It’s always a bummer to see a good deal die. Sometimes, an opportunity is so obviously fragile that it seems best to leave it alone. In the case of the ability to get two consumer Hawaiian Airlines credit cards, it seemed like a great short-term opportunity that was already living on borrowed time with the Hawaiian cards expected to be discontinued at some point this year that it made sense to alert readers to it while it lasted. Unfortunately, it ended much faster than I thought it would. I am hopeful that means that many readers took advantage of the deal while it lasted, but I am nonetheless disappointed as I didn’t expect to see it go so quickly.

The good news is that new opportunities are always around the corner, like Bilt’s newest transfer partner and coming transfer bonus of up to 100% and a chance to get 750,000 miles from a single new credit card. You’ve gotta love a hobby that continues to giveth more than it taketh away.

This week on the Frequent Miler blog…

All-in with Hawaiian Airlines Miles: Better late than never?

I decided late in the game to get aggressive in my pursuit of Alaska miles via Hawaiian Airlines. Part of that pursuit involved getting two Hawaiian Airlines consumer credit cards while it was still possible to do given that we expect all of the Hawaiian cards will likely become unavailable at some point this year. Unfortunately, it seems that this window has now closed. While a number of readers were able to take advantage of the chance to get both the Barclays and Bank of Hawaii versions of the Hawaiian Airline credit cards between the first time we posted about that and when we published this post, many readers now report a policy change at Barclays whereby this is no longer possible. Now to make a final decision as to how many Membership Rewards points to move to Hawaiian while we still can….

Southwest changes, Southwest will still be the same (On Nick’s mind)

Significant changes are coming to Southwest Airlines next month. Many long-time Southwest loyalists are disappointed, and for good reason. The changes are not at all customer-friendly. That said, with a Southwest credit card in our household and a Companion Pass in our possession through at least the end of next year, things will mostly be business as usual for my family. There’s no doubt that Southwest’s competitive advantage has eroded for casual travelers, but for savvy travelers, I think the biggest change is going to be to flight credits. I’ll definitely prefer booking awards moving forward and might consider moving points to Southwest in the future if I need to.

Bilt Rewards: Up to 100% transfer bonus to Southwest Rapid Rewards

It was during our podcast recording yesterday when it hit me that transferring points to Southwest will begin to make sense when flight credits begin to expire after 6 or 12 months. If we can agree on that premise, then a transfer bonus of up to 100% could certainly be intriguing. Even at the 25% transfer bonus, this certainly could be worthwhile since my recent analysis of Southwest points put the floor value around 1.1c per point — with a 25% transfer bonus, you’d be looking at getting a minimum of ~1.375c per Bilt point with that bonus. I wouldn’t advise making a speculative transfer at the bottom end of the bonus, but if you have a use in mind — particularly if that use is closer to the average of ~1.3c per Southwest point before the bonus, this could certainly be a good deal. While I strongly prefer the outsized value opportunities of other airline currencies and while my faith in Southwest not to make further negative changes has completely eroded, I could imagine those who primarily travel domestically being pretty tempted here. Getting around 2.6c per Bilt point (double the average value of a Southwest point) toward domestic airfare is probably an outstanding deal for many travelers.

A World-Class Wells Fargo Wallet | Frequent Miler on the Air Ep303 | 4-25-25 | Podcast

Is Wells Fargo a World-Class Wallet Wannabe, or do they have what it takes to fuel your rewards on the cheap? Would you give up all of the other rewards programs for this one? On this week’s Frequent Miler on the Air podcast, we talk Wells Fargo, a Priority Pass “resort fee”, an even bigger banker offer and a lot more.

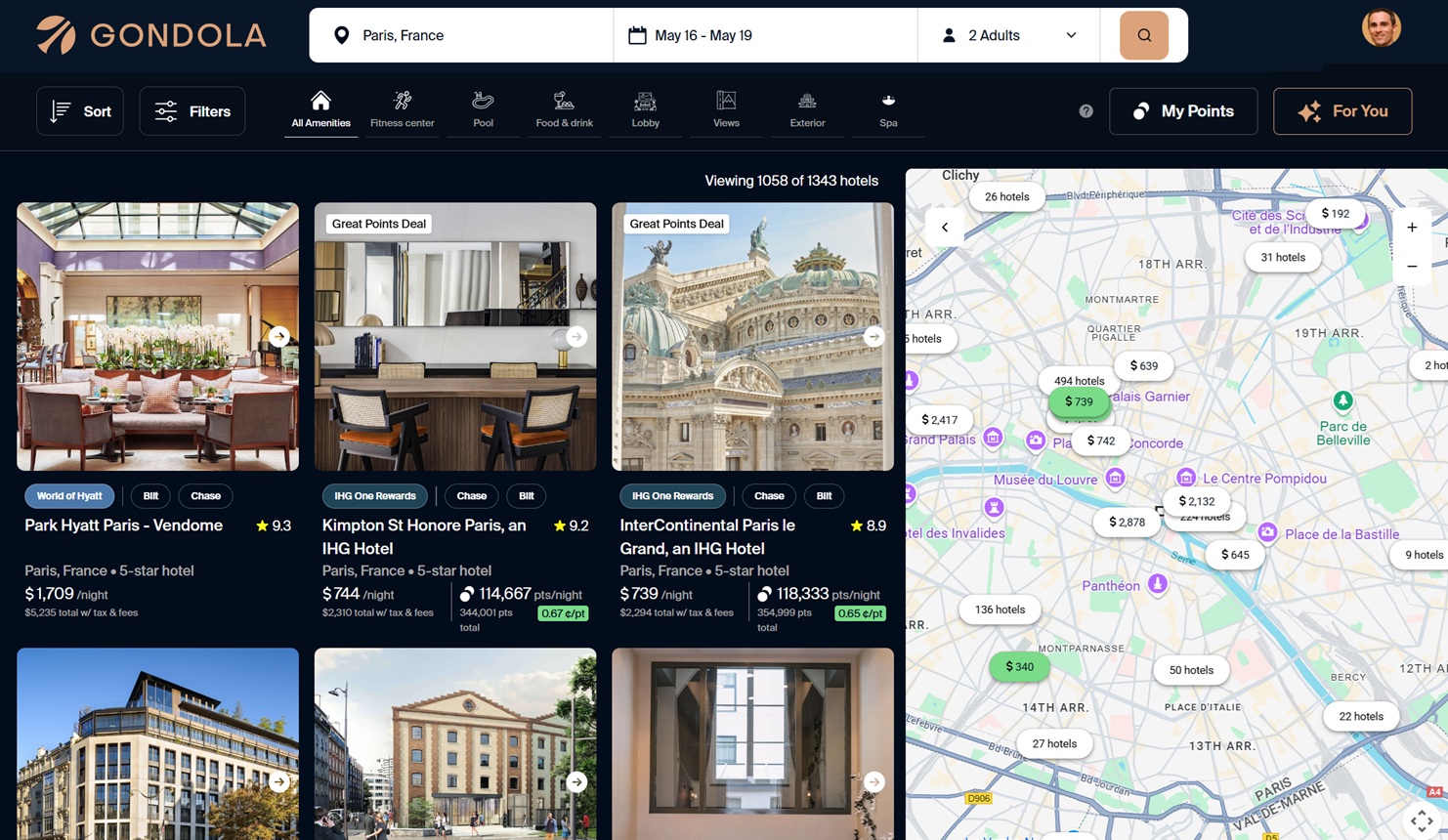

Gondola: Compelling hotel award search tool, but with an email problem

Greg took Gondola.ai for a spin recently. I had also looked at this tool a couple of months ago, and I was initially really excited by the prospect of a tool that could get to know the types of hotels I prefer and make recommendations in an unfamiliar city. Greg also makes the point that the tool offers not just the ability to sort by cents-per-point but rather the ability to sort by value as compared to the typical redemption value of points in that particular program. I think there is a lot of promise here. However, I was really turned off by the fact that this tool requires full access to scan all emails. That’s a level of intrusion that just isn’t worth the added convenience in my opinion. There are the obvious security concerns (not necessarily that Gondola will misuse your information, but rather that a bad actor could potentially get access to far too much data). And while I’m happy to trade away some amount of privacy for convenience, this one turned out to be a step too far for me despite my early excitement. If Gondola had a way to work with forwarded emails the way that TripIt does, I’d be tempted to give this one another shot. They clearly have the ability to scan email for relevant information, so I don’t know why they couldn’t receive that email into a centralized inbox the way that TripIt does — access to one’s full email seems really unnecessary except to gather extraneous data. Further, given the targeted Capital One Shopping offers I keep receiving for hotel chains, I’m not too tempted by the extra 2-3% back.

750,000 miles from one card. Is it worth it? | Coffee Break Ep53 | 4-22-25 | Podcast

The Capital One Venture X Business is out with a massive new offer, but is it massively valuable? I wouldn’t necessarily call it huge for the average person, but for someone with a healthy small business and a desire to keep things simple, this card is tough to beat. Between an excellent set of benefits and the chance to earn three quarters of a million miles, I think this card can be worth it for those for whom the $200K total spending requirement isn’t a tall task. I know plenty of small business owners who could easily meet that requirement and who probably wouldn’t want to juggle multiple cards, so this is a good fit for those in that situation.

Elite status via credit card spend: AA vs Delta vs United vs Alaska vs JetBlue vs Frontier

I was glad to see Greg add Alaska, JetBlue, and Frontier to this post about spending to elite status (My next request: Add Spirit!). This really helps put in perspective the differences in terms of elite earnings from spend. That said, I suspect that most folks interested in airline elite status probably fly enough that they won’t be earning status exclusively through spend. Still, this reference post can be really useful for comparing which airline with which to top off your earnings or chase status. For instance, now that Alaska offers elite-qualifying miles for partner award flights, you’ll have to consider how many miles you’ll earn from both paid and award flights and then decide whether it makes more sense to spend to bridge the gap to status or instead plan to get status with American Airlines, crediting your paid Alaska flights to AA and perhaps getting to meaningful status with less spend.

Best ways to get to Hawaii using points and miles (2025)

It’s hard to believe that the Turkish sweet spot to Hawaii persists. While Turkish increased the rate from 7,500 miles in 2024 (?), flying to Hawaii in economy class for just 10,000 miles each way (or in business for 15,000 each way if you can spot a unicorn! remains an absolutely slamming deal……when United releases availability to partners. Unfortunately, they aren’t great about that these days, so you’ll want to check this post for the multitude of other great ways to get to the Aloha State using points and miles.

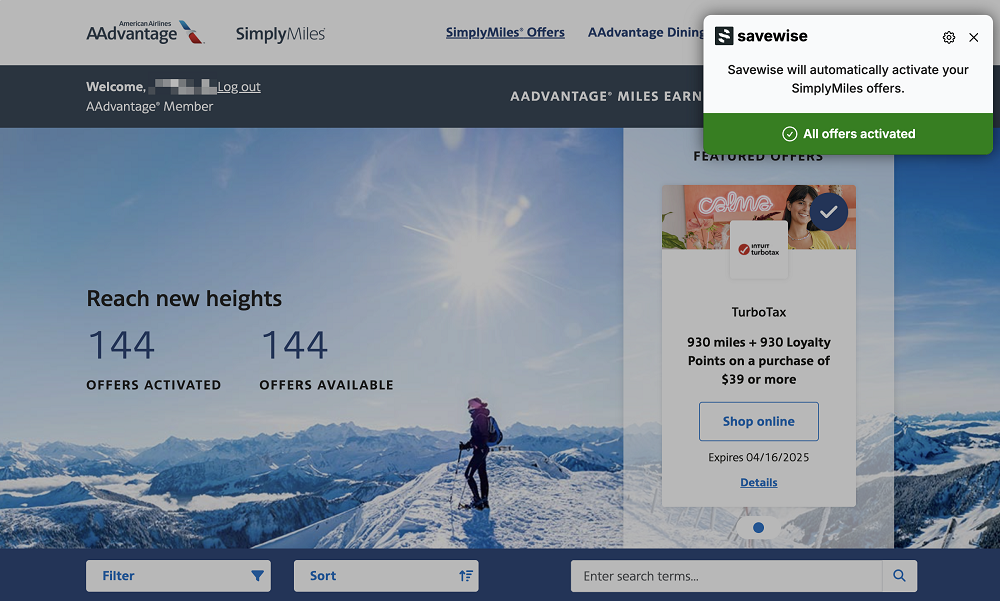

Savewise: An awesome shopping tool (one week left for $99 lifetime membership)

I’m including our republished post about Savewise because the cost of a lifetime membership is rising soon, so if you read about it previously and were interested you may want to consider jumping in sooner rather than later.

That’s it for this week at Frequent Miler. Keep an eye on this week’s month-ending last chance deals to make sure you take advantage of those due to end this week.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

Transferring to Wells Fargo partners is IMPOSSIBLE. Every time I try, a message pops up to “check your internet connection.” I’ve never had problems transferring my Chase or Citi points to partners. But Wells Fargo Rewards website doesn’t work, and their customer service specialists are clueless.

Wells Fargo has said that it expects to expand its transfer partners. If it can parallel what Bilt is doing, it would be a tremendous platform. Or, perhaps WF and Bilt repair their relationship via WF piggy-packing on Bilt’s capabilities.

I very much doubt that they’d be able to get partnerships with Bilt’s US-based partners (never going to happen with Alaska, United, Hyatt, or Southwest), but I’d be happy for them to pick up a handful of Bilt’s foreign partners. I’m really surprised that hasn’t happened.

Agreed.

C’mon, Nick. This hobby does NOT giveth more than it taketh away. It takes away 100x what it gives. That’s quite a load of spin.

I don’t know about you, but I’ve seen far more of the world than I’ve ever expected and had experiences I’d have never imagined thanks to hobby. I’m not sure I understand your point at all?

Me as well. I am just saying that this game is getting worse not better and at a pretty fast pace.

Improvise, adapt, and overcome. Ooh-rah.

I’m not certain what your expectations are or how you are pursuing the hobby. One must focus on the doors that are currently open and those yet to open. Not on the doors that have been closed. I feel blessed.

Some people can do 4 Amex Business Platinums SUBs per year via NLL offers. Some people can do 4 Chase Ink SUBs per year. A person can get a SUB on three different Avios cards, three different Southwest cards, and several United cards every two years. A person can get a SUB on a few different AA cards every four years. And, several Delta cards every seven years. Plus, a person can clean up via a range of shopping portals.

Then, there are tier status matching opportunities. AA has a targeted Loyalty Points promotion for up to 50k LPs. Some programs have tier status soft landings.

Pax vobis cum.

My expectations are a continued steep decline in the opportunities to win at this game. I have taken advantage of more opportunities than almost anyone in this game. I likely have more points than I will ever use, but I am tired of the endless cuts day in and day out.

There certainly are steep declines. Just look at Marriott. But, as I say elsewhere, improvise, adapt, and overcome. The hobby is not a bunny hill. The hobby is a mogul run. You have to be experimenting and devising new strategies. Many good strategies will never be found on blogs because the various programs read the blogs and shut them down. The best strategies are kept quiet for this exact reason.

Even for those that are published they often live a lengthy life of usefulness before going away. As the cruise status match merry go round winds down my family will have taken three cruises for maybe $3500 in total costs that would have retailed for well over double, and with the flights to get to the ports all on points. We’re on pace to earn around $5K in bank bonuses this year and will fly 5 flights all in business class on a two week Europe trip during peak summer season when our daughter is on break from school.

Do I wish I was around before infinite Chase Ink bonuses went away after TPG first made them known? Sure. But there’s still lots of opportunities in this game. Even if the eventual end is that all points become worth 1cpp at cash linked redemption rates who’s going to say no to thousands of dollars in low effort money a year? I don’t even do Visa gift cards or money orders. The wins will continue.

If you really do have ‘more points’ that you’ll ever use, what are you whining about then? My guess is that’s not true or else it would have zero bearing on your ability to ‘win at this game’ going forward. We aren’t owed any of these loopholes we take advantage of. Perhaps your ‘entitled’ colored glasses aren’t allowing you to see the benefits of it all.

I don’t put numbers on public posts. The problem is that winning once you are point-heavy requires great redemption opportunities. That is the part that is dying fastest.

Furthermore, Lee, what good does 50k LP do when the benefits are useless? I don’t wait on upgrade lists, and AA SWUs can rarely be confirmed in advance. What’s the point of chasing status that has useless benefits? Delta Diamond still has useful benefits, but they are cut continuously through the never-ending serial theft of our SkyMiles. One foot forward, two steps back…

One must acknowledge that tier status benefits are (for the most part) not realizable. In that sense, you are absolutely right. BUT, there can be a specific benefit that a specific person finds value and can realize. The only reason why I would seek AA tier status is access to One World first class check-in and lounges. If not for that, I wouldn’t waste my time. Alternatively, Air France top-tier status affords access to first class award inventory. If not for that, I wouldn’t waste my time. Etc. Etc.

Given the state of things, one must look at the game in pure economic terms. The value of points. And, if one is traveling in a premium cabin, what benefits would tier status provide that the premium cabin doesn’t? If one is successful at points generation and is flying on points, one doesn’t care about earn rate on cash tickets. As for IRROPS, I’ll rely on lounge angels as opposed to phone agents.

I’ve had invite-only tier status in a few programs. Certain benefits are nice. But, there’s an opportunity cost to commit to those programs. And, the question becomes whether higher earning opportunities are greater than simply paying for those extra benefits. I’ve pivoted away from such commitments. It’s pure economics.

The Hawaiian consumer deal is gone, but what about having the personal Barclays and business bank of Hawaii? I recently got both of those. My husband has the Barclays personal, now I’m wondering if he would get approved for the biz version of bank of Hawaii?

He should be eligible if he has not held the business version in the past 24 months. Best of luck.

Yes, people can 100% get both the personal and business card. And that’s true for every situation I can think of… not just Hawaiian.

Other examples where you can get approved for similar personal and business cards: