see this being quite useful in other cases as well.

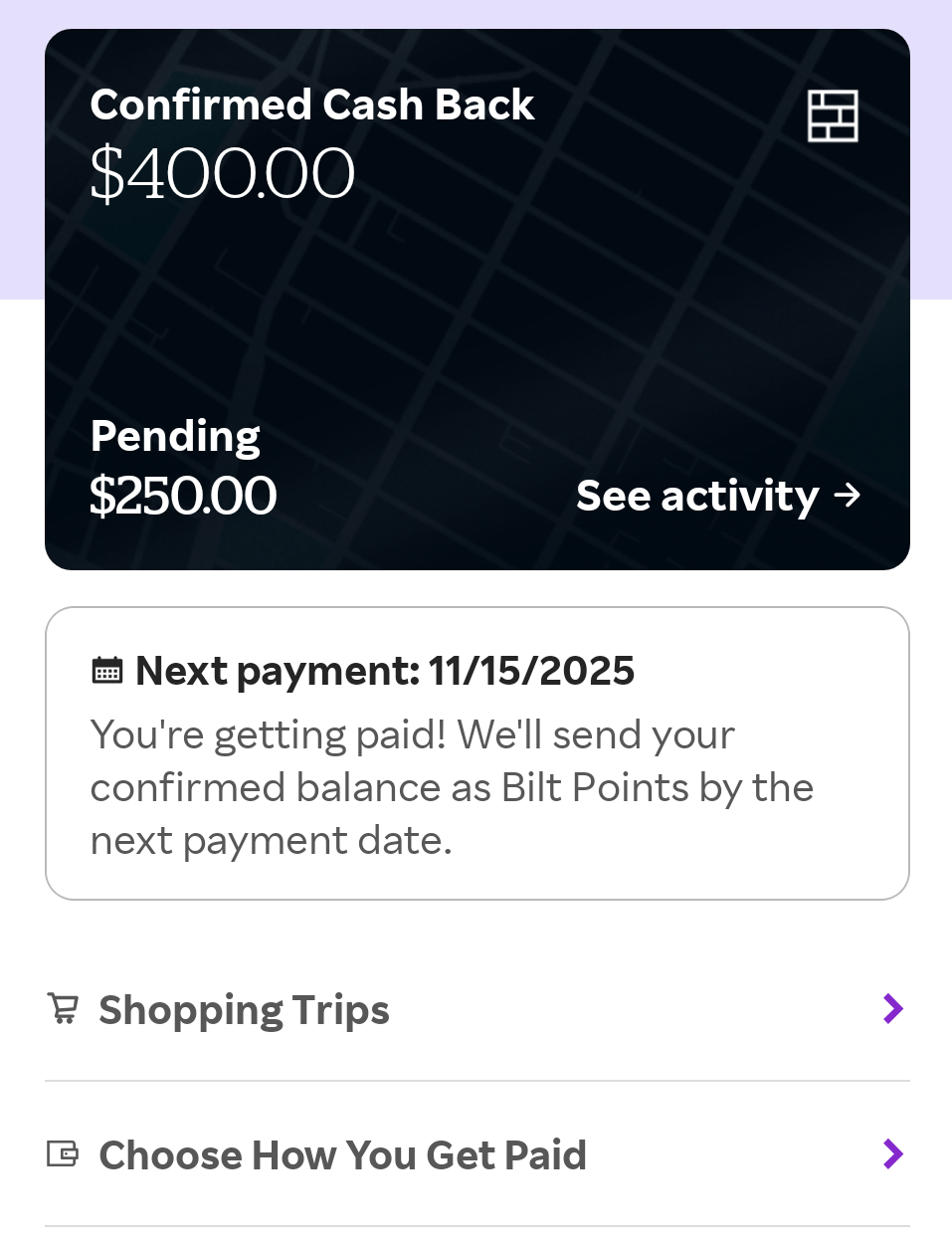

Bilt brings opportunity cost front-and-center with Rakuten (On Nick’s mind)

The previously-rumored partnership between shopping portal Rakuten and Bilt finally came into existence this week. You can now choose to earn your Rakuten rewards with Bilt. On the one hand, that’s awesome. On the other hand, since changing your earning preference to Bilt means that your rewards show up as cash back before being converted to Bilt points, it really reminds me that I’m trading cash that could go in my pocket for Bilt points. Beyond that, comparing different shopping portals becomes a bit more complex, so I worked out a personal rule of thumb to follow that will help me choose which portal to use.

5 rewarding ways to book paid hotel stays | Frequent Miler on the Air Ep331 | 11-6-25

Speaking of a shopping portal, on this week’s Coffee Break, Greg and I discuss how to super-stack for outsized hotel rewards. From clicking through a portal to card-linked offers and more, we talk about the ways you can stack your paid stays for maximum rewards.

AA vs. Atmos: Which elite status game should I play?

It’s Greg’s turn to visit a debate I faced myself early in the year: Should he chase Hyatt elite status with Alaska or American Airlines? Greg ultimately decides to chase Atmos status, though I think the answer here will vary from one person to another. Alaska can make more sense for those who are excited about earning elite credit via award flights, and Greg falls into that camp.

A points and miles education: An experiment in homeschooling

My wife and I began an adventure in temporary homeschooling this week. We’re only intending to take the kids out of school for about two months, and readers have asked me in the past about how that works in practice. In our case, it was pretty easy to set the ball in motion.

Updated Resources

The following resources have been updated this week and are worth a look for all the latest

- Best Credit Card Offers for November 2025

- Current Amex Offers

- Current point transfer bonuses for November 2025

- Current Hotel Promotions for November 2025

That’s it for this week at Frequent Miler. Keep an eye on this week’s last chance deals to get them before they go.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)

I fell prey to credits yesterday as well. We decided to get drinks at a local Hilton to use my $50 quarterly Surpass credit.

If we had just gotten one drink each, we could have just hit the mark with an extra large tip. But no, we both had two drinks and ordered appetizers so our outing to use a $50 credit will end up costing us $50. But, we really enjoyed our afternoon, and I don’t regret it.

NIck, you write,

Actually IHG’s top tier Diamond is a perk at $75k.

I’d be surprised to see Hyatt Globalist at $75k, but perhaps $150k.

Not sure where to put this but Rove is 5x miles on giftcards.com for Airbnb up to $2k (stack with a 2x card for 7x miles with Airbnb) – not sure i’ve seen that good of a deal in awhile? Also 4x miles on Visa/MC giftcards. Ends November 9 at 11:59pm ET.

LOL Nick, I fell into the same coupon trap this past weekend at a weekend stay at a Hilton. I charged to the room like a drunken sailor and had to pay almost $125 upon checkout, after all my credits. lesson learned…

I could certainly see how you could overspend after being given some “generous” credits. What always prevents us from doing so is how outraged we tend to be with ancillary prices at fancy hotels. Not every country is like that, but most are, including America. So we calculate how much credit the hotel is giving us and try not to spend much more than that.

Great article as usual. I am the reason the Saks Credit works so well for Saks. Saks now charges shipping on purchases less than $300. (Who do they think they are? Literally everything they sell under $300 is available somewhere else with free shipping). I was just in Palm Desert and remembered they have a Saks. Figured I would go in and buy a lipstick or something. Then I made the mistake of going upstairs “just to look”. Once again, the credit covered the taxes and I would have qualified for free shipping anyway. ♀️

Agree completely – great article. It’s almost like the house always wins… even if, thanks to the FM team, we’ve all got a good system!

By far the best place to stay in LA with kids is the Magic Castle Hotel. Trust me, they will love it. You do have to book directly with the hotel or through a travel agent if you want access to the Magic Castle Club. (Staying at the hotel is the only way to get entrance to the club unless you know a member.) The evening Magic Castle shows are adult only but the weekend brunch shows are open to kids.

In this case, our only aim was to go to the La Brea Tar Pits. The kids learned about it in an educational app and had been asking for a long time if we could go there someday. And I have a lot of FHR credits to use, so in this case, I definitely wanted to use one if I could.

I appreciate the tip, though! If we ever go back, I’ll have to check it out. Honestly, despite P2’s many terrific qualities and strengths, sitting in traffic is not her strong suit. I think she declared a desire to never go to LA again at least 3 times in the space of 24 hours, solely based on it taking 40 minutes to drive 4 miles lol :-D. And traffic didn’t even seem all that bad to me! Alas, it isn’t very likely that I’ll get a chance to put this tip to use.

Ha, yes our last trip to LA we watched a 45 min ride from the airport suddenly turn into 90 min with an Uber driver who stayed 6 inches away from the bumper of the next car.

Great article, lots of very interesting helpful information thanks for the update.