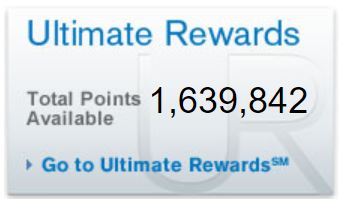

As you can see in the image above, I have a nice stockpile of Ultimate Rewards points. I often transfer points to Hyatt for award or points + cash stays, or to various airline programs when booking flights. I can also move points to my Chase Sapphire Reserve account in order to get 1.5 cents per point value when booking travel. In this way, points needed to book airfare or hotels are sometimes much less than when transferring points and booking awards directly. This method also makes it possible to book car rentals, cruises, tours, and more while getting 1.5 cents per point value.

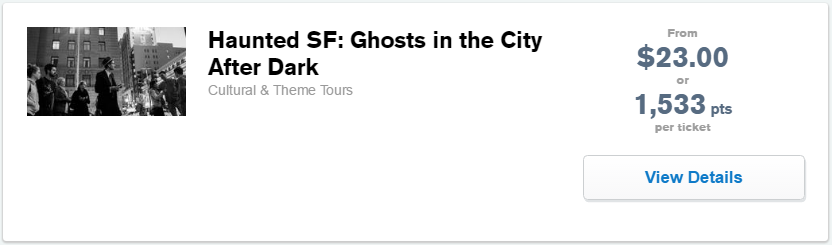

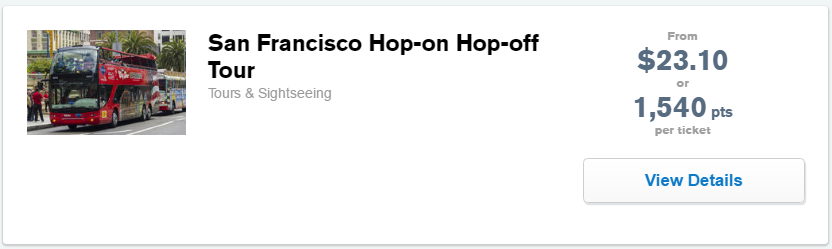

Just to give you an idea of what’s possible, here are some activities I found in the San Francisco area that are bookable with Ultimate Rewards points (note: I picked these somewhat randomly. Their presence here is not an endorsement):

If you don’t have enough points within one credit card account to book your travel, you can move points from other accounts you own, or from a selected household member, or from a joint business owner. See Chase point transfer rules made simple [Infographic] for details.

Also note that some cards are advertised as cash back cards, but they actually earn Ultimate Rewards points. This is true of the Freedom, Freedom Unlimited, Ink Business Unlimited, and Ink Business Cash cards. In each case, you can redeem points for 1 cent each (hence the cash back idea), or move them to a premium card account, such as the Sapphire Reserve, which gives you more valuable options.

Credit Card Welcome Bonuses

The quickest and easiest way to amass Chase Ultimate Rewards points is through credit card welcome bonuses. At the time of this writing, the following bonuses are publicly available (in some cases better offers may be available through targeted offers or in-branch):

- Chase Ink Business Preferred: 80K points after $5K spend

- Chase Sapphire Preferred: 55K points. 50K after $4K spend + 5K for adding an authorized user

- Chase Sapphire Reserve: 50K points after $4K spend

- Chase Ink Business Unlimited: 50K points after $3K spend

- Chase Ink Business Cash: 50K points after $3K spend

- Chase Freedom: 17.5K points. 15K after $500 spend + 2.5K for adding an authorized user

- Chase Freedom Unlimited: 17.5K points. 15K after $500 spend + 2.5K for adding an authorized user

Each of the links above will take you to a page with more details about the card and up-to-date signup offer details.

Without accounting for points earned from spend, one person could earn 320,000 points by signing up for each of the above cards. And a couple could earn twice that many if each signed up for the same cards. Of course you can’t sign up for all of these cards at once, but it is possible to sign up for 1 or 2 every few months.

One problem is that Chase enforces their unwritten “5/24 Rule” for all of the above cards. Unless you are pre-approved, Chase will deny your application if you have opened 5 or more cards, from any bank, in the past 24 months.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

For this reason, if you are new to signing up for cards, I recommend starting with Chase cards. Also, while I used to avoid recommending business cards to those just getting started, I no longer suggest waiting. The Chase Ink Business Cash card, in particular, is great to have for its 5X categories. And the Ink Business Preferred is great for its huge signup bonus and 3X categories. And the Ink Business Unlimited is great for everyday spend.

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

If you are over 5/24, you can try your luck in-branch to see if you are pre-approved for any cards. Or, you can cure your 5/24 status by signing up primarily for cards that do not appear on your credit report (most business cards do not add to your 5/24 count, including Chase business cards). Some couples opt to have one person stay under 5/24 while leaving the other free to sign up for every good non-Chase offer that appears.

Refer-A-Friend Bonuses

Another great way to earn Ultimate Rewards points is by referring friends to sign up for credit cards that you already have. Referral bonuses tend to range from 5,000 to 20,000 points depending upon the card and the current referral promotion. Visit Chase’s Refer-A-Friend site to see if your cards are eligible.

Category Bonuses

The next best way to earn Ultimate Rewards points is through category bonus spend. If you spend a lot personally or through your business on any of the following categories, you can do very well:

| Spend Category | Best Options |

| Dining | Sapphire Reserve 3X Sapphire Preferred 2X Ink Cash 2X |

| Travel | Sapphire Reserve 3X Ink Business Preferred 3X Sapphire Preferred 2X |

| Phone / TV / Internet | Ink Cash 5X Ink Business Preferred 3X |

| Gas | Ink Cash |

| Shipping | Ink Business Preferred 3X |

| Advertising via social media | Ink Business Preferred 3X |

| Office Supply Stores | Ink Cash 5X |

| Rotating Categories | Freedom 5X |

Not shown in the table above are the Freedom Unlimited card and the similar Ink Business Unlimited card. Both cards earn 1.5X everywhere. So, a great approach is to use either Unlimited card for all spend that doesn’t fit any of the above categories.

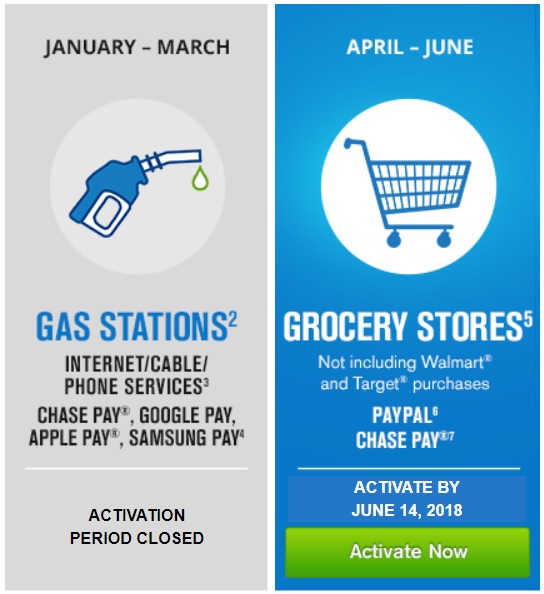

The Freedom card (not the Freedom Unlimited) offers different 5X categories each quarter, up to $1500 in spend. This quarter Chase is offering 5X at grocery stores and for all Paypal and Chase pay purchases. You can always find current 5X categories on Chase’s Freedom Calendar. You must enroll each quarter.

5X grocery / drugstore with Chase Freedom

Occasionally Chase Freedom offers 5X at grocery stores and/or drugstores (but keep in mind the $1500 maximum on 5X earnings each quarter).

Both grocery stores and drugstores tend to carry huge selections of gift cards. And at grocery stores you can sometimes double-dip by earning member rewards (many grocery chains offer fuel rewards programs).

If you don’t need merchant gift cards, it should be possible to buy variable load up to $500 Visa/Mastercard gift cards with a $4.95 fee at some drugstores or up to a $5.95 fee at many grocery stores. Unfortunately, most grocery stores do not offer fuel rewards when you purchase variable load Visa/Mastercard gift cards.

2X to 5X gas station gift cards with Ink Cash or Chase Freedom

Some gas stations sell gift cards and will let you pay with a credit card. And, many numerically named convenience stores code as gas stations even when they are not truly gas stations. Availability of gas stations that sell gift cards and that allow credit card purchases of gift cards varies tremendously by region. So your mileage may vary.

The Ink Cash card earns 2X at gas stations. And with the Chase Freedom card, “gas stations” is a common 5X quarterly bonus category.

Shop through Chase

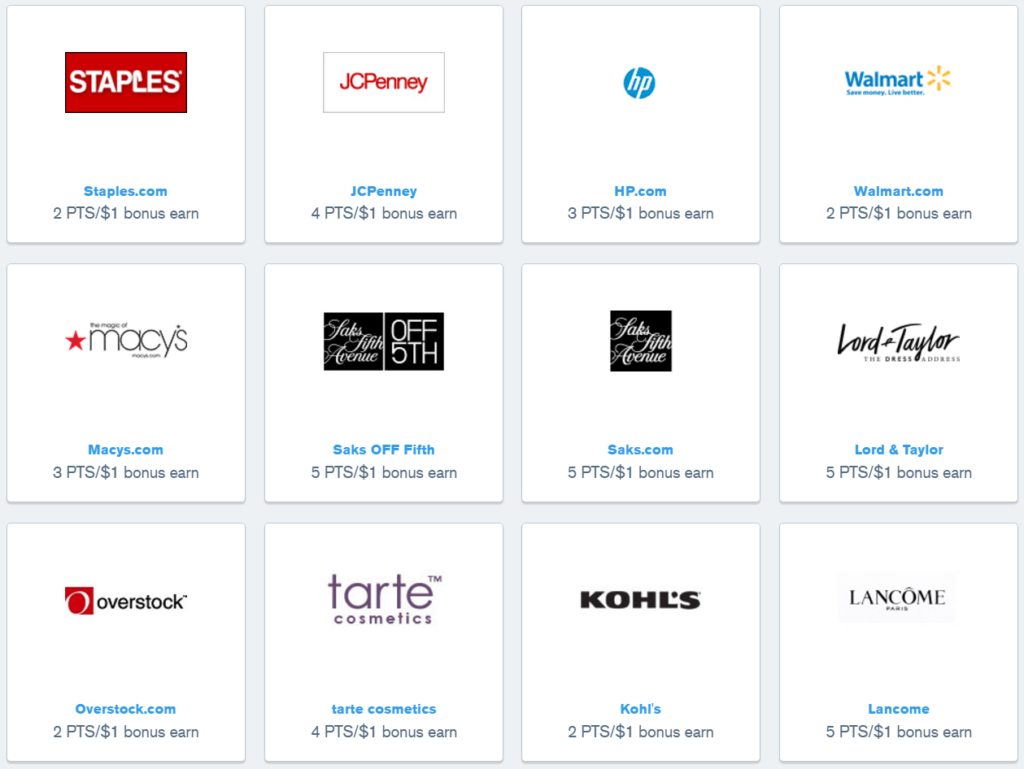

When shopping online, it is often possible to earn bonus points by starting with “Shop through Chase”. To find Shop through Chase, log into your Chase account, click “Go to Ultimate Rewards“, then under the “Earn Points” menu, select “Shop through Chase“.

Find the retailer where you want to shop and click through. In most cases prices will be exactly the same as if you had browsed directly to that merchant, but by going through Chase you’ll earn bonus points in addition to those earned by your credit card.

Note that for any given merchant, other portals may offer better rewards. See CashBackMonitor to find current portal rates for each merchant.

[…] out a couple of helpful posts on Frequent Miler for more about how to earn Ultimate Rewards and their travel transfer partners like Hyatt, IHG, Southwest, United and […]

[…] thanks to Chase credit cards that earn 5X, 3X, and 1.5X Ultimate Rewards points per dollar (see: Amassing Ultimate Rewards and Chase Transfer […]

[…] points from the two promotions may not post before the end of August. Hopefully, you have some Chase Ultimate Rewards that you don’t mind moving over to Hyatt. Even if you don’t, I bet you have a friend […]

Chase closed down my ink cash card because I “used my business card for personal purchases” bought my wife some bags for our anniversary from Lois Vuitton which were pretty expensive and that flagged as personal purchases. I argued until kingdom come but theyre decision stuck. A customer who can afford to buy LV bags and pay off right away is prob the long term Cust you’d think they’d be looking for but I guess not. Atleast I was able to combine my leftover points into another account. Oh well. Moved my spend to Amex.

That’s really strange. Many people use business cards for personal expenses all the time.

[…] For more about earning Ultimate Rewards points, please see our guide: Amassing Ultimate Rewards. […]

[…] reasonable that the reps may have been correct. If true, this would be a blow to those looking to Amass Ultimate Rewards as having both a Freedom card for its 5x rotating categories and a Freedom Unlimited for 1.5x […]

[…] I realize this post gets deep in the weeds and it will just get more so as you read on. If you’re looking for an easy answer for replacing SPG as your go-to credit card, then I recommend that you turn to Chase Ultimate Rewards. See this post for a friendly look at why I believe you can do well with Chase: Amassing Ultimate Rewards. […]