| Card Details and Application Link |

|---|

Brex Cash  ⓘ $208 1st Yr Value Estimate$250 Amazon gift card valued at $225 Click to learn about first year value estimates $250 Amazon gift card ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer $250 Amazon gift card after spending $1,000 on your monthly cardNo Annual Fee Click here to learn how to apply This is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Given the recent downward spiral of Brex, there's probably better places to concentrate business spending. Earning rate: 7x Rideshare ✦ 4x Brex Travel ✦ 3x Restaurants ✦ 2x on recurring software like Salesforce, Zendesk, Twilio, and more ✦ 1x everywhere else Card Info: Mastercard World Elite issued by Emigrant. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points 1 to 1 to airline programs: Aeromexico, Air France Flying Blue, Avianca Lifemiles, Cathay Pacific Asia Miles, Emirates Skywards, JetBlue, Qantas, Singapore KrisFlyer ✦ $5K AWS credits ✦ Up to $100K AWS Activate credits ✦ Up to 50% off UPS shipments ✦ 25% off Slack for 12 months ✦ 20% Annual Zoom Subscription discount ✦ 50% Dropbox discount ✦ Up to $150 Google Ads credit ✦ 40% off first 12 months QuickBooks ✦ And many more discounts |

Brex Cash is a cash management account that functions like a business checking account (but isn’t a bank account). The account comes with a linked credit card. The credit card works like a debit card: you can only spend up to the amount you have available in your cash account (actually, with the Brex card, your credit limit is only 80% of your available cash). Brex Cash rewards points are transferrable to a number of airline programs; it’s completely fee-free; there is no hard credit inquiry involved; and signing up will not add to your 5/24 count. The only catch is that you must own a business that is registered in the United States as a C-corp, S-corp, LLC, or LLP.

Qualifying (and signing up) for the offer

To open a Brex Cash account, you have to own a business. Sole proprietorships don’t count. You must own a business that is registered in the United States as a C-corp, S-corp, LLC, or LLP.

Since the Frequent Miler business is an LLC, I was able to apply for Brex during the original 110K offer. The process was easy but quirky. A few times the screen just churned away with nothing happening, but by refreshing, clicking the email confirmation, or logging in again, the process moved forward. The only slightly difficult part of the application itself was uploading a picture ID to prove my identity. That part fortunately went smoothly. Altogether I had my account up and running in about 15 minutes and was immediately able to access my new card number.

Earning the full bonus

In order to earn the full 110K bonus, you’ll have to complete 3 steps:

1) 80K: Spend $9,000 within 30 days

This is undoubtedly the hardest part. You have to spend $9,000 with the Brex credit card. And, keep in mind that your credit limit will be constrained by the cash in your Brex account. So, it will be necessary to first add a lot of cash to your Brex account and then use your Brex card to spend $9,000 or more within 30 days of opening your account.

2) 10K: Spend $3,000 within first 3 months

There’s nothing to do here. If you completed step 1 and spent $9K in 30 days, then you’ll have more than met the requirement for this step.

3) 20K: Connect your payroll to Brex

The fine print says “*As well as connecting payroll, depositing sales revenue from ecommerce platforms or specific payment gateways may also qualify.” In our past experience, simply adding Brex to your PayPal wallet was enough to trigger this 20K bonus. See: Brex – How I earned 20K for depositing sales revenue.

Brex Card Details

The Brex card has the following features:

- World Elite Mastercard

- No annual fee

- No foreign transaction fee

- Credit limit: 80% of your available Brex Cash balance.

Brex Card Earnings

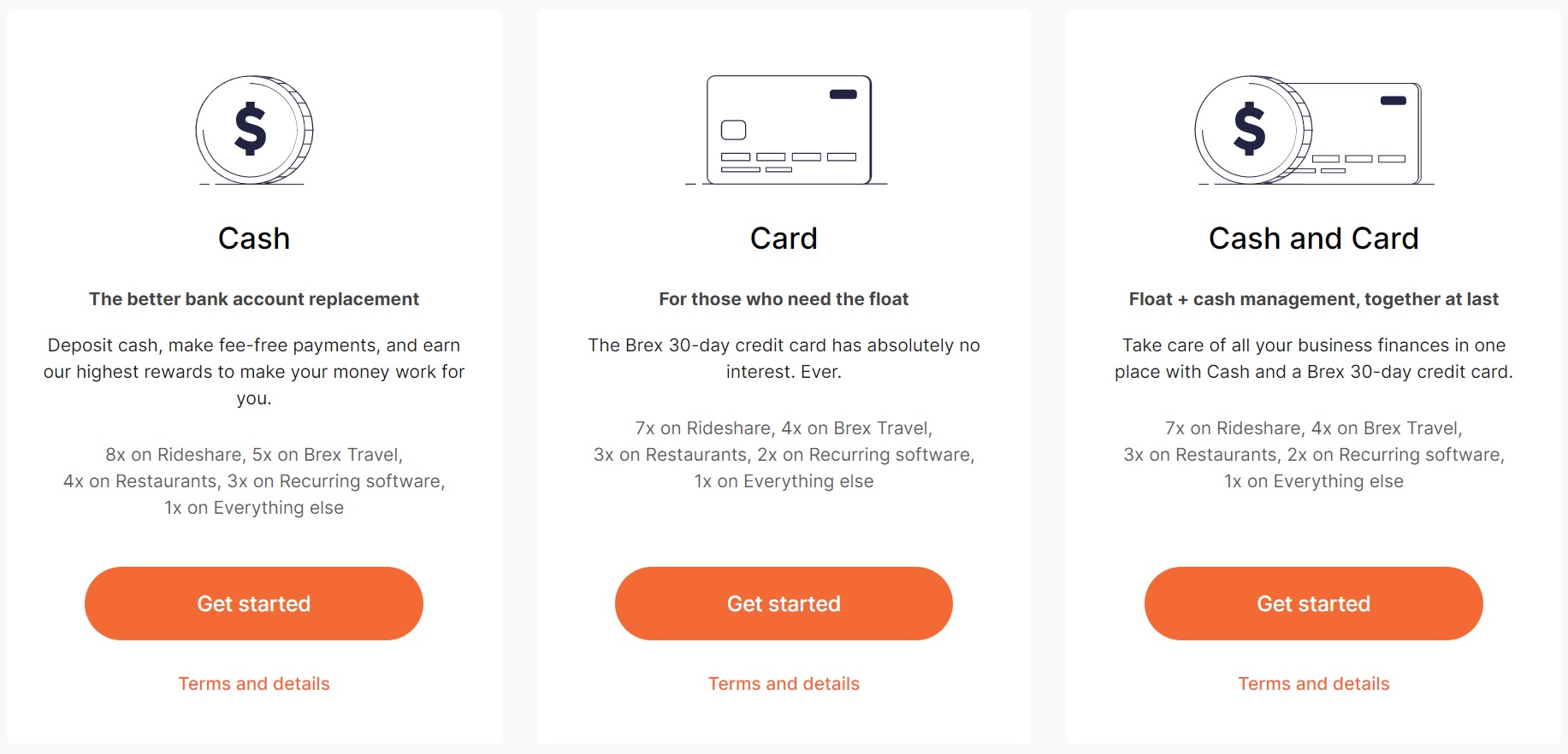

Brex Cash’s included credit card offers the following point earning rates for spend:

- 8x on Rideshare (or 7x if you select the Card or Cash and Card option above)

- 5x on Brex travel

- 4x on Restaurants

- 3x on recurring software like Salesforce, Zendesk, Twilio, and more

- 1x on Everything else

Earning 8x for things like Uber (probably including Uber Eats), taxis, scooters, etc. is pretty incredible. Similarly, earning 4X transferable points for dining with a fee-free card is excellent.

Brex Card Benefits

As a World Elite Mastercard, the Brex card offers the following benefits:

- MasterRental Insurance (rental car insurance)

- Mastercard ID Theft Protection

- Cellular Wireless Telephone Protection (you must pay your cell phone bill each month with the Brex card to qualify)

- Free ShopRunner membership

- Mastercard Easy Savings

- Mastercard Luxury Hotel Program

Details about the above card benefits can be found here.

Point Value and Transfer Partners

Points can be redeemed for 1 cent each or, better yet, can be transferred 1 to 1 to a number of airline transfer partners:

- Aeromexico Club Premier

- Air France/KLM Flying Blue

- Avianca Lifemiles

- Cathay Pacific Asia Miles

- Emirates Skywards

- JetBlue TrueBlue

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

The most widely useful of the above transfer partners, in my opinion, are Avianca Lifemiles and Cathay Pacific. Avianca is an excellent option for booking Star Alliance awards since they do not pass along fuel surcharges. Cathay Pacific is good for booking flights on Cathay Pacific itself or OneWorld partners (like AA, JAL, Qantas, Qatar, etc.). Air France is also useful for booking SkyTeam awards (Delta, for example) and select partners (such as Virgin Atlantic), but the best use is probably to fly Air France or KLM when they offer good Promo Awards (discounted awards). Most of the other partners are also useful at times. For example, Emirates is a great choice for flying Emirates itself. JetBlue points tend to be most valuable for cheap JetBlue flights.

Q&A

- Is the Brex card a debit card? No, but it acts a bit like one. Your credit limit is determined by the amount of cash in your Brex Cash account.

- Is the Brex Cash account FDIC Insured? Yes, Brex Cash offers FDIC insurance up to $250,000 through Brex Cash program banks.

- Is my application approval contingent upon business revenue or years in business? No. Brex is designed to support startups. Simply provide your business name, address, corporation type, and EIN during the application process.

- Will I be taxed on the signup bonus? Will Brex issue a 1099? No.

Recent datapoint, this seems to be dead, signed up with link and it didn’t show the bonus. Contacted supported, they verified I should be getting the bonus, sent them a pic of it not coming up, they said “yup”. Closed the account the next day. Unfortunate as I could actually have gotten some value out of them for my business, but they seem to be run by teenagers.

This is still alive. The landing page still shows the following:

They definitely have big issues when it comes to support, though. I can understand not wanting to trust your business finances to them at this point

Yes, and they verified it was valid, said I will get the bonus, then I pointed out my reward panel doesn’t show it like every other screen shot people have posted, and they said “yup looks fine”.

Still waiting for the 100k point payout Brex promised all of us who took advantage of the PayPal ~ Brex promo. Lots of “pls be patient” “we’re researching”. Scammy company.

I had the same situation with Brex in that they denied my 100K bonus points for signing up with Paypal saying I “didn’t meet the qualifications” for the bonus. But after I complained, unbeknowst to me, they granted me the bonus and it’s sitting in my account waiting for me to figure out what airline to transfer it to!

“5X for BREX Travel”

Did this change somewhere along the way, I was fairly certain that I saw 5x for “travel” (in general). About 5-6 weeks ago, I did get 5x on an airfare I paid with the Brex MC. However there are grumbles on Flyertalk complaining about 1x on lodging.

I have some hotel spending coming up and looking at alternatives to the vanilla Hilton Amex (7x).

As long as you book travel through Brex’s website, I’d expect to earn 5x. Is that how you earned 5x for airfare?

Nope, paid on TAP’s web site during their last amazing Biz fare sales (SFO-LIS-LHR-back for ~$980). I didn’t want to risk horrors of TAP refunds and have a not-so-stellar credit card co at the back of it in case there were some Covid-related issues.

Other than TAP randomly changing the date (1 day earlier), a trifecta: the flights were great (no delays or bag issues, lie flat TATL) 5x points posted to Brex, and ~25K Lufthansa Miles & More points!

To be precise 26,728 M&M points.

That’s really interesting. I had no idea that Brex offered bonus points for direct airfare purchases.

if i have two companies can i apply and get bonus for both the companies (if i apply for current promotion)?

Yep

I’m onto my 2nd account after my first already posted my 110K bonus… having two LLCs is great in times like these!

I just got Brex setup and linked my Citi Business account…when I went to fund it I saw a $15 ACH fee. Is there a way to avoid this or are you just doing it in large lump sums to minimize it?

I pushed from external accounts.

Yep, as Nick said, the key is to find your routing and check number for your Cash account via the Brex website and then log into your bank account, link the Brex account and push money from there.

Yeah, i managed to do it. strangely, i could only wire (with fees) from my biz account but then i linked to my personal account (which isn’t strictly speaking connected to my s-corp) and that worked to push funds via ACH without fees…doesn’t really make sense to me but I geuss I’ll just have to learn to take “yes” for an answer

Nick

Thanks for the fast update. You guys are the best! I just signed up.

Hey the next time your on the Big Island let me know… glad to put you up. Maybe you can MS some gift cards and bring em hahaha. Sadly Its become almost impossible here. I go back to the US Mint days with you guys.

Aloha

Curious has anyone had luck running your Payroll through them. Would be a huge bonus if it works

I have a friend who did successfully.

I signed up for the Brex account on Jan. 31 with my already existing S Corp, no website and a gmail email account. I linked my Paypal account and transferred $250 from my checking to Paypal then to Brex. The day after the $250 posted I received 20,000 points in my Brex account. On Feb. 12th I completed the $3000 spend. At first I received only 10,000 points so I contacted Brex through chat support and let them know I had signed up under the One Mile at a TIme deal. They let me know the rest of the points would post within 5 days. Yesterday, Feb 16th I had 113,000 points in my account worth $1.130 cash. 90.000 for the bonus spend, 20,000 for the link to Paypal, and 3000 for the amount spent for the bonus spend. I’m thinking I may keep as points for a trip in an airline suite! Thank you Frequent Miler!

HI! If I spend 3k with the virtual number will it still count? or… Does the spend need to be with the physical card only so it can count towards getting the bonus?

I used the number from the “virtual card” to make my purchases and it worked just fine.

Yes the virtual number works and counts

Hello just an observation your missing reward categories 3x on recurring software charges, like Salesforce

3x on eligible Apple products through the Brex portal.

Thanks!

I applied to open an account but I wasn’t given the option of Cash, Card or Cash & Card. They may have automatically given me Cash and Card. Thoughts?

Maybe they fixed it to assume that you want that option when coming from One Mile at a Time? I don’t know.

I spent $1003 with my new Brex card and already see 1003 points posted. Do the 80k points post separately or does it sound like I have an issue with the OMAAT Bonus?

It posts separately. I’m still waiting for my spend bonuses too.

I’m curious if your Spend Bonuses posted. I spent $3k paying my taxes on Sunday then got a note today (Monday) that I received the 10k bonus points. I was hoping that would also trigger the spend $1k / get 80k bonus points but it’s not looking promising. I guess I need to spend a separate $1k?

No, you shouldn’t have to spend more. Give it a few weeks.

Just an update I was able to connect with customer service and was told 80k would post 5 business days after 1k spend. Today is exactly 5 business days for me and my 80k points posted as promised.

And… my 80K posted overnight. It was more like 10 business days for me, but I’m not complaining! Still waiting for the final 10K, but again, I’m not worried.

I don’t see any minimum requirements. Can I do the following:

1) Open the account in February.

2) Fund account by transferring, say, $5000 from my Chase business (C Corp) account.

3) Deposit a couple of customers’ checks directly int0o the new BREX account.

4) Link? whatever that means.

5) Spend $3,000 on the associated card.

6) Wait for my 110,000 points.

7) Transfer my points to Avianca.

8) Close all accounts associated with this place. All complete by April.

I think that would work. I’m not sure why you would want to close the account though. It’s totally free.

Greg, they are making this extremely hard to get the points. No where does it tell you that only 80% of your funds are available for the credit card use. I do deposits from Chase and that earns nothing. I want to send funds from PayPal and they say that is not workable. Someone needs to figure out what works to get the 20K.

Seems every year we get the low hanging fruit like Avianca one year, IHG another year. Once we figure this one out, I will do it for my wife’s LLC.

True that the 20K may be more difficult than I thought (I’m not ready to give up on the transfer from Paypal just because a rep said no!). That said, the other 90K is super easy.

Actually, my Paypal deposit worked. Just got the 20K

Greg, I have a business amazon account. I linked it to my Brex card. Would you mind tell me how to make that work.

I don’t know. I haven’t tried that.

This was just hypothetical, as in worst behavior. Sometimes I come off as a bit brash – sorry.

I may give this a go.

Any insights into how they verify that incoming PayPal transfers are sales revenute? I don’t see any ‘official’ way to link PayPal via the Brex site. Did you just add your Brex account as an ACH link from within PayPal and transfer money that way?

Thanks for highlighting this – it’s definitely interesting!!

I’m waiting to see if it works, but here’s what I did:

I don’t think they would have any way to verify that the paypal money is from sales revenue.

I planned to do the same, but here is what I got from them:

Unfortunately it would need to be sent directly from a vendors account

For the sign up bonus, we require that your Cash account is set as a direct recipient for payments

We’ll see

My Paypal approach worked. I just got the 20K bonus.

Yup, this exact approach worked for me as well. It posted super quick – almost like the PayPal trial desposits triggered the bonus but I can’t be sure.

CreditKarma says that Brex wants your business bank account needs 100k and they want access to your bank account and Quickbooks. I need to read up a lot more before I jump in. It also says their FDIC is through a partnership they have. Maybe outdated info? Brex didn’t get great reviews.

Yes, that’s outdated info based on the way Brex used to work. They’ve changed things up to be much simpler now.