Stephen Pepper received a terrific targeted offer on an AARP membership from Capital One Shopping today; it effectively gives you an additional $20 to signup after paying the cost of the membership. Anyone can join AARP (you don’t need to be elderly like me) and there’s a surprisingly good list of benefits.

Stephen’s offer came via email with the subject line ‘Well deserved: You’ve got this offer from AARP,” but it’s a good idea to check any e-mails from C1 Shopping emails as you might see the deal in those as well. (h/t: GC Galore)

As a reminder, you don’t need to have a Capital One card to use Capital One Shopping.

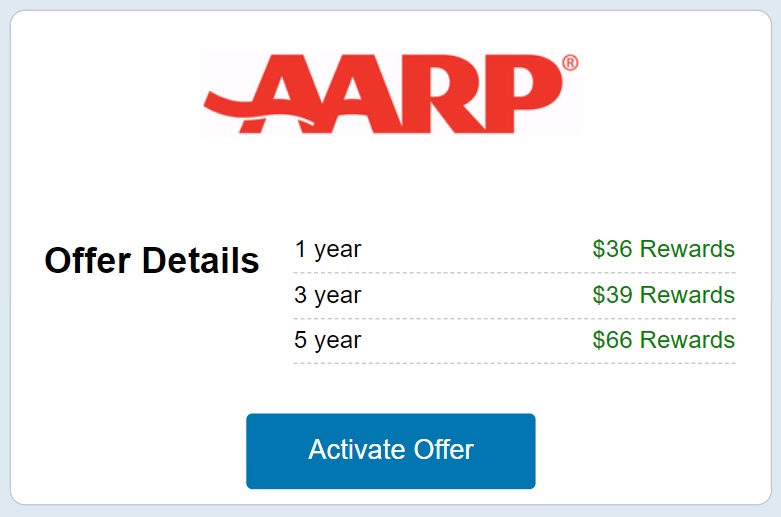

The Deal

- Capital One Shopping is offering the following cashback when taking out an AARP membership:

- 1 year – $36

- 3 year – $39

- 5 year – $66

- The offer appears in an e-mail of deals from Capital One Shopping

Key Terms

- Membership may set to auto-renew, but you can change this in account settings

Quick Thoughts

I’ve been a card-carrying AARP member for years, primarily because of the various travel benefits it provides, as well as the opportunity to buy discounted gift cards through AARP Rewards. Anyone can join AARP — you don’t need to actually be retired. I got my membership in some sort of similar deal and, while I don’t use the benefits often, they do come in handy from time to time.

Probably the most popular perk among frequent flyers is a discount on paid premium cabin flights on British Airways. There are also hotel discounts with Wyndham and Choice and restaurant discounts that include places like Denny’s, Outback Steakhouse, and Carrabba’s.

Hopefully it works on renewals, just renewed for 5 years for $45, $8 chase offer and $66 CapOne. Anyone, how to track CapOne rewards ? AMEX send email after using offers. I have used CapOne shopping 3 times in the last week but nothing shows on the app.

10% discount on gift cards for cruise lines – buy the cruise gf + use them to pay for the cruise itself, or for spending on board.

$8 back using BOA or chase offers.

Thanks.

AARP membership cost is often less than 20 bucks a year, or right now, $9 for multiple year sign up so I guess I am not seeing the big advantage to getting a break on it.

I feel like AARP is way overhyped. Basically it seems useful for two things: Consumer Cellular (I think I get $5/month discount) and British Air. I never buy BA cash tickets but for me Consumer Cellular works bc it’s a great plan for two people. If I didn’t have one of those two uses I wouldn’t bother with AARP. Never found a hotel discount that’s better than the member’s rate. Seems most of the benefits are theoretical, yet other blogs (not FM) love to hype this like it’s some great secret.

Gift card discounts are the big selling point for me. I now buy $500 of Safeway GCs/ month and save $40 on groceries. There’s also value to be had with some of the cards not subject to the 5/month limit, particularly if you want to get in to MS on cruise ships.

Also it’s possible to pay with other Visa and MC gift cards which is another perk.

I’ve been surprised that this aspect is basically never talked about.

Well said

Assuming if already have AAPR membership (just purchased a few months ago) – out of luck on this one? Or is it possible to trigger this for cancelling and resubscribing – or for paying for a renewal early?

I turned off the auto renewal and did it so, yes? Hasn’t tracked just yet so not 100% sure?