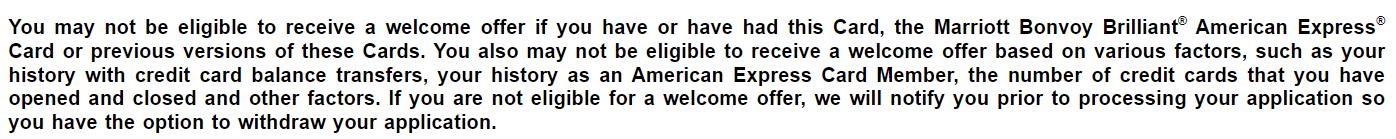

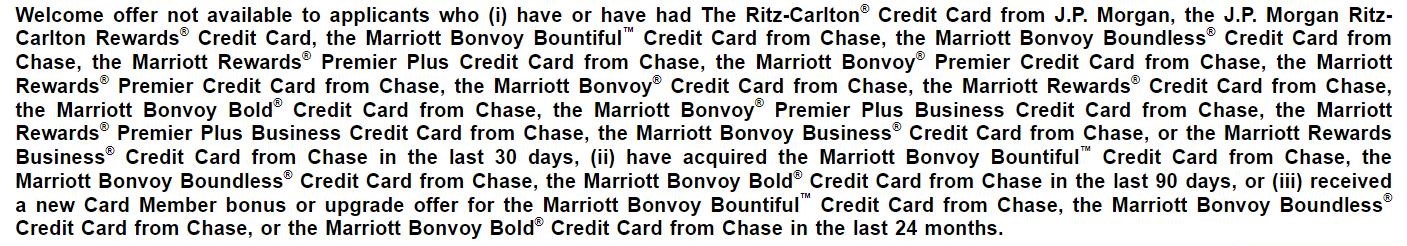

The Amex “family language” disease continues to spread. The latest casualty is the Marriott Bonvoy Bevy card. As per the new offer terms, you may not be eligible to receive the welcome offer on the Bevy if you have or have had that card or the Marriott Bonvoy Brilliant card.

We’ve previously reported on Amex family language being added to various flavors of the Platinum cards, the Delta credit cards and more recently to the consumer Gold card. We also saw this language added on cash back cards. Unfortunately, things are continuing to trend in an unfriendly direction.

What is Amex family language and which cards have it?

Historically, Amex has had “lifetime” language. In the offer terms on most Amex application pages, there is a line that says that the welcome offer may not available to you if you have or have had that specific card before. Up until recent months, that lifetime language has only excluded those who have had that specific product before.

However, in recent months, we have seen Amex create restrictions around product “families” that indicate that, in some instances, you may not be eligible for the welcome bonus if you have or have had one of several cards before.

We have seen the following restrictions this year:

- Consumer Platinum cards: Whereas in the past you could qualify for the welcome bonus on each “flavor” of the Platinum card, you are now restricted from getting the welcome bonus on both the Schwab and vanilla versions of the Platinum card.

- Consumer Delta cards: You may no longer be eligible for the Delta Gold welcome offer if you have or have had the Platinum or Reserve. You can no longer get the Platinum welcome offer if you have or have had the Reserve.

- Cash Back cards: You may no longer be eligible for the welcome bonus on the Blue Cash Everyday card if you have or have had the Cash Magnet, Blue Cash Preferred, or Morgan Stanley Blue Cash Preferred card.

- Gold card: You may no longer be eligible for the welcome bonus on the Gold card if you have or have had a Platinum card.

- Everyday card: You may no longer be eligible for the welcome bonus if you have or have had the Everyday Preferred card before.

Thus far, we have only seen family language appear on consumer cards and the language has spread in stages slowly over the past several months.

What’s happened to the Amex Marriott cards

Archie over at Seal the Deal recently noticed that the following language had been added to the Marriott Bevy card:

This continues the pattern that we’ve seen with Amex’s Membership Rewards-earning and Delta cards. Now, the Hilton cards are the last “family” group standing that hasn’t yet added the restrictions (along with the Amex Green).

It’s worth noting that this language varies from the previous restrictions with other Marriott cards in one key way: “may not” vs “not:”

Currently, the family language terms say that you may not be eligible to qualify for the bonus if you have or have had the Bevy or Bonvoy Brilliant cards before. That is a distinct difference from not available. The second set of terms creates a seemingly ironclad rule, and it has been in practice. “May not” leaves the door open. In other words, although you may not get the welcome bonus, maybe you will. The terms go on to say that, if you are not eligible for the bonus, Amex will let you know before processing your application and give you the opportunity to withdraw it. In other words, if Amex doesn’t give you the pop-up, they are committing to giving you the bonus.

The FM team has all been recently approved for cards where the “may not” language was present and would be disqualifying if applied. In those cases it’s a good idea to take a screen shot of the terms on the off chance that you’re denied the bonus. You could then point to those terms in a complaint. That said, I’ve yet to hear of a data point of someone not getting the promised welcome offer when there was no pop-up.

Quick Thoughts

It’s discouraging to see the continued spread of family language throughout the Amex card portfolio. Increasingly, those who take advantage of a welcome offer on a higher-level (i.e., more expensive) card risk locking themselves out of earning a bonus on a lower-tier card later. Given the continued expansion of these terms, it might only be a matter of time before the Amex Green and the Hilton Honors cards are affected as well.

[…] Frequent Miler and Seal the Deal […]

[…] Frequent Miler and Seal the Deal […]

COVID gave us some gravy-train years with Amex. Now, the pendulum is swinging the other way. Not that any of us like these changes but I’m thankful to Amex for what I’ve been able to do until now.

[…] Hat tip to Frequentmiler […]

[…] Hat tip to Frequentmiler […]

[…] Hat tip to Frequentmiler […]

[…] Hat tip to Frequentmiler […]

Amex Marriott cards lack value. They need better bonus multipliers.

I think you mean “all Marriott cards lack value” when it comes to spending on them. The Bountiful from Chase is the same card as the AMEX Bevy, and the other Chase Marriott cards only have 3X categories.

They can be good cards for the SUBs and benefits – especially the Ritz – but none of the cards generate a lot of points on non-Marriott spend. Trying to get the 50K FNC after earning the SUB on a Bevy or Bountiful is about the only time more spend on a Marriott card makes sense.

Need a working NLL for the Surpass before it follows.

P2 got the 170K surpass in November and will PC to another Aspire after 365 days. I want to do the same – with the new split resort credit you almost need 3-4 Aspire cards to maximize the Resort credit with weekend getaways.

With 3 Aspire cards you can use 1 FNC and use $600 Resort credit to cover 2nd night at some properties but then you paying resort F&B pricing for the stay.

Time to turn the Marriott card matrix into an app. Maybe there should be a dedicated 800 number to determine eligibility?

You don’t need to give me an excuse not to get a Marriott card.

Have the Bevy now, will dg back to old SPG/Bonvoy card next year. Unless I got a juicy upgrade offer to the Brilliant. C’mon Amex…send it to me! And none of this 5,000 pt crap…I want the full offer.

No reason to keep the Bevy…it’s a terrible card – doesn’t come with any “free” night for the fairly high a/f. No way to offset the a/f either. Not sure what they were thinking. I only have it due to an upgrade offer.