| Card Details and Application Link |

|---|

Ink Business Unlimited® Credit Card 75K points ⓘ Affiliate 75K after $6K spend in 3 monthsNo Annual Fee Click here to learn how to apply This is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Alternate Offer: You may be able to get an offer of 120,000 points after $6,000 in purchases via a Business Relationship Manager. Recent better offer: 90K after $6K spend in 6 monthd (expired 1/17/24) FM Mini Review: Great welcome bonus for a fee-free card. Good option for earning 1.5X everywhere. Good companion card to Ink Business Preferred, Sapphire Reserve or Sapphire Preferred. Click here for our complete card review Earning rate: 1.5X on all purchases ✦ 5X Lyft through through March 2025 Card Info: Visa Signature Business issued by Chase. This card imposes foreign transaction fees. See also: Chase Ultimate Rewards Complete Guide |

The Ink Business Unlimited® Credit Card is an excellent card to pair with other Chase Ultimate Rewards cards. It has no annual fee, it offers 1.5 points per dollar for all spend, and even though it is advertised as a cash back card it actually earns valuable Chase Ultimate Rewards points. Surprisingly this no-fee card offers a few valuable perks as well: auto rental coverage, 1 year extended warranty, and 120 day purchase protection.

Unfortunately, this card does charge foreign transaction fees, so it is not a good choice for spend outside of the US.

Chase Ink Business Unlimited® Credit Card Application Tips

Should you apply?

Even though this is a business card, it’s a great choice for anyone interested in earning Chase Ultimate Rewards points. It offers an excellent combination of a great signup bonus, no annual fee, super-valuable points, and solid rewards for all spend. If you are eligible (see next section) and you don’t already have the similar Freedom Unlimited card, you should consider this card.

Are you eligible?

To get this card you must have a business, and you must be under 5/24 (more on 5/24 below).

Similarly, if you have more than one business, it’s possible to get the same Chase Ink card and welcome bonus for each business you own. This is true even though the application terms state otherwise: “I understand that any new cardmember bonus offers for this product are not available to either current or previous cardmembers of this product who received a new cardmember bonus for this product in the last 24 months.” Despite those terms, it's very common for people to successfully apply for more than one of the same Ink card across multiple businesses.

Even better, experience has proven that it is possible to successfully apply for the same Ink card for a single business multiple times even if you still have the older Ink card open. As long as your application is approved, you should qualify for the welcome bonus.

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

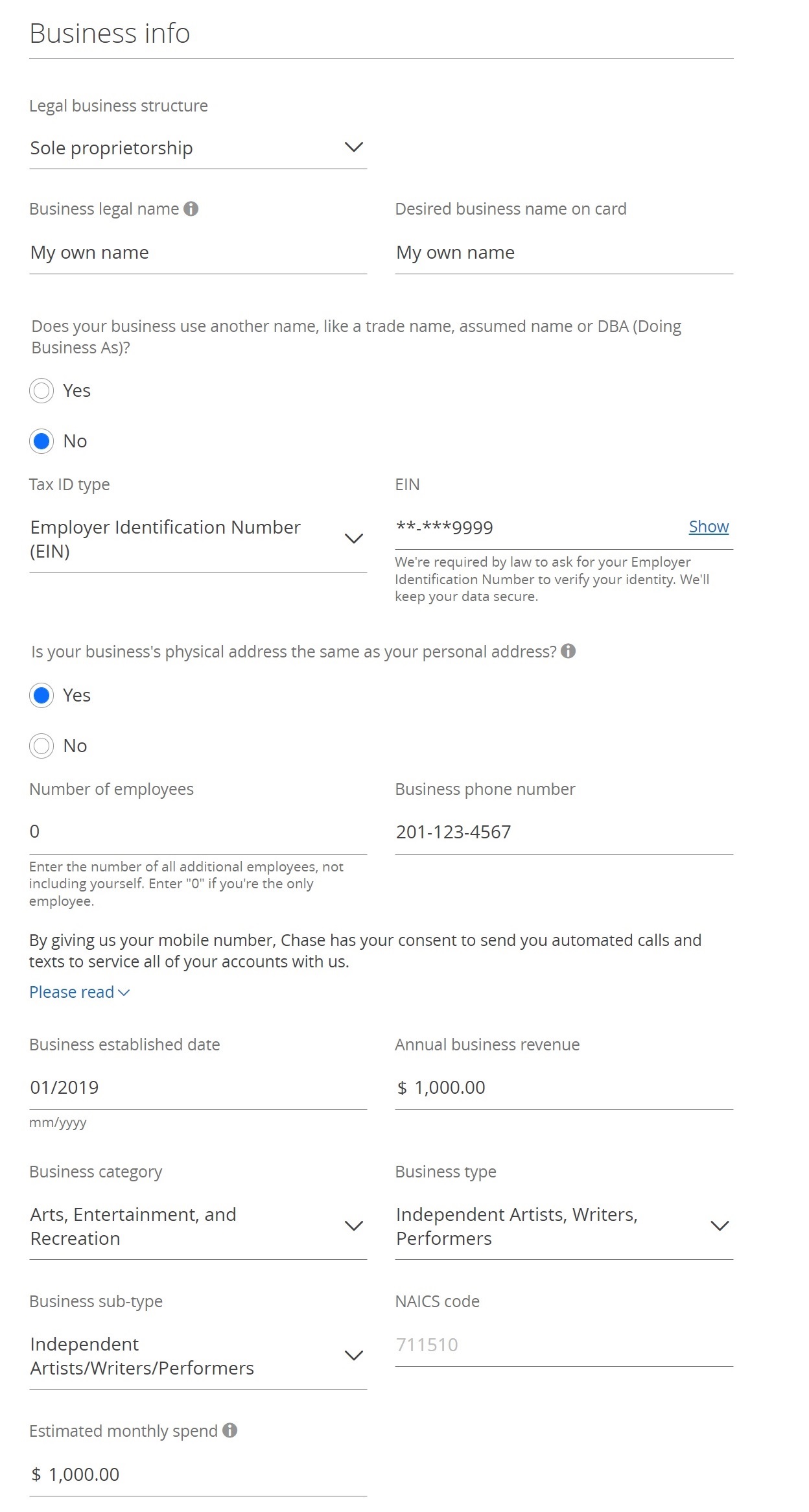

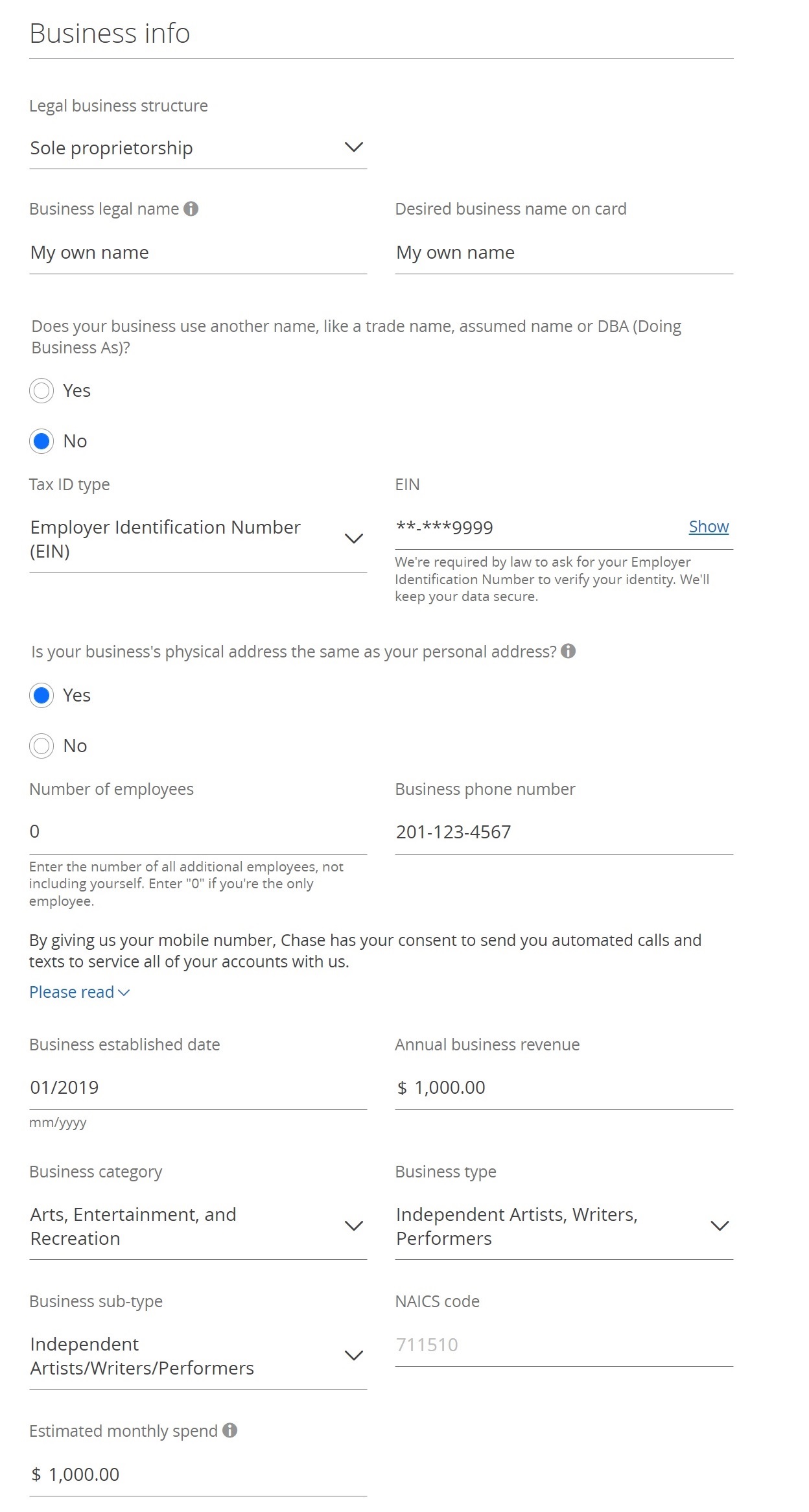

How to apply

You can find the current best signup offer and application link here: Chase Ink Business Unlimited.

- Legal business structure: Sole Proprietor

- Business legal name: If you don’t already have a business name, I recommend using your own name as the business name.

- Desired business name on card: Again, this can be your own name if you don’t have a business name to use.

- Does your business use another name? No

- Tax ID type: EIN (you can get an EIN quickly and for free from the IRS here) If you'd prefer to use your social security number as your tax ID, select SSN rather than EIN.

- Is your business's physical address the same as your personal address? Yes

- Number of employees: 0 (the instructions say to enter the number of employees you have, not including yourself)

- Business phone number: Your phone number

- Business established date: When did your business start? If you've been doing your business for years (selling stuff at yard sales, for example), it's fine to estimate the starting date.

- Annual business revenue: $0 (or project an amount based on expected revenue)

- Business category, Business type, Business sub-type: Pick whichever categories are closest to your business. For example, an aspiring author, artist, or musician might choose: "Arts, Entertainment, and Recreation" and "Independent Artists, Writers, Performers."

- Estimated monthly spend: $3,000 (Use your judgement here. A higher number might lead to a larger credit line, but if it's too high it might negatively affect approval).

Reconsideration

If your application is denied, I recommend calling for reconsideration (1-888-270-2127). It’s surprising how often denials can be changed to approvals just by asking.

Chase Ink Business Unlimited Perks

Travel Protection

- Auto Rental Coverage: Chase offers primary auto rental CDW (collision damage waiver) when renting for business purposes. Here’s the description directly from Chase: “Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary when renting for business purposes and provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most cars in the U.S. and abroad.”

- Baggage Delay Insurance: “Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 3 days.”

- Travel Accident Insurance: “When you pay for your air, bus, train or cruise transportation with your card, you are eligible to receive accidental death or dismemberment coverage of up to $500,000.”

Purchase Protection

Extended Warranty: “Extends the time period of U.S. manufacturer’s warranty by an additional year, on eligible warranties of three years or less.”

Damage and Theft Protection: “Covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.”

Chase Ink Business Unlimited Earn Points

Signup Bonus

The signup bonus for this card is advertised as cash back, but the rewards are actually delivered as Ultimate Rewards points. Here’s the current signup offer:

| Card Offer |

|---|

75K points ⓘ Affiliate 75K after $6K spend in 3 monthsNo Annual Fee Alternate Offer: You may be able to get an offer of 120,000 points after $6,000 in purchases via a Business Relationship Manager. Recent better offer: 90K after $6K spend in 6 monthd (expired 1/17/24) |

Refer Friends

Bonus Spend

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 1.5X on all purchases ✦ 5X Lyft through through March 2025 |

This one is pretty simple: earn 1.5 points per dollar everywhere. With points worth up to 1.5 cents each towards travel (when paired with the Sapphire Reserve card), that’s like a 2.25% everywhere rebate.

Chase Ink Business Unlimited Redeem Points

Cash Back

Cardholders can redeem points for 1 cent each either as statement credits or as cash back. Cash back can be taken as a statement credit or via check or ACH transfer.

Travel

Redeem points for travel: 1.5 cents per point

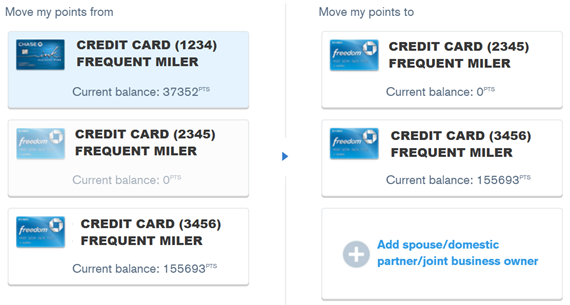

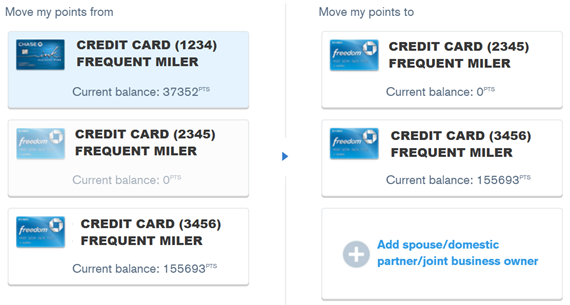

This option requires that someone in your household has the ultra-premium Chase Sapphire Reserve card. First move (combine) points from your no-fee card to the Sapphire Reserve account. Next, log into Chase under the Sapphire Reserve account, and go to the Chase portal to book your travel. A $500 flight would usually cost 50,000 points if you used points attached to the no-fee card, but with the Chase Sapphire Reserve it would cost only 33,333 points.Redeem points for travel: 1.25 cents per point

This option requires that someone in your household has a premium card that earns Chase points: Chase Sapphire Preferred or Chase Ink Business Preferred. First move (combine) points from your no-fee card to one of these premium cards. Next, log into Chase under the account that now has the points, and go to the Chase portal to book your travel. A $500 flight would usually cost 50,000 points if you used points attached to a no-annual-fee card, but with the Chase Sapphire Preferred it would cost only 40,000 points.Details about booking travel through Chase

You can use the Chase portal to book airfare, hotels, cruises, activities, and car rentals. Airfare purchased through the portal still earns airline miles and elite qualifying miles. Hotels booked this way do not earn hotel rewards. Worse, hotels booked through the portal often won't offer you elite benefits even if you have status.Travel protections apply

When you pay with points for travel, Chase's automatic travel protections do apply. So, you can be covered for things like car rentals, trip delays, trip cancellation & interruption, lost luggage, etc. The coverage you receive will be based on which card's rewards were used to book the trip. For example, if you have both a Chase Sapphire Preferred and a Sapphire Reserve, you would want to move your points from the Preferred to the Reserve and then use the Reserve points to book your trip. You will get both better value (1.5 cents per point) and better travel protections. See: Sapphire Reserve Travel Insurance.Transfer points

Move points to premium or ultra-premium card first

You cannot transfer points directly from a no-annual-fee Chase card to airline or hotel partners, but you can move points first to a premium card (Sapphire Preferred or Ink Business Preferred, for example) or ultra-premium card (Sapphire Reserve) and then transfer the points to airline or hotel partners. Points can be transferred to the loyalty accounts of the primary cardholder or any authorized user on the account. Points can also be transferred to the loyalty account of a joint business owner, but they do need to be an authorized user on the associated business account.Transfer Partners

| Rewards Program | Best Uses |

|---|---|

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Air Canada Aeroplan | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can be had in redeeming BA points for short distance flights. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Emirates Skywards | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be steep. See: Emirates Sweet Spot Awards - First class from 30K miles round trip. |

| Hyatt | Use for Hyatt free nights, free suite nights, lounge upgrades, or suite upgrades. Hyatt points are often worth at least 2 cents each, but they’re sometimes worth far more. Bonus: award nights are not subject to resort fees. |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| IHG | IHG dynamically prices their awards and sometimes offer very good value. IHG Premier and IHG Premier Business cards offer the fourth night free on award stays. |

| JetBlue | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. |

| Marriott Bonvoy | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. |

| Singapore Airlines KrisFlyer | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). |

| Southwest Rapid Rewards | Award flights are fully refundable. Point values vary due to certain taxes not being charged on awards, but tend to average around 1.5 cents per point. |

| United MileagePlus | United offers free award changes and free cancelations. Like Avianca and Aeroplan, United never charges fuel surcharges for awards. Unfortunately, United charges many more miles for international first class awards. Good uses of miles include United's Excursionist Perk awards and (sometimes) dynamically priced United economy awards. |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few great sweet spot awards including US to Europe on Delta One business class for 50K points one-way. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). |

Other ways to redeem points

You can also use points to pay some merchants directly (Amazon.com, for example or via Chase Pay). Don't do this. These options offer very poor value. Further, they may compromise the security of your account (i.e. if someone hacks into your Amazon account, they might spend your points - causing you a headache in getting your points reinstated).

Chase Ink Business Unlimited Manage Points

Combine Points Across Cards

If you intend to cancel a card that earns Chase points, you should first combine your points with a card you intend to keep active. Once you cancel, you will forfeit any unused points in that account (See: My 90,000 Points mistake). A product change should not affect your balance, but some people prefer moving points before a product change as well just to be safe.

Share Points Across Cardholders

- You earn points with the card offering the best return on purchases and then use points with the card offering the best redemption rate.

- Only one member of your household needs to maintain a premium card for transferring to partners or booking travel (though note that the primary cardholder can only transfer points to partner loyalty programs in the name of the primary cardholder or authorized users).

How to Keep Points Alive

Chase Ink Business Unlimited Lifecycle

How to meet minimum spend requirements

If your usual spend isn’t enough, consider using the Plastiq bill pay service to use your card to pay bills that can’t usually be paid by credit card (rent, mortgage, contractors, etc.). Click here to find many more options for increasing credit card spend.

Keep, cancel, or product change?

Is this card worth keeping in the long run? Yes! It has no annual fee and it offers 1.5X rewards for all spend. What’s not to like? If you decide to cancel anyway, make sure to first redeem any remaining points or move them to another Ultimate Rewards card.

Related Cards

Ultimate Rewards Business Cards

| Card Offer and Details |

Ultimate Rewards Consumer Cards

| Card Offer and Details |

I keep getting denied by Chase for “insufficient business deposits with us.” Any advice for this? I am under 5/24 and have a freedom flex that has been open about 7 months that is in good standing.

Any thoughts on whether to keep or cancel this card? I’ve had it a couple years and only put nominal spend on it each month. Am thinking, though it’s no-fee, cancelling would make it less risky to apply for another one in the future (though I’ve read it’s not technically necessary). And help reduce overall # of Chase accounts.

If you could use more 5x capacity then product change it to an Ink Cash. Otherwise I don’t see any harm in cancelling

Do we know when the current chase ink bonus offer will end?

No. Chase rarely ever announces an end date in advance.

Hey! I am considering this card. I currently have a Chase Ink Business Unlimited that I downgraded from a Chase Ink Business Preferred, although I have never applied for or received a bonus for a Business Unlimited account. Can you have an existing unlimited account and open a second?

I believe you can, yes. If you don’t want to risk it though, you have a couple of good alternative options:

Hey Greg. Thanks for the info. I originally had the Chase Ink Business Preferred, and downgraded to Chase Ink Business Unlimited several years ago. I got the Chase Ink Business Cash earlier this year. I just applied for this Chase Ink Business Unlimited and was deferred to a decision by mail within the next 30 days. I am willing to close my original Chase Ink Business Unlimited, although I am curious if this could help or hurt my decision / which department would I call? Any insight? Thank you so much.

So, just applied for this card for my spouse and was declined for 5/24 but in fact she only had 3 cards in 5/24. During the reconsideration discussion, the CSR mentioned that she was an authorized user on two cards that took her up to 5/24. So, had to clarify that she would not responsible for payments on those cards and then CSR approved the card. Is it expected behavior that 5/24 takes authorized user cards as part of the count?

Yes, this just happened to me, where the fifth card was b/c I was an AU. Chase “erased” this from the application and sent it for reconsideration after a phone call.

I tried to transfer point to Hyatt, but couldn’t find a transfer option on the Ink Unlimited Ultimate Rewards page. I messaged and was told the transfer program in not available on the Ink Unlimited “The feature to transfer points to supported partner programs is not available on the Chase Ink Business Unlimited card. Only Chase Sapphire Preferred, Chase Sapphire Reserve, J.P. Morgan Reserve, Chase Ink Plus Business, Chase Ink Bold Business, Chase Ink Business Preferred and Chase Corporate Flex Card customers can transfer points to supported partner programs. You have other redemption options with Chase Ultimate Rewards: – Book flights or hotels for yourself or someone else through Ultimate Rewards with your points, Chase card, or a combination of both. – Redeem your points for cash back and have it deposited into most U.S. checking and savings accounts. – You may also choose to receive it as a statement credit on your account.”

Yes, that’s correct. You need one of the premium cards to transfer to partners. If you also have one of those cards — for instance, if you have the Chase Ink Business Preferred or the Chase Sapphire Preferred — you can click “combine points” to first move your Ultimate Rewards from your Ink Unlimited to your Ink Business Preferred or Sapphire Preferred and then you can transfer them on to Hyatt or other partners.

Without a premium card, your main option is to redeem points at a value of $0.01 each.

I don’t see the 75k option available. Only the $750

Chase advertises the bonus as $750 but it is delivered in the form of 75K Ultimate Rewards points.

FYI: The ability to add a household member for new accounts is no longer available online, but can be done by calling very confused customer service representatives. They keep transferring between several departments with everyone unaware of the feature NOT working online. I waited for over 30 minutes before hanging up.

PS: This is only an issue for creating a new household account. Existing household accounts are still operating as expected.

[…] See also: Chase Ink Business Unlimited Complete Guide […]

Is there an end date to the new business unlimited 75k offer? Or is there a rule of thumb for how long promotional offers like this last?

I’m juggling multiple offers and I’m trying to manage spend.

We haven’t been told of an end date. In a normal world, increased offers like this usually last at least a month and sometimes more, but in 2020 it is very hard to predict. We recently saw an offer that only increased for a couple of weeks.

Appreciate you answering my question.

If I can’t manage to apply before the 75k promo ends, what is the standard bonus and minimum spend? 50k points for 5k in spend?

If I have acquired this card as a result of a product change (downgraded my Business Ink Preferred in Aug 2020), when can I apply for this card to get the 50k SUB? I don’t have any EIN, so it would just be my SSN, which is tied into my current card, I presume. As a DP, I was just instantly approved for the United Business Card (75k SUB) using the same SSN.

Also, any idea if there is a referral bonus/link? I can refer my spouse.

[…] Alternatively, those who would consider applying for a business card would likely find the Chase Ink Business Unlimited more appealing than the Freedom Unlimited thanks to a much larger welcome bonus and identical […]

[…] are great reasons to want both the Ink Business Cash and the Ink Business Unlimited cards. The former has incredible 5X bonus categories while the latter offers 1.5X earnings on all […]

[…] Chase Ink Business Unlimited […]

[…] at least one to an Ink Business Unlimited (no annual […]